State of Utah

Counties in the State of Utah

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...

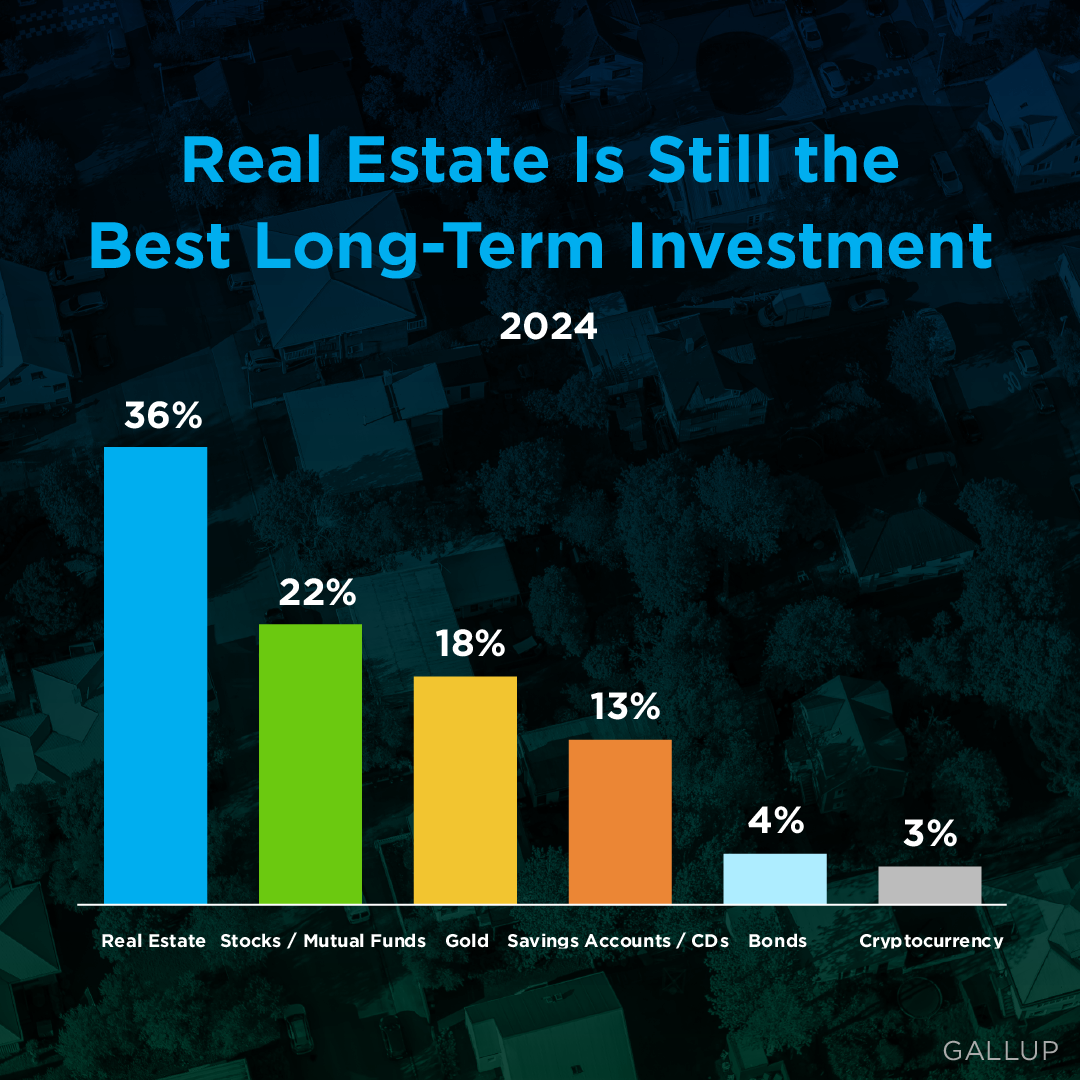

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate

How Missing or Ghosting A Home Showing Can Damage Your Reputation And Business In Real Estate In the competitive world of real estate, maintaining a stellar reputation is not just important; it's paramount. Missing a home showing might seem like a minor mishap, easily...

Real Estate Agent Marketing Methods

Ready to sell your house? One of your top priorities may be getting help marketing your home. Partnering with a great agent can make all the difference. These are just a few strategies we can use to get your house more visibility. Ready to maximize your home's...

Hiring a PSA or Pricing Strategy Advisor is the Key to Pricing your Home Right

Your Agent Is the Key To Pricing Your House Right [INFOGRAPHIC] Some Highlights The asking price for your house can impact your bottom line and how quickly it sells. Both under- and overpricing have drawbacks. So to find the right price for your house, lean on your...

Home Prices Rising in the Next 5 Years

Wondering about the future of home prices? Here's the scoop. Experts forecast a steady rise in home prices until at least 2028. That means buying now sets you up to gain equity as values climb. But, if you wait, the price of a home will only be higher later on. If you...

The Number of Homes for Sale Is Increasing

The Number of Homes for Sale Is Increasing There’s no denying the last couple of years have been tough for anyone trying to buy a home because there haven’t been enough houses to go around. But things are starting to look up. There are more homes up for grabs this...

Home Prices Are Climbing in These Top Cities

Home Prices Are Climbing in These Top Cities Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what's going on with home prices these days. Here's the scoop. The latest national data from Case-Shiller and...

The Sun Is Shining on Sellers This Summer

The Sun Is Shining on Sellers This Summer Some Highlights If your needs have changed, now’s a great time to sell and get the features you want most. Many buyers are eager to move between the school years, so you may see a faster sale, multiple offers, a higher...

How Buying or Selling a Home Benefits Your Community

How Buying or Selling a Home Benefits Your Community If you're thinking of buying or selling a house, it's important to know it doesn't just impact you—it helps out the local economy and your community, too. Every year, the National Association of Realtors (NAR) puts...

Gen Z Buyers – Directors Mortgage Quote

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly...

What’s Motivating Your Move?

Considering making a move? According to Realtor.com, profit potential and family priorities are the top motivators for homeowners right now.Let’s d What's Motivating Your Move? Thinking about selling your house? As you make your decision, consider what's pushing you...

Now’s a Great Time To Sell Your House

Now’s a Great Time To Sell Your House Thinking about selling your house? If you are, you might be weighing factors like today’s mortgage rates and your own changing needs to figure out your next move. Here’s something else to consider. According to the latest Home...

