2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

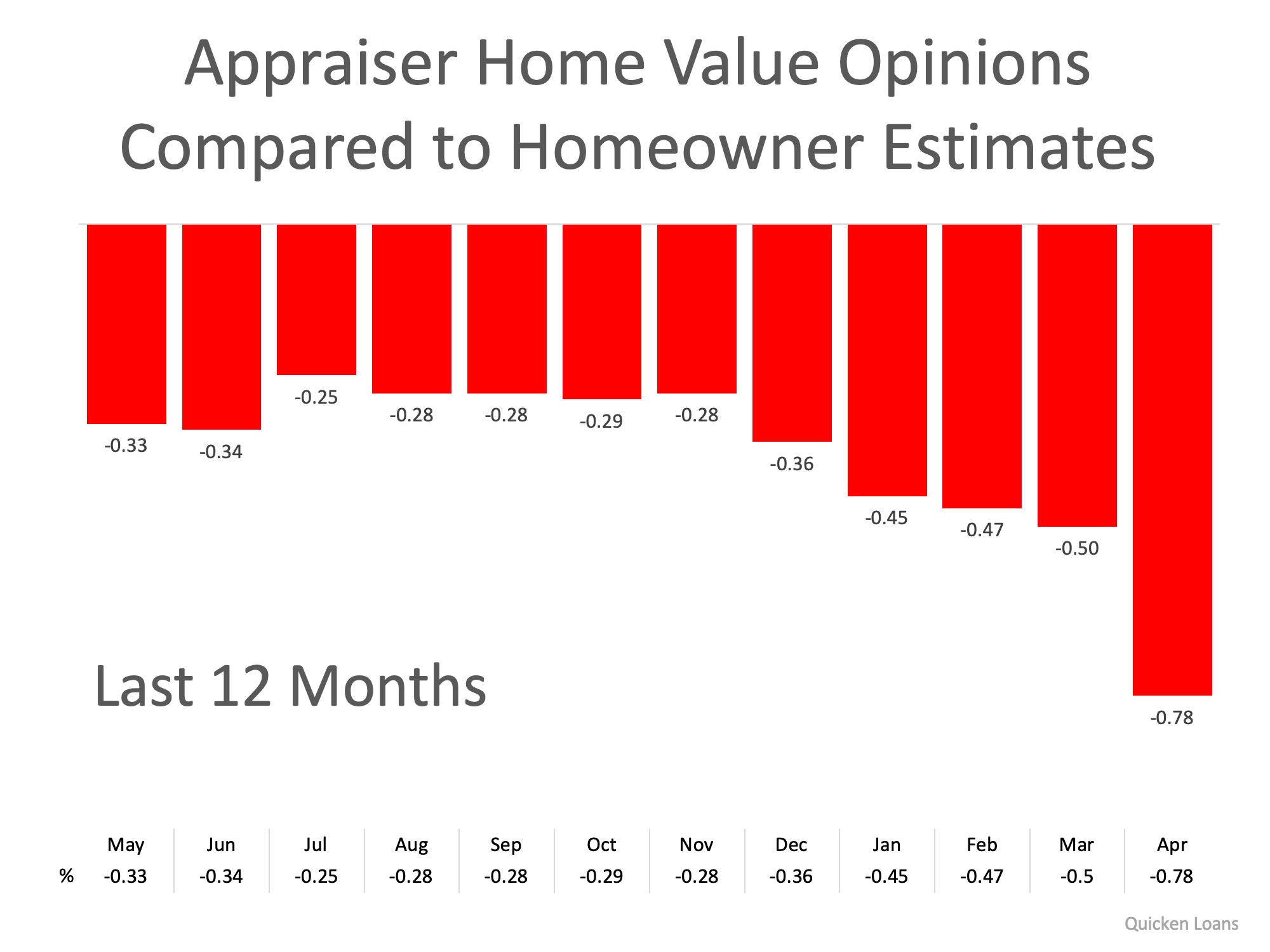

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

8 Tips for First-Time Home Buyers

First-time homebuyers should save for a down payment, typically 20%, and budget for additional costs like fees, moving, and furniture. Choose a neighborhood that fits long-term needs, prioritize must-haves, and get a home inspection to avoid surprises. Use a mortgage...

5 Reasons Enticing Me to Buy a Home Before 2025 Ends

Slide 1 Mortgage rates dropped to around 6%, down from the 7.79% peak in 2023. Slide 2 Housing supply rose 15.7% in 2025, giving buyers 1.55 million homes to choose from. Slide 3 Home prices are still high but rising slower, with just 2.9% annual growth mid-2025....

22 Real Estate Investment Strategies

Real estate investing offers strategies for wealth building, passive income, and portfolio diversification, including buy-and-hold, fix-and-flip, REITs, and rental property diversification. REITs have shown stability and often outperform stocks over time, while...

Housing Market’s Next Chapter: Second Half 2025

Borrowing costs set to ease, boosting affordability and enticing sidelined buyers back into the market. Sales expected to strengthen modestly, with fall poised to show the year’s best momentum. Prices likely to rise gradually, reflecting steady demand and limited...

Forecast Signals Confident Buyers, Steady Prices by Late-2025

Slide 1 Total home sales in 2025 are forecast at 4.74 million units. Slide 2 Mortgage rates expected to finish 2025 at 6.5%, dipping to 6.1% by 2026. Slide 3 Forecast revisions are modest, keeping housing sales stable despite economic uncertainties. Slide 4 Fannie Mae...

Multifamily Housing Starts Surge 21% in Q2 2025

Multifamily housing starts reached 109K units in Q2 2025, with 102,000 built-for-rent, ↑ 21% yearly. Rental units made up 94% of multifamily starts, far above the long-term avg of 80% and the historical low of 47% during the 2005 condo boom. Condo construction starts...

The 8 best real estate markets in the country right now

WalletHub ranked 300 U.S. cities to identify the strongest housing markets in 2025, considering factors like home-price appreciation, foreclosure rates, affordability, job growth, and new home construction. With rising mortgage rates and a seller-friendly market,...

Are 2027 Trends Favoring Long-Term Gains?

Home prices are projected to rise 4% in 2027, reaching 10.8% cumulative growth since 2024. Experts forecast continued moderate gains in 2027, following slower increases in 2025 and 2026.

Utah: Hottest Spots for New Home Builds

Utah is one of the top states in the country for new home builds. Utah ranks No. 4 nationally, building 18.6 new homes per 1,000 existing.

Utah: Among States With High Home Values by 2030

Slide 1: "Utah’s Silicon Slopes drive home prices toward $673K by 2030." Slide 2: Limited housing and zoning challenges keep prices rising fast."