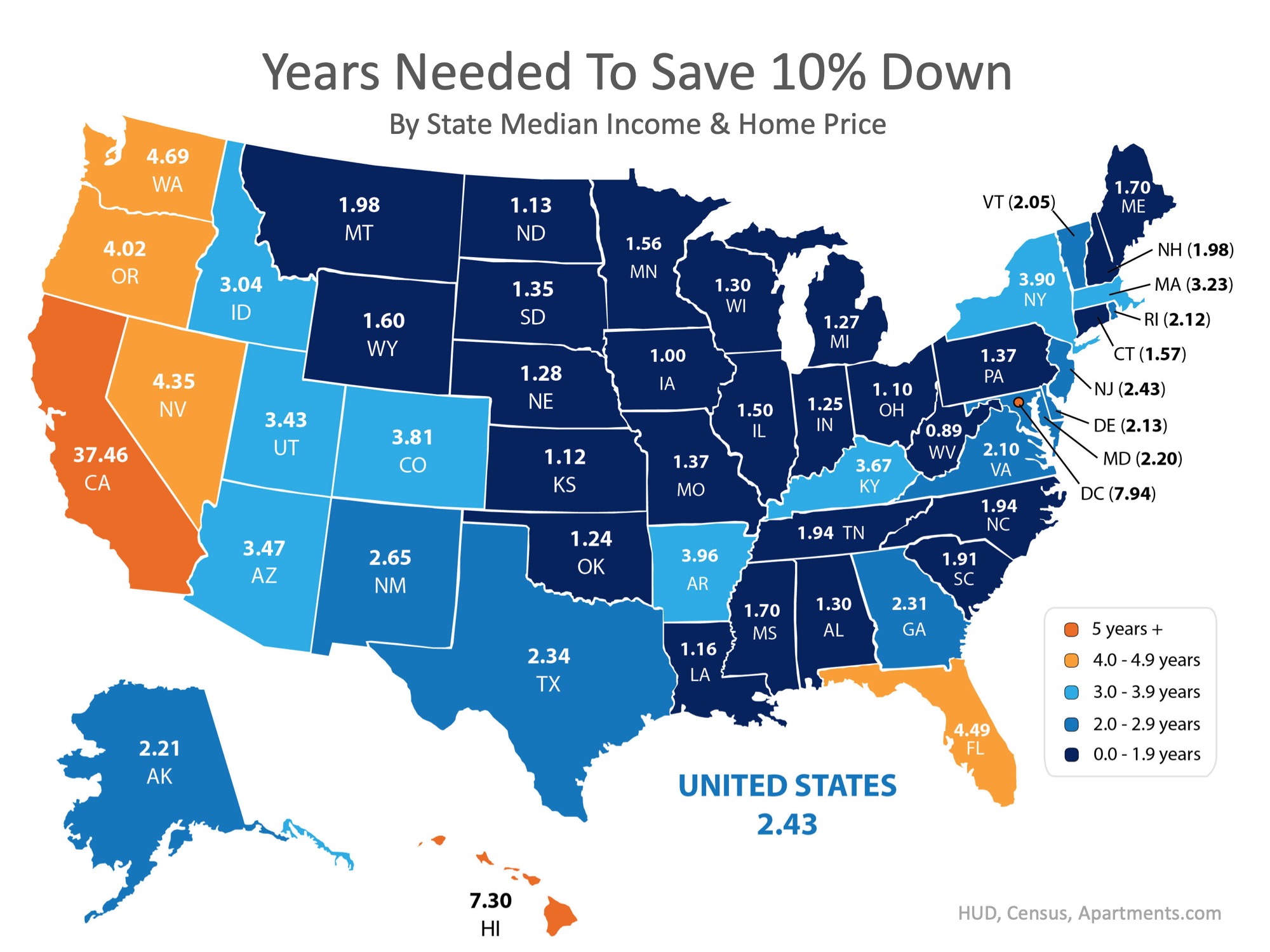

How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

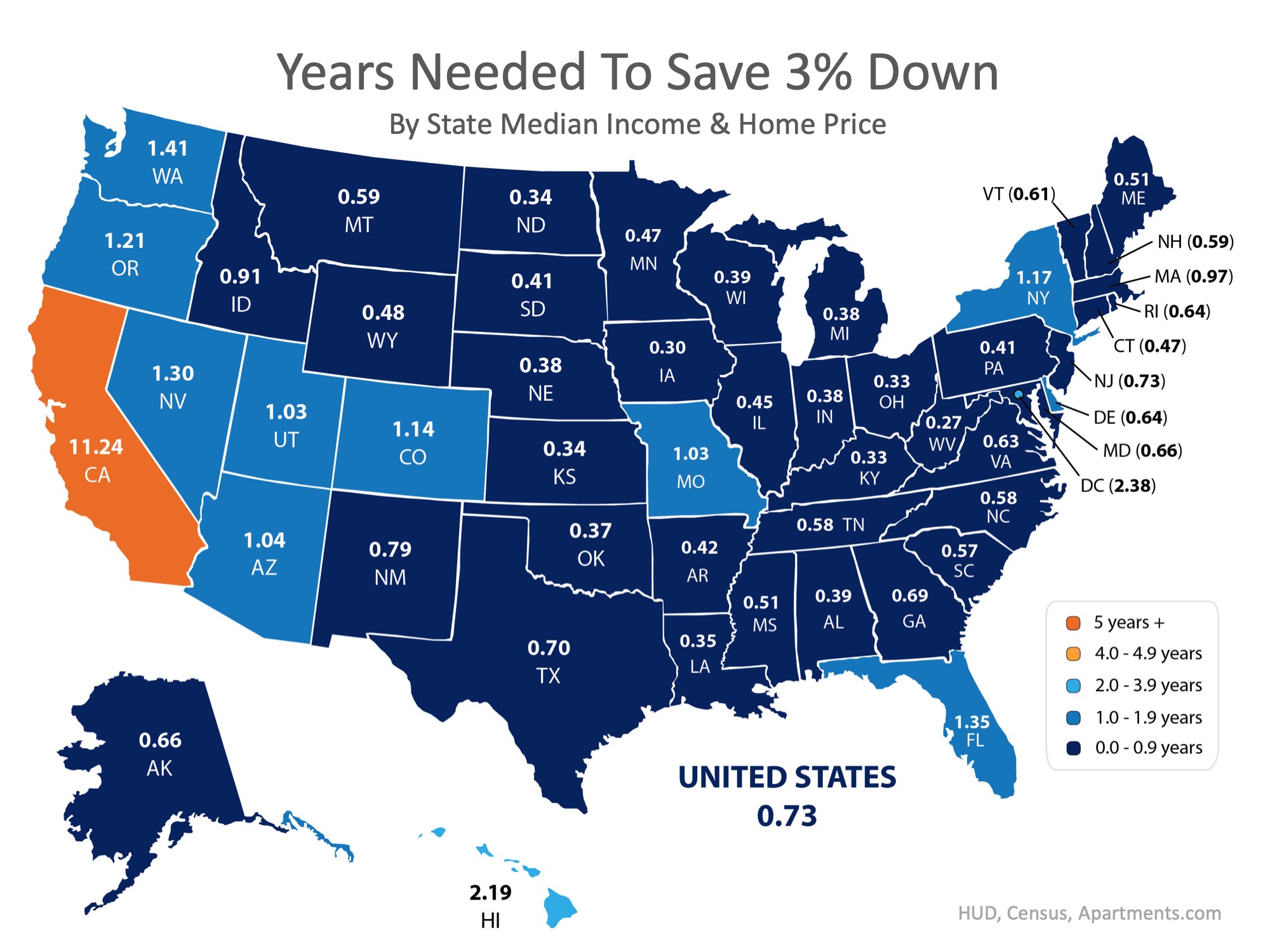

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

The Housing Market Is Positioned to Help the Economy Recover

The Housing Market Is Positioned to Help the Economy RecoverSome HighlightsExpert insights are painting a bright future for housing when the economy bounces back – and it will.We may be facing challenging economic times today, but the housing market is poised to help...

Looking to the Future: What the Experts Are Saying

