How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

The Beginning of an Economic Recovery In Utah

The Beginning of an Economic RecoveryThe news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand...

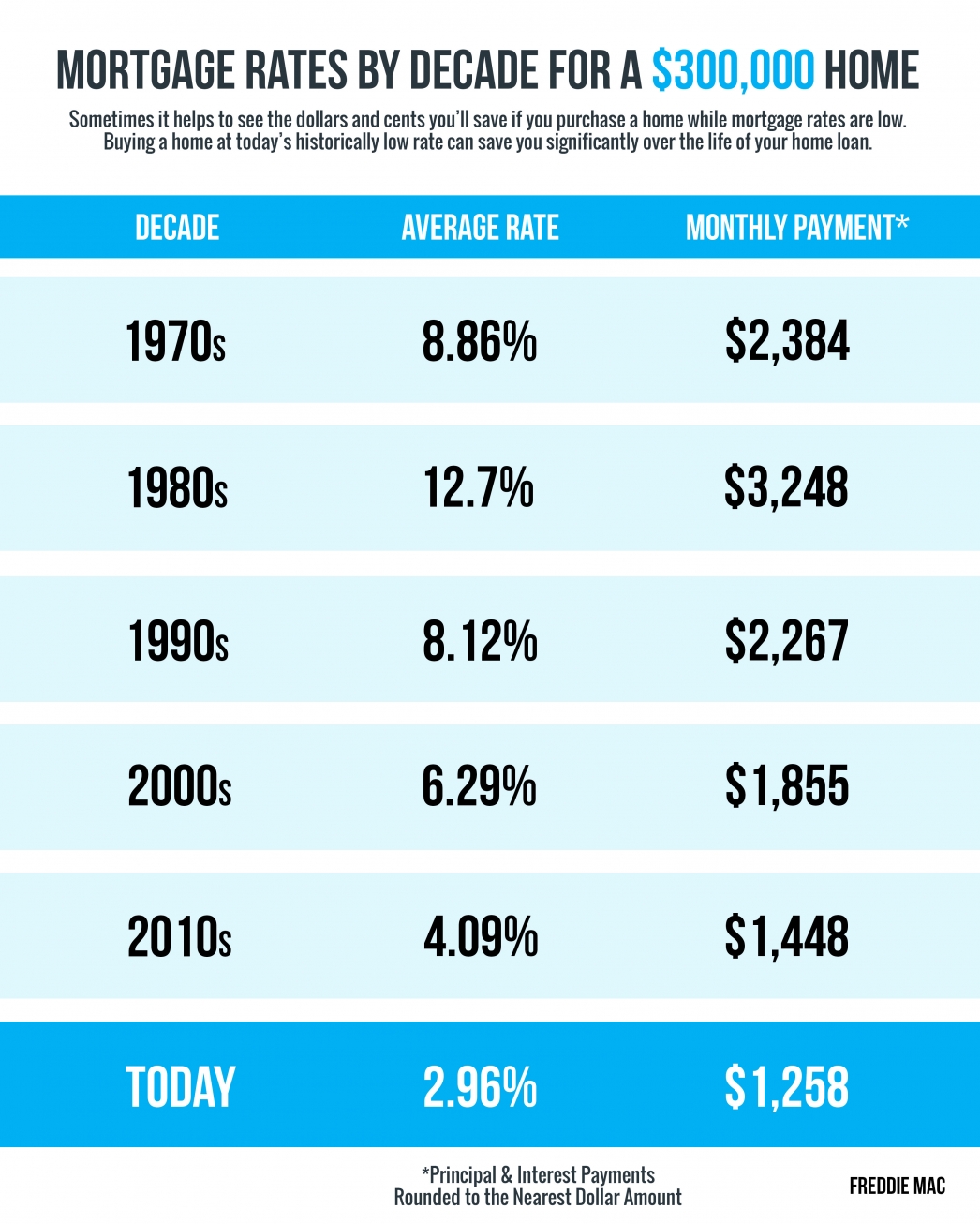

Mortgage Rates and Payments by Each Decade

Mortgage Rates & Payments by DecadeSome HighlightsSometimes it helps to see the dollars and cents you’ll save when you purchase a home while mortgage rates are low.Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your...

Housing by the Numbers by Utah Realty

Homes Are More Affordable Right Now Than They Have Been in Years

Homes Are More Affordable Right Now Than They Have Been in YearsToday, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low...

Why Foreclosures Won’t Crush the Housing Market Next Year

Why Foreclosures Won’t Crush the Housing Market Next YearWith the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well...

The Latest Unemployment Report: Slow and Steady Improvement

The Latest Unemployment Report: Slow and Steady ImprovementLast Friday, the Bureau of Labor Statistics (BLS) released its latest Employment Situation Summary. Going into the release, the expert consensus was for 1.58 million jobs to be added in July, and for the...

