How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

The Difference a Year Makes for Homeownership

The Difference a Year Makes for HomeownershipOver the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant...

Holidays Aren’t Stopping Homebuyers

The Holidays Aren’t Stopping Homebuyers This Year Black Friday and Cyber Monday are behind us, yet finding the perfect holiday gifts for friends and family is certainly still top of mind for many right now. This year, there’s another type of buyer that’s very active...

Utah Forbearance Problems

Are Home Prices Headed Toward Bubble Territory

Are Home Prices Headed Toward Bubble Territory?Talk of a housing bubble is beginning to crop up as home prices have appreciated at a rapid pace this year. This is understandable since the appreciation of residential real estate is...

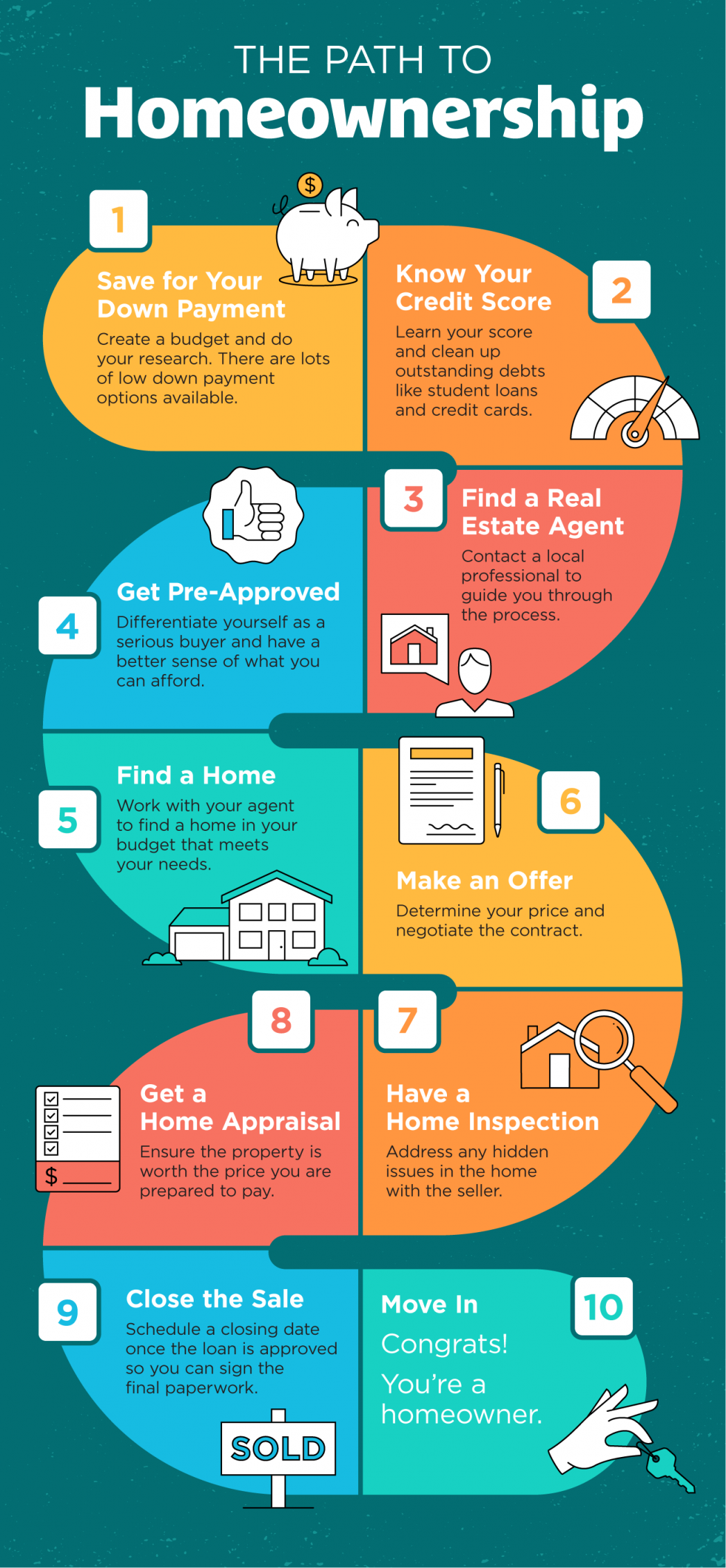

Homeownership can be yours

The Path to Homeownership Some Highlights If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the homebuying process. Let’s connect today to discuss the specific steps along the way in our...

Shop for Homes in a Virtual World

A New Way to Shop for Homes in a Virtual WorldIn a year when we’re learning to do so much remotely, homebuying is no exception. From going to work to attending school, grocery shopping, and even seeing our doctors online, digital practices have changed the way we...

