Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore, the HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions.

Great News! The index reached its highest level since Fannie Mae began their survey. Breaking it down, the report revealed:

- The share of Americans who say it is a good time to buy a home increased from the same time last year.

- The share of those who say it is a good time to sell a home increased from the same time last year.

- The share of Americans who say they are not concerned about losing their job over the next 12 months increased dramatically (16 percentage points) from the same time last year.

- The share of Americans who say mortgage rates will go down over the next 12 months increased dramatically (24 percentage points) from the same time last year.

The day after the index was released, Freddie Mac also announced the 30-year fixed-rate mortgage rate fell to its lowest level in three years.

Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae explained the uptick in the index:

“Consumer job confidence and favorable mortgage rate expectations lifted the HPSI to a new survey high in July, despite ongoing housing supply and affordability challenges. Consumers appear to have shaken off a winter slump in sentiment amid strong income gains. Therefore, sentiment is positioned to take advantage of any supply that comes to market, particularly in the affordable category.”

Bottom Line

Consumers are feeling good about the real estate market. Since Americans are not worried about their jobs, see mortgage rates near an all-time low, and believe it is a good time to buy, the housing market will remain strong for the rest of the year.

Homes for Sale In Utah

[idx-platinum-widget id=”21243-48027″ ]

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...

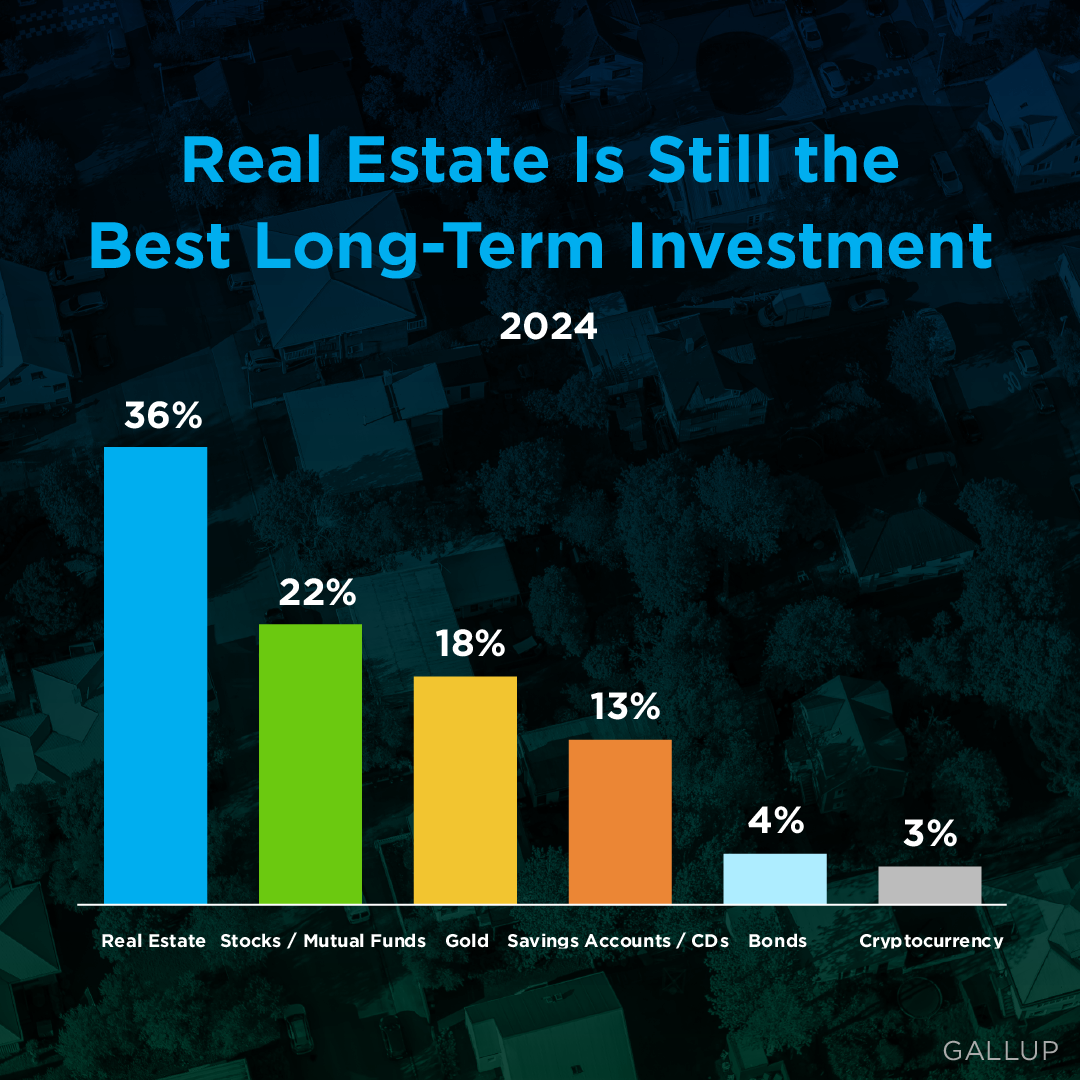

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate In the competitive world of real estate, maintaining a stellar reputation is not just important; it's paramount. Missing a home showing might seem like a minor mishap, easily...

Real Estate Agent Marketing Methods

Ready to sell your house? One of your top priorities may be getting help marketing your home. Partnering with a great agent can make all the difference. These are just a few strategies we can use to get your house more visibility. Ready to maximize your home's...

