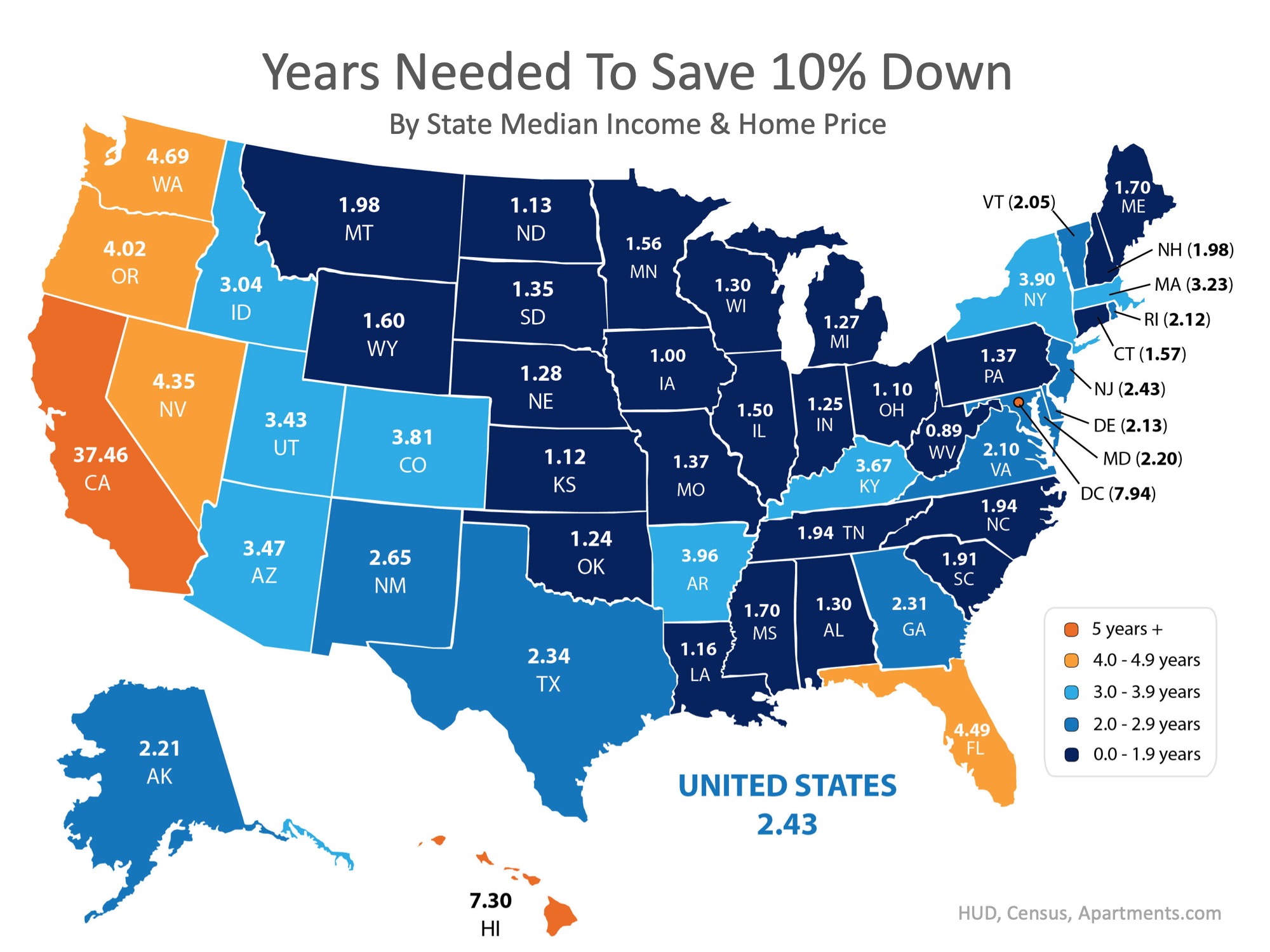

How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

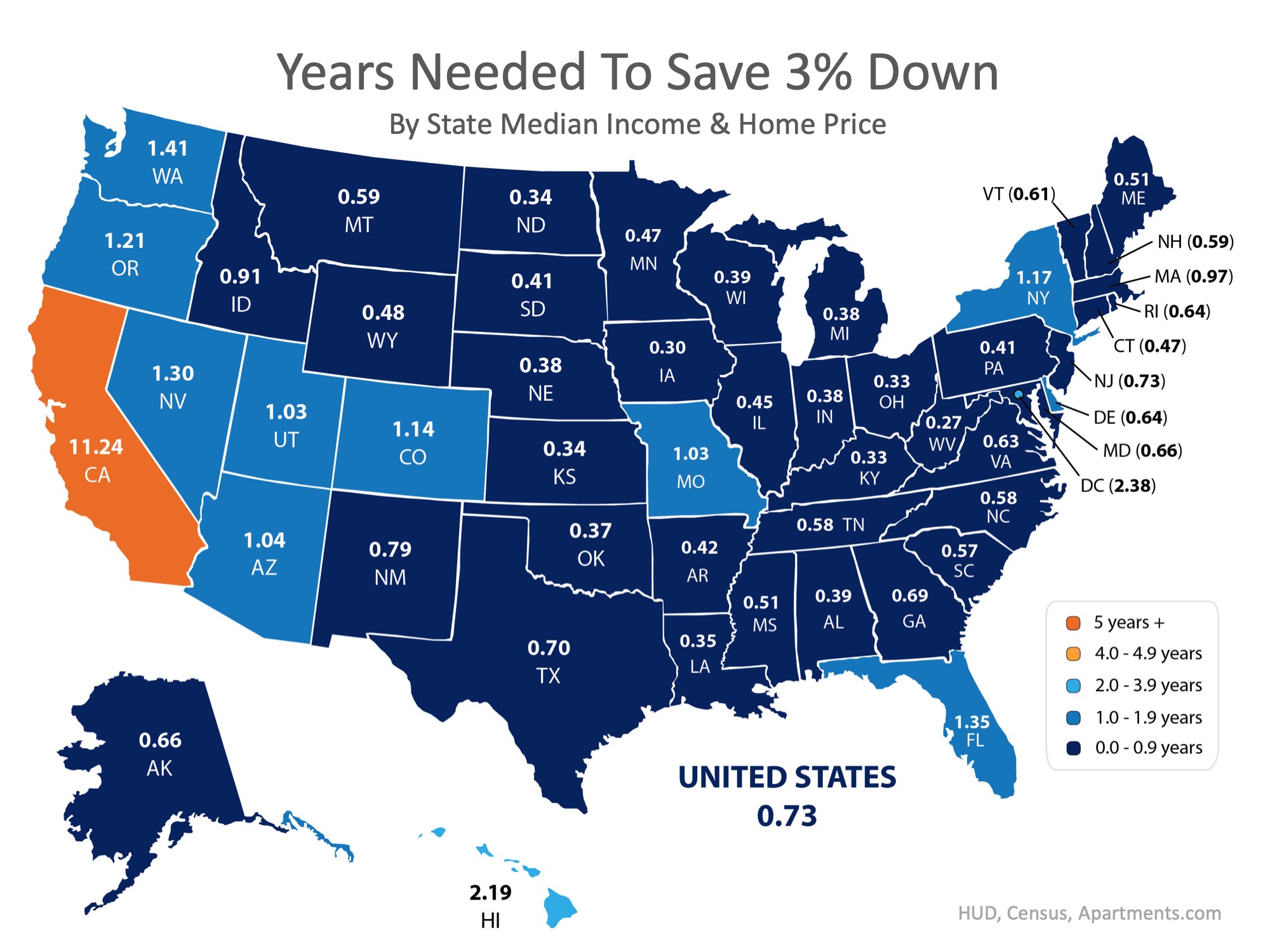

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Consumers Agree: It’s a Good Time To Sell

Consumers Agree: It’s a Good Time To Sell In today’s sellers’ market, many homeowners are weighing their options and trying to decide if they should sell their house. If you’re in that group, you may be balancing things like the ongoing health crisis, rising mortgage...

How Remote Work Impacts Your Home Search

How Remote Work Impacts Your Home Search Some Highlights If your workplace is delaying its return to office plans or is allowing permanent work from home options, that may open up new possibilities for your home search. Ongoing remote work could give you the chance...

Pre-Approval Gives You The Edge

Pre-approval gives you a competitive edge when you make an offer on a house. Let's connect so you're in the best position when you find your dream home. [video width="1920" height="1080"...

Sam and Lacie Diamond

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Why a Move Could Bring You More Happiness This Year

Why a Move Could Bring You More Happiness This Year Over the past two years, we’ve lived through one of the most stressful periods in recent history. Because of the health crisis, many of us have spent more time at home and that’s led us to re-evaluate both what we...

