No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year.

There is, however, one thing that may cause the industry to tap the brakes: an overall lack of housing inventory. Buyer demand naturally increases during the summer months, but the current supply is not keeping up.

Lawrence Yun, Chief Economist at National Association of Realtors

“Imbalance persists for mid-to-lower priced homes with solid demand and insufficient supply, which is consequently pushing up home prices.”

Mark Fleming, Chief Economist of First American

“Market conditions are ripe for increasing home sales with one glaring exception. The supply of homes for sale remains tight, keeping existing home sales below potential.”

Danielle Hale, Chief Economist of Realtor.com

“We’re not seeing as many new listings come up on the market…It was only 18 months ago that the number of homes for sale hit its lowest level in recorded history and sparked the fiercest competition among buyers we’ve ever seen.”

If you’re thinking of selling, now may be the time. Demand for your house will be strong during a period when there is very little competition, ideally leading to a quick sale and a great return on your investment.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

We’re halfway through the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the experts predict for the second half of 2019.

Danielle Hale, Chief Economist at realtor.com

“Lower mortgage rates, higher wages and more homes for sale have helped counteract rising home prices, and ultimately, made it so that buyers are able to afford more than last year.”

“Our outlook implies 4% growth for the remaining months of the year, predicated on…more supply than last year, the decline in mortgage rates, moderating home price appreciation and improving affordability.”

Lawrence Yun, Chief Economist at NAR

“Rates of 4% and, in some cases even lower, create extremely attractive conditions for consumers. Buyers, for good reason, are anxious to purchase and lock in at these rates.”

Doug Duncan, Chief Economist for Fannie Mae

“Moderating home price appreciation and attractive mortgage rates continue to support affordability, particularly as home builders are now paying more attention to the entry-level portion of the housing market.”

Kaycee Miller in a Realtor Magazine article

“At the moment, some observers suggest the housing market is indeed headed for a slowdown. But no need to panic — experts say the financial and economic factors that were in play during the big crash a decade ago don’t exist today.”

The housing market will be stronger for the rest of 2019. If you’d like to know more about your specific market, let’s get together to chat about what’s happening in our area.