Hiring a PSA or Pricing Strategy Advisor is the Key to Pricing your Home Right

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC] Some Highlights The asking price for your house can impact your bottom line and how quickly it sells. Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your...

Home Prices Rising in the Next 5 Years

Wondering about the future of home prices? Here's the scoop. Experts forecast a steady rise in home prices until at least 2028. That means buying now sets you up to gain equity as values climb. But, if you wait, the price of a home will only be higher later on. If you...

The Number of Homes for Sale Is Increasing

The Number of Homes for Sale Is Increasing There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up. There are more homes up for grabs this...

Home Prices Are Climbing in These Top Cities

Home Prices Are Climbing in These Top Cities Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what's going on with home prices these days. Here's the scoop. The latest national data from Case-Shiller and...

The Sun Is Shining on Sellers This Summer

The Sun Is Shining on Sellers This Summer Some Highlights If your needs have changed, now’s a great time to sell and get the features you want most. Many buyers are eager to move between the school years, so you may see a faster sale, multiple offers, a higher...

How Buying or Selling a Home Benefits Your Community

How Buying or Selling a Home Benefits Your Community If you're thinking of buying or selling a house, it's important to know it doesn't just impact you—it helps out the local economy and your community, too. Every year, the National Association of Realtors (NAR) puts...

Gen Z Buyers – Directors Mortgage Quote

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly...

What’s Motivating Your Move?

Considering making a move? According to Realtor.com, profit potential and family priorities are the top motivators for homeowners right now.Let’s d What's Motivating Your Move? Thinking about selling your house? As you make your decision, consider what's pushing you...

Now’s a Great Time To Sell Your House

Now’s a Great Time To Sell Your House Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move. Here’s something else to consider. According to the latest Home...

