How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Trusted Professionals Make Homebuying Easier

How Trusted Professionals Make Homebuying Easier to Understand In the spring, many excited buyers get ready to enter the housing market. Others continue dreaming about the homes they’d like to buy. The truth is, many potential buyers continue to dream longer than they...

The Overlooked Financial Advantages of Homeownership

The Overlooked Financial Advantages of Homeownership There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can...

Why the Electoral College Is So Important

Why The Electoral College Is So Important?

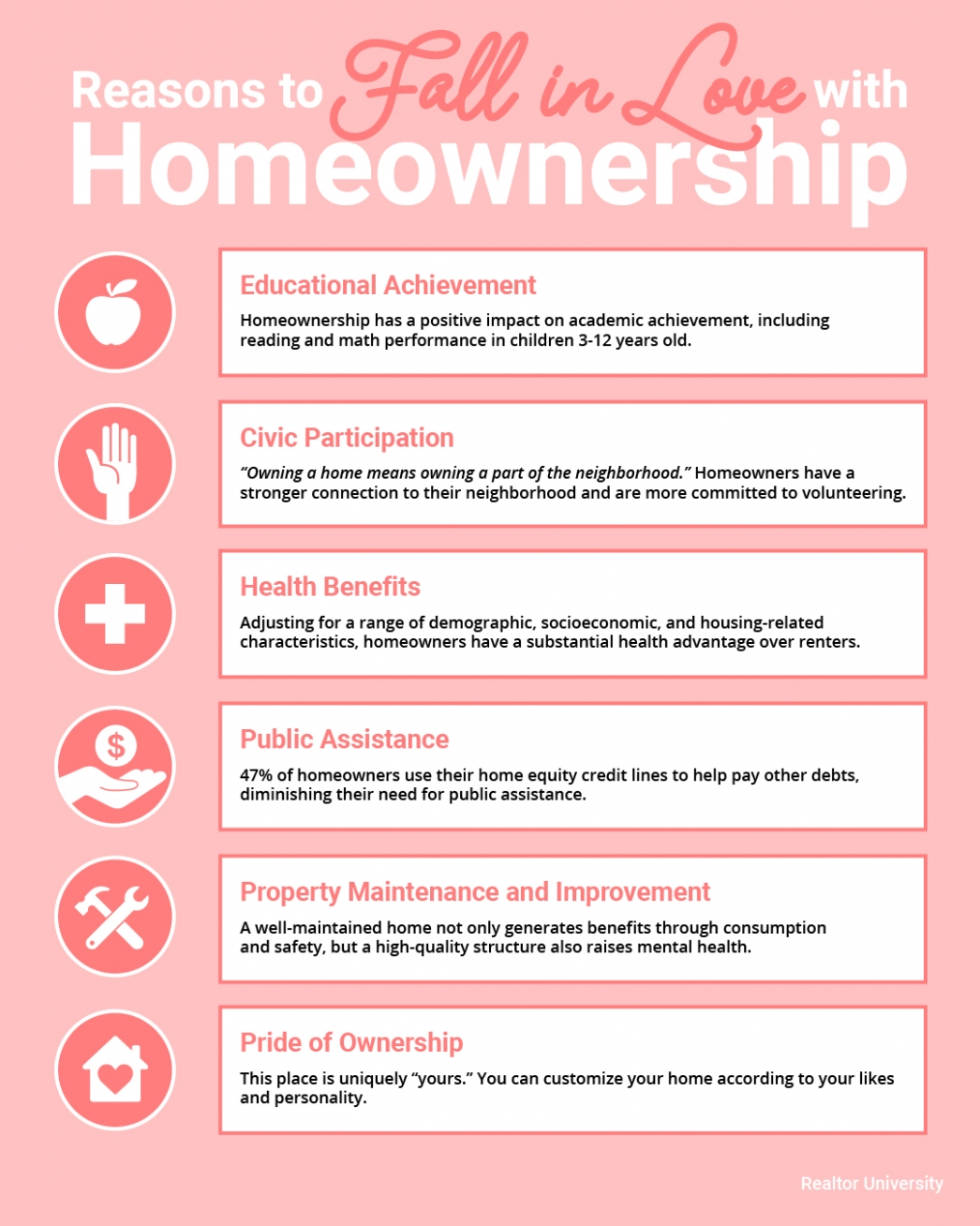

Reasons to Fall in Love with Homeownership

Reasons to Fall in Love with Homeownership Some Highlights: There are many benefits to love about homeownership, and they’re not all financial. Being a part of a neighborhood, driving academic achievement, and improving mental health are just a few of these...

Home Prices Are on the Rise This Year and to 2024

Home prices are appreciating, and they're forecasted to continue doing so through the next few years. Let's connect to see if now is a great time to make your next move.

How the Housing Market Benefits with Uncertainty in the World

How the Housing Market Benefits with Uncertainty in the World It’s hard to listen to today’s news without hearing about the uncertainty surrounding global markets, the spread of the coronavirus, and tensions in the Middle East, just to name a few. These concerns have...

The #1 Reason to List Your House Right Now

The #1 Reason to List Your House Right Now The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that...

Underwater with Two Mortgages? Here are 5 Ways to Refinance

Underwater with Two Mortgages? Here are 5 Ways to Refinance Having a second mortgage or home equity line can make refinancing an underwater mortgage nearly impossible, but one of these five strategies might bail out your refinance. The mortgage market is awash in...

Homeownership Rate on the Rise to a 6-Year High

Homeownership Rate on the Rise to a 6-Year High Regardless of the lack of inventory on the market, the U.S. homeownership rate has climbed to a 6-year high. The United States Census Bureau reported that it increased to 65.1% in the fourth quarter of 2019, representing...

How Pricing Your Home Right Makes a Big Difference

How Pricing Your Home Right Makes a Big Difference Even though there’s a big buyer demand for homes in today’s low inventory market, it doesn’t mean you should price your home as high as the sky when you’re ready to sell. Here’s why making sure you price it right is...