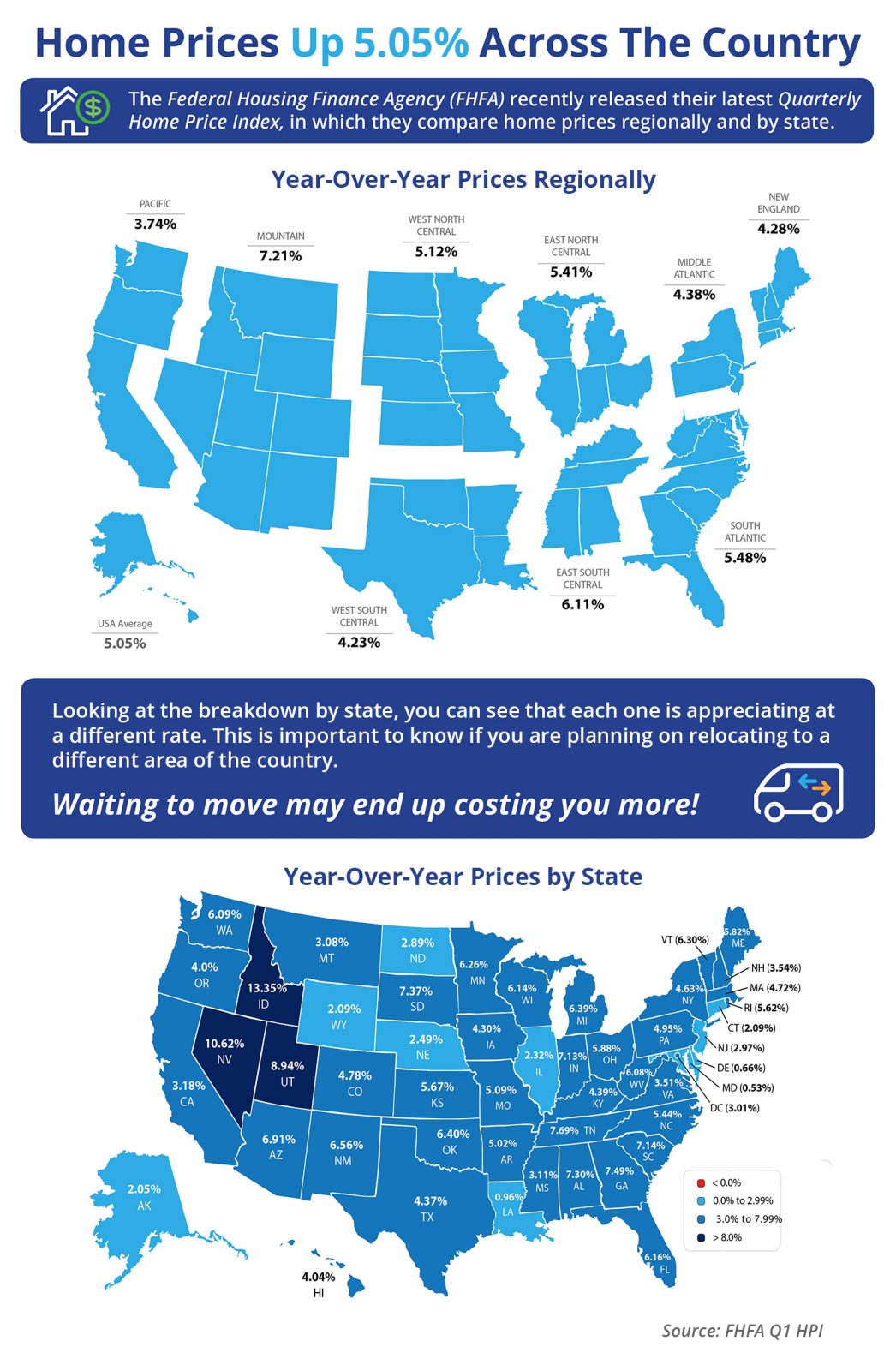

![Home Prices Up 5.05% Across the Country [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/07/25072858/20190729-MEM-1046x1600.jpg)

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Wasatch Front median home prices bottomed in 2011, years after The Great Recession ended. Since then, home prices (all housing types) have been on the rise. The median price of Wasatch Front homes sold in the first quarter of this year was $308,000, 75 percent higher than the median price in 2011.

Wasatch Front median home prices bottomed in 2011, years after The Great Recession ended. Since then, home prices (all housing types) have been on the rise. The median price of Wasatch Front homes sold in the first quarter of this year was $308,000, 75 percent higher than the median price in 2011.

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

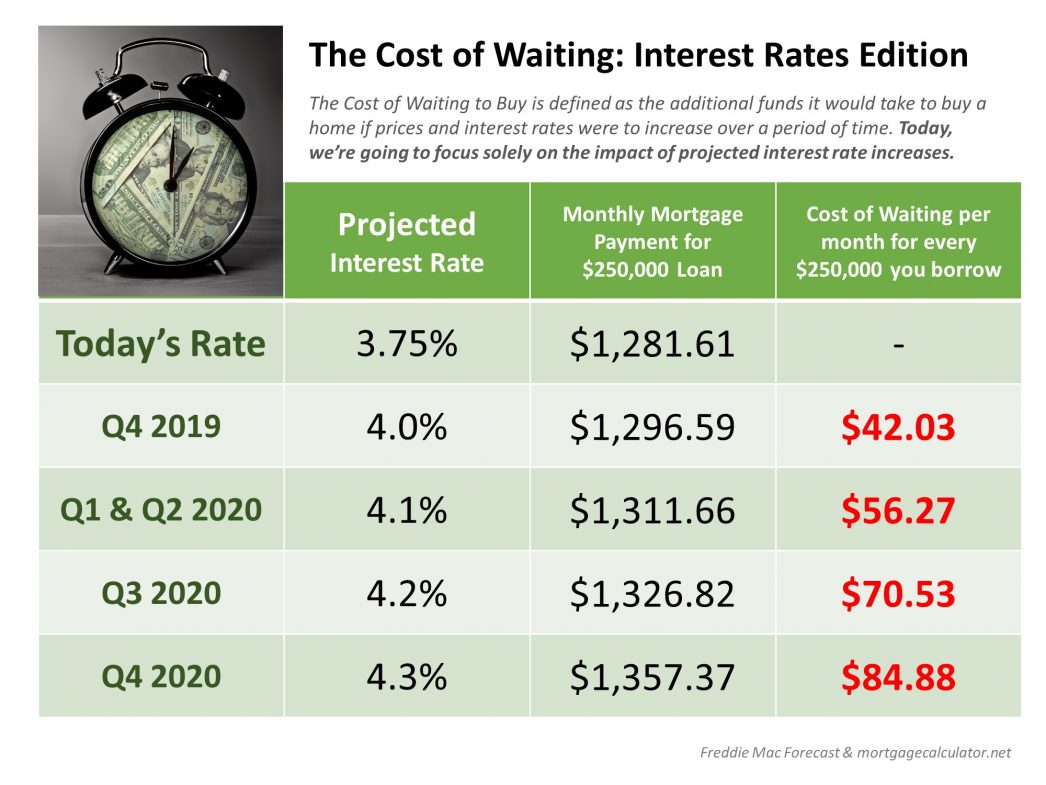

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/07/15085631/20290719-MEM-1046x785.jpg)

