How Quickly Can You Save Your Down Payment?

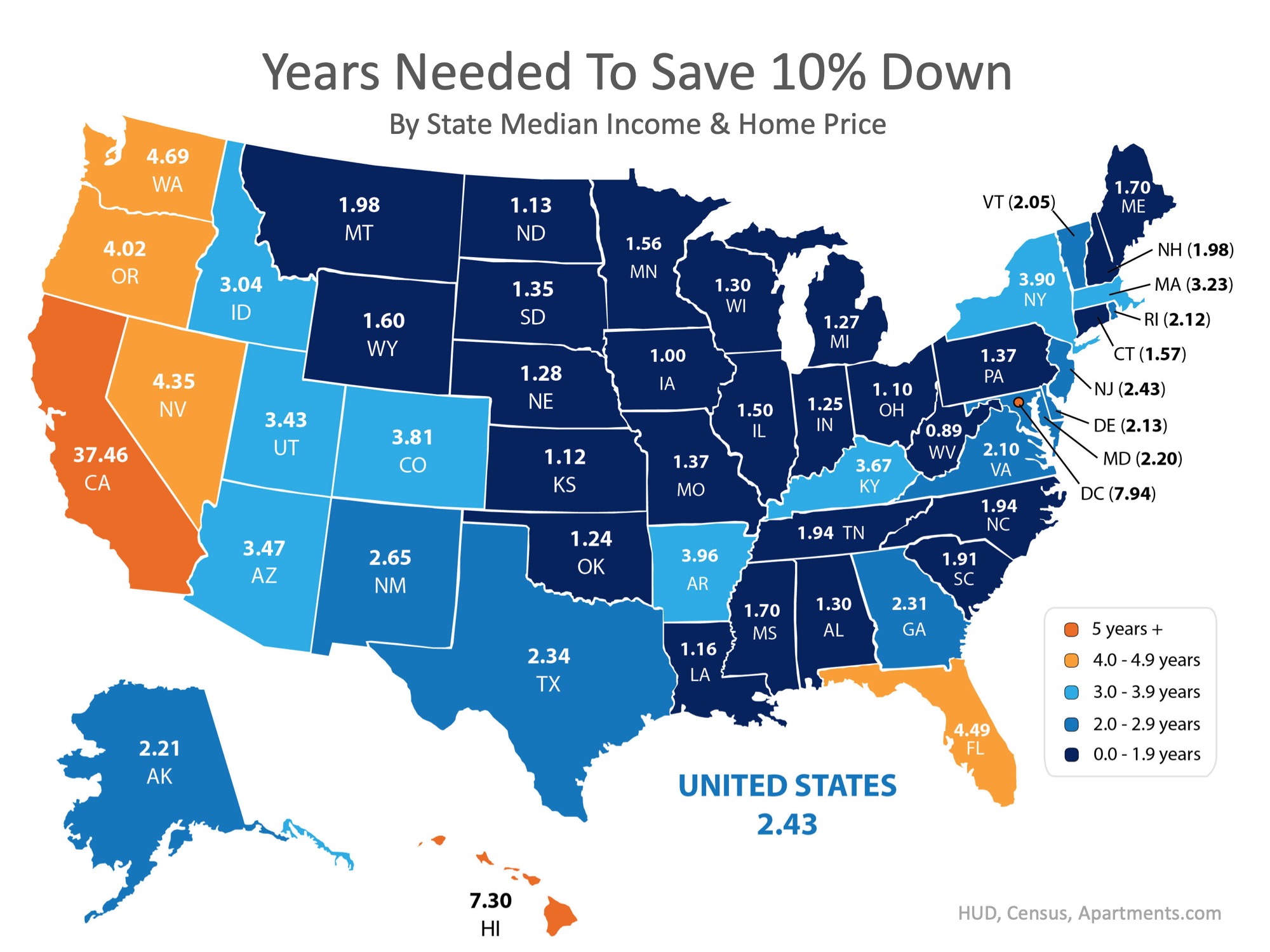

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

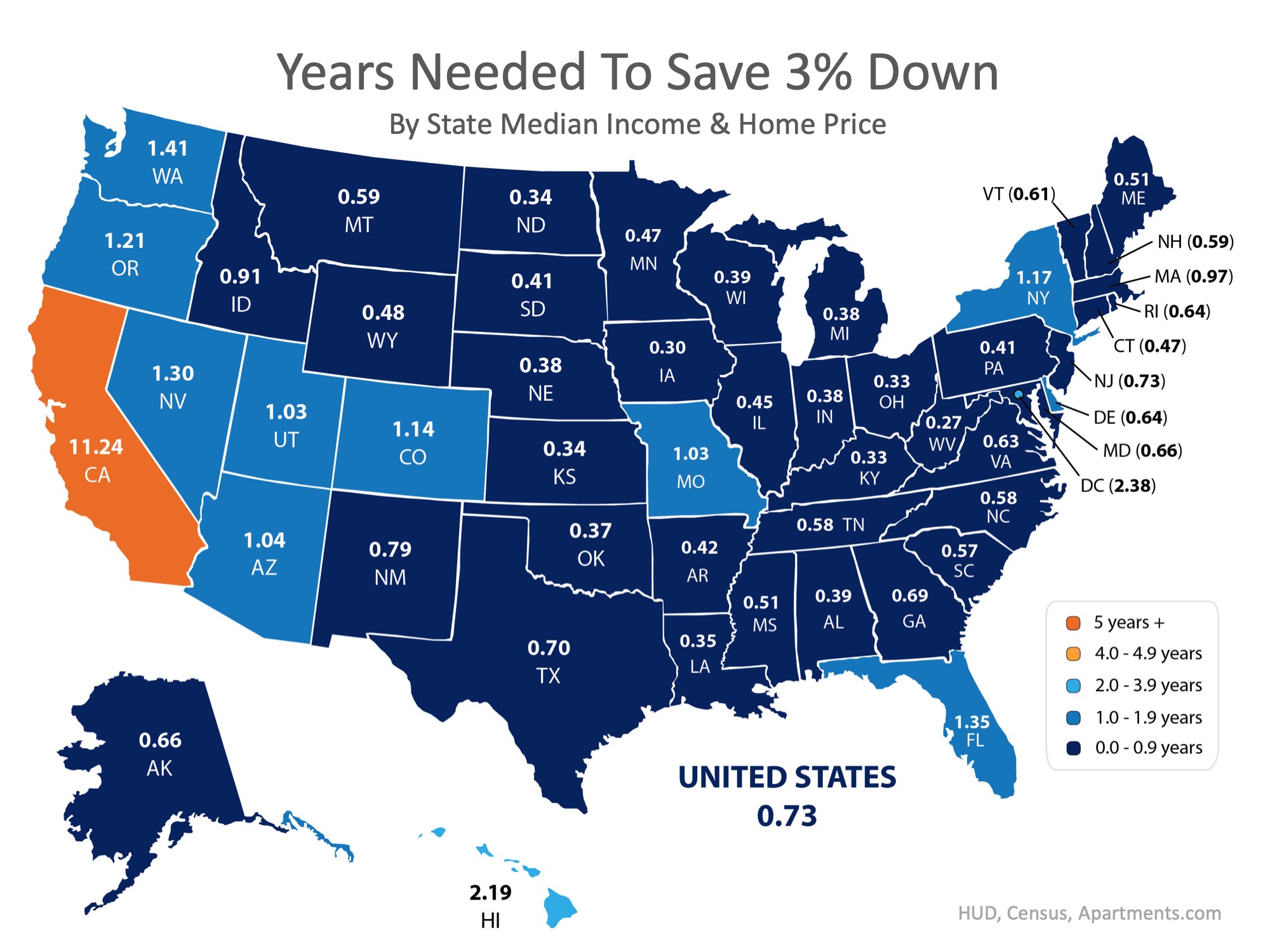

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

It’s Not Just About the Price of the Home

It’s Not Just About the Price of the HomeWhen most of us begin searching for a home, we naturally start by looking at the price. It’s important, however, to closely consider what else impacts the purchase. It’s not just the price of the house that matters, but the...

Salt Lake Home Sales Climb to Record High in July 2020

Salt Lake Home Sales Climb to Record High in July Salt Lake County home sales reached an all-time high in July at 2,093 homes sold, 15 percent higher than July 2019. It's the first time monthly sales surpassed 2,000 closings since the MLS began keeping records....

Utah Real Estate Tip – there are no “easy” transactions.

Real Estate Legal Tip - there are no "easy" transactions.Some people say that when the market is hot, "I can sell my home myself," or "I don't need an experienced agent because it costs money," or "how hard can it be?"Curtis Bullock From the Salt Lake Board of...

