How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

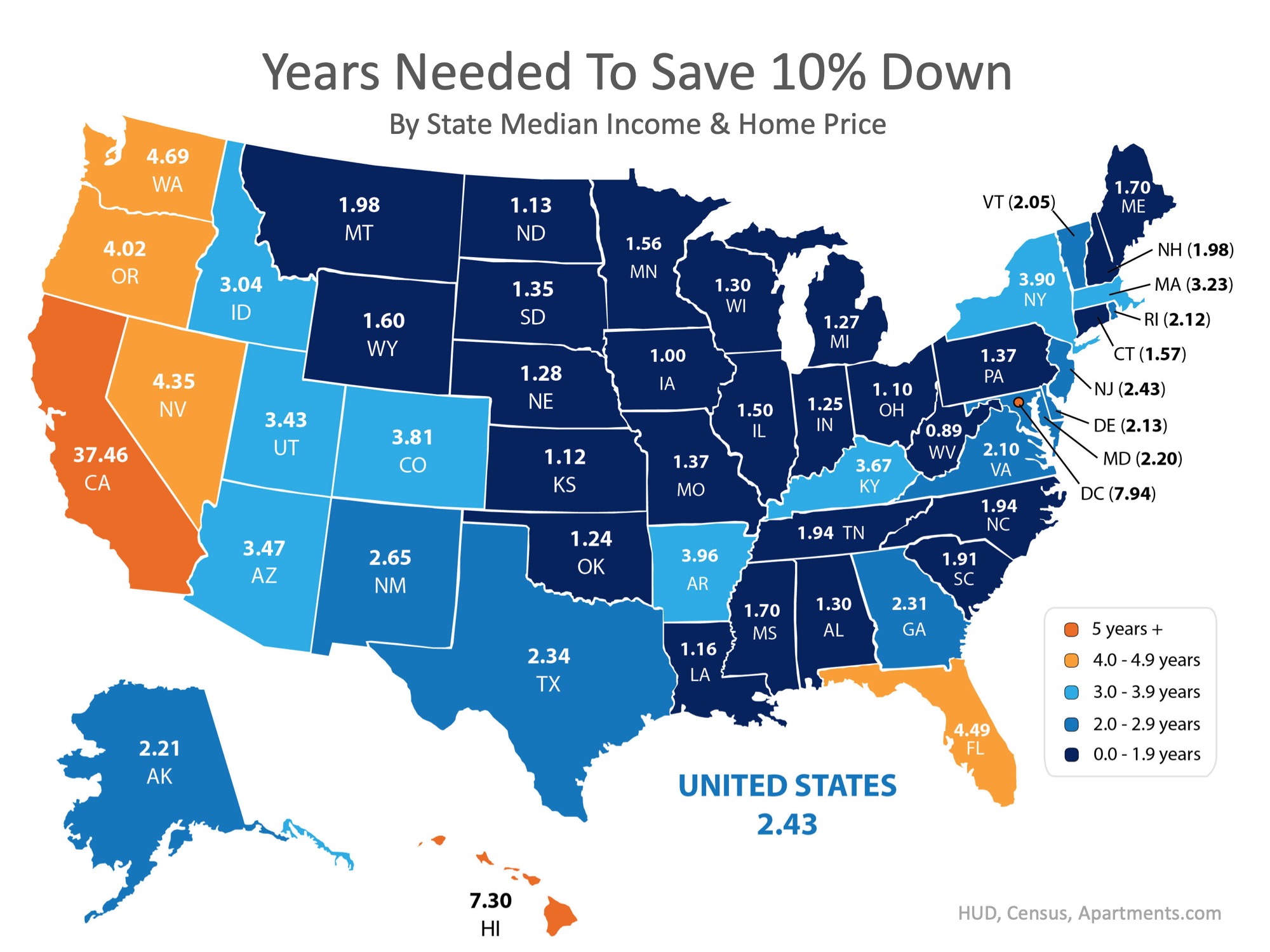

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

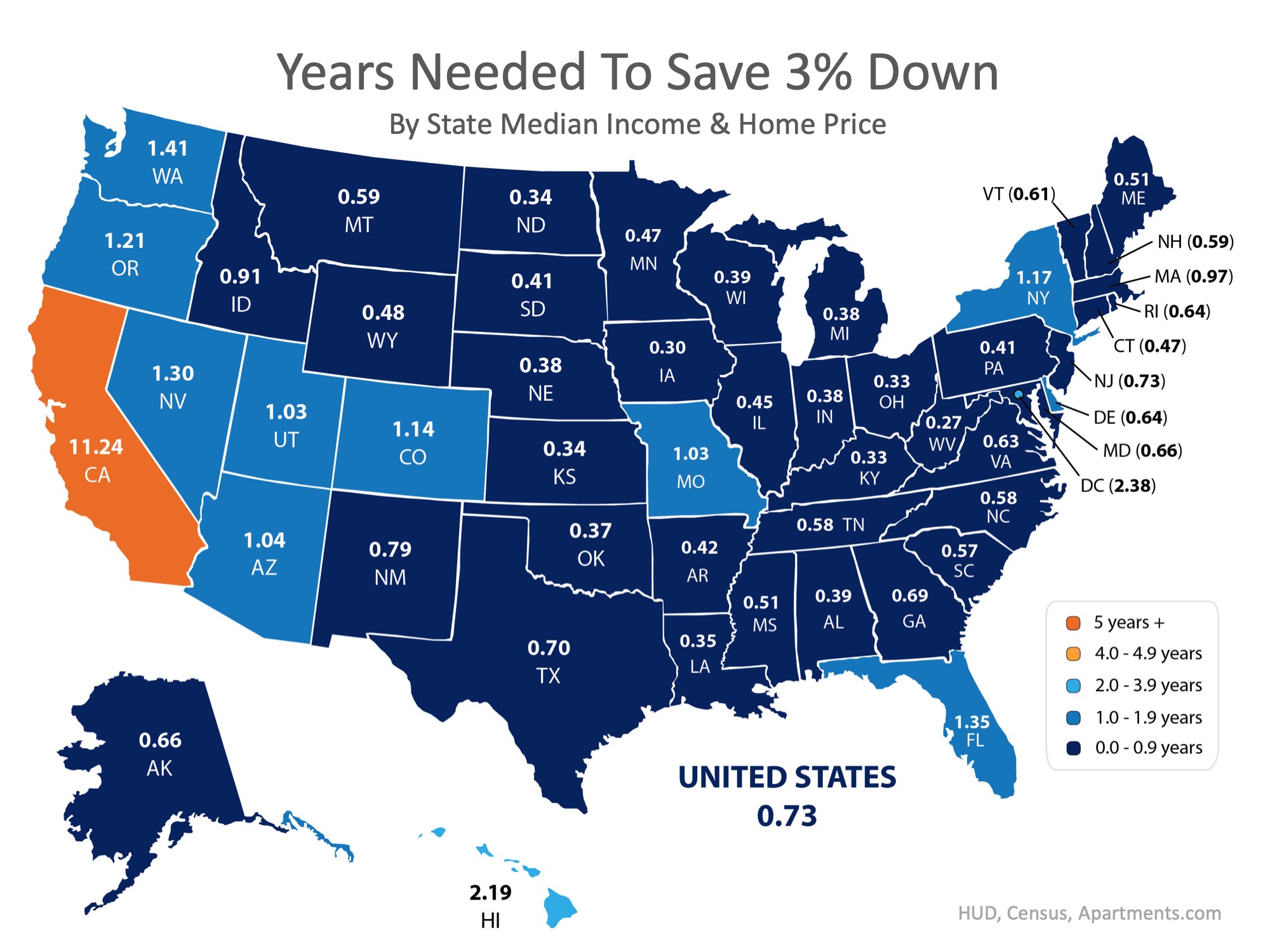

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Why You Need a True Expert in Today’s Housing Market

Why You Need a True Expert in Today’s Housing Market The housing market continues to shift and change, and in a fast-moving landscape like we’re in right now, it’s more important than ever to have a trusted real estate agent on your side. Whether you’re buying your...

How To Get Property Tax Relief In Salt Lake County. Elderly Or Low Income

How To Get Property Tax Relief In Salt Lake County. Elderly Or Low Income Navigating through the maze of property taxes can be a daunting task, particularly for the elderly or those with low incomes. However, in Salt Lake County, there are several options available to...

People Want Less Expensive Homes – And Builders Are Responding

People Want Less Expensive Homes – And Builders Are Responding In today’s housing market, there are two main affordability challenges impacting buyers: mortgage rates that are higher than they’ve been the past couple of years, and rising home prices caused by low...

55 Plus Townhomes Reviewed

As the demand for comfortable and inclusive living spaces for seniors continues to rise, it's crucial to understand the key factors that make a community truly exceptional. In this piece, we will specifically focus on the South Jordan and Daybreak areas in Utah...

What Makes Garden Park Town Homes In Daybreak South Jordan The Best Place For 55 And Older Adults

