In contemplating the future of one’s real estate investments, the decision to sell a home in 2024 demands a meticulous evaluation of the current economic landscape, market trends, and individual financial goals. This article aims to provide homeowners with a comprehensive analysis of the factors to consider before putting their property on the market. By dissecting the potential benefits and drawbacks, economic indicators, and forecasted market conditions, we equip readers with the insight needed to make an informed decision regarding their real estate portfolio in the coming year.

Financial Considerations: Assessing Your Home’s Value And Equity

Before deciding whether 2024 is the opportune moment to sell your home, a thorough financial assessment is paramount. Evaluating your home’s current market value against your outstanding mortgage can reveal the equity you’ve built up over time. This equity represents the difference between the value of your home in today’s market and the amount you owe the lender. Factors influencing this value include recent sales of comparable properties in your area, market trends, and the condition of your home. A professional appraisal or a real estate agent’s market analysis can provide you with an accurate valuation, setting a foundational understanding of your potential financial return upon selling.

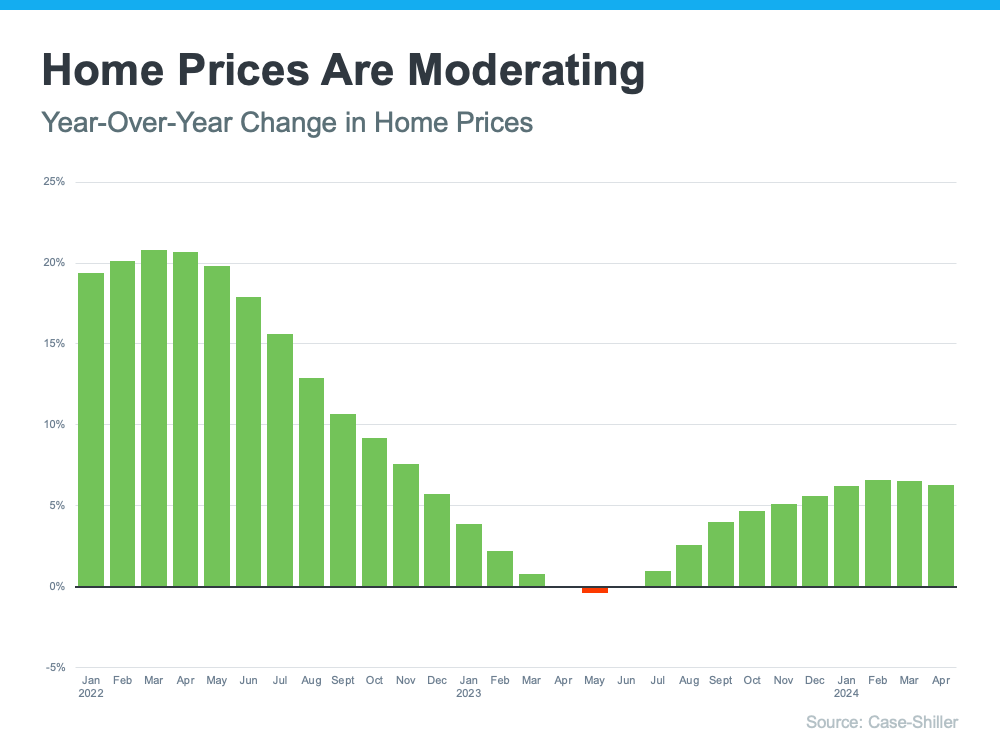

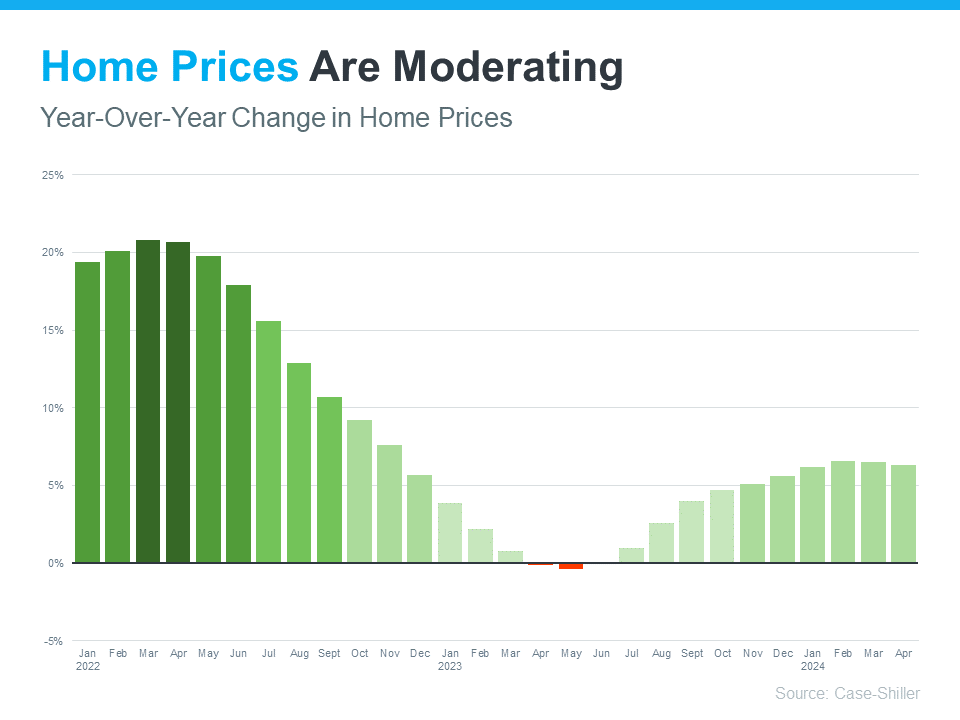

On the other hand, understanding market conditions and the broader economic landscape is equally critical. Economic indicators such as interest rates, inflation, and employment rates can significantly affect buyer demand and, consequently, the value of your property. In moments of low interest rates and high demand, sellers might find favorable conditions to achieve a premium on their properties. Conversely, in a market characterized by high interest rates and economic uncertainty, the potential for decreased buyer interest might necessitate adjustments in expectations regarding the sale price and timing. Therefore, keeping an informed eye on economic trends and forecasts for 2024 and beyond is necessary to align your selling strategy with the most advantageous market conditions.

By conducting a detailed assessment of your home’s value and equity, coupled with a keen understanding of the economic and market conditions, homeowners can make a well-informed decision on whether selling in 2024 is financially prudent. This preparatory step is crucial in strategizing for a sale that aligns with personal financial goals and market opportunities, ensuring that you are positioned advantageously in the real estate market.

