How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Unpacking the Long-Term Benefits of Homeownership

Unpacking the Long-Term Benefits of Homeownership If you’re thinking about buying a home soon, higher mortgage rates, rising home prices, and ongoing affordability concerns may make you wonder if it still makes sense to buy a home right now. While those market factors...

Fitness Tips For Seniors

Fitness Tips Prevent Falls For Seniors As we age, maintaining our balance and stability becomes increasingly important to prevent the risk of falls. Falls can have serious consequences for seniors, leading to injuries and a loss of independence. But fear not,...

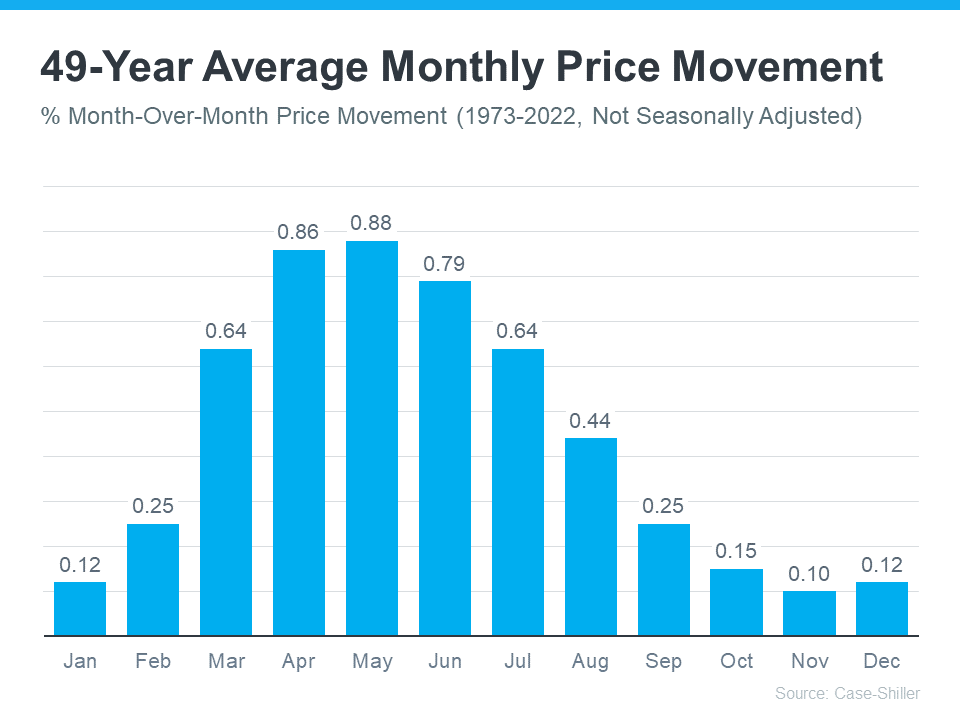

The Return of Normal Seasonality for Home Price Appreciation

The Return of Normal Seasonality for Home Price Appreciation If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening with home prices? Despite what you may be hearing in the news, nationally, home prices...

Beginning with Pre-Approval

Beginning with Pre-Approval If you’re looking to buy a home this fall, there are a few things you need to know. Affordability is tight with today’s mortgage rates and rising home prices. At the same time, there’s a limited number of homes on the market right now and...

The Many Non-Financial Benefits of Homeownership

The Many Non-Financial Benefits of Homeownership Buying and owning your own home can have a big impact on your life. While there are financial reasons to become a homeowner, it's essential to think about the non-financial benefits that make a home more than just a...

Remote Work Is Changing How Some Buyers Search for Their Dream Homes

Remote Work Is Changing How Some Buyers Search for Their Dream Homes The way Americans work has changed in recent years, and remote work is at the forefront of this shift. Experts say it’ll continue to be popular for years to come and project that 36.2 million...

What is Housing going to do this fall in Salt Lake County?

Housing is always a hot topic in Utah and the anticipated Fall housing market in Salt Lake County. As seasons change, so do the dynamics of real estate, and we are here to provide you with an insightful glimpse into what can be expected in this vibrant and dynamic...

Plenty of Buyers Are Still Active Today

Plenty of Buyers Are Still Active Today Some Highlights Holding off on selling your house because you believe there aren’t any buyers out there? Data shows buyers are still active, even with higher mortgage rates. This goes to show, people still want to buy homes, and...

Should Baby Boomers Buy or Rent After Selling Their Houses?

Should Baby Boomers Buy or Rent After Selling Their Houses? Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different...

Today’s Housing Market Has Only Half the Usual Inventory

Today’s Housing Market Has Only Half the Usual Inventory Some Highlights There are only about half the number of homes for sale compared to the last normal years in the market. That means buyers don’t have enough options right now. So, if you work with an agent to...