How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

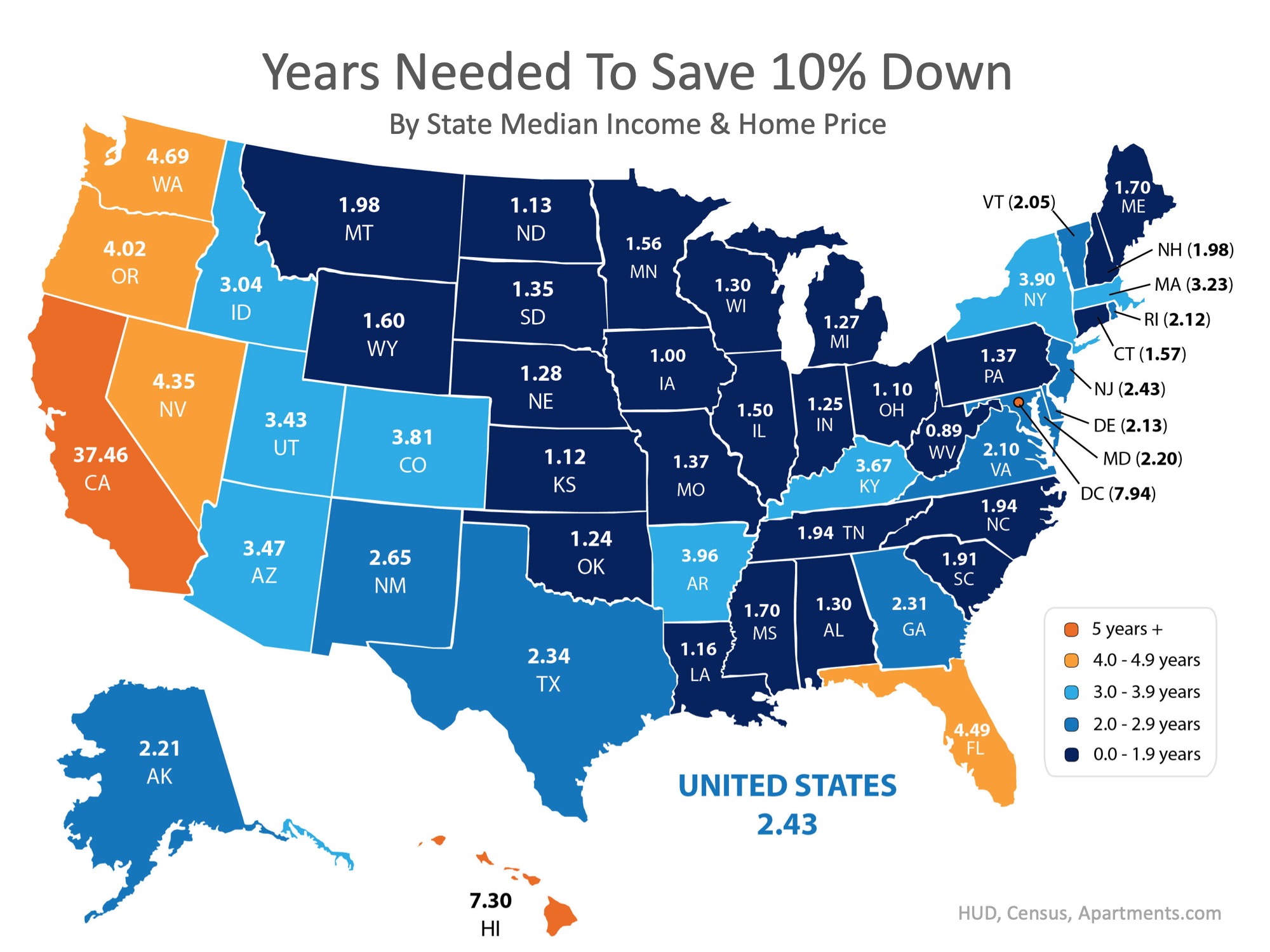

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

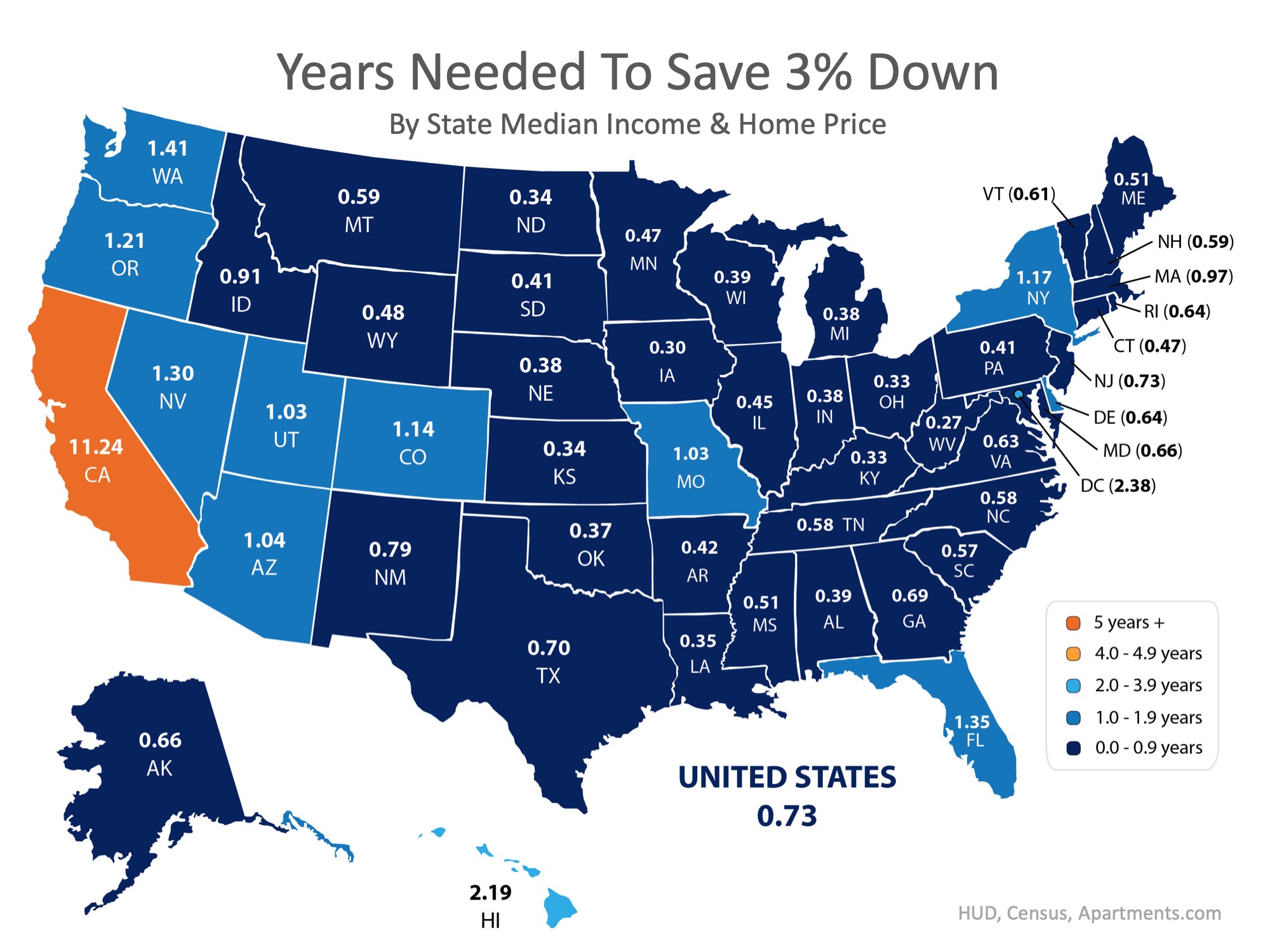

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Today’s mortgage rates are still incredibly low compared to the historical norm. Let’s connect so you can strike while the iron is hot.

There's Still Time To Take Advantage of Historically Low Mortgage RatesToday's...

Why You May Want To Cash in on Your Second Home

Why You May Want To Cash in on Your Second HomeWhen stay-at-home mandates were enforced last year, many households realized their homes didn’t really fulfill their new lifestyle needs. An office (in some cases two), a media room, space for children to learn, a gym,...

Buying a Home Is Still Affordable

Buying a Home Is Still AffordableThe last year has put emphasis on the importance of one’s home. As a result, some renters are making the jump into homeownership while some homeowners are re-evaluating their current house and considering a move to one that better fits...

3 Things To Prioritize When Selling Your House

3 Things To Prioritize When Selling Your HouseToday’s housing market is full of unprecedented opportunities. High buyer demand paired with record-low housing inventory is creating the ultimate sellers’ market, which means it’s a fantastic time to sell your house....

Why Is This Spring a Great Time to Sell Your House?

Why Is This Spring a Great Time to Sell Your House?

Your House Could Be the Oasis in an Inventory Desert

Your House Could Be the Oasis in an Inventory DesertHomebuyers are flooding the housing market right now to take advantage of record-low mortgage rates. Many have a sense of urgency to find a home soon since experts forecast a steady rise in both rates and home prices...

It’s Not Too Late To Apply For Forbearance

It’s Not Too Late To Apply For Forbearance Over the past year, the pandemic made it challenging for some homeowners to make their mortgage payments. Thankfully, the government initiated a forbearance program to provide much-needed support. Unless they’re extended once...

Americans Have Their Hearts Set on Homeownership

801-205-3500

Are Interest Rates Expected to Rise Over the Next Year?

Are Interest Rates Expected to Rise Over the Next Year?So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into...