Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore, the HPSI reflects consumers’ current views and forward-looking expectations of housing market conditions.

Great News! The index reached its highest level since Fannie Mae began their survey. Breaking it down, the report revealed:

- The share of Americans who say it is a good time to buy a home increased from the same time last year.

- The share of those who say it is a good time to sell a home increased from the same time last year.

- The share of Americans who say they are not concerned about losing their job over the next 12 months increased dramatically (16 percentage points) from the same time last year.

- The share of Americans who say mortgage rates will go down over the next 12 months increased dramatically (24 percentage points) from the same time last year.

The day after the index was released, Freddie Mac also announced the 30-year fixed-rate mortgage rate fell to its lowest level in three years.

Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae explained the uptick in the index:

“Consumer job confidence and favorable mortgage rate expectations lifted the HPSI to a new survey high in July, despite ongoing housing supply and affordability challenges. Consumers appear to have shaken off a winter slump in sentiment amid strong income gains. Therefore, sentiment is positioned to take advantage of any supply that comes to market, particularly in the affordable category.”

Bottom Line

Consumers are feeling good about the real estate market. Since Americans are not worried about their jobs, see mortgage rates near an all-time low, and believe it is a good time to buy, the housing market will remain strong for the rest of the year.

Homes for Sale In Utah

[idx-platinum-widget id=”21243-48027″ ]

How to Avoid Capital Gains Taxes on Investment Properties

Capital gains on investment properties must be reported in the year of sale unless deferred. Use IRS Code Section 1031 to defer capital gains taxes by exchanging for a similar property.

Balanced Market Ahead: Median Price Approaches $411K

Home prices are expected to increase modestly in 2025, with a forecasted median of $410,700. Inventory will rise slightly, creating a balanced market with more opportunities for buyers in 2025.

Happy April Fool’s Day

Breaking news! Interest rates at pre-pandemic levels, mortgage rates at all-time low, announces Fed. It's a dream come true for homebuyers who have been waiting for the perfect time to enter the market! Dream on… Happy April Fool’s Day!

What’s Shaping the Future of Real Estate?

Rising mortgage rates and economic shifts continue to influence housing affordability and accessibility. Homeowners' insurance costs have surged due to climate risks, prompting state-led policy solutions.

Single & Secure: Financial Planning Tips

Sharing expenses with friends or family, like splitting groceries or carpooling, helps reduce costs. Establishing an emergency fund ensures financial security; aim to save 3-6 months of expenses.

New Year, New Home: Buying & Selling Tips

Start Early: Sellers should begin the process early, evaluating their home and preparing for the market.Home Preparation: Sellers should invest in updates, cleaning, and professional staging to increase appeal.

How Insurance Can Help With Retirement Planning

Long-term care insurance shields retirement funds by covering care costs like home care or assisted living. Cash-value life insurance offers tax-deferred growth, ideal for those maximizing retirement plans and seeking additional savings.

How to Protect Your Belongings With Insurance

Ensure your coverage includes extended or guaranteed replacement cost to cover spikes in repair costs. Don’t skip flood insurance—99% of counties faced flooding between 1996-2019, according to FEMA.

3 buildings in Utah among hundreds of federal properties ‘designated for disposal’

Three federal properties in Utah, including the IRS Service Center in Ogden, the St. George Federal Building, and the Wallace F. Bennett Federal Building in Salt Lake, are among hundreds designated for disposal by the GSA. These buildings are considered “non-core” and...

How Stable Is Utah’s Housing Market?

Utah's housing market has a 20.7% chance of a 5% price drop over the past 25 years, lower than the US 26.4% avg. Since 2000, the median home price ↑ 210%, higher than the national ↑ 196%.

Happy St. Patrick’s Day

St Patrick's Day is the day we all turn a bit Irish. 13 million pints of Guinness are consumed worldwide on St. Patrick's Day. Green is now the traditional color of St. Patrick's Day.

US Market Trends: Is Passive Investing Out?

Positive sentiment is growing, with lower interest rates fostering liquidity and selective investment opportunities.Investors must focus on active management and asset selection as the market evolves post-2024.

Fed Holds Rates Steady at 4.24%-4.5%

The Federal Reserve held key interest rates at 4.25%-4.5% despite Trump’s calls for immediate cuts.Inflation remains at 2.9%, with steady job growth and strong consumer spending supporting the economy.The Fed’s next policy meeting is scheduled for March 18-19, 2025.

