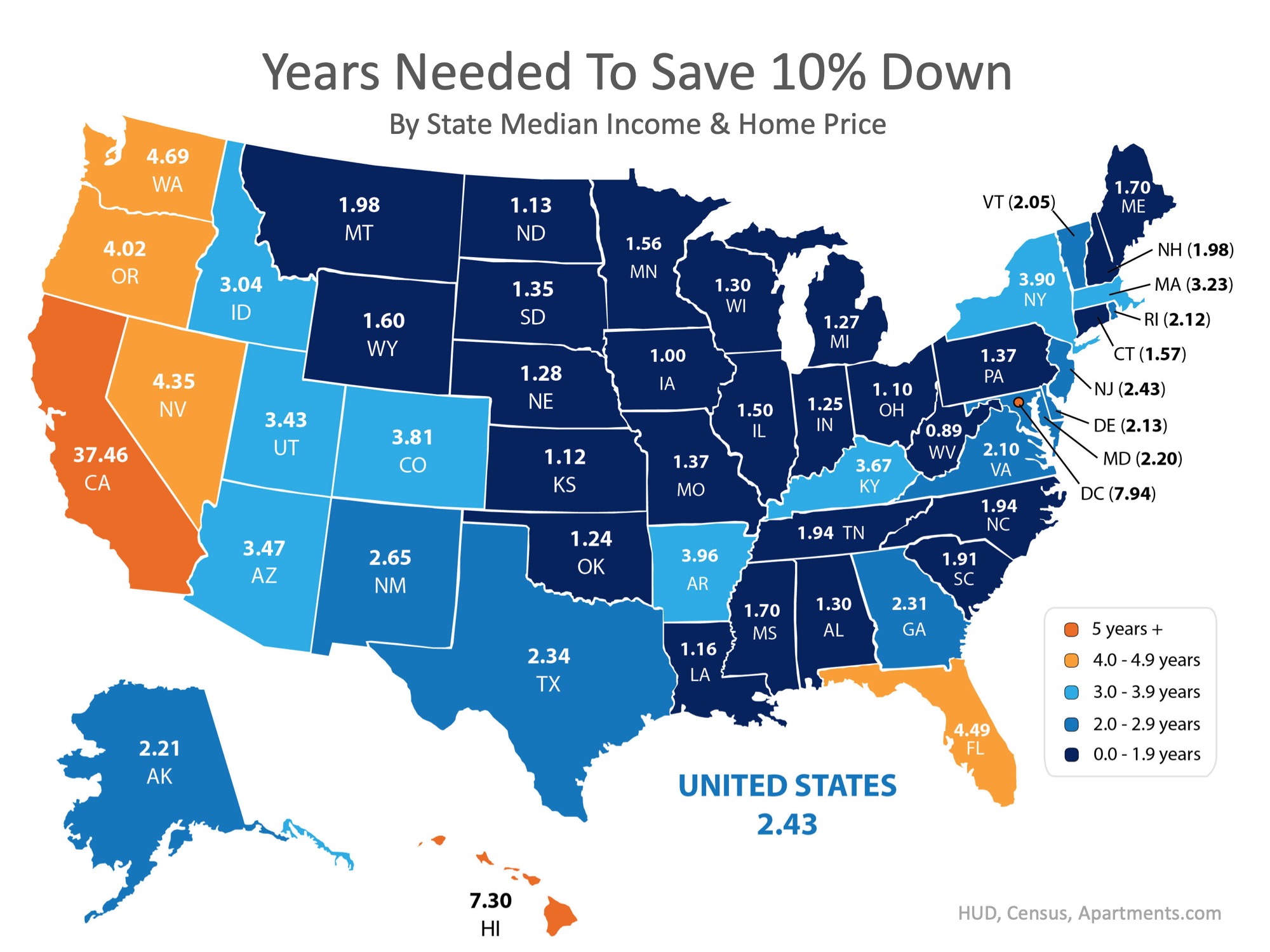

How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

