How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

How Buyers Can Win By Downsizing in 2020

Marty Gale SRESHow Buyers Can Win By Downsizing in 2020 Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as...

The 2 Surprising Things Homebuyers Really Want

The 2 Surprising Things Homebuyers Really Want In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though –...

2020 Expert Forecast in Numbers

The expert forecast is looking bright when it comes to the 2020 housing market. Let’s connect to talk about how these numbers can bring you one step closer to homeownership this year.

Homes Are More Affordable Today, Not Less Affordable

Homes Are More Affordable Today, Not Less Affordable There’s a current narrative that owning a home today is less affordable than it has been in the past. The reason some are making this claim is because house prices have substantially increased over the last several...

2020 Luxury Market Forecast

2020 Luxury Market Forecast By the end of last year, many homeowners found themselves with more equity than they realized, and at the same time their wages were increasing. When those two factors unite, it can spark homeowners to think about making a move to a larger...

Buying a Home Early in Life Can Increase Future Wealth

Buying a Home Early Can Significantly Increase Future Wealth According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60. The good news is, our younger generations are strong believers in...

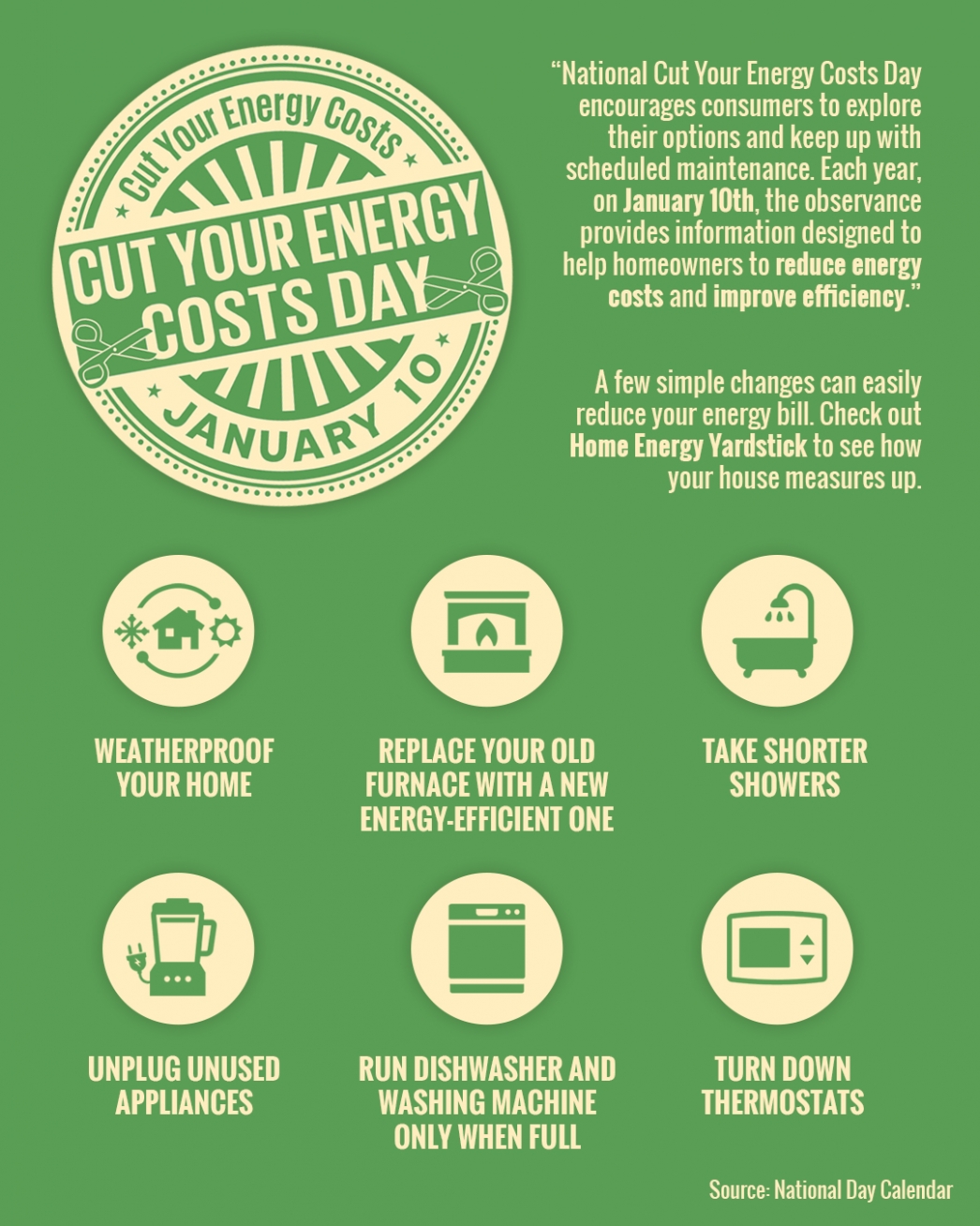

National Cut Your Energy Costs Day

National Cut Your Energy Costs Day | January 10 2020 Some Highlights: On January 10th of each year, “National Cut Your Energy Costs Day” encourages consumers to reduce their overall energy costs by improving home efficiency. According to Freddie Mac, a typical U.S....

There’s a Long Line of Buyers Waiting for Your House

There’s a Long Line of Buyers Waiting for Your House If you’re following what’s happening in the housing market right now, you know that many people believe the winter months aren’t a good time to sell a home. As realtor.com Senior Economist George Ratiu recently...

How can SRES Help You Plan for Your Future Housing Needs

How can SRES Help You Plan for Your Future Housing Needs? Most of us put time and effort into planning for retirement. That is, we plan for money related issues such as retirement funds. Secondly, people plan for long-term care and life insurance. Deciding on where...

Plus Fifty Today

Do you know where is your market is going? In 2020: More than one-third of the U.S. population reached age 50. 17 million baby boomers (20 percent) were age 60 or older. Generation X moved into middle age and began knocking on the door of age 58 Today demographic...