Is requiring buyers to live in the homes they purchase a solution to Utah’s housing issues?

A bill in Utah aims to address the impact of investors on first-time homebuyers by requiring buyers of single-family homes in Salt Lake County to sign an affidavit stating their intent to live in the home for at least a year if purchased within the first 30 days on...

First-Time Homebuyer: Do You Qualify?

A first-time home buyer hasn’t owned a primary residence in the past three years. Renters, even those with no prior homeownership, qualify for first-time buyer assistance programs.

Happy Women’s Day

International Women's Day, also known as IWD for short, grew out of the labour movement to become a recognized annual event by the UN.It all started in 1908 when 15K women marched through NYC demanding shorter working hours, better pay and the right to vote....

10 Best States to Buy a House in 2025

As 2025 approaches, many are exploring the best states for homeownership in the U.S. Key contenders include Iowa, known for its low cost of living and stable housing market; Indiana, offering affordability and a blend of urban and rural living; and Utah, with a strong...

What Is Final Expense Life Insurance?

Purpose: A whole life insurance policy providing $2,000–$35,000 in coverage to cover funeral and end-of-life costs. Eligibility: Requires no medical exams; approval based on answering basic health questions, making it accessible for most individuals.

Trump’s Economic Policies Impacting Housing

Mortgage rates may stay elevated at 6-7% due to inflation and monetary policy. Proposed tax changes could boost homeownership through mortgage deductions and capital gains adjustments.

Utah legislators reject ‘preemption,’ stop two housing bills intended to permit smaller homes

Utah lawmakers are struggling to tackle the state's housing affordability crisis, as recent bills promoting smaller housing types have stalled. HB88 and HB90, which proposed mandatory accessory dwelling units and smaller lot sizes, faced local government...

Happy Mardi Gras

Utah House Committee Votes Against Bills That Make Housing More Affordable

A Utah House committee did not vote on two housing bills, HB 88 and HB 90, aimed at addressing the state's housing shortage, despite support from the governor's office. HB 88 would allow detached accessory dwelling units in urban residential zones, while HB...

Ready to Buy a Home in 2025? Get the Inside Scoop

Start preparing finances early: Ensure credit is good, calculate affordability, and get ready to make a competitive offer.Current market improvements: 2025 offers better opportunities for buyers after high prices and limited options in 2024.

Cut Your Insurance Premiums: Simple Savings Tips

Maintain a Good Credit Rating: Strong credit scores often lead to lower premiums for auto and homeowner insurance.Drive Safely: A clean driving record and good grades for students can significantly reduce insurance costs.

Utah lawmakers say no to ‘preemption,’ halt 2 housing bills aimed at allowing smaller homes

Utah lawmakers are facing challenges in addressing the housing affordability crisis, with two bills aimed at allowing smaller homes failing to progress in the legislative session. Rep. Ray Ward's proposals, which included permitting accessory dwelling units and...

Tips for Finding Bargain Houses in 2025

Start house hunting in January to benefit from lower prices and reduced buyer competition. Hire a local Real Estate agent with expertise in undervalued properties and market trends.

A Utah bill requiring 60 days notice to raise rent fails

A Utah bill requiring landlords to provide two months' notice before raising rent has been halted for the third consecutive year. The House Business, Labor, and Commerce Committee rejected HB182, which aimed to give tenants more security. The Utah Rental Housing...

Surprising Trend Pops Up in This State To Help Buyers Nab Their First Homes

A new housing trend in Utah is emerging, offering affordable options amid skyrocketing home prices, with the median list price in Salt Lake City at $550,000. Local employers are struggling to find workers due to high property costs. Homebuilder BoxHouse in St. George...

Get Your House Market-Ready

Consult a REALTOR®: A local agent helps price your home correctly and attract potential buyers. Complete Repairs: Fix any outstanding issues, like leaky faucets or worn-out flooring, for a polished look.

Conditions That Make or Break Your Home Contract

Specify mortgage details, interest rates, and loan types to avoid issues with earnest money deposits. Want seller assistance with closing costs? You must ask for it in your offer!

Does Home Insurance Shield Hurricane Damage?

Dwelling and personal property coverage repair your home and replace belongings, subject to policy limits and deductibles. Hurricane deductibles differ: Typically 1–5% of dwelling coverage, significantly impacting your out-of-pocket costs.