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

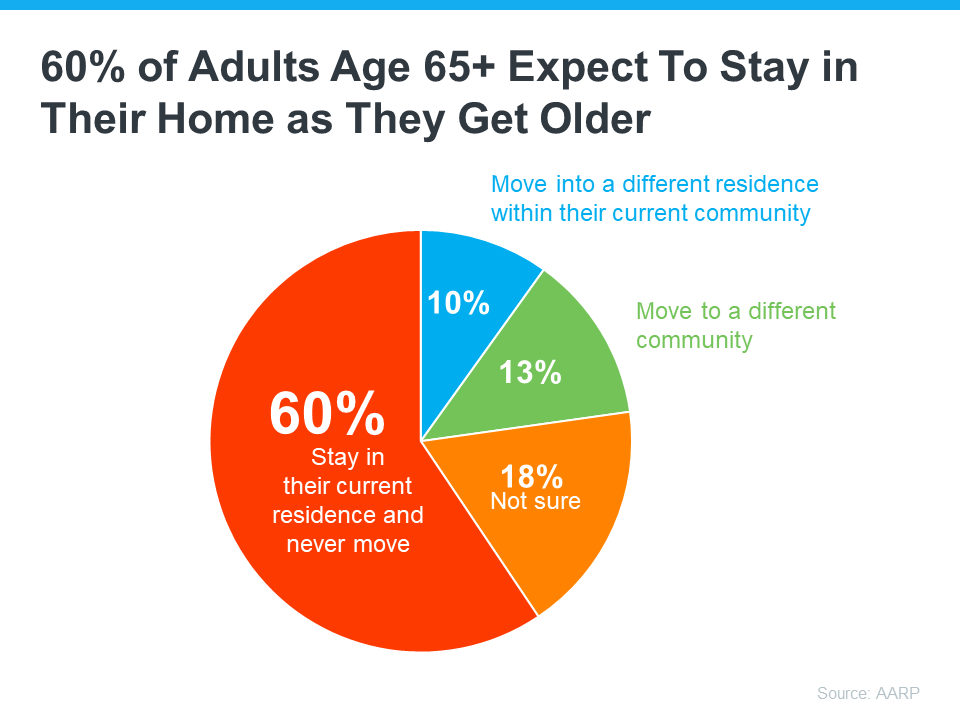

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...

Utah Licensed Real Estate Agents

In the past, we have had over 30,000 Active licenses. At the End of 2023 here is where we stand. Data is sourced from the Utah Division of Real Estate 22, 853 Active Licensees Sales Agent - 18,517 Principal Broker - 2442 Branch Broker - 171 Inactive - 4016 In...

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....

What Are Experts Saying About the Spring Housing Market?

What Are Experts Saying About the Spring Housing Market? If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here's what the...

NAR Lawsuit Update – How does this effect Utah Realty?

NAR Lawsuit Update What we Know.... The NAR has reached a settlement agreement on the class action lawsuits relating to the offer of compensation rule. Details are in the link below. There is much to digest and more info and training will come out in the days ahead....

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...

Why There Won’t Be a Recession That Tanks the Housing Market

Why There Won’t Be a Recession That Tanks the Housing Market There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to...

The First Step: Getting Pre-Approved for a Mortgage

The First Step: Getting Pre-Approved for a Mortgage Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow....

Why You Want an Agent’s Advice for Your Move

Why You Want an Agent’s Advice for Your Move No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re...

How Changing Mortgage Rates Impact You

How Changing Mortgage Rates Impact You Some Highlights If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. That’s because even a small change in mortgage rates can have a big impact...

Expert Home Price Forecasts for 2024 Revised Up

Expert Home Price Forecasts for 2024 Revised Up Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall. So, let’s see exactly how experts’...

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last...

Strategic Tips for Buying Your First Home

Strategic Tips for Buying Your First Home Buying your first home is a big, exciting step and a major milestone that has the power to improve your life. As a first-time homebuyer, it's a dream you can make come true, but there are some hurdles you'll need to overcome...

It’s Time To Prepare Your House for a Spring Listing

It’s Time To Prepare Your House for a Spring Listing If you're thinking of selling your house this spring, now is the perfect time to start getting it ready. With the market gearing up for its busiest time of year, it'll be important to make sure your house shines...

Don’t Let the Latest Home Price Headlines Confuse You

Don’t Let the Latest Home Price Headlines Confuse You Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture. If you look at the national data for...

Maximizing The Benefits Of Home Equity When Downsizing

Maximizing The Benefits Of Home Equity When Downsizing When it comes to downsizing, homeowners often view it as a way to simplify their lives, reduce maintenance costs, or even relocate to a more desirable location. But what many don't realize is that downsizing can...

Why Pre-Approval Is Even More Important This Year

Why Pre-Approval Is Even More Important This Year On the road to becoming a homeowner? If so, you may have heard the term pre-approval get tossed around. Let’s break down what it is and why it’s important if you’re looking to buy a home in 2024. What Pre-Approval Is...

There’s No Foreclosure Wave in Sight

There’s No Foreclosure Wave in Sight Some Highlights Headlines saying foreclosures are rising might make you feel uneasy. But the truth is, there’s no need to worry. If you look at the latest numbers, they’re still below pre-pandemic norms and way below what happened...

Don’t Wait Until Spring To Sell Your House

Don’t Wait Until Spring To Sell Your House As you think about the year ahead, one of your big goals may be moving. But, how do you know when to make your move? While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell....

Blockchain technology and its integration with real estate transactions

Blockchain technology and its integration with real estate transactions. Blockchain has been making waves in various industries, revolutionizing the way we store and transfer data securely. And with the ever-evolving real estate market, it comes as no surprise that...