Market Projections For 2024: Timing Your Sale

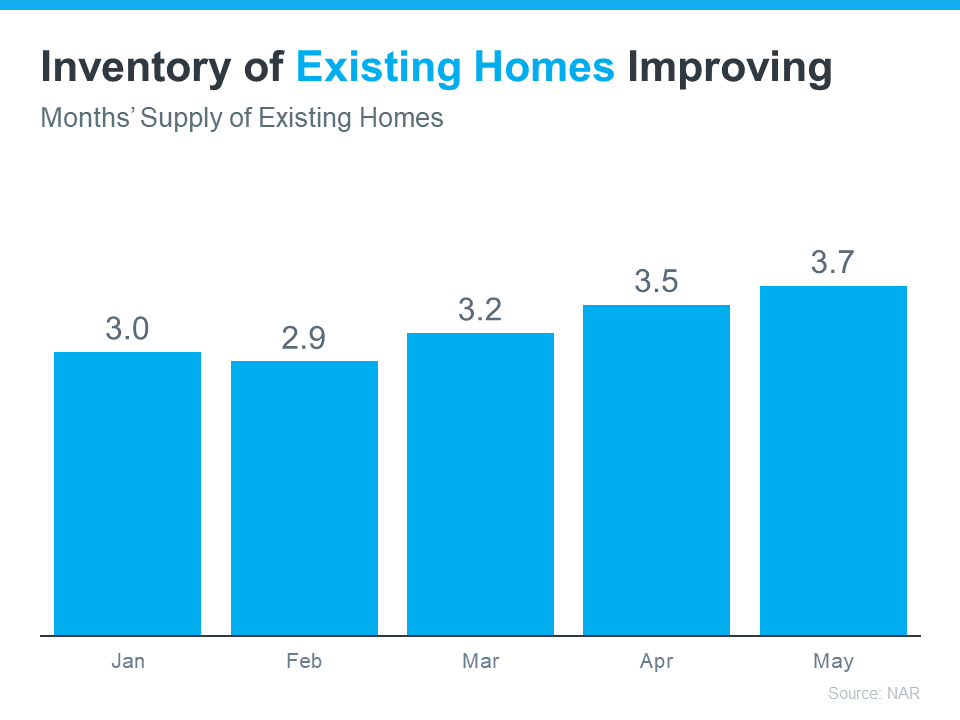

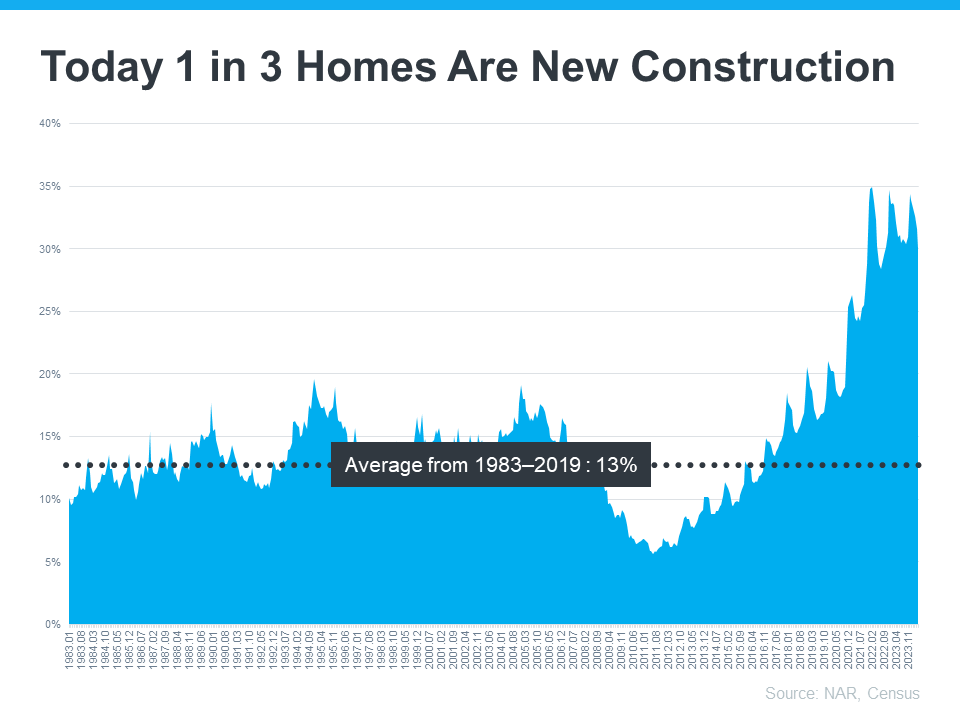

As we move toward 2024, homeowners contemplating the sale of their property should closely monitor market projections to optimize the timing of their sale. Several economic indicators and real estate trends point toward potential shifts in the housing market, influenced by factors such as interest rates, inventory levels, and broader economic conditions. Historically, market dynamics such as increased demand coupled with limited inventory have favored sellers, leading to shorter listing periods and higher sale prices. However, with predictions of economic restructuring and changes in consumer behavior, the landscape in 2024 may present new challenges and opportunities. Understanding these nuances is critical in determining the most advantageous time to list your home for sale.

