Trends in Senior Housing

In this article, we dive into the fascinating realm of senior purchasing habits when it comes to housing. With the aging population, the needs and preferences of seniors have transformed, leading to new trends and demands in the housing market. Join us as we uncover the changing landscape and delve into the key factors that influence these purchasing decisions. Whether you’re a senior yourself, a caregiver, or simply curious about the future of senior housing, you’re in the right place. Let’s explore the trends that are shaping senior purchasing habits in the housing market today.

Aging In Place: A Rethink Of Traditional Housing Options

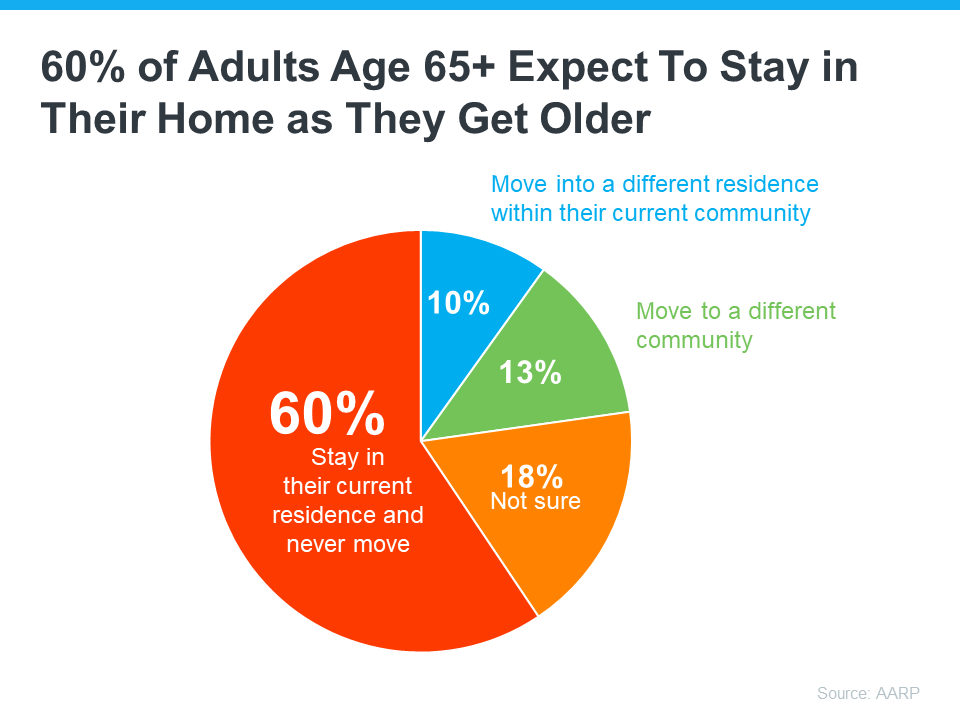

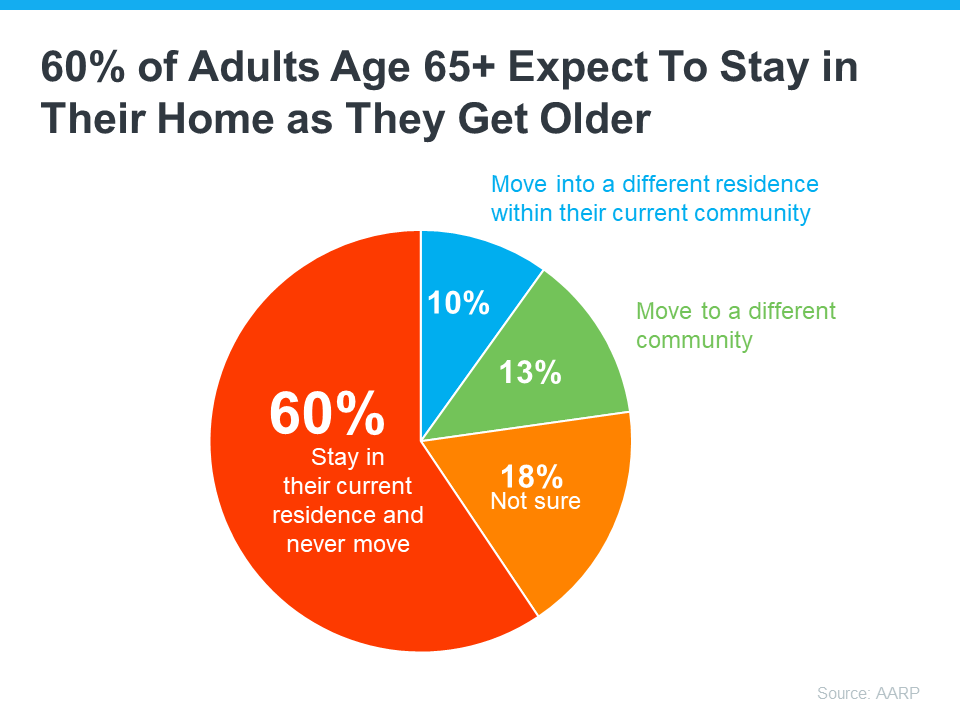

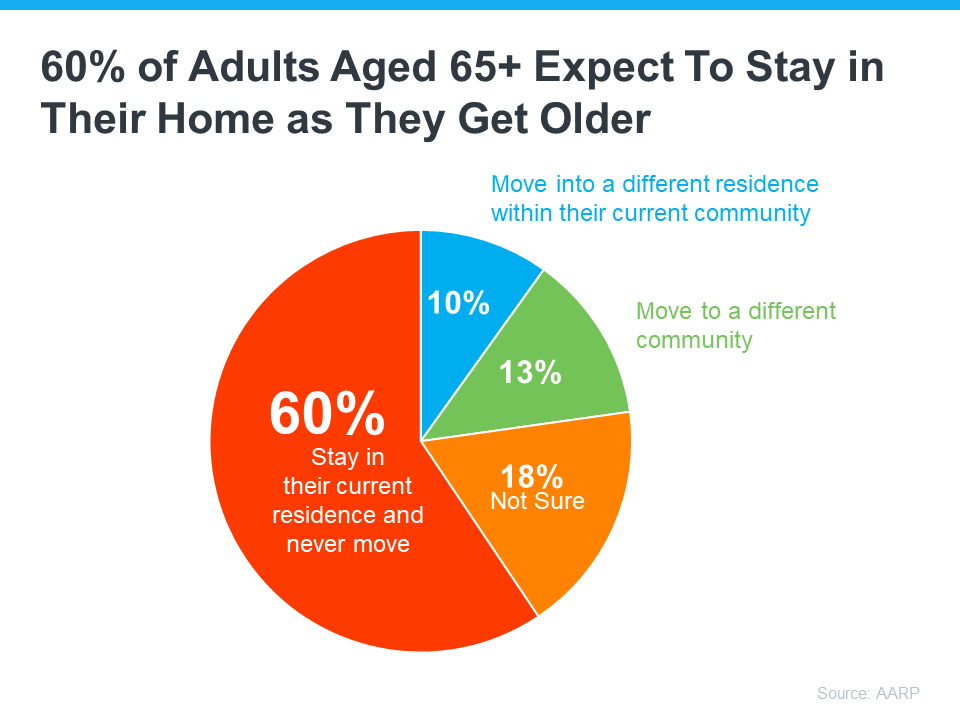

As the population continues to age, there is a growing trend among seniors to age in place rather than making the traditional move to a retirement community or nursing home. This shift in senior purchasing habits when it comes to housing is driven by a desire for independence, a need for familiar surroundings, and a preference for maintaining a sense of community and social connections.

One of the main reasons why aging in place has become increasingly popular is the desire for independence. Many seniors value their ability to live in their own homes and maintain their daily routines without having to rely heavily on others for assistance. Aging in place allows seniors to retain control over their surroundings and make decisions that align with their personal preferences.

