How Much Has Your Home Home Increased in Value?

DISCLAIMER: A Home Valuation report is not a substitute for a Real Estate Appraisal in purchase or refinance transactions. Home Valuation report is only available for homes in Utah.

How Much Has Your Home Value Increased?

Home values have risen dramatically over the last twelve months. In CoreLogic’s most recent Home Price Index Report, they revealed that national home prices have increased by 6.2% year-over-year.

CoreLogic broke down appreciation even further into four price ranges, giving us a more detailed view than if we had simply looked at the year-over-year increases in national median home price.

The chart below shows the four price ranges from the report, as well as each one’s year-over-year growth from July 2017 to July 2018 (the latest data available).

New Home Prices Second Quarter of 2018

For Sale By Owner (FSBO) Statistics

- FSBOs accounted for 8% of home sales in 2016. The typical FSBO home sold for $190,000 compared to $249,000 for agent-assisted home sales.

- FSBO methods used to market home:

- Yard sign: 35%

- Friends, relatives, or neighbors: 24%

- Online classified advertisements: 11%

- Open house: 15%

- For-sale-by-owner websites: 8%

- Social networking websites (e.g. Facebook, Twitter, etc.): 13%

- Multiple Listing Service (MLS) website: 26%

- Print newspaper advertisement: 5%

- Direct mail (flyers, postcards, etc.): 4%

- Video: 2%

- None: Did not actively market home: 28%

- Most difficult tasks for FSBO sellers:

- Getting the right price: 15%

- Understanding and performing paperwork: 12%

- Selling within the planned length of time: 13%

- Preparing/fixing up home for sale: 9%

- Having enough time to devote to all aspects of the sale: 3%

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...

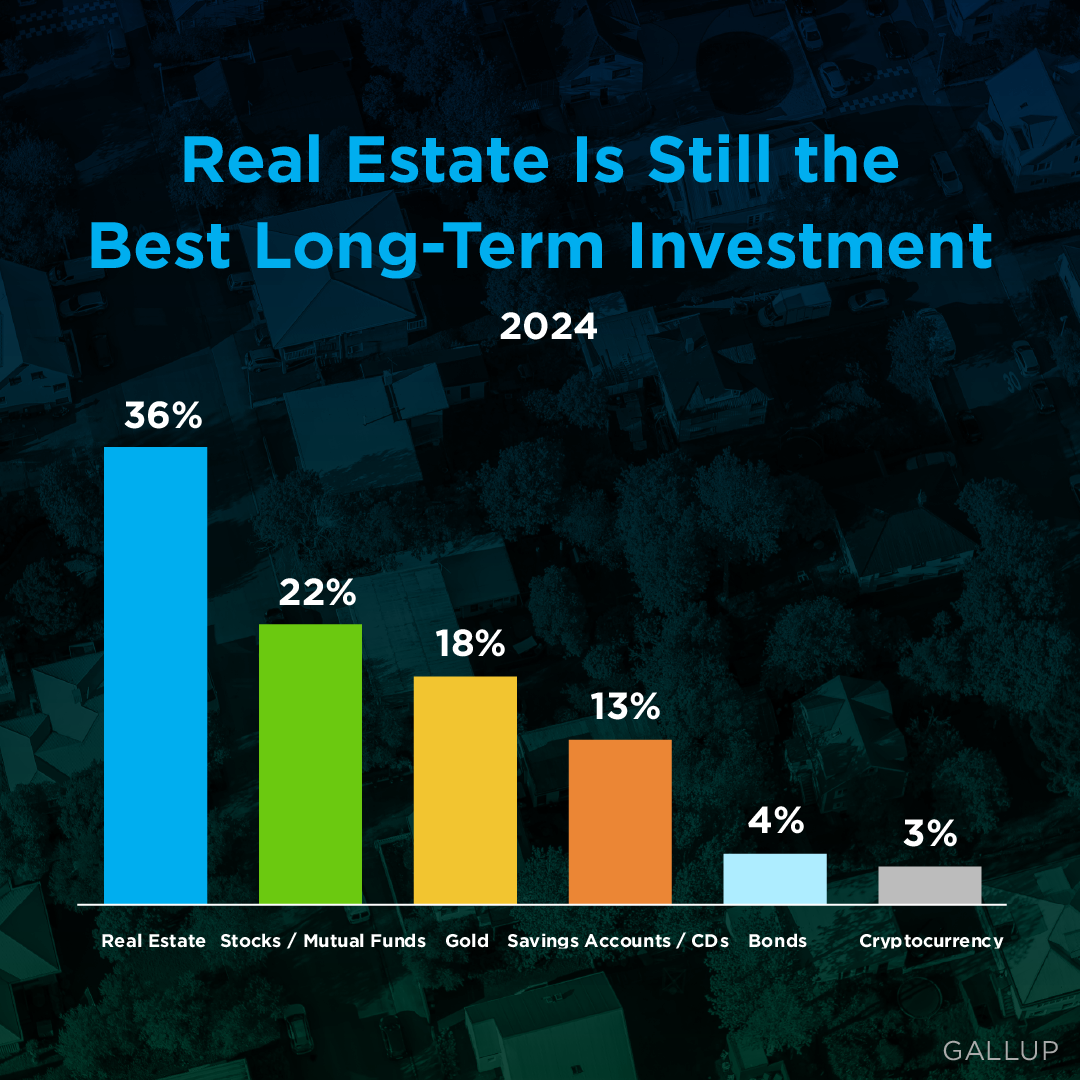

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...