How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

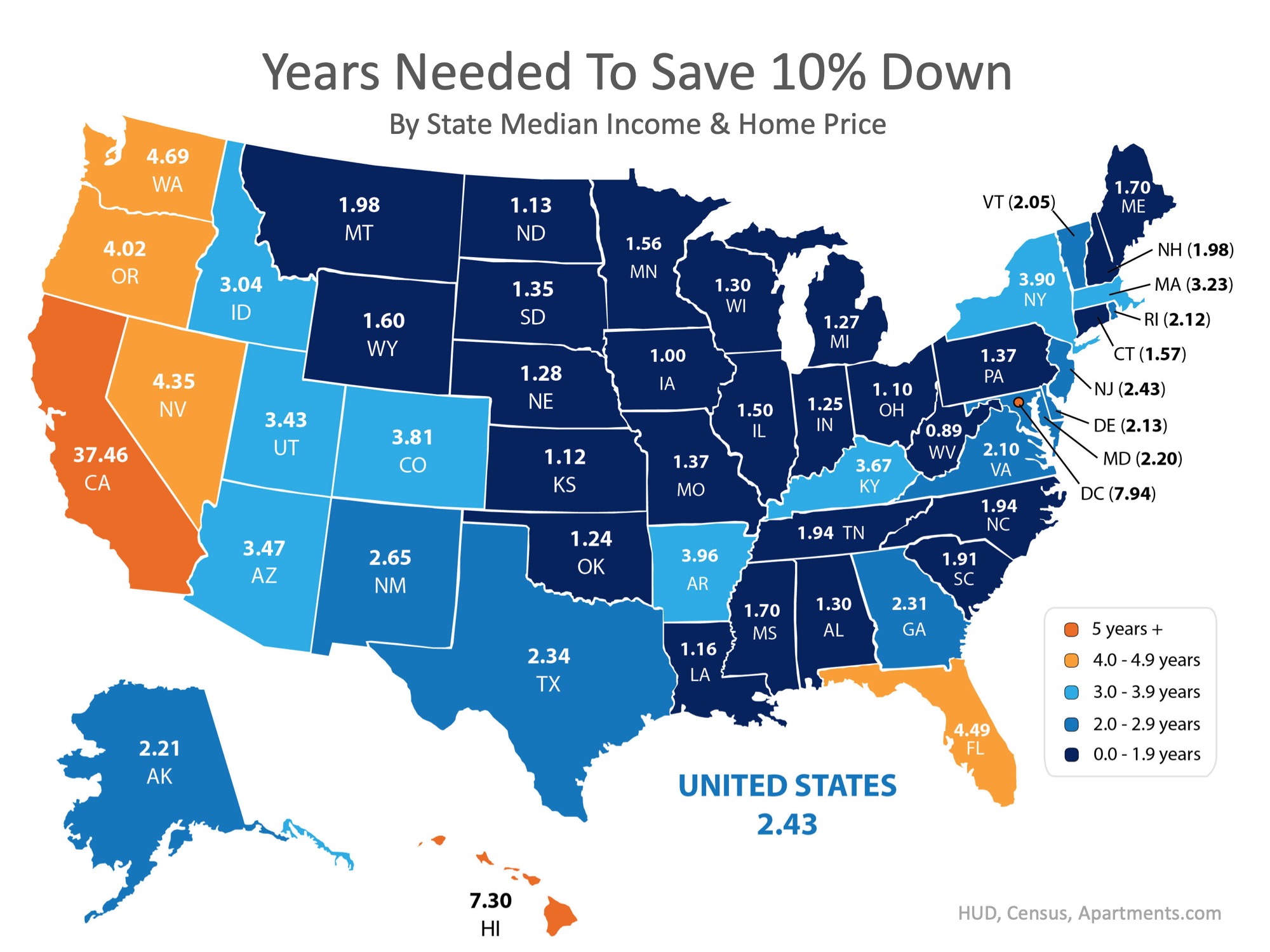

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

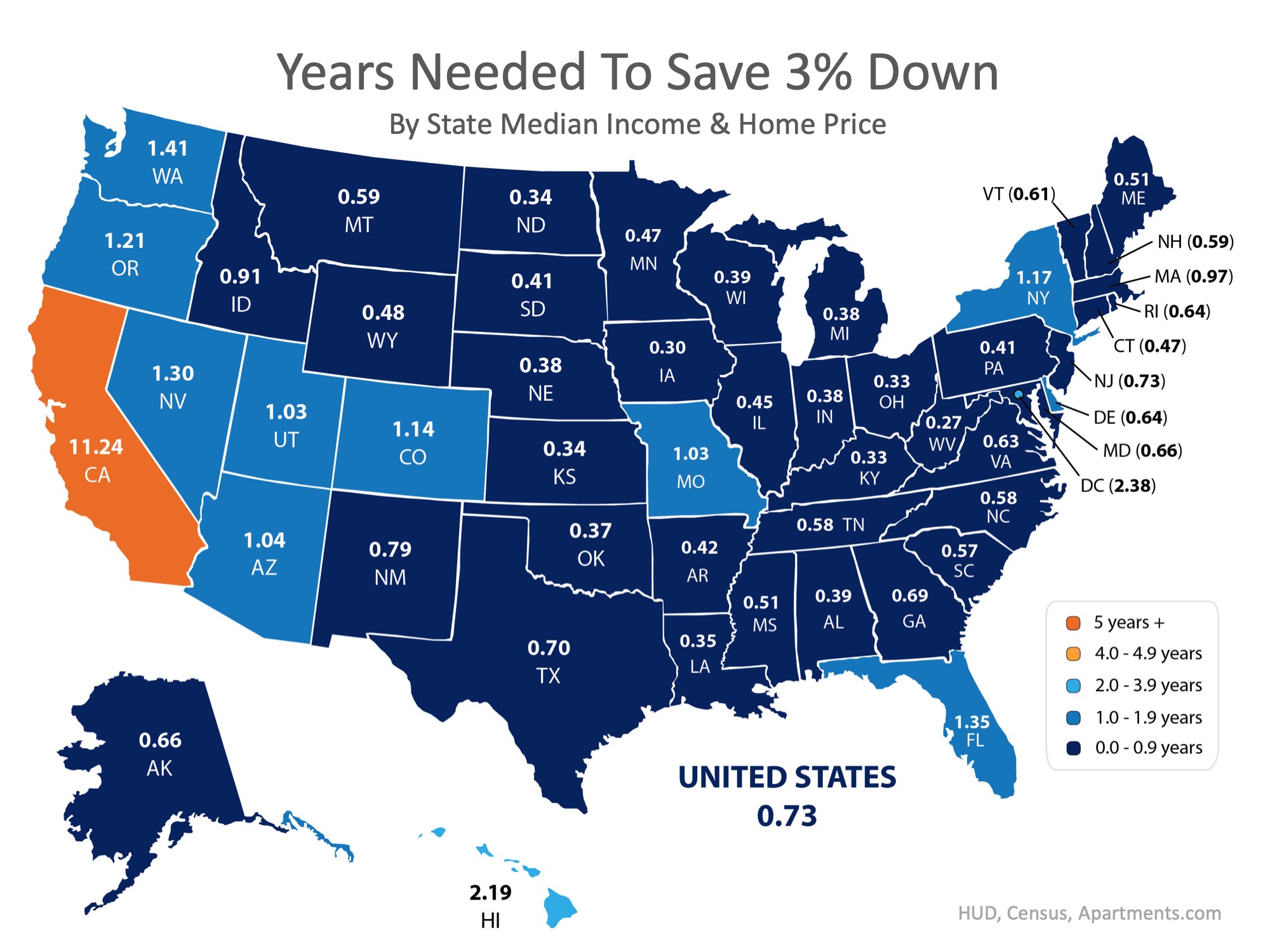

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

The True Strength of Homeowners Today

The True Strength of Homeowners Today The real estate market is on just about everyone’s mind these days. That’s because the unsustainable market of the past two years is behind us, and the difference is being felt. The question now is, just how financially strong are...

Fall Home Selling Checklist

Fall Home Selling Checklist Some Highlights When it comes to selling your house, you want it to look its best inside and out so it catches the attention of buyers. A real estate professional can help you decide what to do to make that happen. Focus on tasks that can...

Top Reasons Homeowners Are Selling Their Houses Right Now

Top Reasons Homeowners Are Selling Their Houses Right Now Some people believe there’s a group of homeowners who may be reluctant to sell their houses because they don’t want to lose the historically low mortgage rate they have on their current home. You may even have...

Getting Your House Ready To Sell? Work with an Agent for Expert Advice

Getting Your House Ready To Sell? Work with an Agent for Expert Advice In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional...