2 of the Factors That Impact Mortgage Rates

2 of the Factors That Impact Mortgage Rates If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why?...

Trends in Senior Housing

Trends in Senior Housing In this article, we dive into the fascinating realm of senior purchasing habits when it comes to housing. With the aging population, the needs and preferences of seniors have transformed, leading to new trends and demands in the housing...

Will a Silver Tsunami Change the 2024 Housing Market?

Will a Silver Tsunami Change the 2024 Housing Market? Have you ever heard the term “Silver Tsunami” and wondered what it's all about? If so, that might be because there’s been lot of talk about it online recently. Let's dive into what it is and why it won't...

Why It’s More Affordable To Buy a Home This Year

Why It’s More Affordable To Buy a Home This Year Some Highlights Home affordability depends on three factors: mortgage rates, home prices, and wages. Mortgage rates are down from their recent peak, home prices are expected to rise at a slower pace, and wages are...

Experts Project Home Prices Will Increase in 2024

Experts Project Home Prices Will Increase in 2024 Even though home prices are going up nationally, some people are still worried they might come down. In fact, a recent survey from Fannie Mae found that 24% of people think home prices will actually decline over the...

3 Must-Do’s When Selling Your House in 2024

3 Must-Do’s When Selling Your House in 2024 If one of the goals on your list is selling your house and making a move this year, you’re likely juggling a mix of excitement about what’s ahead and feeling a little sentimental about your current home. A great way to...

Buying Real Estate With Crypto Currency In Utah

Buying Real Estate With Crypto Currency In Utah As the world continues to evolve, so too does the way we invest and transact. In recent years, cryptocurrencies such as Bitcoin and Ethereum have emerged as prominent investment vehicles for tech-savvy individuals....

Key Terms Every Homebuyer Should Learn

Key Terms Every Homebuyer Should Learn Some Highlights Buying a home is a big deal and can feel especially complicated if you don't know the terms used during the process. If you want to become a homeowner this year, it's a good idea to learn these key housing...

3 Key Factors Affecting Home Affordability

3 Key Factors Affecting Home Affordability Over the past year, a lot of people have been talking about housing affordability and how tight it’s gotten. But just recently, there’s been a little bit of relief on that front. Mortgage rates have gone down since their most...

Why the Price of Your House Matters When Selling

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY...

Home Prices Forecast To Climb over the Next 5 Years

Home Prices Forecast To Climb over the Next 5 Years Some Highlights If you’re worried about what’s next for home prices, know the HPES shows experts are projecting they’ll continue to rise at least through 2028. Based on that forecast, if you bought a $400,000 house...

The Dramatic Impact of Homeownership on Net Worth

The Dramatic Impact of Homeownership on Net Worth If you're trying to decide whether to rent or buy a home this year, here's a powerful insight that could give you the clarity and confidence you need to make your decision. Every three years, the Federal...

Avoid These Common Mistakes After Applying for a Mortgage

Avoid These Common Mistakes After Applying for a Mortgage If you’re getting ready to buy a home, it’s exciting to jump a few steps ahead and think about moving in and making it your own. But before you get too far down the emotional path, there are some key things to...

What are your Goals for 2024?

What are your Goals for 2024?

What Lower Mortgage Rates Mean for Your Purchasing Power

What Lower Mortgage Rates Mean for Your Purchasing Power If you want to buy a home, it's important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly...

Achieving Your Homebuying Dreams in 2024

Achieving Your Homebuying Dreams in 2024 [INFOGRAPHIC] Some Highlights Planning to buy a home in 2024? Here’s what to focus on. Improve your credit score, plan for your down payment, get pre-approved, and decide what’s most important to you. Let’s connect so you have...

Why Pre-Approval Is Your Homebuying Game Changer

Why Pre-Approval Is Your Homebuying Game Changer If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip. So, before you start picturing yourself in your new living room or dining on your future...

Thinking About Buying a Home? Ask Yourself These Questions

Thinking About Buying a Home? Ask Yourself These Questions If you’re thinking of buying a home this year, you’re probably paying closer attention than normal to the housing market. And you’re getting your information from a variety of channels: the news, social media,...

Things To Consider If Your House Didn’t Sell

Things To Consider If Your House Didn’t Sell If your listing has expired and your house didn’t sell, it's completely normal to feel a mix of frustration and disappointment. Understandably, you're probably wondering what may have gone wrong. Here are three questions to...

