How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

A Recession Does Not Equal a Housing Crisis

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

Today’s Homebuyers Want Lower Prices. Sellers Disagree.Utah Single Family Inventory has risen from 5775 to 5940 from April 5th to April 16th.Utah County Single Family Inventory April 5th was 1401, April 16th up a little to 1466Salt Lake County Single Family Home...

Think This Is a Housing Crisis? Think Again.

Think This Is a Housing Crisis? Think Again.With all of the unanswered questions caused by COVID-19 and the economic slowdown we’re experiencing across the country today, many are asking if the housing market is in trouble. For those who remember 2008, it's logical to...

What If I Need to Sell My Home Now? What Can I Do?

What If I Need to Sell My Home Now? What Can I Do?Every day that passes, people have a need to buy and sell homes. That doesn’t stop during the current pandemic. If you’ve had a major life change recently, whether with your job or your family situation, you may be in...

Recession? Yes. Housing Crash? No.

Recession? Yes. Housing Crash? No.With over 90% of Americans now under a shelter-in-place order, many experts are warning that the American economy is heading toward a recession, if it’s not in one already. What does that mean to the residential real estate...

More than half of homes in America have at least 50% equity. Wondering how much equity you have? Let’s connect.

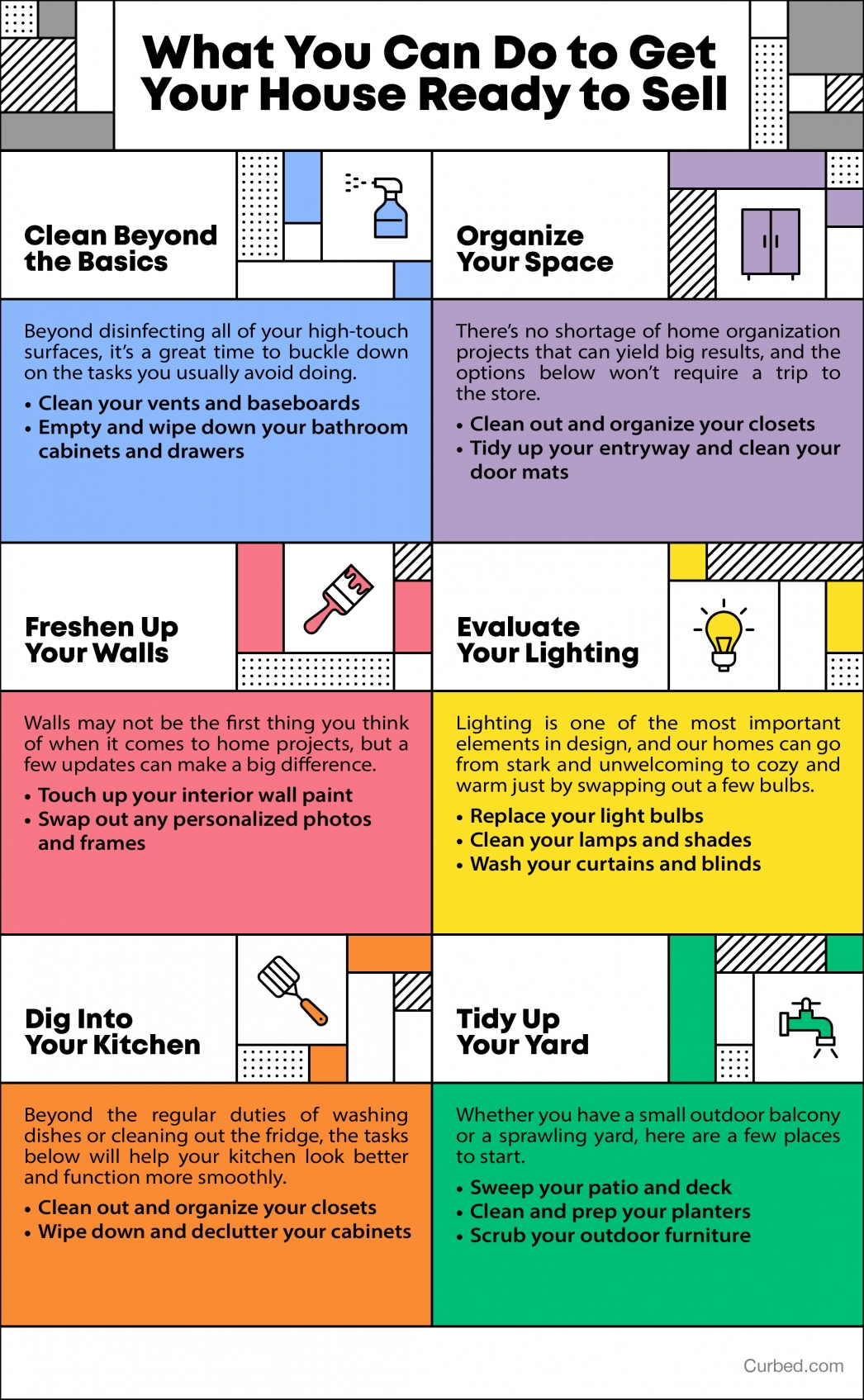

What You Can Do to Get Your House Ready to Sell

What You Can Do to Get Your House Ready to Sell Some Highlights: Believe it or not, there are lots of things you can do to prep your house for a sale without even going to the store. Your real estate plans don’t have to be completely on hold even while we’ve hit the...

Why Home Office Space Is More Desirable Than Ever

Why Home Office Space Is More Desirable Than EverFor years, we’ve all heard about the most desirable home features buyers are looking for, from upgraded kitchens to remodeled bathrooms, master suites, and more. The latest on the hotlist, however, might surprise...

Will Surging Unemployment Crush Home Sales?

Will Surging Unemployment Crush Home Sales?Ten million Americans lost their jobs over the last two weeks. The next announced unemployment rate on May 8th is expected to be in the double digits. Because the health crisis brought the economy to a screeching halt, many...

Auto DraftWhy Pre Approval Is a Great Step to Take Today

Why Pre Approval Is a Great Step to Take Today If you’re in the position to buy a home this year, pre-approval is something you can still do right now to get ahead in the homebuying process. Let’s connect to talk about your goals for 2020.