How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

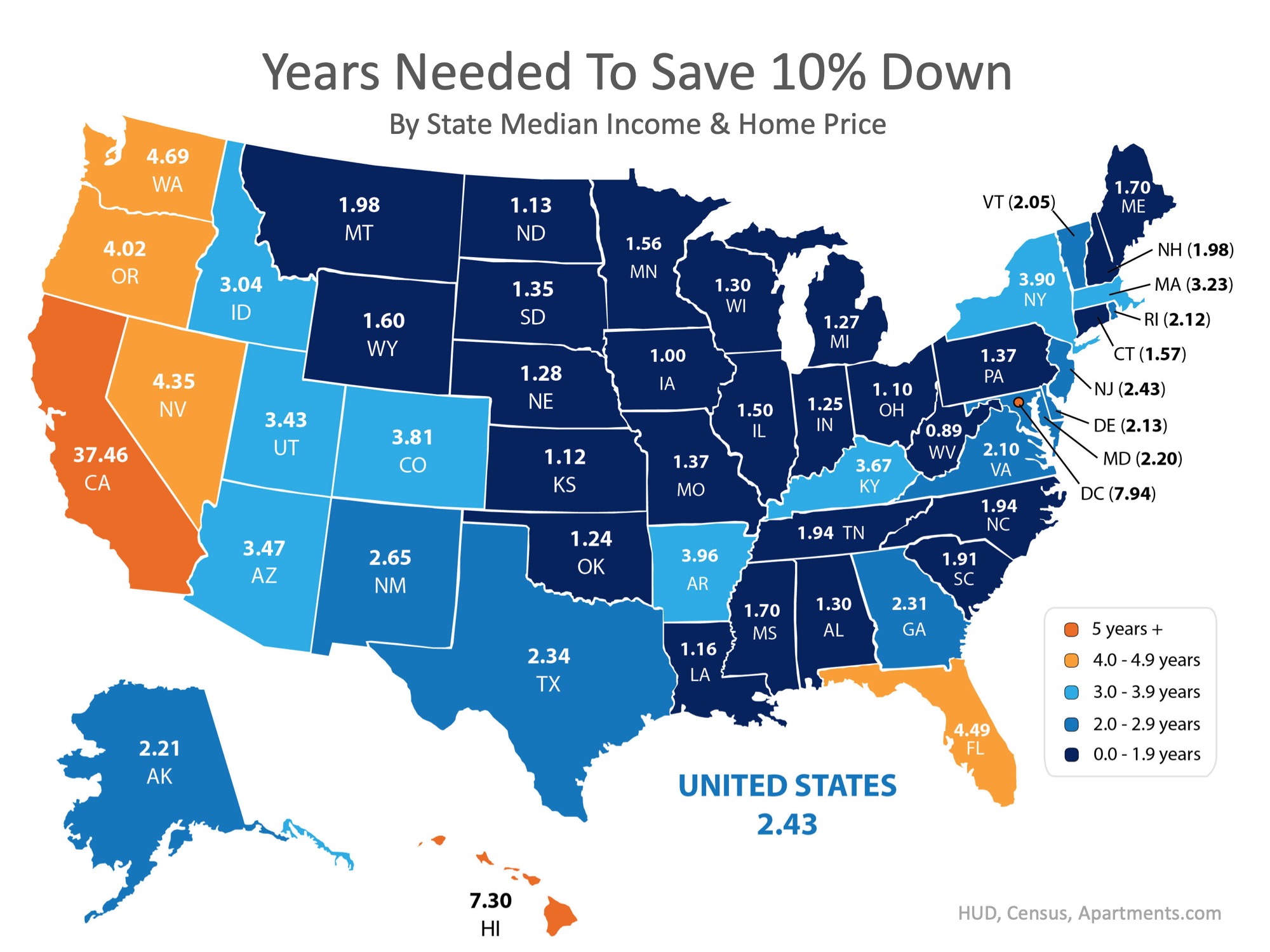

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

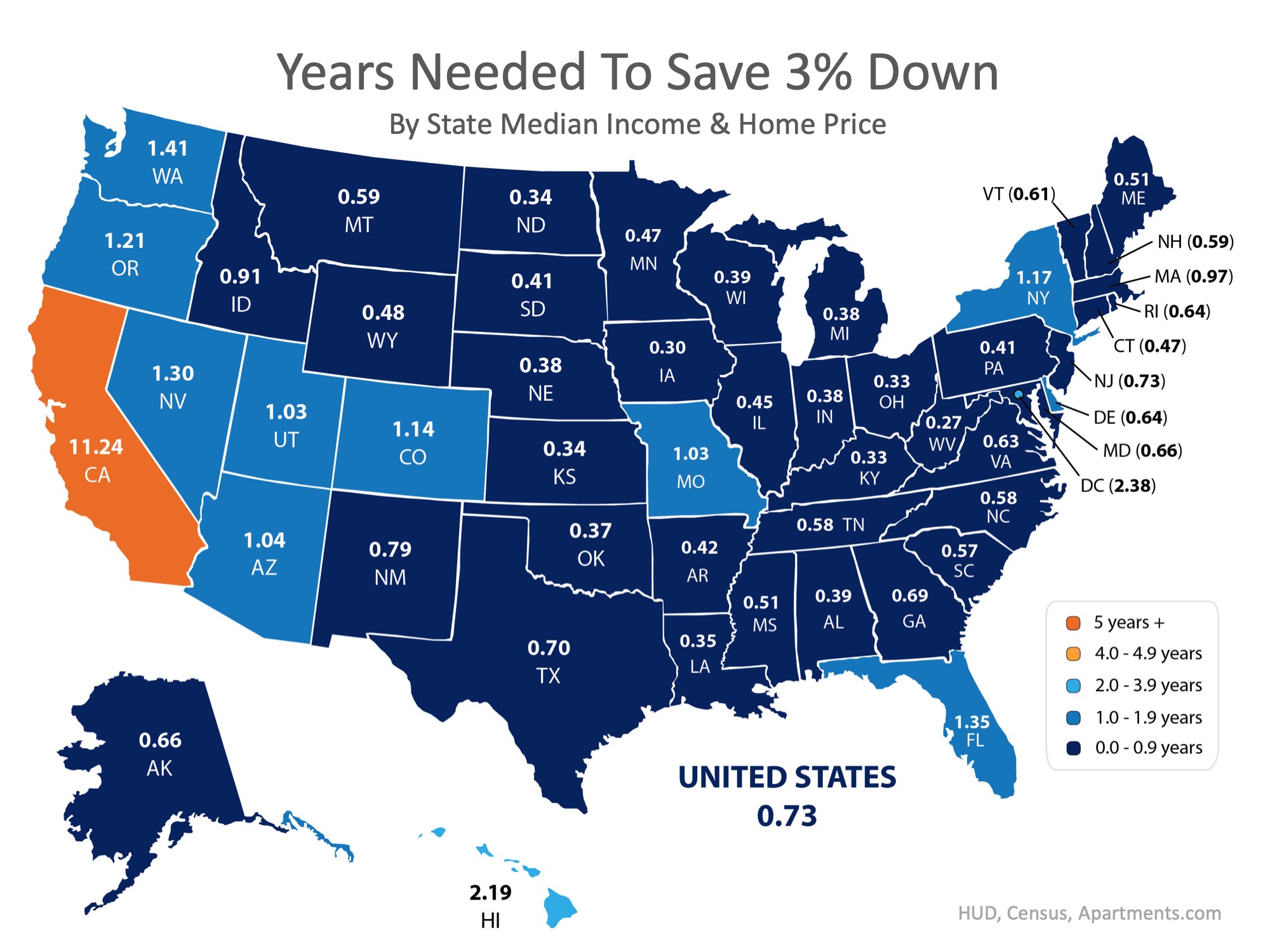

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Home Prices: It’s All About Supply and Demand

Home Prices: It’s All About Supply and Demand As we enter the summer months and work through the challenges associated with the current health crisis, many are wondering what impact the economic slowdown will have on home prices. Looking at the big picture, supply and...

The Benefits of Homeownership May Reach Further Than You Think

The Benefits of Homeownership May Reach Further Than You Think More than ever, our homes have become an integral part of our lives. Today they are much more than the houses we live in. They’re evolving into our workplaces, schools for our children, and safe havens...

Pandemic Mortgage Relief

Clients who are struggling financially because of the pandemic may look to you for advice if they can’t pay their mortgage.Keep up on mortgage relief options, so you’re prepared to guide them to appropriate resources.For instance, thanks to the Coronavirus Aid,...