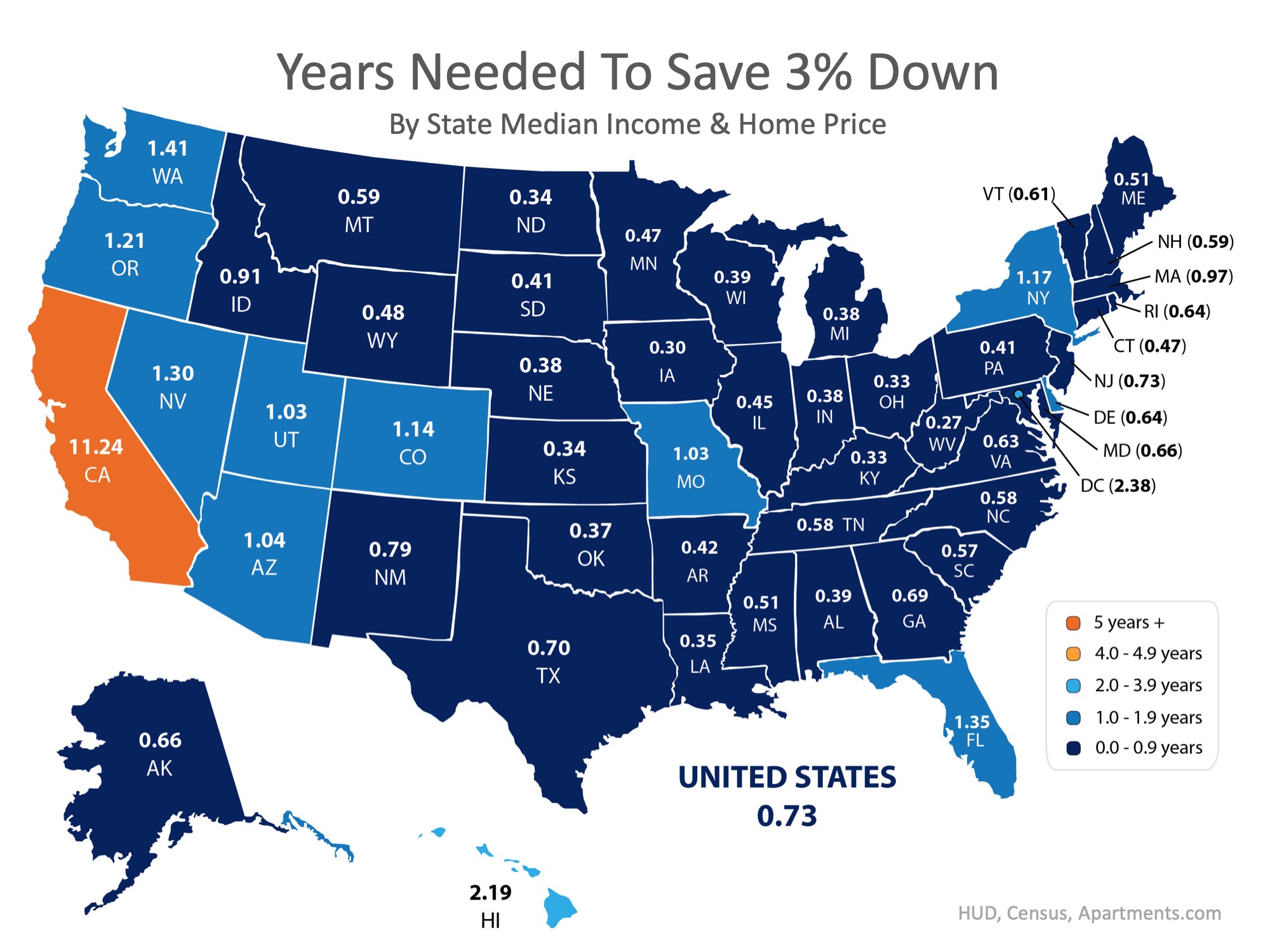

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since...