Looking to the Future: What the Experts Are SayingAs our lives, our businesses, and the world we live in change day by day, we’re all left wondering how long this will last. How long will we feel the effects of the coronavirus? How deep will the impact go? The human...

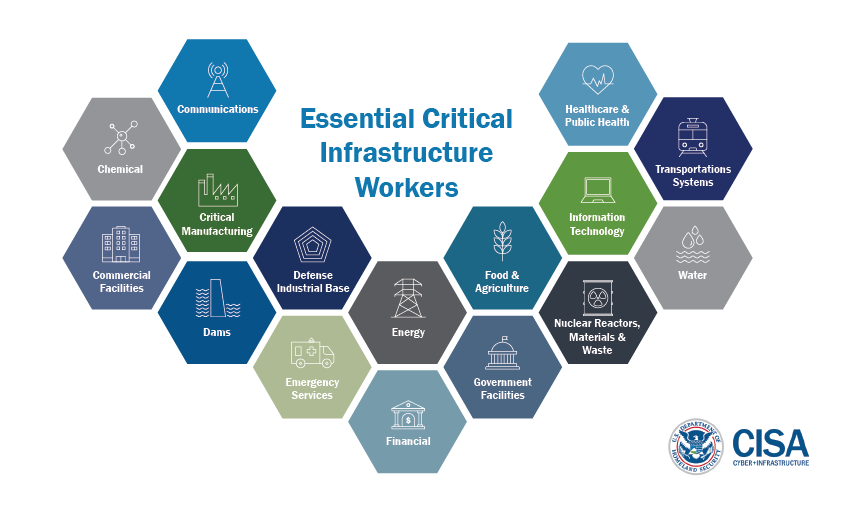

Real Estate Is an Essential Service According to U.S. Government

According to CISA (Cybersecurity and Infrastructure Security Agency)This list is advisory in nature. It is not, nor should it be considered, a federal directive or standard. Additionally, this advisory list is not intended to be the exclusive list of critical...