What Experts Say About The Housing Market in 2024

The Benefits of Working With an Experienced Agent When You Sell Your House

The Benefits of Working With an Experienced Agent When You Sell Your House Some Highlights When it comes to selling your house, the expertise of a trusted real estate agent can make a big difference. They’ll explain what’s happening today, what that means for you, and...

Retiring Soon? Why Moving Might Be the Perfect Next Step

Retiring Soon? Why Moving Might Be the Perfect Next Step If you’re thinking about retirement or have already retired this year, it’s a good time to consider if your current house is still a good fit for the next chapter in your life. Fortunately, you may be in a...

Get Ready To Buy a Home by Improving Your Credit Score

Get Ready To Buy a Home by Improving Your Credit Score As the new year approaches, the idea of buying a home might be on your mind. It’s an exciting goal to set, and it's never too early to start laying the groundwork. One crucial step to prepare for homeownership is...

Get Your House Ready To Sell This Winter

Get Your House Ready To Sell This Winter [INFOGRAPHIC] Some Highlights As you get ready to sell your house, there are a few things you should add to your to-do list to make it inviting and boost curb appeal. To name just a couple, it’s a good idea to declutter, take...

Why Mortgage Rates Could Continue To Decline

Why Mortgage Rates Could Continue To Decline When you read about the housing market, you’ll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying...

Expert Quotes on the 2024 Housing Market Forecast

Expert Quotes on the 2024 Housing Market Forecast If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market in 2024. In 2023, higher mortgage rates, confusion over home price headlines, and a lack of...

Why Now Is Still a Great Time To Sell Your House

Why Now Is Still a Great Time To Sell Your House If you were worried buyer demand disappeared when mortgage rates went up, the data shows there are plenty of interested buyers still out there. The housing market isn't as frenzied as it was during the ‘unicorn’...

What You Need To Know About Down Payments

What You Need To Know About Down Payments Some Highlights If you want to buy a home, you may not need as much for your down payment as you think. There are various loan options for qualified buyers with down payments as low as 3.5% or even no down payment requirement....

If Your House Hasn’t Sold Yet, It May Be Overpriced

If Your House Hasn’t Sold Yet, It May Be OverpricedHas your house been sitting on the market a while without selling? If so, you should know that’s pretty unusual, especially right now. That’s because the supply of homes available for sale is still far lower than what...

Marty Gale: A Real Estate Journey Spanning 38 Years

When it comes to real estate, there are few professionals who can boast the level of experience and expertise that Marty Gale brings to the table. With an impressive 38 years in the business, Marty has not only weathered the ups and downs of the industry, but has...

The Perfect Home Could Be the One You Perfect After Buying

The Perfect Home Could Be the One You Perfect After Buying There’s no denying mortgage rates and home prices are higher now than they were last year and that’s impacting what you can afford. At the same time, there are still fewer homes available for sale than the...

Your Homebuying Adventure

Your Homebuying Adventure Some Highlights Here are the key milestones you’ll encounter on your path to homeownership. From building your team, to house hunting, all the way to moving into your new home – it’s an exciting adventure. Your journey starts here. Let’s...

Why You Need To Use a Real Estate Agent When You Buy a Home

Why You Need To Use a Real Estate Agent When You Buy a Home If you’ve recently decided you’re ready to become a homeowner, chances are you’re trying to figure out what to do first. It can feel a bit overwhelming to know where to start, but the good news is you don’t...

New Loan Limits Raised To Help Home Buyers in 2024

The year 2024 has begun with a bang, as the Federal Housing Administration (FHA) and conventional loan limits have increased. This means that potential homebuyers and refinancers now have even more opportunities to secure funding for their dream homes or make...

Experts Project Home Prices Will Rise over the Next 5 Years

Experts Project Home Prices Will Rise over the Next 5 Years Even with so much data showing home prices are actually rising in most of the country, there are still a lot of people who worry there will be another price crash in the immediate future. In fact, a recent...

Wednesday Word | After-Repair Value

"Wednesday Word" After-Repair Value or ARV What Is After-Repair Value (ARV) In Real Estate? ARV is the estimated value of a property after completed renovations, not in its current condition. House flippers commonly use ARV as a way to gauge the worth of a...

Are the Top 3 Housing Market Questions on Your Mind?