Salt Lake homebuyers, on average, paid $120,000 more than they did the same quarter last year

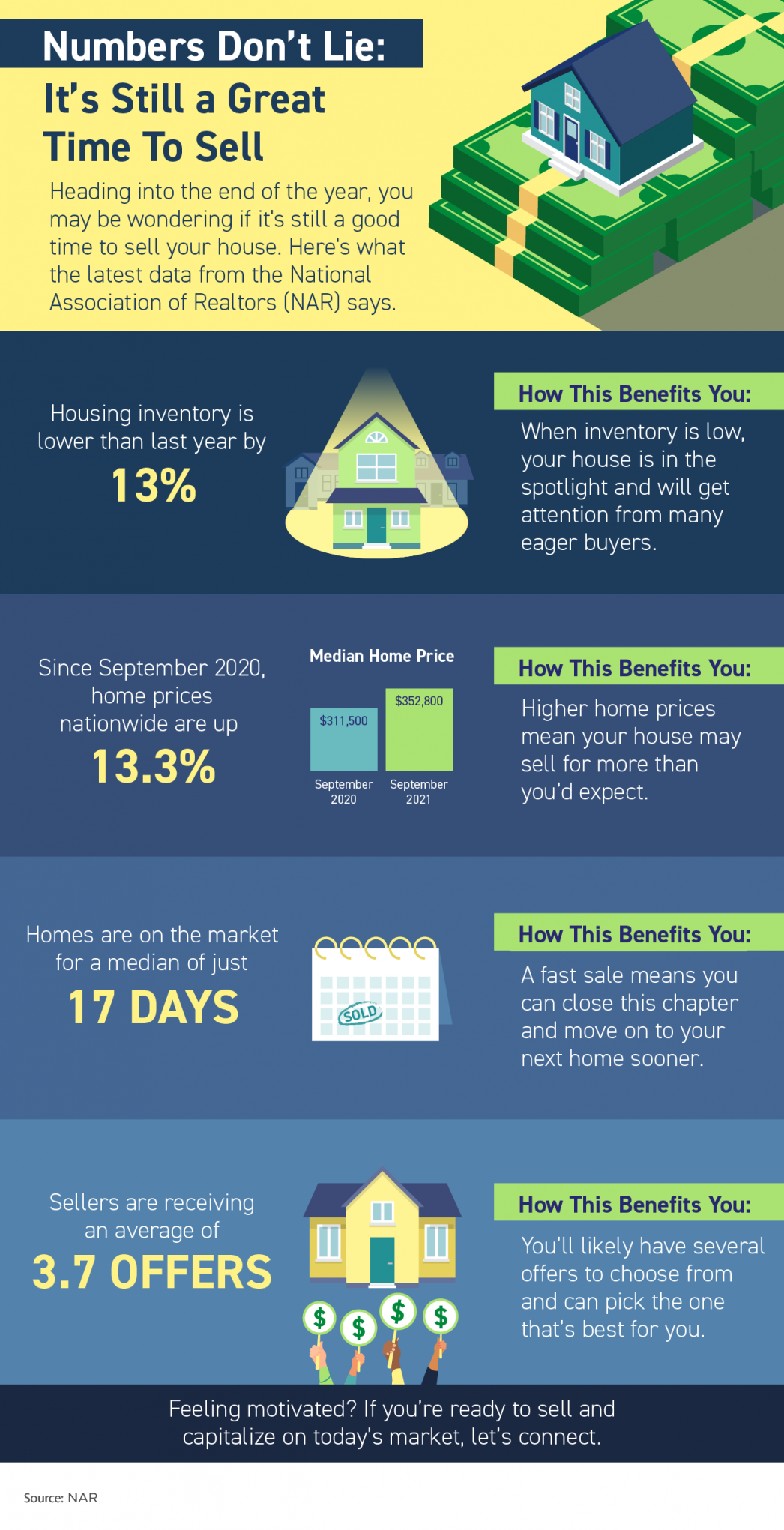

Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell Some Highlights Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says. Housing supply is...

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022 Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates...

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of...

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary Some Highlights Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare. Know your credit score and work to build strong credit. When...

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends. The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced...

