How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

5 Simple Graphs That Prove This Is Not Like the Last Time

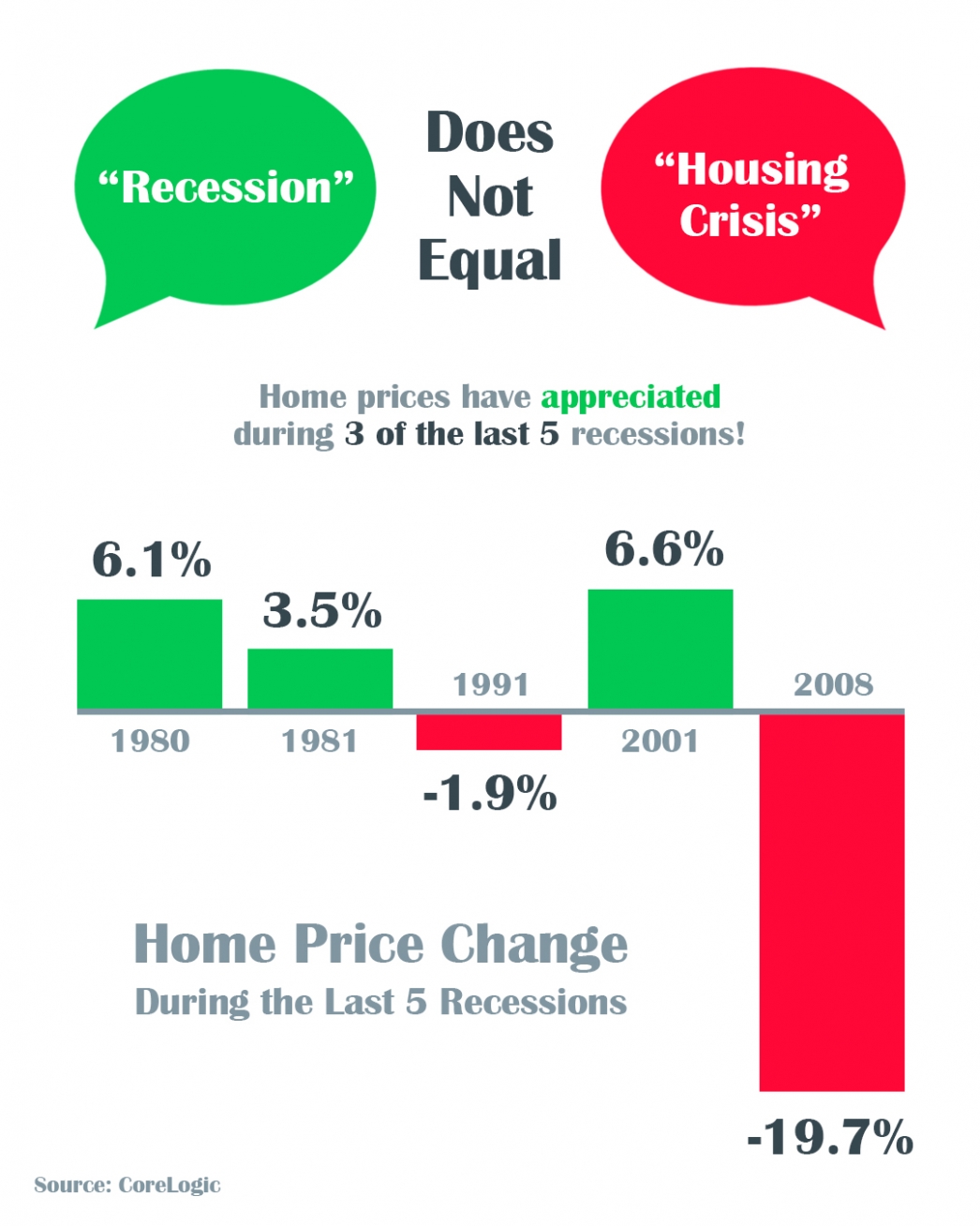

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Coronavirus Map

View the the interactive map https://google.org/crisisresponse/covid19-map

Coronavirus (COVID-19)

Notice the On Set Dates Below

Three Reasons Why This Is Not a Housing Crisis

Three Reasons Why This Is Not a Housing Crisis In times of uncertainty, one of the best things we can do to ease our fears is to educate ourselves with research, facts, and data. Digging into past experiences by reviewing historical trends and understanding the peaks...

Happy St Patrick’s Day Utah!

Two Big Myths in the Homebuying Process

Two Big Myths in the Homebuying Process The 2020 Millennial Home Buyer Report shows how this generation is not really any different from previous ones when it comes to homeownership goals: “The majority of millennials not only want to own a home, but 84% of...

5 Simple Graphs Proving This Is NOT Like the Last Time

5 Simple Graphs Proving This Is NOT Like the Last Time With all of the volatility in the stock market and uncertainty about the Coronavirus (COVID-19), some are concerned we may be headed for another housing crash like the one we experienced from 2006-2008. The...

Yes, You Can Still Afford a Home

Yes, You Can Still Afford a Home The residential real estate market has come roaring out of the gates in 2020. Compared to this time last year, the number of buyers looking for a home is up 20%, and the number of home sales is up almost 10%. The increase in purchasing...

Confidence Is the Key to Success for Young Homebuyers

Confidence Is the Key to Success for Young HomebuyersBuying your first home can seem overwhelming. Thankfully, there’s a lot of great information out there to help you feel more confident as you learn about the process. For those in younger generations who aspire to...