Utah rent increase proposal fails for third year in a row

A bill in Utah aimed at requiring landlords to provide 60 days' notice for rent increases was rejected for the third consecutive year, with a tied vote in the House Business, Labor, and Commerce Committee. Supporters argued it would benefit renters, but the...

Happy Presidents’ Day

Presidents' Day celebrates all past and present U.S. presidents. It reflects on the nation's founding principles and values, including the Constitution and union. Reading of Washington's Farewell Address by a U.S. senator remains an annual event for...

Utahns agree housing is a problem. What they don’t agree on is why

A recent survey by Envision Utah reveals that over two-thirds of Utah residents believe the state faces serious housing issues, yet many are unclear about the causes. Key factors identified include rising interest rates, construction costs, and an influx of new...

Happy Valentine’s Day

Valentine’s Day occurs every February 14 around the world, and candy, flowers and gifts are exchanged between loved ones, all in the name of St. Valentine Valentine greetings were popular as far back as the Middle Ages, though written Valentine’s didn’t begin to...

Fannie Mae’s 2025 Housing Forecast

Mortgage rates remain above 6%, with slight home price growth and low supply continuing to pressure affordability. Existing home sales expected to recover slightly from multi-decade lows due to limited inventory and affordability barriers.

How to Invest Globally in Real Estate

Investing globally in Real Estate requires understanding market dynamics, including rent growth and job creation trends.Tap into local expertise, including brokers, property managers, and market analysts, to gain on-the-ground insights.

Looking to Sell a Home in 2025? Take These 5 Steps

Start by researching and interviewing realtors knowledgeable about your local market before selling.A fresh home makeover, including new paint and flooring, boosts appeal and first impressions.

Homeowner Tax Breaks: All the Ways Your House Can Boost Your Tax Refund

Owning a house in the US is expensive, with rapidly rising home prices and hidden expenses. However, tax credits and deductions for homeowners can lead to a bigger tax refund. Homeowners can take advantage of tax deductions by itemizing their deductions using Form...

How 2025 Trends Fuel Homeownership Potential

Home sales may rise 1.5%, prices climb 3.7%, and mortgage rates stay above 6% despite slight cuts. A historic 11.7% home inventory jump and 13.8% new construction surge mark supply resurgence in 2025.

Buying a Home in 2025? Do 3 Things ASAP!

Mortgage rates are expected to fall in 2025, easing the path to homeownership. As rates drop, more homeowners may sell, boosting real estate inventory and market opportunities.

What is ‘missing middle’ housing, and could it solve Utah’s housing crisis?

Since 2015, 87% of building permits in Utah have been for single-family homes, but experts suggest focusing on "missing middle housing" like duplexes and triplexes to address affordability. Daniel Parolek, who coined the term, emphasizes that these smaller,...

5 Reasons to Buy in 2025

Reduced demand could lead to stagnant or declining prices, creating better deals for new buyers. Buyers prepared with savings and good credit can benefit from hesitant competition.

What’s The Most Expensive Zip Code In Southern Utah?

A unique perspective on the current housing market highlights the challenges of home buying, especially in Utah, where prices have surged. A recent analysis of 184 ZIP codes revealed Park City (84060) as the most expensive, with a median home value of over $2.047...

Capital Economics 2025 Home Price Forecast

Capital Economics forecasts U.S. home prices will ↑ 4.0% in both 2025 and 2026, signaling a stable housing market.Limited inventory will likely prevent price declines, supporting steady growth despite constrained buyer demand.

Will 2025 Finally Be a Normal Housing Market?

New listings ↑ 8% weekly, signaling more seller activity as the market heads into 2025. Pending home sales ↑ 10% yearly, reflecting slight optimism in the housing market.

Happy Lunar New Year

恭喜發財. Wishing you prosperity. Lunar New Year, is the most important celebration observed in China, with cultural and historic significance.The New Year celebration is centered around removing the bad and the old, and welcoming the new and the good. Traditional...

California wildfires could have ‘domino effect’ on Utah’s home insurance market

Insurance companies like State Farm and Allstate have halted new home-insurance policies in California due to rising wildfire risks, with the state experiencing eight of the ten costliest wildfires in the U.S. Insurers are now using advanced wildfire mapping tools to...