Top Reasons to Own Your Home

Economists Forecast Recovery to Begin in the Second Half of 2020

Economists Forecast Recovery to Begin in the Second Half of 2020With the U.S. economy on everyone’s minds right now, questions about the country’s financial outlook continue to come up daily. The one that seems to keep rising to the top is: when will the economy begin...

Buying or Selling a Home? You Need an Expert Kind of Guide

Buying or Selling a Home? You Need an Expert Kind of GuideIn a normal housing market, whether you’re buying or selling a home, you need an experienced guide to help you navigate through the process. You need someone you can turn...

We Remember & Honor Those Who Gave All

We Remember & Honor Those Who Gave All We remember, today and always.

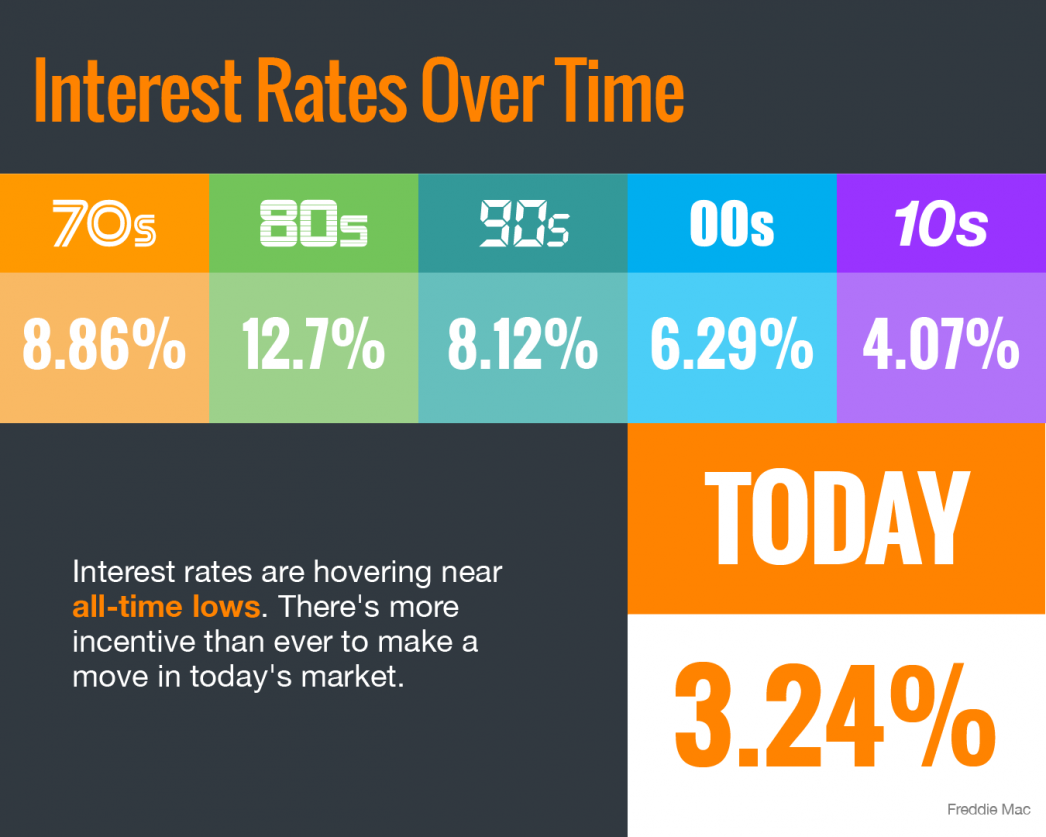

Interest Rates Hover Near Historic All-Time Lows

Interest Rates Hover Near Historic All-Time LowsSome HighlightsMortgage interest rates have dropped considerably this spring and are hovering at a historically low level.Locking in at a low rate today could save you thousands of dollars over the lifetime of your home...

Summer is the new Spring for Placing your home on the Market

Experts Predict Economic Recovery Should Begin in the Second Half of 2020

Experts Predict Economic Recovery Should Begin in the Second Half of the Year One of the biggest questions we all seem to be asking these days is: When are we going to start to see an economic recovery? As the country begins to slowly reopen, moving forward in...