Moreover, remaining in familiar surroundings is not only emotionally comforting but can also contribute to better overall well-being. Seniors have often spent many years in their homes, creating memories and a sense of belonging. Staying in a familiar environment can help to reduce stress, promote mental well-being, and provide a sense of security. Research has shown that familiarity with surroundings can result in improved cognitive function and reduced risk of depression or anxiety.

Additionally, aging in place allows seniors to maintain their social connections and sense of community. By staying in their own homes, seniors can continue to participate in local activities and engage with friends and neighbors, which can be crucial for their mental and emotional health. These social connections provide a support system and can help combat loneliness and isolation that can often come with aging.

Furthermore, advancements in technology have made it easier for seniors to age in place by offering a wide range of home automation and safety features. Smart home devices, such as voice-assistant speakers, remote monitoring systems, and wearable health trackers, enable seniors to live independently while still having access to support when needed. These technological advancements have given seniors the confidence and peace of mind to remain in their homes for longer periods.

Recognizing this trend, there has been a shift in the housing market towards providing suitable options for seniors who wish to age in place. Builders and developers are incorporating universal design principles, such as wider doorways, step-free entrances, and accessible bathrooms, into new home construction. Additionally, home renovation companies are offering aging-in-place modifications, such as installing grab bars, ramps, or stairlifts, to improve accessibility and safety for seniors.

In conclusion, the trend of seniors aging in place represents a rethinking of traditional housing options. It is driven by a desire for independence, the need for familiar surroundings, and a preference for maintaining social connections. With advancements in technology and an increased focus on creating suitable housing options, seniors are able to enjoy the benefits of aging in place while maintaining their quality of life and sense of community. Embracing this trend can lead to a more inclusive and accommodating society for seniors as they navigate the later stages of life.

Embracing Technological Advancements In Senior Housing

It is no secret that technology has begun to permeate almost every aspect of our lives. From smartphones and social media platforms to smart home devices and virtual assistants, technological advancements are shaping our daily routines and revolutionizing the way we interact with the world around us. While many might assume that it is predominantly younger generations leading the charge in embracing these innovations, seniors, too, are jumping on the technology bandwagon.

When it comes to senior housing, technology has opened up a whole new world of possibilities and convenience. Seniors are increasingly recognizing the benefits of integrating technology into their living spaces, and as a result, they are becoming more receptive to the idea of embracing technological advancements in senior housing.

One of the most significant ways technology is transforming senior housing is through the development and implementation of smart home technology. Smart homes are equipped with various automated systems that can be controlled remotely via a smartphone or another smart device. These systems enable seniors to easily manage and customize their living environment, from adjusting lighting and temperature to controlling security systems and appliances.

For seniors, especially those living alone, smart home technology offers a greater sense of security and peace of mind. Smart security systems provide real-time monitoring, alerting residents of any suspicious activity or emergencies, and enabling the ability to contact authorities with just a few taps on a mobile device. This technology not only enhances safety but also allows seniors to age in place more confidently, reducing their reliance on external assistance.

Another area where technology is making waves in senior housing is telehealth and remote healthcare monitoring. With telehealth services, seniors can consult with healthcare professionals from the comfort of their own homes, eliminating the need for unnecessary trips to hospitals or doctors’ offices. Remote healthcare monitoring applications and wearable devices can also track vital signs and transmit data to healthcare providers, enabling proactive health management and timely intervention when required.

Communication and social connectivity are crucial aspects of senior housing. Loneliness and social isolation can have a profound impact on seniors’ overall well-being and mental health. Thankfully, technology has opened up new avenues for seniors to stay connected with loved ones and engage in social activities. Video calling applications and social media platforms allow seniors to maintain meaningful connections with family and friends regardless of physical distance. Moreover, virtual communities and online platforms specifically designed for seniors foster a sense of camaraderie and provide opportunities for shared interests, discussions, and emotional support.

In addition to the benefits mentioned above, technology also plays a significant role in assisting seniors with daily tasks and personal care. Advancements in assistive technology have led to the development of devices and applications that aid in medication management, memory enhancement, navigation assistance, and even simple tasks like turning on lights or operating appliances. These technologies not only provide practical support but also promote independence and autonomy, allowing seniors to maintain a high quality of life.

Despite the increasing acceptance and potential benefits of embracing technological advancements in senior housing, it is essential to address any barriers that may exist. Accessibility and ease of use are critical factors to consider when implementing these technologies. Seniors may need additional guidance, training, or user-friendly interfaces to fully utilize the potential of these innovations. Furthermore, affordability should be taken into account, ensuring that technology remains accessible to seniors across different financial backgrounds.

In conclusion, the integration of technology into senior housing is more than just a trend. It is a transformative force that empowers seniors to lead more independent, connected, and secure lives. With the continued development and refinement of innovative solutions, seniors can thrive in an increasingly technology-driven world, embracing the advantages that technological advancements bring to their housing choices. As society continues to evolve, it is vital to support and encourage seniors in embracing these advancements, ensuring a brighter future for older adults in their living arrangements.

Community And Social Interaction: The Key Drivers For Senior Housing Choices

Senior housing choices have undergone a significant transformation in recent years, with community and social interaction emerging as key drivers. Gone are the days when seniors primarily sought housing based on practical factors like proximity to medical facilities and ease of accessibility. Today, the focus has shifted to fostering a sense of community, creating opportunities for social engagement, and promoting overall well-being.

As individuals enter their golden years, their priorities change. Long gone are the days of raising children and establishing careers. Seniors increasingly seek a living environment that allows them to connect with like-minded individuals, engage in social activities, and maintain an active lifestyle. This shift in preference has given rise to a variety of housing options tailored to meet the unique needs and desires of senior citizens.

One of the primary reasons community and social interaction have become such crucial factors is the recognition of the impact they have on mental health and overall well-being. Studies have shown that social connections and a sense of belonging can contribute to longevity, cognitive function, and overall happiness. As a result, senior housing developers and providers have focused on creating spaces that foster socialization, encourage interaction, and provide opportunities for residents to engage in a wide range of activities.

