2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

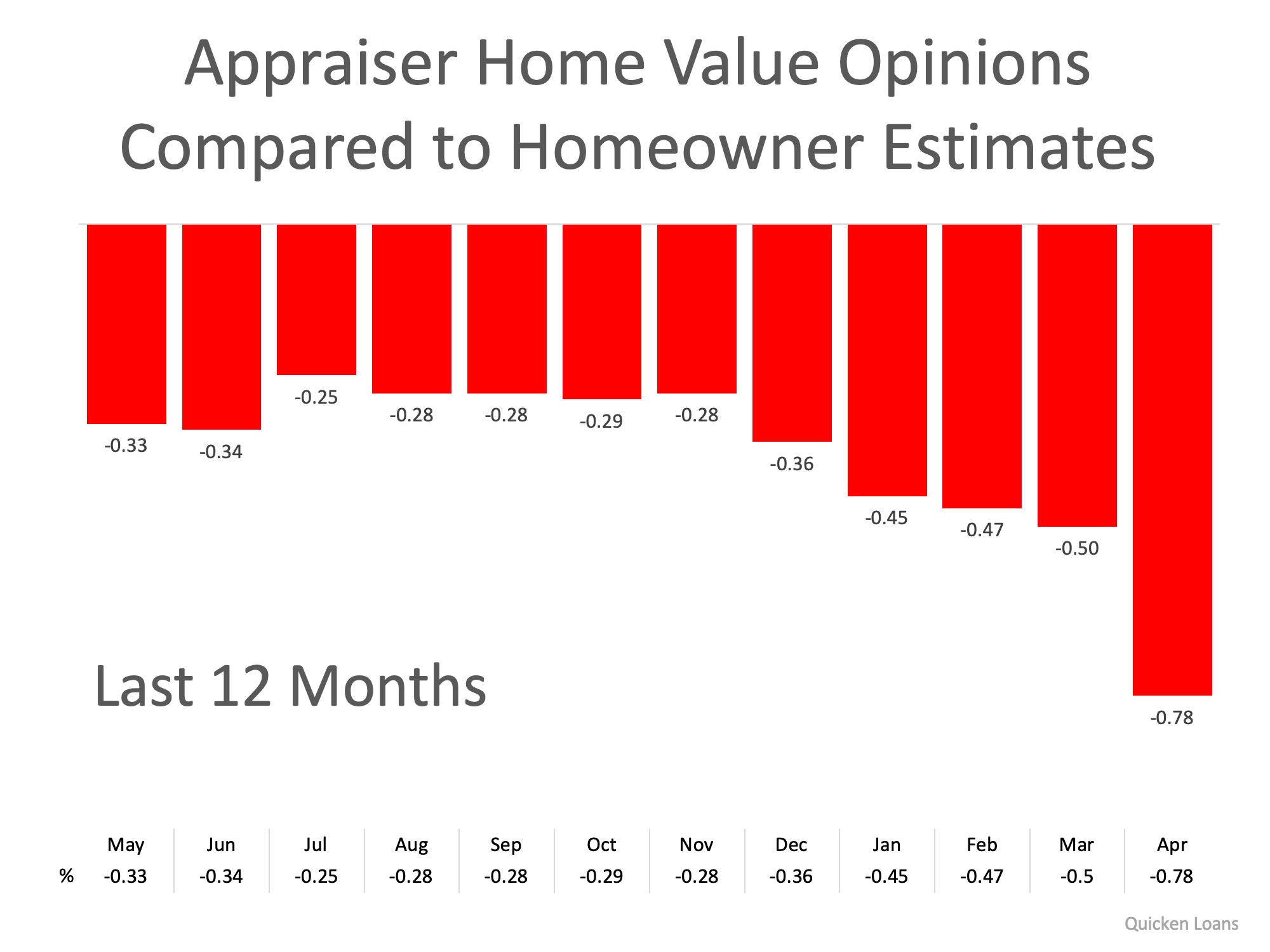

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Why There Won’t Be a Recession That Tanks the Housing Market

Why There Won’t Be a Recession That Tanks the Housing Market There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to...

The First Step: Getting Pre-Approved for a Mortgage

The First Step: Getting Pre-Approved for a Mortgage Some Highlights If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow....

Why You Want an Agent’s Advice for Your Move

Why You Want an Agent’s Advice for Your Move No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re...

How Changing Mortgage Rates Impact You

How Changing Mortgage Rates Impact You Some Highlights If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. That’s because even a small change in mortgage rates can have a big impact...

Expert Home Price Forecasts for 2024 Revised Up

Expert Home Price Forecasts for 2024 Revised Up Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall. So, let’s see exactly how experts’...

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year

Some Experts Say Mortgage Rates May Fall Below 6% Later This Year There’s a lot of confusion in the market about what’s happening with day-to-day movement in mortgage rates right now, but here’s what you really need to know: compared to the near 8% peak last...

Strategic Tips for Buying Your First Home

Strategic Tips for Buying Your First Home Buying your first home is a big, exciting step and a major milestone that has the power to improve your life. As a first-time homebuyer, it's a dream you can make come true, but there are some hurdles you'll need to overcome...

It’s Time To Prepare Your House for a Spring Listing

It’s Time To Prepare Your House for a Spring Listing If you're thinking of selling your house this spring, now is the perfect time to start getting it ready. With the market gearing up for its busiest time of year, it'll be important to make sure your house shines...

Don’t Let the Latest Home Price Headlines Confuse You

Don’t Let the Latest Home Price Headlines Confuse You Based on what you’re hearing in the news about home prices, you may be worried they’re falling. But here’s the thing. The headlines aren’t giving you the full picture. If you look at the national data for...

Maximizing The Benefits Of Home Equity When Downsizing

Maximizing The Benefits Of Home Equity When Downsizing When it comes to downsizing, homeowners often view it as a way to simplify their lives, reduce maintenance costs, or even relocate to a more desirable location. But what many don't realize is that downsizing can...