Are the Top 3 Housing Market Questions on Your Mind? When it comes to what’s happening in the housing market, there’s a lot of confusion going around right now. You may hear one thing in conversation with your friends, see something totally different on the news, and...

Is Wall Street Buying Up All the Homes in America?

Is Wall Street Buying Up All the Homes in America?If you’re thinking about buying a home, you may find yourself interested in the latest real estate headlines so you can have a pulse on all of the things that could impact your decision. If that’s the case, you’ve...

cost-effective and flexible solution for an accessory dwelling unit (ADU)?

Are you searching for a cost-effective and flexible solution for an accessory dwelling unit (ADU)? Look no further than a manufactured double wide mobile home. ADUs have gained popularity as a versatile and affordable housing option, and manufactured homes offer...

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season? This time every year, homeowners who are planning to move have a decision to make: sell now or wait until after the holidays? Some sellers with homes already on the market may even remove their...

Selling Property to Family Creates Tax Complications

Our Friend Karl from K.A.N. Accounting & Tax, Inc. Sent us this and we thought we should share! Selling property to a family member or loved one is deemed a related party transaction by the IRS. If contemplating a transaction like this, you need to review the tax...

502 So 1040 E H 143 American Fork Utah 84003

502 So 1040 E H 143 American Fork Utah 84003 Mt Timpanogos Village Comparative Market Analysis and Broker Opinion of Value 502 So 1040 E H 143 American Fork Utah 84003 Sold $317,578 502 So 1040 W H 143 American Fork Utah 84003...

2024 Housing Market Forecast

2024 Housing Market Forecast Some Highlights Thinking of buying or selling a house and wondering what the new year holds for the housing market? Experts forecast home prices to end this year up 2.8% and to rise another 1.5% in 2024. And climbing prices help...

People Are Still Moving, Even with Today’s Affordability Challenges

People Are Still Moving, Even with Today’s Affordability Challenges If you're thinking about buying or selling a home, you might have heard that it’s tough right now because mortgage rates are higher than they’ve been over the past few years, and home prices are...

The Latest 2024 Housing Market Forecast – Utah Realty

The Latest 2024 Housing Market Forecast The new year is right around the corner, and you might be wondering if 2024 will be the right time to buy or sell a home. If you want to make the most informed decision possible, it’s important to know what the experts have to...

Reasons To Sell Your House Before the New Year

Reasons To Sell Your House Before the New Year As the year winds down, you may have decided it's time to make a move and put your house on the market. But should you sell now or wait until January? While it may be tempting to hold off until after the holidays, here...

Don’t Believe Everything You Read About Home Prices

Don’t Believe Everything You Read About Home Prices According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way? It has a lot to do with all the...

A Real Estate Agent Helps Take the Fear Out of the Market

A Real Estate Agent Helps Take the Fear Out of the Market Do negative headlines and talk on social media have you feeling worried about the housing market? Maybe you’ve even seen or heard something lately that scares you and makes you wonder if you should...

8 Great Quotes

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY...

7 Things Homebuyers Should Know Right Now

7 Things Homebuyers Should Know Right Now Navigating The Home Loan Process Amid Today's Sky-high Mortgage Rates Is Extremely Complicated—particularly For First-time Homebuyers. With mortgage rates soaring to unprecedented heights, it's crucial for homebuyers to...

The Perks of Selling Your House When Inventory Is Low

The Perks of Selling Your House When Inventory Is Low When it comes to selling your house, you’re probably trying to juggle the current market conditions and your own needs as you plan your move. One thing that may be working in your favor is how few homes there are...

Why Home Prices Keep Going Up

Why Home Prices Keep Going Up If you've ever dreamed of buying your own place, or selling your current house to upgrade, you're no stranger to the rollercoaster of emotions changing home prices can stir up. It's a tale of financial goals, doubts, and a dash of anxiety...

Home Price Growth Is Returning to Normal

Home Price Growth Is Returning to Normal Some Highlights If you're wondering what’s happening with home prices, know they’re still rising, just at a slower pace – and that’s perfectly normal for this time of year. Based on typical seasonality in the market, prices go...

Are Higher Mortgage Rates Here To Stay?

Are Higher Mortgage Rates Here To Stay? Mortgage rates have been back on the rise recently and that’s getting a lot of attention from the press. If you’ve been following the headlines, you may have even seen rates recently reached their highest level in over...