Analysts predict that interest rates may fluctuate, influencing buyer affordability and potentially affecting the volume of active buyers in the market. Additionally, demographic shifts, such as the increasing buying power of millennials and changes in work-from-home policies, could significantly impact regional markets differently. Areas with growing employment opportunities and those offering a high quality of life may see continued or increased demand, whereas regions dependent on industries facing downturns might experience a decrease in housing prices. For sellers, this means that a strategic assessment of local and national economic indicators, coupled with professional real estate advice, is paramount in deciding whether 2024 is the opportune moment to enter the market. Remaining attuned to these projections and trends can empower homeowners to make informed decisions, potentially maximizing their returns and reducing the time their property spends on the market.

The Impact Of Selling On Your Lifestyle And Future Plans

Deciding to sell your home in 2024 involves more than just considering current market conditions and potential financial gains. It is equally crucial to examine how this significant move could affect your lifestyle and long-term objectives. For many, a home is not just a financial asset but a backdrop to life’s most enduring memories and a cornerstone of daily routine. Selling could mean leaving a neighborhood you love, changing your commute, or disrupting your social and family life. On the flip side, it could also open doors to new adventures, bring you closer to family, or better align with your lifestyle aspirations, such as downsizing for simplicity or upsizing for a growing family. Assessing how the sale aligns with your personal and professional growth plans is pivotal. Will the move bring you closer to your goals, or could it introduce unnecessary hurdles? This intersection of financial reasoning with personal aspirations underscores the importance of a holistic approach in decision-making.

Furthermore, the impact on your future plans, particularly financial security and retirement planning, cannot be overstated. Selling your home in the upcoming year could provide the capital needed for significant investments, pay off existing debt, or fund education and retirement accounts, thereby enhancing your financial freedom and stability in the long run. However, it is essential to weigh these potential benefits against the costs associated with selling, such as real estate commissions, moving expenses, and possible tax implications. Additionally, consider the housing market dynamics and economic forecasts for 2024 and beyond. Will you be entering a buyer’s market, potentially complicating your next home purchase, or will conditions favor sellers, offering a strategic advantage? An informed, well-rounded approach to these considerations will help ensure that the decision to sell is not only financially prudent but also in harmony with your broader life plans and aspirations.

Preparing For Sale: Steps To Maximize Your Home’s Marketability

In preparation for putting your home on the market in 2024, there are several key steps you can take to ensure it stands out and commands the best possible price. Firstly, consider the appeal of your home’s curb appeal; a well-maintained exterior can significantly influence a potential buyer’s first impression. Investing in landscaping, a fresh coat of paint, and ensuring the front entrance is welcoming can make a substantial difference. Inside the home, decluttering and depersonalizing spaces are crucial. These efforts help prospective buyers envision themselves in the space, making the property more appealing. Additionally, undertaking necessary repairs and considering minor renovations in outdated areas can boost the home’s value and attractiveness. This stage also involves a thorough cleaning, including windows, carpets, and hard-to-reach areas, to present a well-cared-for home.

Another vital step in maximizing your home’s marketability involves understanding current market trends and pricing your home accordingly. Professional advice from a real estate expert can provide valuable insights into local market conditions, comparable property prices, and buyer demand. This expertise ensures that your pricing strategy strikes the right balance between competitive positioning and achieving your financial goals. High-quality, professional photographs and virtual tours have become increasingly important in showcasing properties effectively. Investing in these services can highlight your home’s best features and attract a wider pool of potential buyers. Moreover, staging your home, either by yourself or with the help of a professional, can further enhance its appeal, making rooms appear larger, brighter, and more inviting, which can significantly impact the speed and success of the sale process.

In conclusion, the decision of whether to sell your home in 2024 is multifaceted, demanding a careful consideration of financial implications, market predictions, personal circumstances, and preparatory actions to enhance home marketability. Assessing your home’s value and equity, along with a keen understanding of upcoming market trends, is crucial for a well-timed sale that maximizes returns. Furthermore, evaluating the impact of the sale on your lifestyle and future aspirations ensures that your decision aligns with your long-term goals. Lastly, diligent preparation can significantly influence the success of your sale, making your property more appealing to potential buyers. By meticulously analyzing these components, homeowners can make informed, strategic decisions about selling their property in 2024.