What Makes Garden Park Town Homes In Daybreak South Jordan The Best Place For 55 And Older Adults Welcome to the Utah Realty Blog Article where we delve into the reasons why Garden Park Town Homes in Daybreak South Jordan is an exceptional choice for 55 and older...

Home Prices Are Back on the Rise

Home Prices Are Back on the Rise Some Highlights Looking at monthly home price data from six expert sources shows the worst home price declines are behind us, and they’re rising again nationally. If you’ve put your plans to move on pause because you were worried about...

About 11,000 Houses Will Sell In The USA Today

About 11,000 Houses Will Sell Today Some homeowners have been waiting for months to put their house on the market because they don’t think people are buying homes right now. If that’s you, know that even though the housing market has slowed compared to the frenzy of a...

There’s Only Half the Inventory of a Normal Housing Market Today

There's Only Half the Inventory of a Normal Housing Market Today Wondering if it still makes sense to sell your house right now? The short answer is, yes. Especially if you consider how few homes there are for sale today. You may have heard inventory is low right now,...

Things To Know When Getting Ready To Buy A Home

Things To Know When Getting Ready To Buy A Home Are you in the market to buy your dream home? Congratulations! This is an exciting step in your life, but it can also be overwhelming and confusing at times. From navigating the financial aspects to understanding the...

Considering Selling Your Home As A Senior?

Considering Selling Your Home As A Senior? Let A Senior Real Estate Specialist (SRES) Be Your Guide! Are you a senior considering a move or possibly selling your home? Making decisions related to real estate can be overwhelming, especially as you enter the golden...