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

![The Cost of Waiting: Interest Rates Edition [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/07/15085631/20290719-MEM-1046x785.jpg)

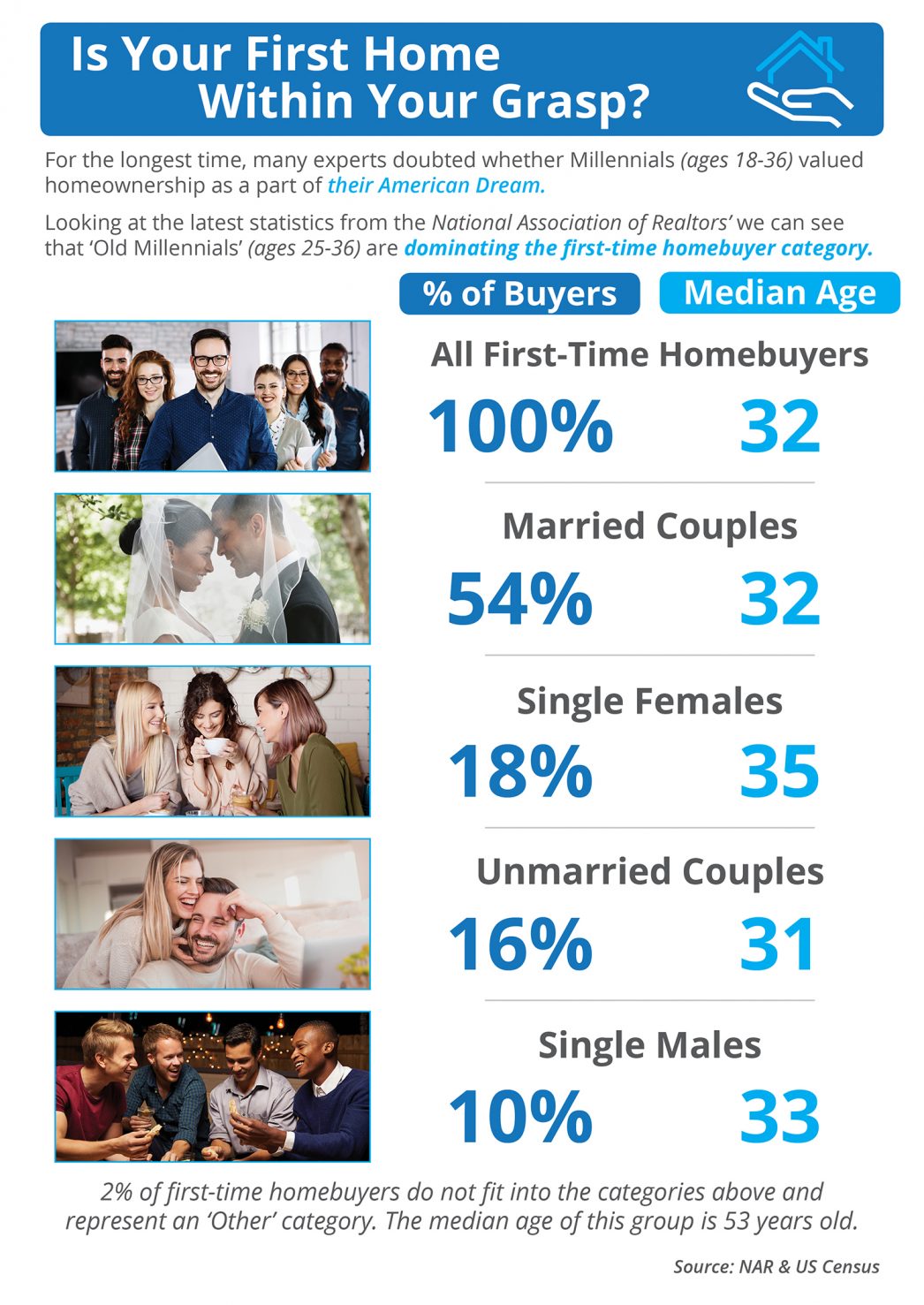

![Is Your First Home Now Within Your Grasp? [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2019/06/24131009/FTHB-Demographics-ENG-MEM-1046x1477.jpg)