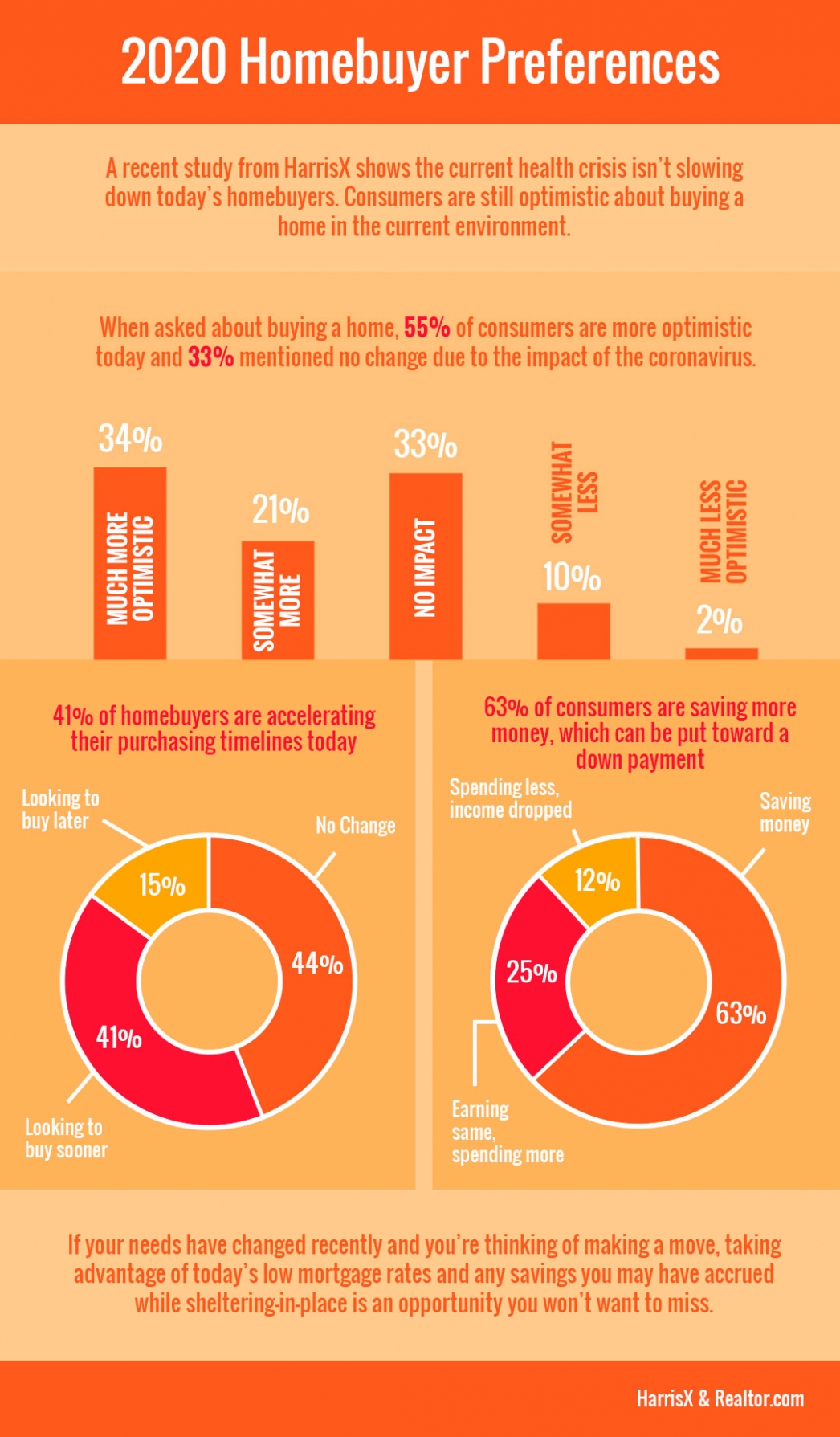

2020 Homebuyer Preferences

2020 Homebuyer PreferencesSome HighlightsA recent study from HarrisX shows the current health crisis isn’t slowing down today’s homebuyers.Many buyers are accelerating their timelines to take advantage of low mortgage rates, and staying home has enabled some to save...

Expert Reactions to the 2020 Housing Market Recovery

America Has a Surprising New Favorite Room in the House

Photo Copyright Marty Gale The family room has long been the favorite room in the house—it’s where homeowners get to spend quality time with other family members. However, as the significant increase in time spent at home during the pandemic has changed preferences,...

How Is Remote Work Changing Homebuyer Needs?

How Is Remote Work Changing Homebuyer Needs?With more companies figuring out how to efficiently and effectively enable their employees to work remotely (and for longer than most of us initially expected), homeowners throughout the country are re-evaluating their...