Housing Inventory Lower than Last Year

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

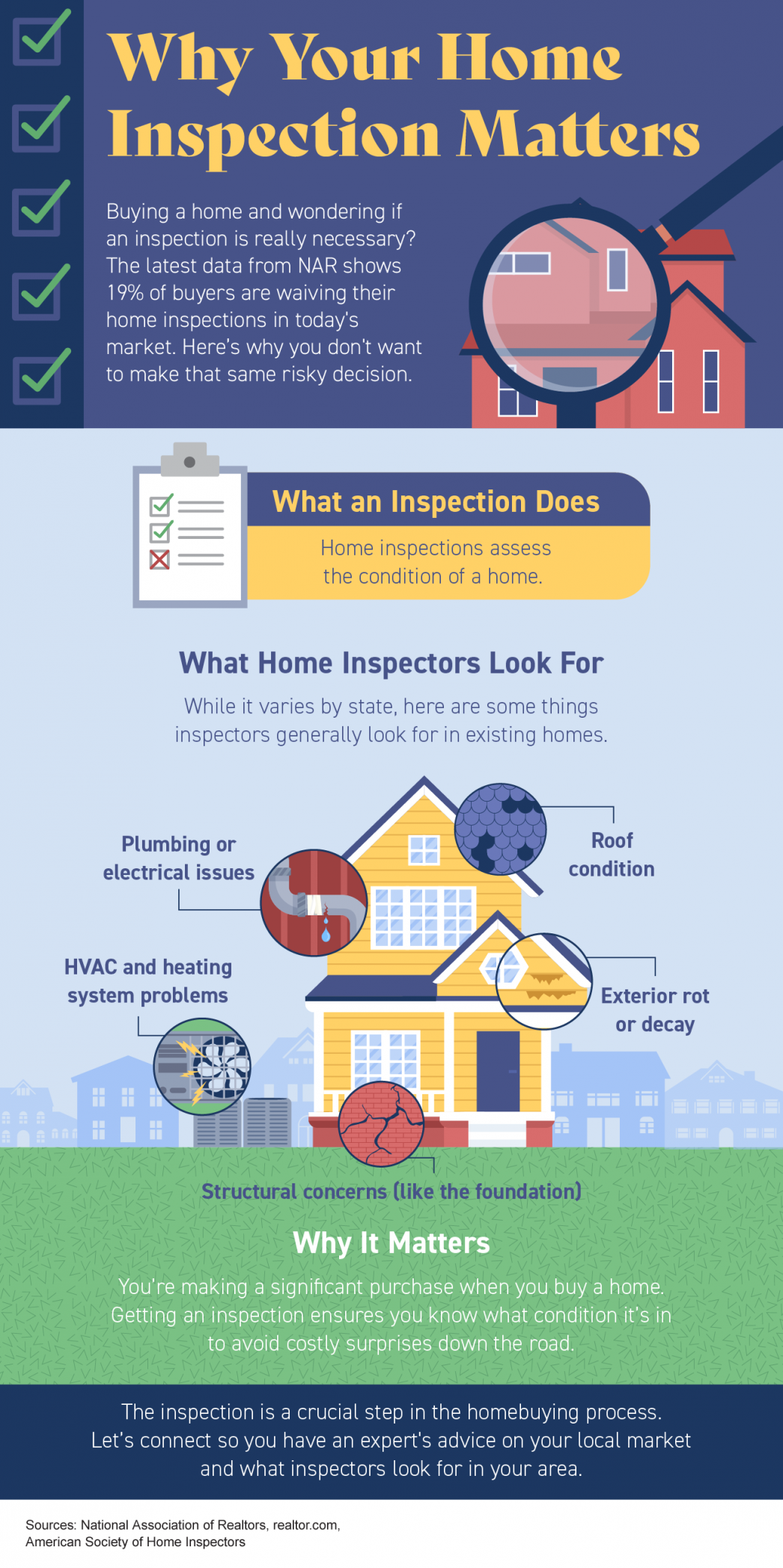

Why Your Home Inspection Matters

Why Your Home Inspection Matters Some Highlights Buying a home and wondering if your inspection is necessary? While some buyers may decide to waive their inspection, it’s risky decision. Your home inspection is a crucial step in the homebuying process. It assesses the...