Watching the Stock Market? Check the Value of Your Home for Good News.

Watching the Stock Market? Check the Value of Your Home for Good News. While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner,...

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market

Buyers Are Regaining Some of Their Negotiation Power in Today’s Housing Market If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling...

Your Guides to Buying or Selling a Home This Fall

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 General Contractor 2000 (in-active) e-pro (advanced digital marketing) 2001 Certified Residential Specialist 2009 Certified Negotiation Expert 2014 Master...

Expert Forecasts on Mortgage Rates

Expert Forecasts on Mortgage Rates If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues...

How Owning a Home Builds Your Net Worth

How Owning a Home Builds Your Net Worth Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning...

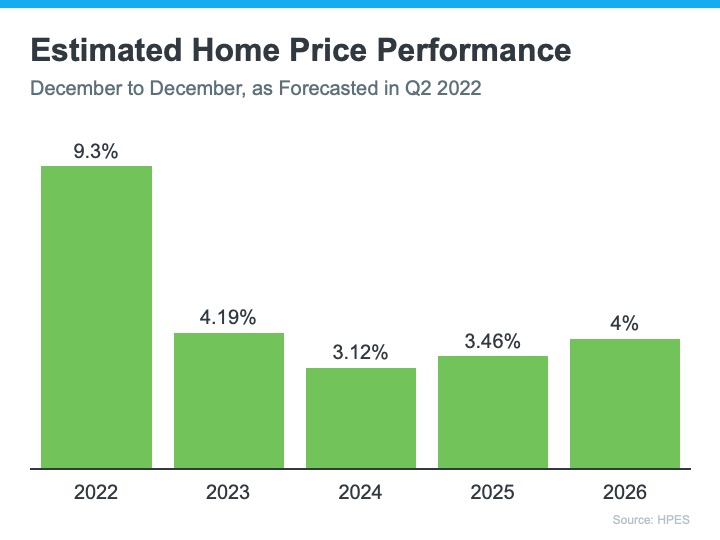

Should I wait to buy a home?

Part 4 Should I wait to buy a home? This is probably one of the biggest questions you’re getting asked right now, and it’s never been more important to have a good answer for it. Even though purchasing a home today may not be as easy as it was a couple of years ago,...