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

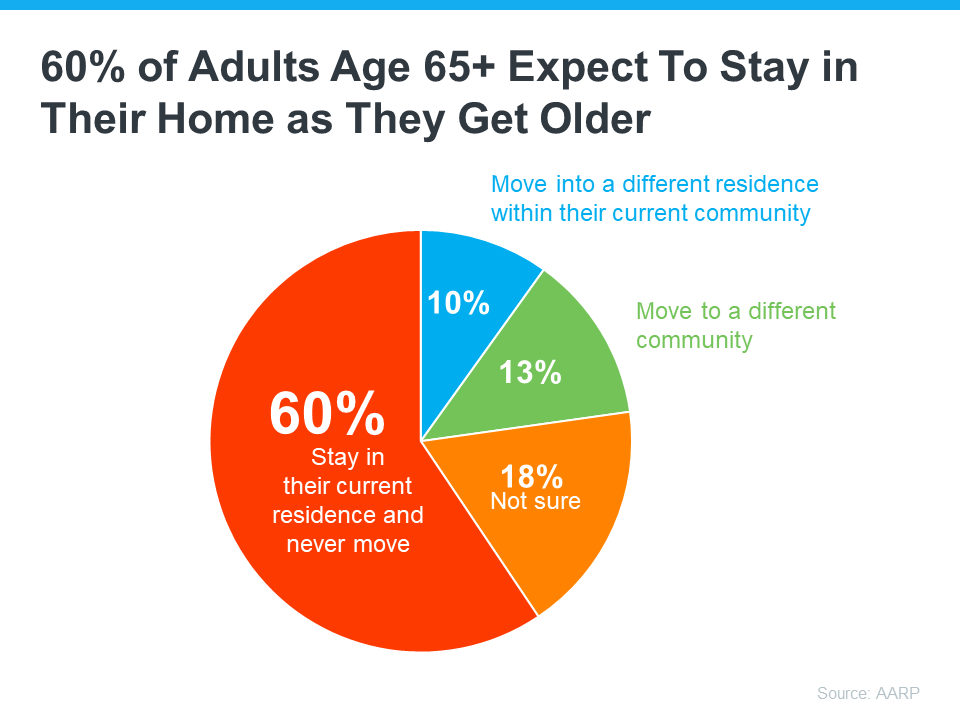

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...

Utah Licensed Real Estate Agents

In the past, we have had over 30,000 Active licenses. At the End of 2023 here is where we stand. Data is sourced from the Utah Division of Real Estate 22, 853 Active Licensees Sales Agent - 18,517 Principal Broker - 2442 Branch Broker - 171 Inactive - 4016 In...

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence

11 Must-Do Actions To Ensure A Smooth Transition Into Your New Residence Moving into a new residence marks a significant milestone that brims with excitement and potential. However, to translate this new beginning into a seamless transition, careful planning and a...

3 Helpful Tips for First-Time Homebuyers

3 Helpful Tips for First-Time Homebuyers Some Highlights Trying to buy your first home? If you’re worried about affordability today or the limited number of homes for sale, these tips can help. Look into homebuyer programs, expand your search area, and consider...

Short list of things that you must get rid of before moving

Embarking on a new chapter of your life by relocating to a different home can be an exciting yet daunting process. The key to ensuring a smooth and stress-free move lies in effective preparation and organization, of which a critical component is the pre-move purge....

What Are Experts Saying About the Spring Housing Market?

What Are Experts Saying About the Spring Housing Market? If you’re planning to move soon, you might be wondering if there'll be more homes to choose from, where prices and mortgage rates are headed, and how to navigate today’s market. If so, here's what the...

NAR Lawsuit Update – How does this effect Utah Realty?

NAR Lawsuit Update What we Know.... The NAR has reached a settlement agreement on the class action lawsuits relating to the offer of compensation rule. Details are in the link below. There is much to digest and more info and training will come out in the days ahead....

Why Access Is So Important When Selling Your House

Why Access Is So Important When Selling Your House If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to...

Why There Won’t Be a Recession That Tanks the Housing Market

Why There Won’t Be a Recession That Tanks the Housing Market There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to...

The First Step: Getting Pre-Approved for a Mortgage

The First Step: Getting Pre-Approved for a Mortgage Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow....

Why You Want an Agent’s Advice for Your Move

Why You Want an Agent’s Advice for Your Move No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re...

How Changing Mortgage Rates Impact You

How Changing Mortgage Rates Impact You Some Highlights If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. That’s because even a small change in mortgage rates can have a big impact...

Expert Home Price Forecasts for 2024 Revised Up

Expert Home Price Forecasts for 2024 Revised Up Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall. So, let’s see exactly how experts’...

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last...

Strategic Tips for Buying Your First Home

Strategic Tips for Buying Your First Home Buying your first home is a big, exciting step and a major milestone that has the power to improve your life. As a first-time homebuyer, it's a dream you can make come true, but there are some hurdles you'll need to overcome...

It’s Time To Prepare Your House for a Spring Listing

It’s Time To Prepare Your House for a Spring Listing If you're thinking of selling your house this spring, now is the perfect time to start getting it ready. With the market gearing up for its busiest time of year, it'll be important to make sure your house shines...

Don’t Let the Latest Home Price Headlines Confuse You

Don’t Let the Latest Home Price Headlines Confuse You Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture. If you look at the national data for...