Buyer Demand Surging in Utah as Spring Market Begins

Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade.

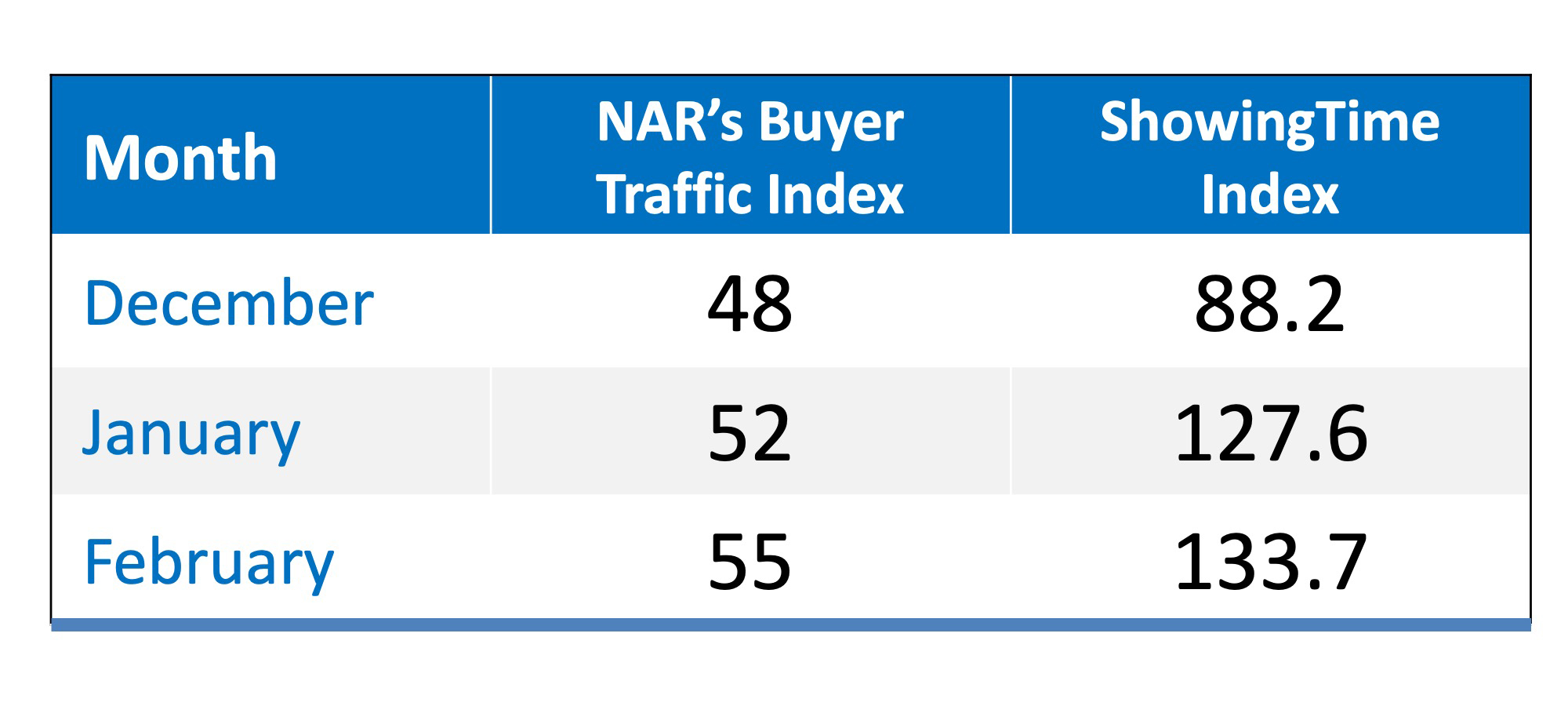

However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available).

Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months.

Why the increase in demand? Increased buying power.

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand.

“Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.”

Bottom Line

It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news.

*The methodology behind the indices:

The ShowingTime Showing Index

“The ShowingTime Showing Index® tracks the average number of buyer showings on active residential properties on a monthly basis, a highly reliable leading indicator of current and future demand trends.”

The National Association of REALTORS® Buyer Traffic Index

“In a monthly survey of REALTORS®, NAR asks respondents ‘Compared to the same month last year, how would you rate the past month’s traffic in neighborhood(s) or area(s) where you make most of your sales?’ NAR compiles the responses into an index, where an index above 50 indicates that more respondents reported “stronger” traffic than “weaker” traffic.”

Housing Crash in Utah

3 Reasons Why We Are Not Heading Toward Another Housing Crash With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of...

first time buyer?

Ready for some Baby Steps Start looking for homes at https://Utah RealtyPlace.com/buying Let Marty be your guide to a new home! After all his is the most interesting Realtor in Utah! https://youtu.be/lqHiZgEy074

How To List Your Home for the Best Price

How To List Your Home for the Best Price If your plan for 2019 includes selling your home, you will want to pay attention to where experts believe home values are headed. According to the latest Home Price Index from CoreLogic, home prices increased by 4.7% over the...

4 Questions to Ask Before Selling Your House

Why It Makes No Sense to Wait for Spring to Sell

Why It Makes No Sense to Wait for Spring to Sell The price of any item (including residential real estate) is determined by the theory of ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item...

The Difference Having a Professional on Your Side Makes

The Difference Having a Professional on Your Side Makes In today’s fast-paced world, where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, with...

Utah Housing Loan Changes

Did you know? Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/ HomeAgain: May include an...

Buying a Home this Year?

Utah Realty Market Statistics for December 2018

Housing Market Statistics for December of 2018

Average Home Mortgage Rates Over Time

With interest rates still around 4.5%, now is a great time to look back at where rates have been over the last 40 years. Rates are projected to climb to 5.0% by this time next year according to Freddie Mac. The impact your interest rate makes on your monthly mortgage...