2025 Interest Rate Forecast: Economic Balancing Act

Rates to drop from 4.5% (Q1) to 3.9% (Q4), following gradual rate cuts across four quarters. Rate cuts aim to boost borrowing and economic activity while addressing inflation concerns.

Salt Lake County, central Utah receive federal funding to make homes safer

Salt Lake County and six central Utah counties will receive nearly 50% of the $6.8 million allocated for home safety improvements in the Mountain West region. The funds, awarded by the U.S. Department of Housing and Urban Development, aim to address health hazards in...

Homebuyers: 2025’s Ride Will Be Bumpy!

Home values are expected to rise 2.6% in 2025, matching 2024's growth pace. Sales of existing homes will climb to 4.3 million in 2025, up from 4 million this year.

How Rate Cuts Could Fuel Homebuying Competition

The Fed influences mortgage rates indirectly through its policy on inflation and labor market data. Mortgage rates generally drop with Fed rate cuts, making borrowing cheaper for consumers.

Top Tips for Avoiding High Mortgage Rates

Feeling trapped by high interest rates? Take charge with these effective strategies to secure better mortgage rates. Review and improve your credit report and score to enhance lender confidence and secure favorable rates.

Utah’s Housing Landscape Reveals Significant Demographic Shifts

A comprehensive analysis of housing permits in Utah shows significant changes in residential development over the past 30 years. Approximately 416,000 new residential units have been built, with two-thirds located in Salt Lake, Davis, Utah, and Weber Counties....

When Are Quarterly Taxes Due in 2025?

Quarterly taxes are due four times per year to avoid IRS penalties. The first quarterly payment for 2025 is due on April 15, for income earned in Q1.

How to buy a multifamily property with low income

Investing in real estate can be lucrative, even for those with limited funds. Buying a multifamily property with no money down offers income potential, lower risk, and potential for appreciation. Benefits include cash flow, building equity, tax advantages, and...

Does Spouse’s Debt Impact Joint Mortgages?

Your spouse’s debt can impact your joint mortgage application, potentially limiting loan options and eligibility. Mortgage lenders prioritize a front-end ratio of 28% and back-end ratio of 36% or less.

Nebraska, Utah, Texas and 12 more states sue feds on housing efficiency standards

Nebraska, Utah, Texas, and several other states are suing the federal government over energy efficiency standards they claim increase the cost of affordable housing. The lawsuit targets the Energy Efficiency Standards section of the Cranston-Gonzalez Act, arguing it...

Understanding The Crucial Role of Credit Scores in Home Buying

In the journey towards home ownership, one's credit score emerges as a pivotal factor, influencing opportunities and shaping choices. This article delves into the intricate role that credit scores play in the home buying process, providing a comprehensive overview of...

Where to Get a Non-QM Loan

Check if you meet the typical requirements: 620+ credit score, stable income, and consistent employment history. Look for lenders or mortgage brokers who work with non-QM wholesale lenders; they can connect you with options.

Top Markets for Office Development in the West

In 2024, the office sector saw significant changes with high vacancy rates and minimal increases in office utilization. Nationally, office space under construction decreased to 57.8 million square feet, down by 39 million from 2023. In the Western U.S., the office...