There Are More Homes Available Now than There Were This Spring

There Are More Homes Available Now than There Were This Spring There’s a lot of talk lately about how challenging it can be to find a home to buy. While housing inventory is still low, there are a few important things to understand about the supply of homes for sale...

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

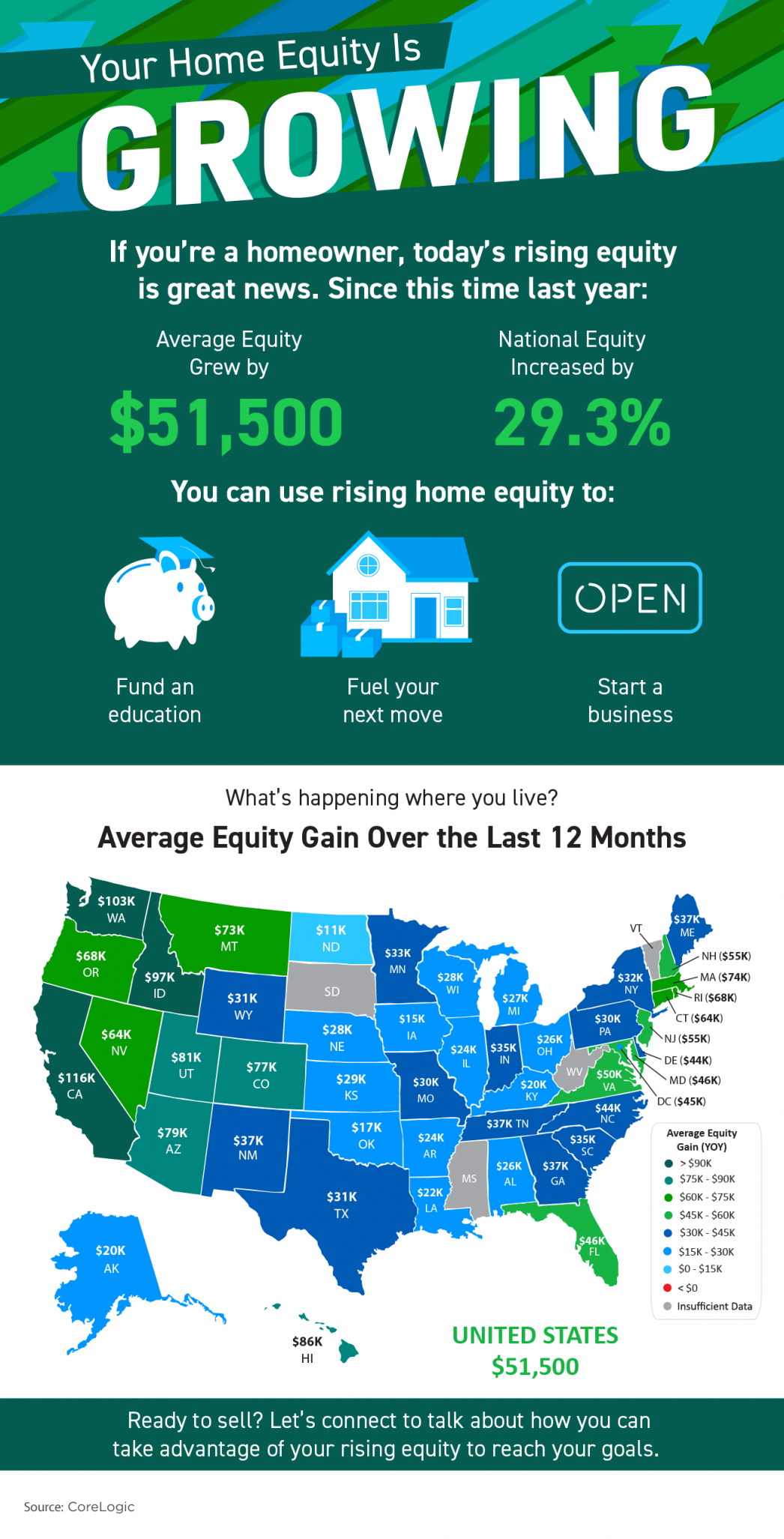

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...