How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

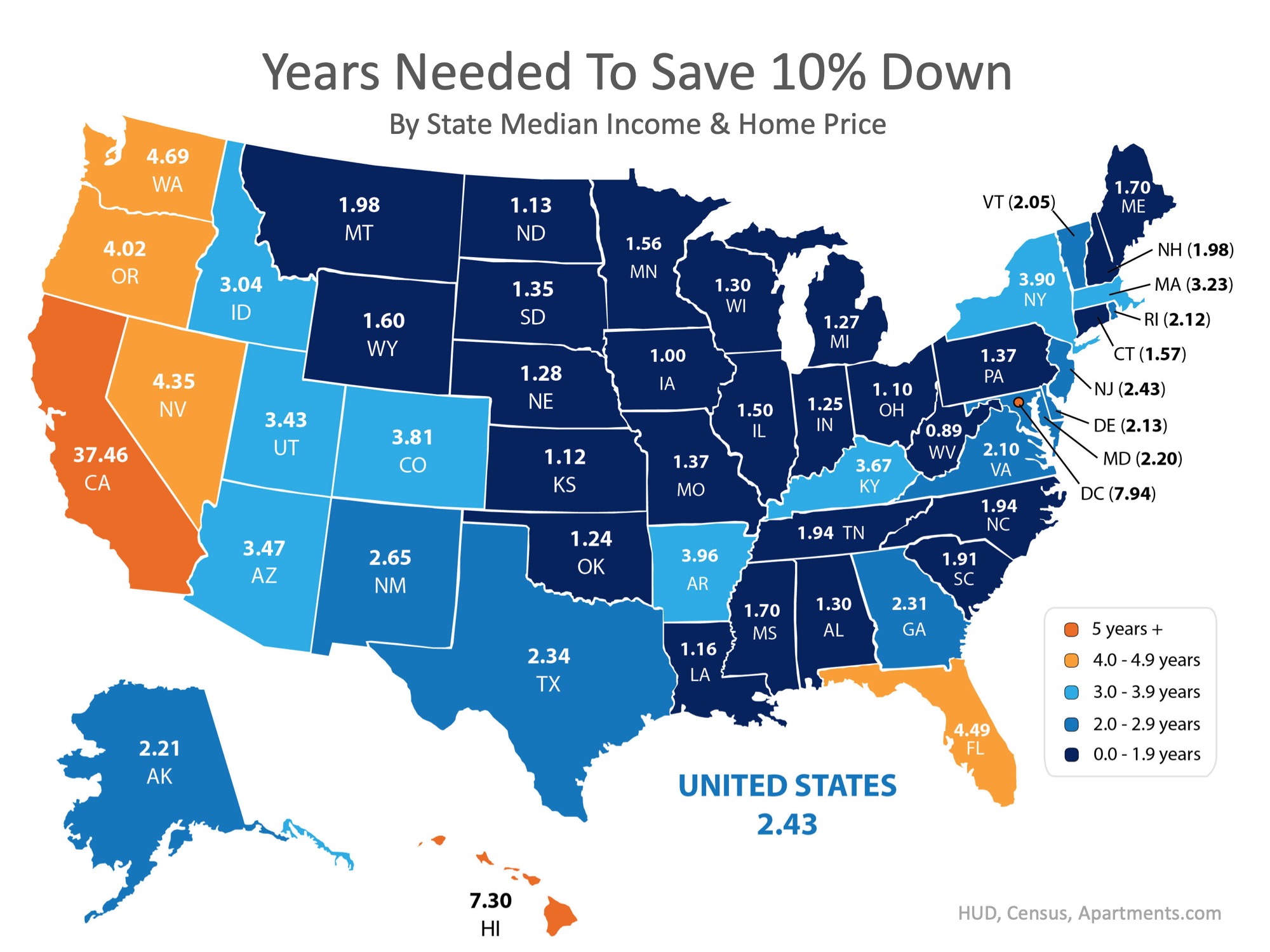

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

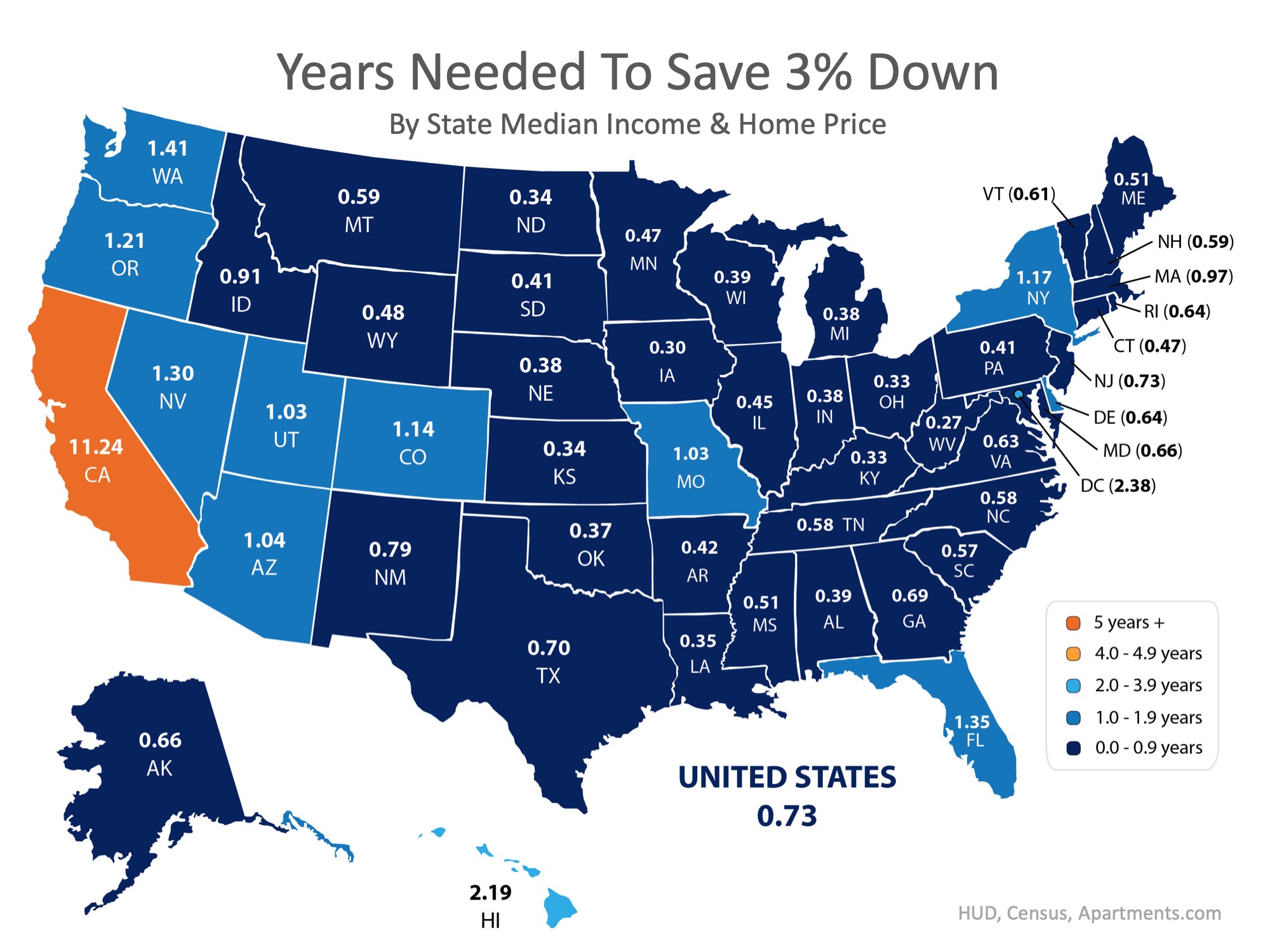

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Goldman Sees More Rate Cuts Ahead

Goldman Sachs expects 3 rate cuts in 2025, totaling 0.75%, while the Fed currently projects only two. Tariffs and higher costs are likely driving Goldman’s forecast, predicting slower growth and weaker consumer confidence

Happy Fourth of July

To all great Americans around the world, a very Happy Fourth of July to you all. This day is incredibly significant as the day the United States officially became its own nation. Let’s celebrate America’s birthday with festivals, parades, fireworks and other festive...

Have 3 Remodeling Options? High-Value Ones for 2025

Not all renovations boost home value; strategic improvements matter most for 2025. Energy-efficient upgrades like solar panels and insulation cut utility bills and attract budget-conscious buyers.

Can You Afford a 3-Bed Home in Utah in 2025?

In 2025, buying a home remains out of reach for many Americans as housing prices continue to rise. A recent report shows that in 35 out of 50 states, a 6-figure income is now required to afford a median-priced 3-bed home. In high-cost states like Utah, buyers need a...

Recession Coming? Turn It Into a Wealth Opportunity

Recessions often trigger Real Rstate dips, creating prime opportunities for investors to buy undervalued properties. Short sales and foreclosures surge during downturns, expanding inventory and increasing buyer negotiating power.

Fannie Mae Revises 2025 Growth Down to 3.4%

U.S. home prices are projected to grow 3.4% in 2025 and 3.3% in 2026. These forecasts are slightly lower than previous estimates of 3.8% for 2025 and 3.6% for 2026.

What’s the Cost to Rent 1,000 Sq Ft in Utah?

Utah has an avg rent of $1,612/mo. The avg apartment size is 920 sq ft. Rent per sq ft comes to about $1.75. Utah ranks among the more costly states for rental housing. It’s a competitive market for renters valuing both space and location.

How to Determine Home Value

To determine a home's value, consider various methods including online automated valuation models (AVMs), which use public records and recent sales data. For a more detailed assessment, a comparative market analysis (CMA) from a local agent or a professional...

The Minimum Savings You Need to Retire in Utah

Utah ranks #15 among the most expensive states to retire based on the minimum savings needed Minimum savings needed to retire in the state: $1,083,951 Annual cost of living (total expenditures): $65,795 Annual Social Security income: $22,523.40 Annual expenditures...

Happy Father’s Day

Approximately 2.5 billion Father's Day cards are sent each year. Neckties have become a popular traditional gift for Father's Day. "World's Greatest Dad" is a popular Father's Day phrase. Breakfast in bed is a common Father's Day...