Thank You

Thank You for Your Support!

It Pays to Sell with a Real Estate Agent

It Pays to Sell with a Real Estate Agent Some HighlightsToday, it’s more important than ever to have an expert you trust to guide you as you sell your house.From your safety throughout the process to the complexity of negotiating...

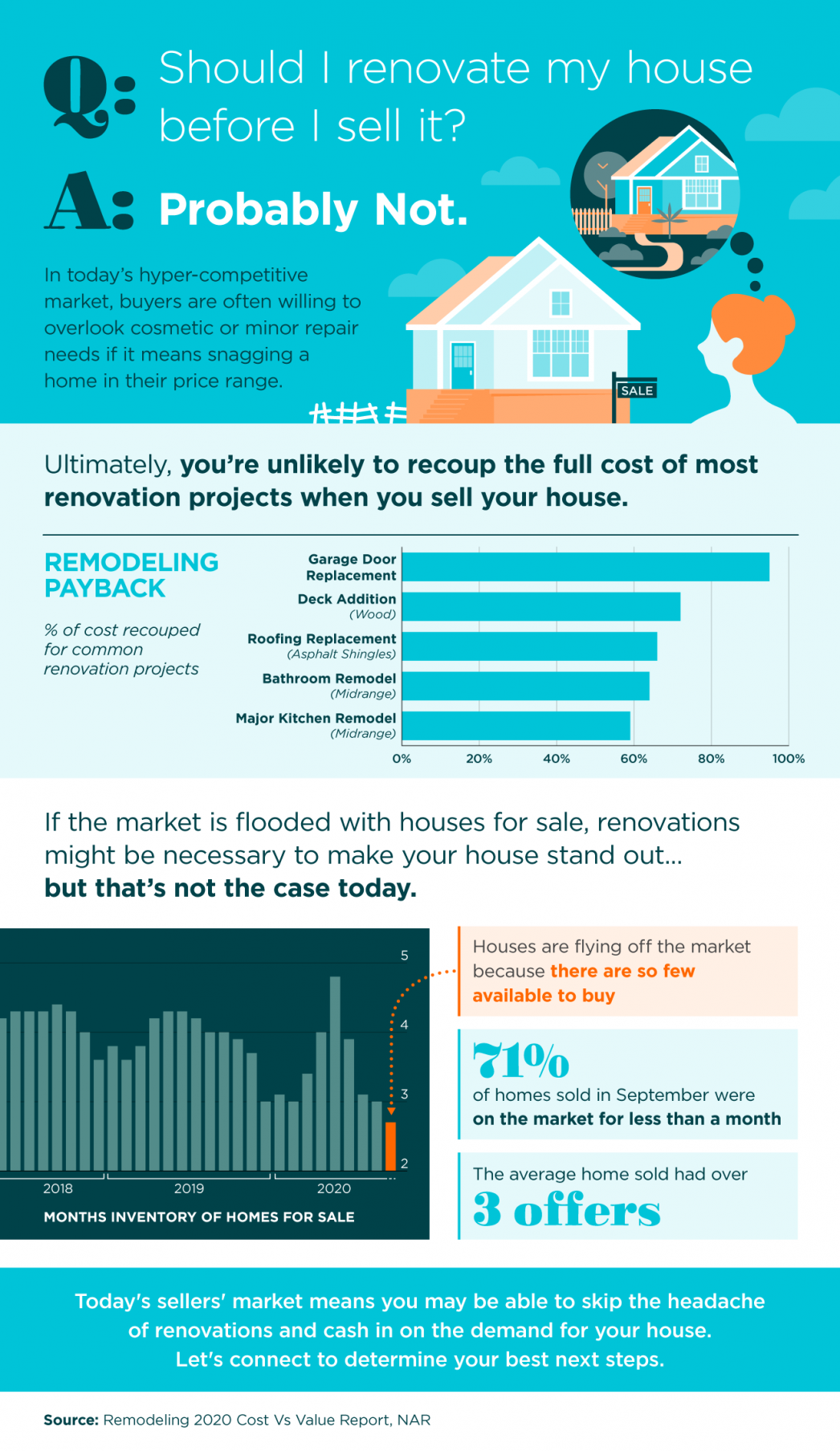

Should I Renovate My House Before I Sell It?

Should I Renovate My House Before I Sell It? Some HighlightsIn today’s hyper-competitive market, buyers are often willing to overlook cosmetic or minor repair needs if it means snagging a home in their price range.With so few houses available for sale today, you may...

Don’t Fear the Real Estate Market

Don't Fear the Real Estate Market October 29, 2020 Fear should never be a factor when navigating the housing market. Whether you're buying or selling a home this fall, let's connect to make sure you're empowered to take the safest path.