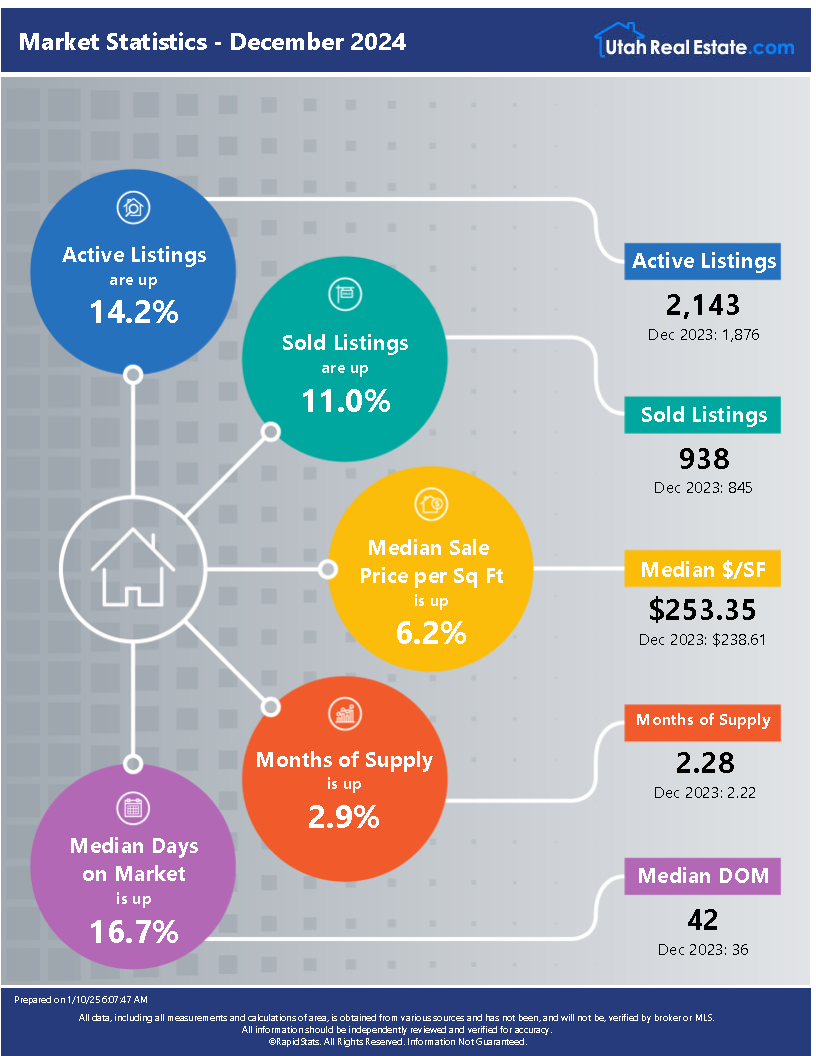

Utah Market Stats January 2025

Key Factors Influencing Utah Insurance Rates

The average annual homeowners insurance premium for a $200K home in Utah is $1,063. Utah’s insurance rates are influenced by low weather risks, local crime, and construction material costs.

Salt Lake City – A Top Pick for Millennial Homeowners

Salt Lake City: A Top Pick for Millennial Homeowners Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor...

2026 Interest Rate Forecast: Continued Adjustments

Federal funds rate projected to fall from 3.7% (Q1) to 3.1% (Q4), marking consistent quarterly reductions. Rate adjustments aim to stabilize the economy, setting the stage for long-term equilibrium.

2025 Housing Market Forecast for Buyers & Sellers

2025 housing market: moderate rise in home sales, stabilized mortgage rates, and slower price increases. All-cash buyers make up 26% of sales, driven by increased homeowner equity.

Home Prices Stay High, Buyers Wait for Relief

In October, the combination of rising mortgage rates and high home prices has slowed home sales to a 14-year low.New single-family home sales ↑ 4.1% MoM, signaling potential market recovery.

How To Use the 28/36 Rule To Determine How Much House You Can Afford

The 28/36 rule is a guideline for determining how much house you can afford. It states that your total housing costs should not exceed 28% of your gross income, and your total debt should not exceed 36%. This rule helps ensure that you don't take on too much...

Governors of Western states consider public lands for developing affordable housing

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Household debt in Utah rising at one of the fastest rates in the nation

A report reveals that Utah has one of the highest rates of household debt growth in the U.S., with residents adding over $1 billion in debt between the second and third quarters of 2024. The average household increased its debt by more than $1,000, ranking just behind...

Tips for Cutting Costs: Boost Savings for Home Buying!

Create a budget by listing income sources, tracking spending, and identifying non-essential expenses to reduce. Set financial goals by researching housing markets, breaking down savings into monthly or yearly targets.

Will You Owe Taxes When You Sell Your Home?

Homeowners may owe taxes if their profit exceeds the exclusion limits when selling their home. Single filers can exclude up to $250K in profits; couples filing jointly can exclude up to $500K.

Mortgage Calculator: How Much You Need To Buy a Home in Utah at a Rate of 6.60%

The average rate on a 30-year mortgage has decreased to 6.60%. In Utah, the median home price is $595,000, requiring a 20% down payment of $119,000, resulting in a monthly payment of $3,040. With a 10% down payment, the upfront cost is $59,500, leading to a monthly...

How to Maximize Profit When Selling a Damaged House

Selling a damaged house can still be profitable if you follow certain strategies. Start by staging the property to highlight its best features. Make necessary repairs without overspending. Improve curb appeal by cleaning up the exterior. Depersonalize and deep-clean...