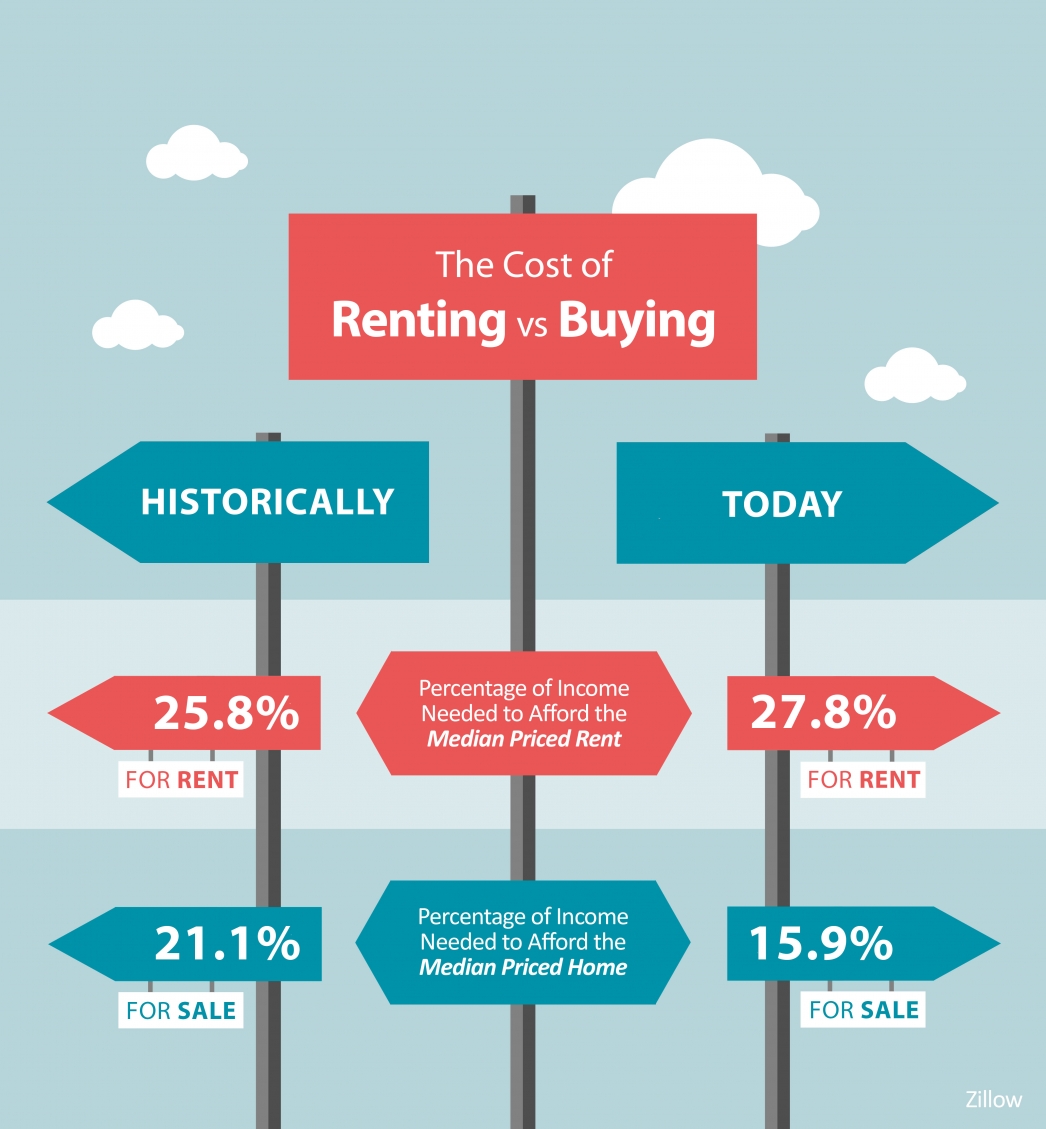

The Cost of Renting Vs. Buying a Home

The Cost of Renting Vs. Buying a HomeSome HighlightsThe percentage of income needed to afford a median-priced home today is declining, while that for renting is on the rise.This is making buying a home an increasingly attractive option for many people, especially with...

Forbearance Numbers Are Lower Than Experts Forecasted

Forbearances have stayed well under the rate experts initially forecasted. Let's connect if you have questions about your options.

Top Reasons People Are Moving This Year In 2020

The Top Reasons People Are Moving This YearToday, Americans are moving for a variety of different reasons. The current health crisis has truly re-shaped our lifestyles and our needs. Spending extra time where we currently live is enabling many families to re-evaluate...