The Best Advice Does Not Mean Perfect Advice

The Best Advice Does Not Mean Perfect AdviceThe angst caused by the coronavirus has most people on edge regarding both their health and financial situations. It’s at times like these when we want exact information about anything we’re doing – even the correct protocol...

What You Can Do to Keep Your Dream of Homeownership Moving Forward

What You Can Do to Keep Your Dream of Homeownership Moving ForwardSome Highlights:Don’t put your homeownership plans on hold just because you’re stuck inside.There are several things you can do right now to keep your home search moving forward.Connect with an agent,...

With so much changing in today’s market

Does the News have you Scared

Don’t Let Frightening Headlines Scare YouThere’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.Amidst all this anxiety, anyone with a...

According to the Salt Lake Board of Realtors®Salt Lake home sales year-to-date are roughly the same as they were last year at this time. While everyday life has changed, the current economic quarantine could be short-lived, according to Lawrence Yun, chief economist...

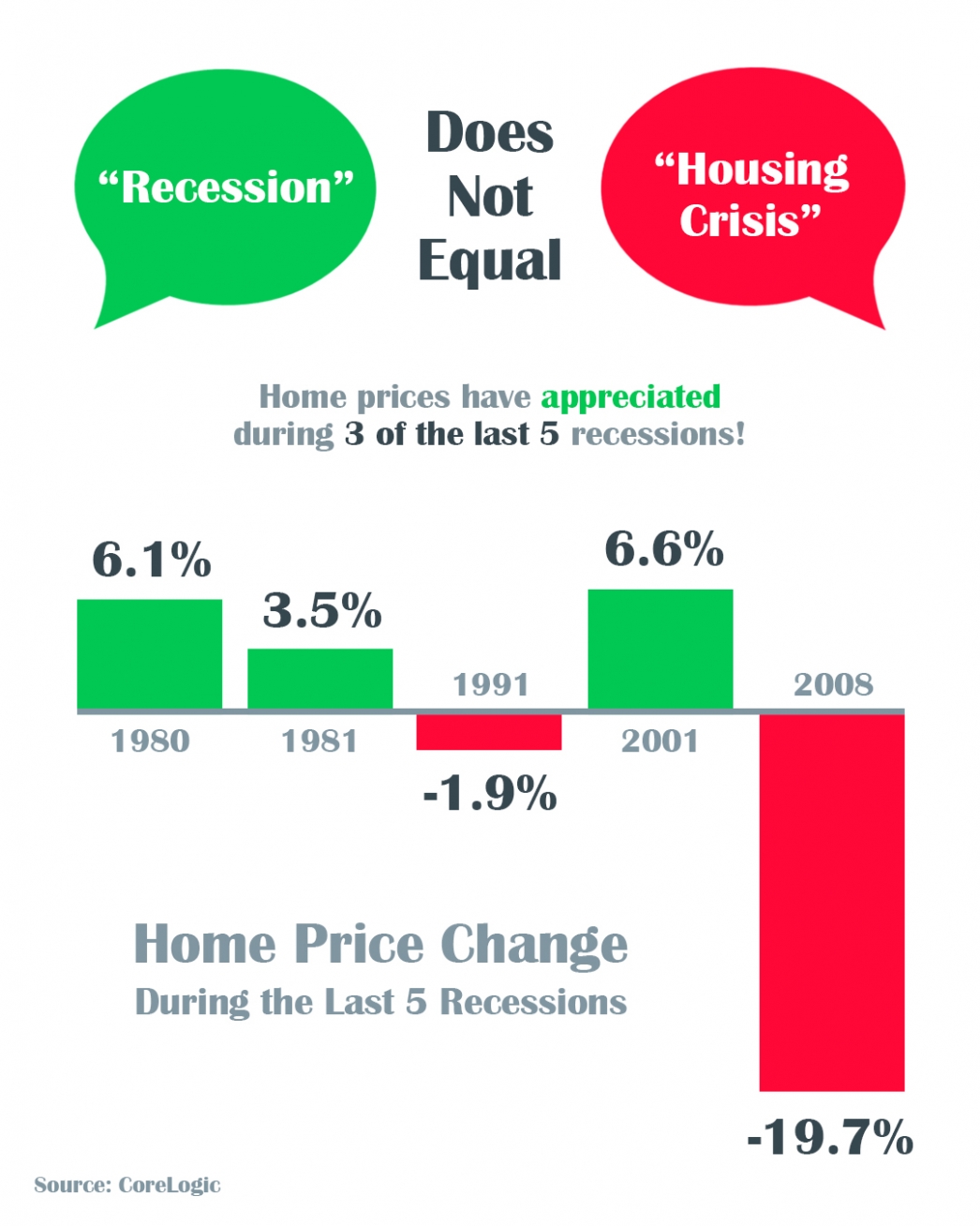

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Why the Stock Market Correction Probably Won’t Impact Home Values

Why the Stock Market Correction Probably Won’t Impact Home ValuesWith the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking...