How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

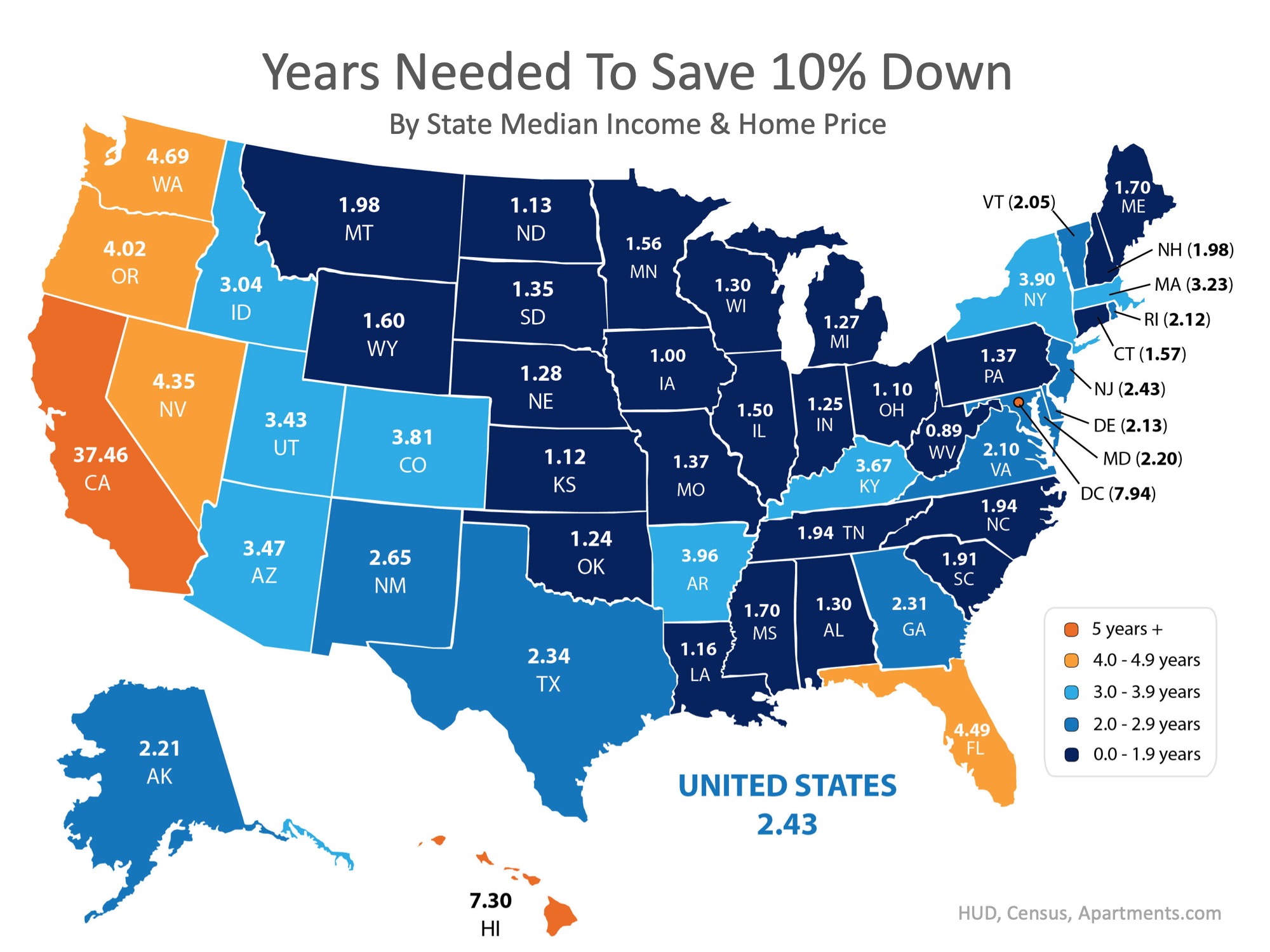

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

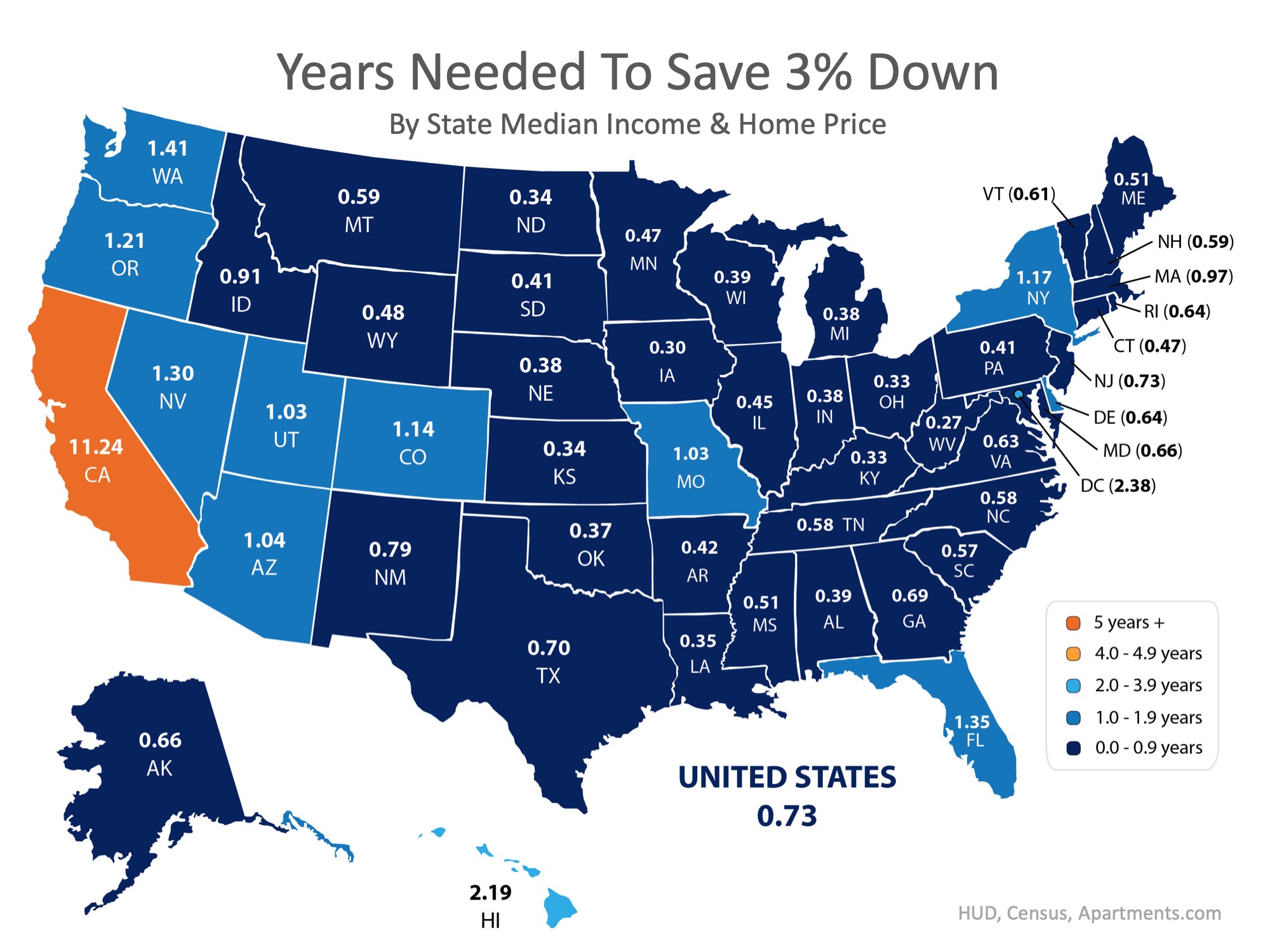

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....

What Are Experts Saying About the Spring Housing Market?

What Are Experts Saying About the Spring Housing Market? If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here's what the...

NAR Lawsuit Update – How does this effect Utah Realty?

NAR Lawsuit Update What we Know.... The NAR has reached a settlement agreement on the class action lawsuits relating to the offer of compensation rule. Details are in the link below. There is much to digest and more info and training will come out in the days ahead....

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...

Why There Won’t Be a Recession That Tanks the Housing Market

Why There Won’t Be a Recession That Tanks the Housing Market There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to...

The First Step: Getting Pre-Approved for a Mortgage

The First Step: Getting Pre-Approved for a Mortgage Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow....

Why You Want an Agent’s Advice for Your Move

Why You Want an Agent’s Advice for Your Move No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re...

How Changing Mortgage Rates Impact You

How Changing Mortgage Rates Impact You Some Highlights If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. That’s because even a small change in mortgage rates can have a big impact...