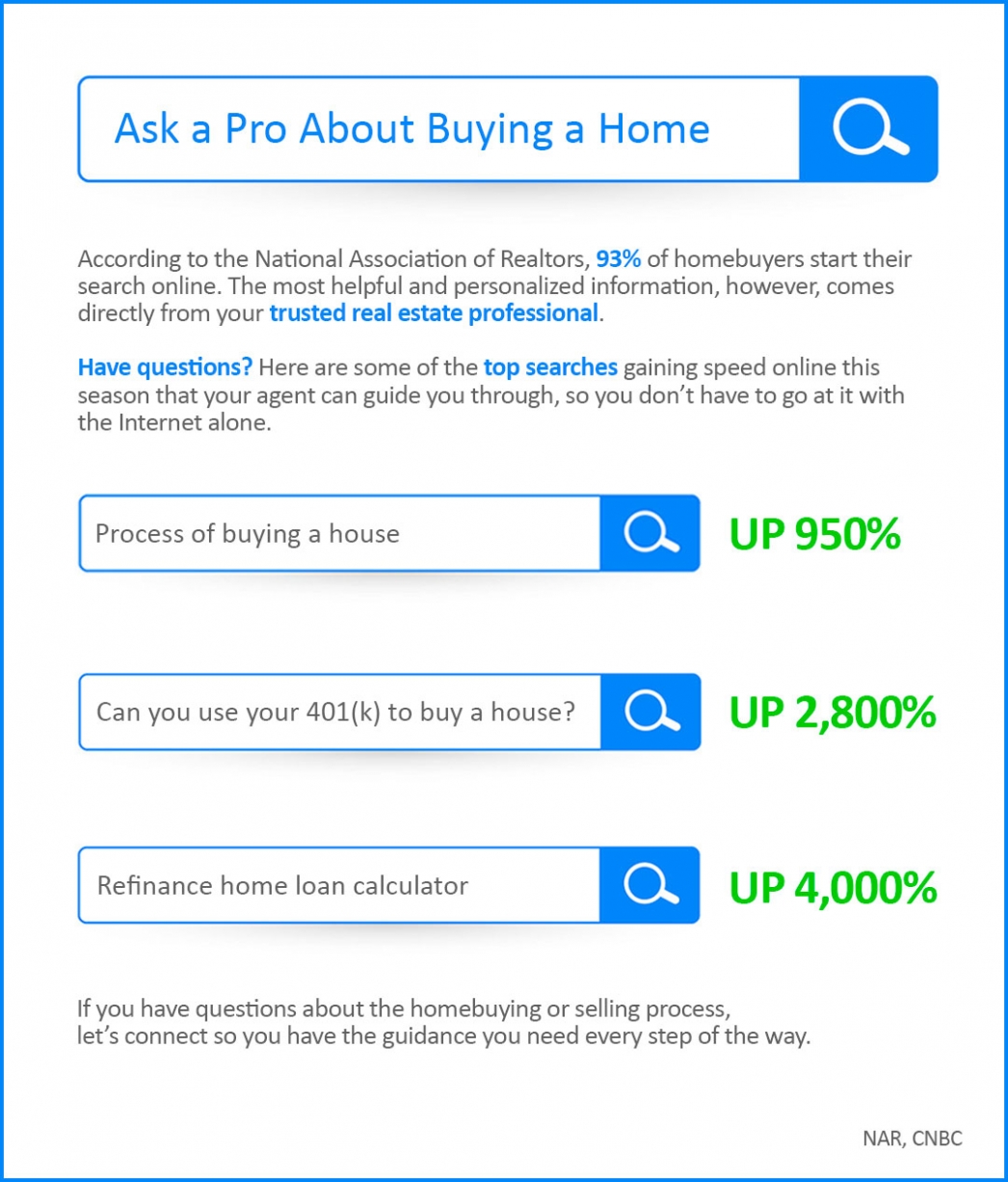

Ask a Pro About Buying a Home

Ask a Pro About Buying a Home Some HighlightsAccording to trending data, searches for key real estate topics are skyrocketing online.Clearly, lots of people have questions about buying a home, and other topics related to the process.Working with a trusted real estate...

Home Has a Whole New Meaning Today

Forbearance Numbers Are Lower than Expected

Forbearance Numbers Are Lower than ExpectedOriginally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some...

Are you Thinking About Selling? Sellers Are Returning to the Housing Market

Sellers Are Returning to the Housing MarketGet Your PEAR Report Today! (Professional Equity Assessment Report)In today’s housing market, it can be a big challenge for buyers to find homes to purchase, as the number of houses for sale is far below the current demand....