Sold (My Favorite 4 Letter Word)

I Was able to help Sam and Lacie sell their home in Price Utah! Thank you for putting your trust in me! Sold (My Favorite 4 Letter Word)

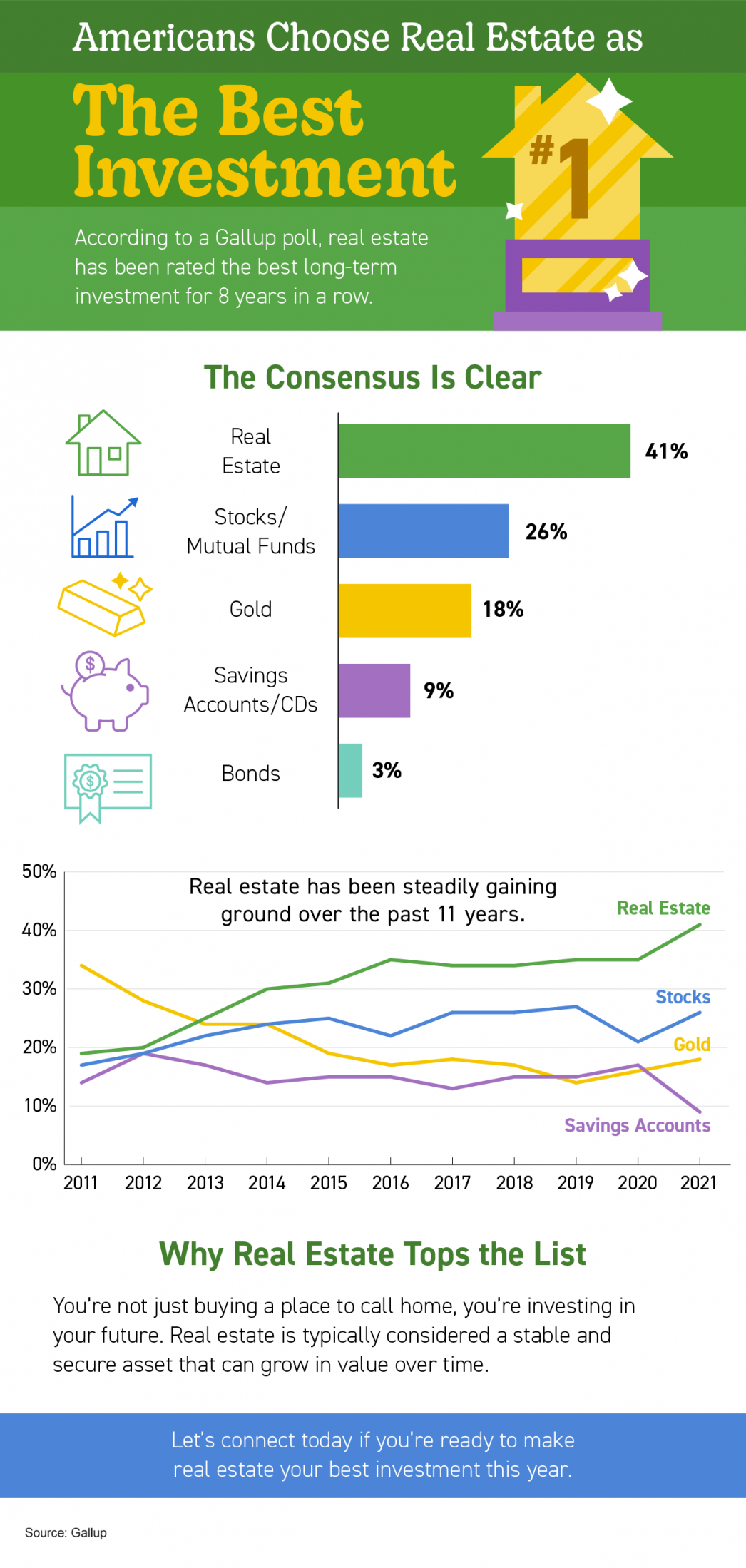

Americans Choose Real Estate as the Best Investment

Americans Choose Real Estate as the Best Investment Some Highlights According to a Gallup poll, real estate has been rated the best long-term investment for eight years in a row. Real estate tops the list because you’re not just buying a place to call home – you’re...

The Next Generation of Homebuyers Is Here

The Next Generation of Homebuyers Is Here Many members of Generation Z (Gen Z) are aging into adulthood and deciding whether to rent or buy a home. If you find yourself in this group, it’s important to understand you’re never too young to start thinking about...