How Quickly Can You Save Your Down Payment?

Saving for a down payment is often the biggest hurdle for a first-time homebuyer. Depending on where you live, median income, median rents, and home prices all vary. So, we set out to find out how long it would take to save for a down payment in each state.

Using data from HUD, Census and Apartment List, we determined how long it would take, nationwide, for a first-time buyer to save enough money for a down payment on their dream home. There is a long-standing ‘rule’ that a household should not pay more than 28% of their income on their monthly housing expense.

By determining the percentage of income spent renting in each state, and the amount needed for a 10% down payment, we were able to establish how long (in years) it would take for an average resident to save enough money to buy a home of their own.

According to the data, residents in Kansas can save for a down payment the quickest, doing so in just over 1 year (1.12). Below is a map that was created using the data for each state:

What if you only needed to save 3%?

What if you were able to take advantage of one of Freddie Mac’s or Fannie Mae’s 3%-down programs? Suddenly, saving for a down payment no longer takes 2 to 5 years, but becomes possible in less than a year in most states, as shown on the map below.

Bottom Line

Whether you have just begun to save for a down payment or have been saving for years, you may be closer to your dream home than you think! Let’s get together to help you evaluate your ability to buy today.

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Taking the Fear out of Saving for a Home

Taking the Fear out of Saving for a Home If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first. But it doesn’t have to be. One way to take the fear out of budgeting is understanding some of the costs you might...

when one door closes

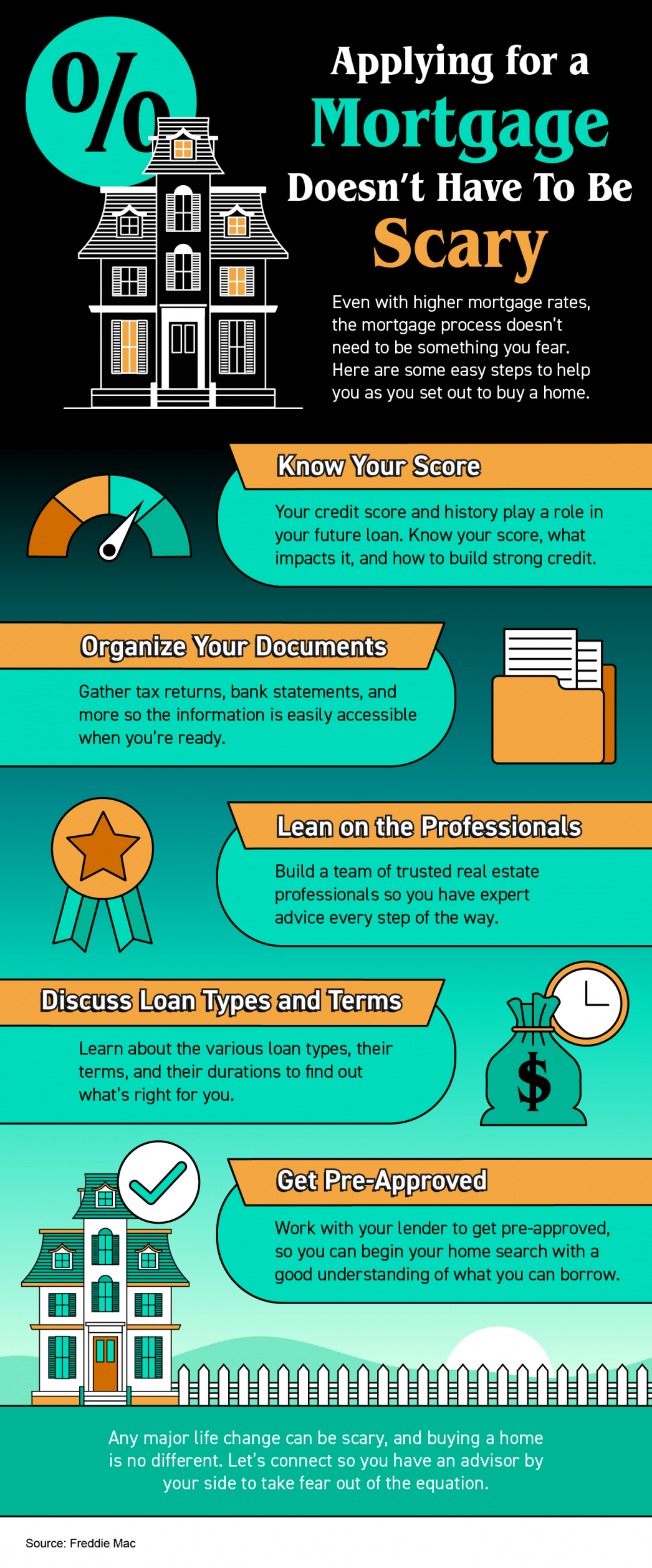

Applying for a Mortgage Doesn’t Have To Be Scary

Applying for a Mortgage Doesn’t Have To Be Scary Some Highlights Even with higher mortgage rates, the mortgage process doesn’t need to be something you fear. Here are some steps to help as you set out to buy a home. Know your credit score and work to build strong...

Millennials Are Still a Driving Force of Today’s Buyer Demand

Millennials Are Still a Driving Force of Today’s Buyer Demand If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what...

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008 With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it...

Pre-Approval Is a Critical First Step on Your Homebuying Journey

Pre-Approval Is a Critical First Step on Your Homebuying Journey If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months...

Tips For First-Time Homebuyers

Tips For First-Time Homebuyers Some Highlights If you’re trying to buy your first home in today’s housing market, you’ll want to know what you can do as mortgage rates rise and inventory stays low overall. Connect with a lender to get pre-approved, prioritize your...

Saving for a Down Payment

Saving for a Down Payment? Here’s What You Should Know. As you set out to buy a home, saving for a down payment is likely top of mind. But you may still have questions about the process, including how much to save and where to start. If that sounds like you, your down...

How an Expert Can Help You Understand Inflation & Mortgage Rates

How an Expert Can Help You Understand Inflation & Mortgage Rates If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one. Inflation and the Housing Market This...