How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

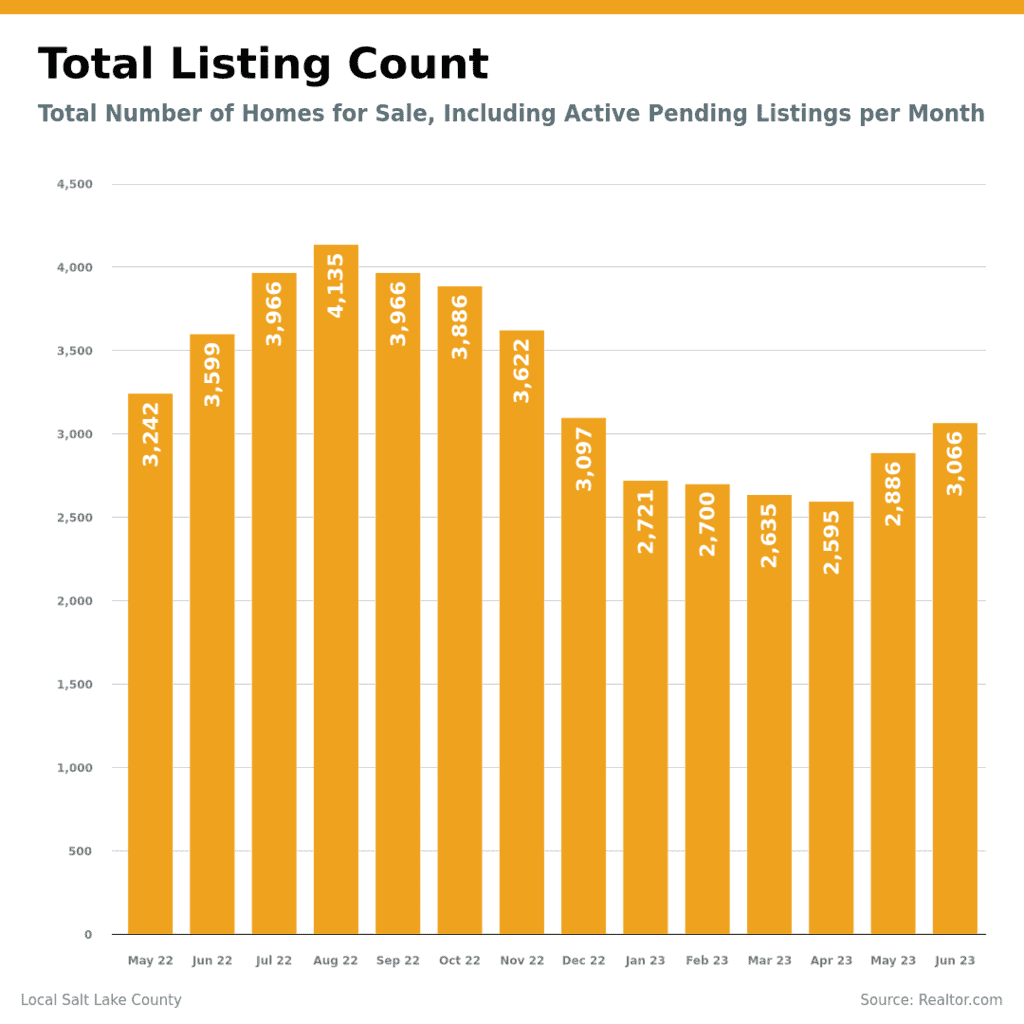

Salt Lake County Market Insights By Marty Gale Utah Realty

Salt Lake County Market Insights from May 2022 to June 2023 Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General...

What Makes A Great Real Estate Agent

What Makes A Great Real Estate Agent Are you on the hunt for your dream home or perhaps looking to sell your property for top dollar? Choosing the right real estate agent is essential in ensuring a smooth and successful transaction. But what exactly sets apart a...

Are you or a loved one facing the prospect of downsizing? It can be an overwhelming process.

Marty's Monday Blog Are you or a loved one facing the prospect of downsizing? It can be an overwhelming process, filled with practical and emotional challenges. That's why utilizing the expertise of a Senior Real Estate Specialist (SRES) can make all the difference....

Key Housing Market Trends

Key Housing Market Trends Some Highlights If you’re considering buying or selling a home, you’ll want to know what’s happening in the housing market. Housing inventory is still very low, prices are climbing back up, and homes are selling fast when priced right. If you...

Economic Trends And Factors Influencing The Luxury Home Market In Utah

Welcome to our blog article all about the exciting developments and trends in Utah's luxury home market this fall! As the leaves change color and the cool autumn breeze settles in, Utah's real estate market is buzzing with activity. Whether you're a potential buyer or...

Homebuyers Are Still More Active Than Usual

Homebuyers Are Still More Active Than Usual Even though the housing market is no longer experiencing the frenzy that was so characteristic of the last couple of years, it doesn’t mean today’s market is at a standstill. In actuality, buyer traffic is still strong...

Tips for Making Your Best Offer on a Home

Tips for Making Your Best Offer on a Home While the wild ride that was the ‘unicorn’ years of housing is behind us, today’s market is still competitive in many areas because the supply of homes for sale is still low. If you’re looking to buy a home this season, know...

Don’t Fall for the Next Shocking Headlines About Home Prices

Don’t Fall for the Next Shocking Headlines About Home Prices If you’re thinking of buying or selling a home, one of the biggest questions you have right now is probably: what’s happening with home prices? And it’s no surprise you don’t have the clarity you need on...

Low Housing Inventory Is a Sweet Spot for Sellers

Low Housing Inventory Is a Sweet Spot for Sellers Some Highlights Today’s housing inventory is still well below more normal years. This low inventory is why homes that are priced right are still selling quickly and seeing multiple offers. If you want to sell your...

Renting or Selling Your House: What’s the Best Move?

Renting or Selling Your House: What's the Best Move? If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative...