How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Rise to the Top of the Pool by Selling Your House Today

Rise to the Top of the Pool by Selling Your House Today With the release of the latest Economic Pulse Flash Survey from the National Association of Realtors (NAR), results show that people selling their houses today are holding strong on price. According to the most...

What Impact Might COVID-19 Have on Home Values?

What Impact Might COVID-19 Have on Home Values?A big challenge facing the housing industry is determining what impact the current pandemic may have on home values. Some buyers are hoping for major price reductions because the health crisis is straining the economy.The...

New Technology Is Powering the Real Estate Process

Technology Is Powering the Real Estate Process Technology is the driving force behind many of today's real estate transactions. Let’s connect to discuss how working together to go digital can give you an edge when buying or selling your home.

Uncertainty Abounds in the Search for Economic Recovery Timetable

Uncertainty Abounds in the Search for Economic Recovery TimetableEarlier this week, we discussed how most projections from financial institutions are calling for a quick V-shaped recovery from this economic downturn, and there’s research on previous post-pandemic...

Keys to Selling Your House Virtually

Keys to Selling Your House VirtuallyIn a recent survey by realtor.com, people thinking about selling their homes indicated they’re generally willing to allow their agent and some potential buyers inside if done under the right conditions. They’re less comfortable,...

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?

Will This Economic Crisis Have a V, U, or L-Shaped Recovery?Many American businesses have been put on hold as the country deals with the worst pandemic in over one hundred years. As the states are deciding on the best strategy to slowly and safely reopen, the big...

The Pain of Unemployment: It Will Be Deep, But Not for Long

The Pain of Unemployment: It Will Be Deep, But Not for LongThere are two crises in this country right now: a health crisis that has forced everyone into their homes and a financial crisis caused by our inability to move around as we normally would. Over 20 million...

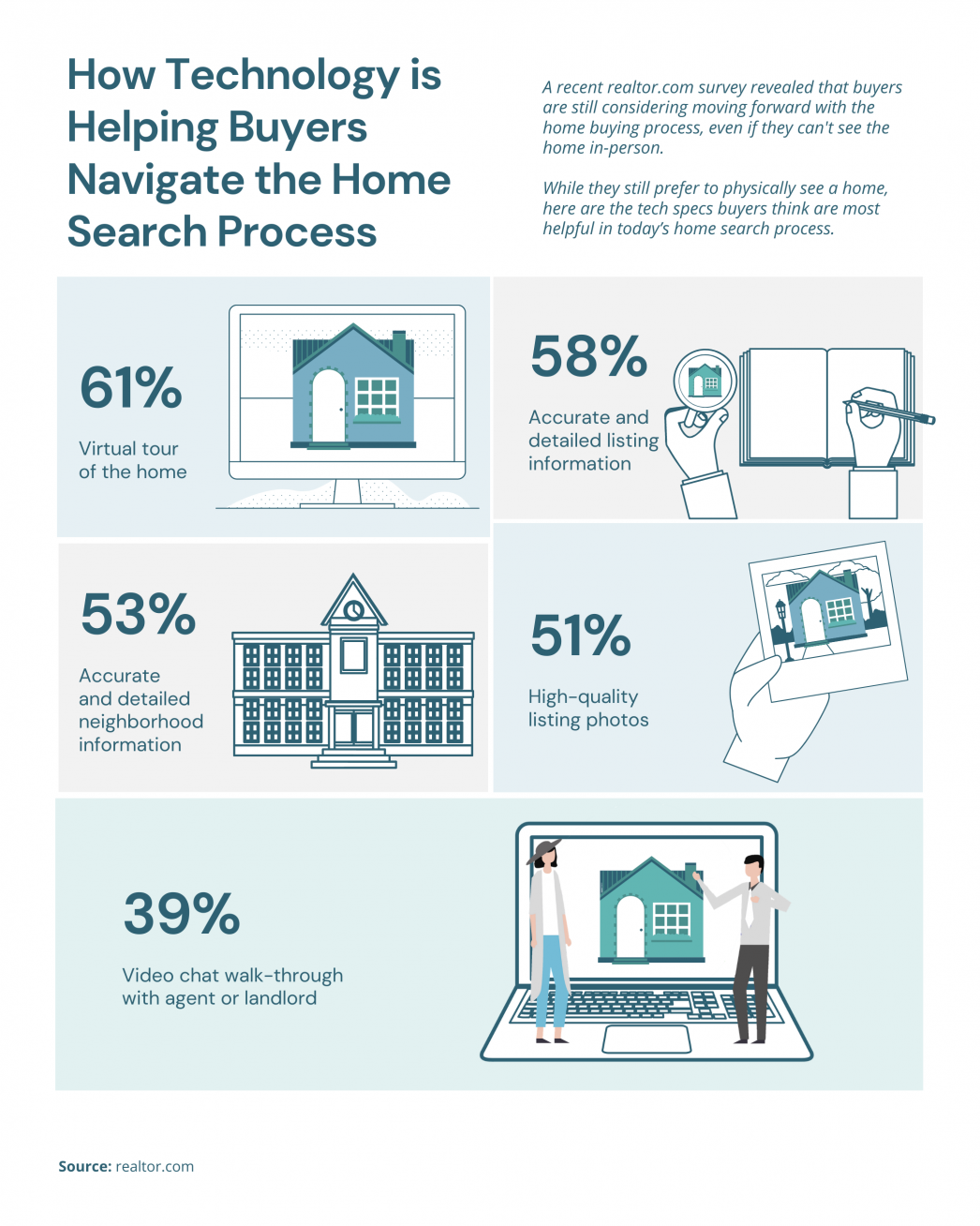

How Technology is Helping Buyers Navigate the Home Search Process

How Technology is Helping Buyers Navigate the Home Search Process Some Highlights:A recent realtor.com survey revealed that buyers are still considering moving forward with the homebuying process, even if they can’t see the home in-person.While they still prefer to...

A Recession Does Not Equal a Housing Crisis

Today’s Homebuyers Want Lower Prices. Sellers Disagree.

Today’s Homebuyers Want Lower Prices. Sellers Disagree.Utah Single Family Inventory has risen from 5775 to 5940 from April 5th to April 16th.Utah County Single Family Inventory April 5th was 1401, April 16th up a little to 1466Salt Lake County Single Family Home...