Retirement communities have become increasingly popular choices for seniors due to their emphasis on community and social interaction. These communities often provide a wide range of amenities and facilities, including social clubs, fitness centers, group outings, and organized events. They offer a sense of camaraderie, allowing seniors to bond over shared interests and experiences. Retirees are drawn to the opportunity to socialize, make new friends, and engage in activities that promote overall wellness.

Co-housing is another emerging trend in senior housing, focusing on creating intentional communities where individuals of similar age groups live together, sharing common spaces and resources. These communities foster social interaction, encourage collaboration, and provide a support network for residents. Co-housing allows seniors to maintain their independence while also having the benefit of social connections and a sense of belonging.

In addition to retirement communities and co-housing, many seniors are also opting to age in place while taking advantage of shared living arrangements. This concept involves multiple seniors living together in a shared home, pooling resources, and supporting one another. These arrangements allow individuals to age in familiar surroundings while fostering a strong sense of community and shared responsibility.

The role of technology in promoting social interaction and connection among seniors should not be overlooked. With the rise of smartphones, tablets, and social media platforms designed specifically for older adults, staying connected has become easier than ever. Seniors can video chat with loved ones, join online communities, and participate in virtual events, all from the comfort of their own homes.

The demand for senior housing that prioritizes community and social interaction is only expected to grow in the coming years. As the senior population continues to increase, so too does the need for housing options that cater to their desire for social engagement, mental stimulation, and overall well-being. Developers and providers in the housing industry must recognize and respond to this trend, creating innovative and inclusive living environments that prioritize community and social interaction.

In conclusion, community and social interaction have emerged as the key drivers for senior housing choices. Seniors are seeking housing options that prioritize social engagement, enable them to connect with like-minded individuals, and promote overall well-being. Retirement communities, co-housing, shared living arrangements, and the use of technology are all trends that highlight the importance of community in senior housing. As the senior population continues to age and grow, it is essential for the housing industry to adapt and meet the evolving needs and desires of this demographic.

Sustainable And Multi-Generational Housing: Towards An Inclusive Future

As the senior population continues to grow around the world, there is a growing trend among this demographic in redefining their housing needs and preferences. Seniors today are seeking housing options that not only meet their specific needs but also align with their desire for sustainability and inclusivity. This shift has given rise to the concept of sustainable and multi-generational housing, which aims to create an inclusive future for seniors and the broader community.

One of the main driving factors behind the surge in sustainable and multi-generational housing options is the desire for seniors to live in sustainable environments. As the effects of climate change become increasingly apparent, seniors are becoming more conscious of the impact their housing choices have on the environment. With this in mind, they are seeking housing options that prioritize energy efficiency, renewable energy sources, and eco-friendly construction materials.

Beyond the environmental benefits, sustainable housing options also tend to offer long-term cost savings for seniors. In an era of rising energy prices, opting for energy-efficient homes can significantly reduce utility bills, allowing seniors to allocate their funds towards other essential expenses or activities that enhance their quality of life. Additionally, homes with sustainability features often have a higher resale value, making them a viable investment for seniors planning for their financial future.

Another crucial factor shaping senior purchasing habits in housing is the increasing desire for multi-generational living arrangements. Seniors today place a high value on maintaining close relationships with family members, including their children and grandchildren. They are actively seeking housing options that allow them to live in proximity to their loved ones. Multi-generational housing not only promotes intergenerational bonding but also offers the opportunity for shared responsibilities, caregiving support, and emotional well-being.

Multi-generational housing encompasses a variety of options, including accessory dwelling units (ADUs) or “granny flats,” where seniors can live in a separate, self-contained unit on their children’s property. This arrangement provides the perfect balance between independence and proximity to family. Alternatively, some seniors choose to live in intentional communities, where different generations live together in a shared space, fostering social connections, and reducing isolation.

The benefits of multi-generational living extend beyond familial ties. They also contribute positively to society by maximizing resources and minimizing environmental impact. Sharing communal spaces, appliances, and utilities in a multi-generational housing setting helps to reduce energy consumption and waste. Additionally, these communities often prioritize accessible design, making them friendly for seniors with mobility challenges.

In conclusion, the trends in senior purchasing habits when it comes to housing are veering towards sustainable and multi-generational options. As seniors seek housing solutions that align with their desire for environmental consciousness, they are also embracing the benefits of multi-generational living arrangements. These housing options provide seniors with the opportunity to live in sustainable environments, maintain close relationships with family, and actively contribute to an inclusive society. With the continued growth of the senior population, it is essential for housing developers and communities to adapt to these evolving preferences and create inclusive spaces that cater to seniors’ unique needs and desires.