Realtor.com 2025 Housing Forecast

In 2025, home prices are projected to rise by 3.7%, with mortgage rates averaging 6.3%. The housing market may experience shifts due to potential regulatory and tax changes under a Trump administration. Home sales are expected to increase by 1.5%, while for-sale...

4 mortgage interest rate scenarios that could occur in 2025

Mortgage rates have fluctuated since January 2024, starting near 7% and briefly dropping to 6.15% in September before rising to an average of 6.93%. Experts predict various scenarios for 2025, including rate stability, gradual declines, continued volatility, or...

Fed Interest Rate Forecast for 2025-26: Expert Insights

Fed Funds Rate Trends Forecast: - 2025 rate: drop to 4.0% - 2026 rate: to hold ~3.8% Economic Outlook for 2025: - GDP growth: taper from 1.8% to 2.5% by year-end - Rate cuts respond to slower economic growth

Winter Savings Tips for 2025 Homebuyers

Track your spending this winter to identify areas for cost-cutting before buying a home in 2025. Winter-proof your home to reduce energy bills and save money during the colder months.

Western state governors eye public lands for affordable housing development

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Utah’s Fall Housing Market Shows Growth Despite Higher Prices

Utah's fall housing market in 2024 experienced a 1.6% increase in home prices and a 12.5% rise in sales compared to the previous year, with a median home price of $553,000. In Salt Lake City, prices rose by 7.3% to an average of $550,000, although sales decreased...

What Makes Your Home Sell Faster?

Pricing slightly below market value attracts multiple offers and encourages faster sales across regions. Well-maintained exteriors and appealing landscapes boost property attractiveness in any climate.

Thanksgiving The True Meaning

Thanksgiving Day, celebrated predominantly in the United States, is often symbolized by the quintessential turkey dinner and indulgent pies, marking a period of feasting and familial gatherings. However, the essence of this holiday transcends beyond the mere...

Should you have your home pre-appraised before placing it on the Market?

In the complex and often unpredictable journey of selling a home, understanding the value of your property through a pre-listing appraisal emerges as a critical step that can significantly impact the outcome of your sale. This introduction to pre-listing appraisals...

State of Utah Market Update – Residential Homes

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING...

6 Must-Haves for a 2025 Home Sale

Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor 2000 (in-active) e-pro (advanced digital marketing)...

Top 8 most asked questions from Home Buyers and Sellers.

Top 8 most asked questions Home Buyers and Sellers ask From Home Buyers 1. **What is the current market condition?** Buyers want to know whether it’s a buyer’s or seller’s market to gauge competition and pricing. 2. **What are the property taxes and homeowners...

Navigating Complex Transactions: The Broker Benefit over using a Real Estate Agent

Navigating Complex Transactions: The Broker Benefit In the intricate world of real estate transactions, the distinction between opting for a broker over an agent plays a pivotal role in not just simplifying the process, but in elevating the entire experience....

Five Key Factors Driving The Improvement In Home Affordability

Five Key Factors Driving The Improvement In Home Affordability In recent years, the landscape of home affordability has undergone tangible transformations, with several key factors contributing to a more accessible real estate market for a broader demographic. This...

Insights Into The Dynamic Shift: Home Values Rise As Median Prices Fall

In the ever-evolving landscape of the real estate market, a surprising trend has emerged—one that defies conventional wisdom and prompts a closer examination of underlying factors. This article delves into the complexities behind the seemingly paradoxical...

Secrets to a Successful Sale of Your Home

In the intricate dance of real estate, where emotion meets investment, the art of selling your home demands a blend of strategy, finesse, and keen insight. As navigators through the ever-evolving property landscape , homeowners poised to make their move must...

Why Buying Beats Renting in Salt Lake County Utah

In the current real estate climate, making the decision between buying a home and renting is more crucial than ever, particularly within the vibrant communities of Salt Lake County. This article delves into the five fundamental reasons why purchasing a property...

Evaluating Your Options: Should You Sell Your Home In 2024?

In contemplating the future of one’s real estate investments, the decision to sell a home in 2024 demands a meticulous evaluation of the current economic landscape, market trends, and individual financial goals. This article aims to provide homeowners with a...

Are Home Prices Going To Come Down?

Are Home Prices Going To Come Down? Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking...

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...