2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

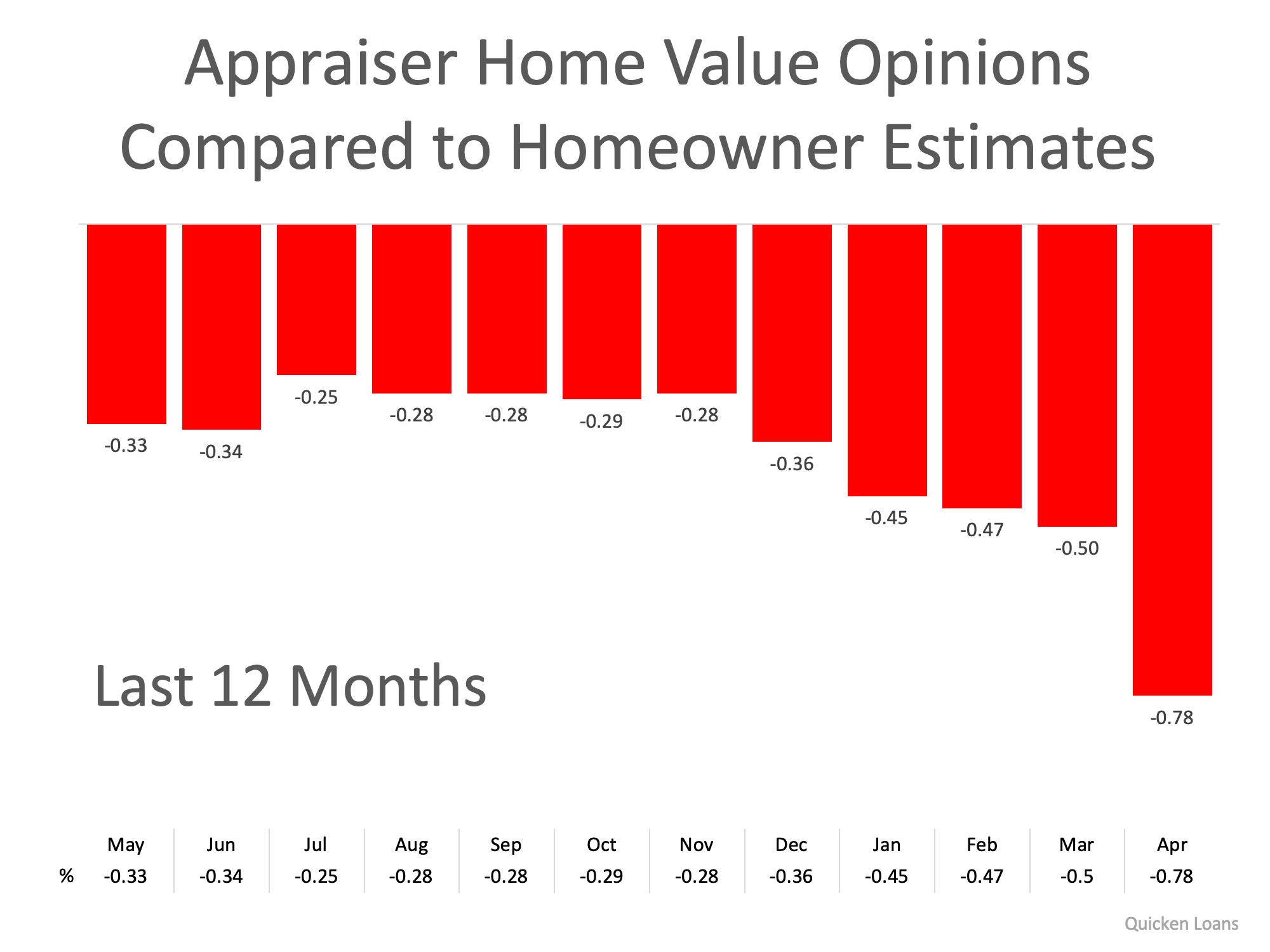

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Happy Flag Day

Flag Day is the American flag's birthday party every June 14th! Flag Day was proclaimed in 1916 but officially recognized in 1949. Talk about a late celebration! Betsy Ross, a seamstress, sewed the first flag. Imagine if designers today made flag-inspired...

Why Everyone’s Moving to Utah

Utah ranks as the best state to live in for the 3rd consecutive year. Residents enjoy a mix of urban life in Salt Lake City and scenic small towns like Midway. It stands out for its fiscal stability, family-friendly communities, and outdoor recreation. A lower cost of...

Utah’s Home Values and Mortgage Balances Over 5 Years

Avg home value in 2025: ~$550K Change: ↑ 42% from ~$367K in 2020 Avg mortgage balance in 2025: ~$312K Change: ↑ 39% from ~$225K in 2020 US national 5-yr growth: • Home value: ↑ 40% • Mortgage balance: ↑ 24%

June is National Homeowners Month

In recognition of National Homeowner Month, it's essential to shed light on the multifaceted value that homeownership brings to individuals, families, and communities at large. This observance not only celebrates the achievement of owning a home but also delves...

Utah Tops Nation in Income vs. Cost of Living

Utah ranks #1 nationally for household income adjusted for cost of living, boosting real buying power. Utah’s diversified economy and strong GDP growth fuel rising household wages despite high housing costs.

Governor meets with mayors about boosting housing stock, announces dashboard to view progress

Utah aims to build 35,000 starter homes in four years to address housing affordability. Gov. Spencer Cox met with 48 mayors to discuss progress, noting 5,100 homes are underway but more effort is needed due to population growth. Cities like Clearfield and Herriman...

Here’s How to Start Collecting Passive Income from Real Estate for Less Than $100.

Investing in rental properties requires a large upfront investment, but Real Estate Investment Trusts (REITs) offer a more affordable and passive alternative. Companies like Invitation Homes and Equity Residential allow investors to access rental properties for a...

2025 Design Trends: Speed up Your Sale

Japandi style tops buyer preferences with its minimal, nature-inspired, and calming aesthetic. Scandinavian design emphasizes simplicity, natural materials, and serene neutral tones.

Utah Among States With High Housing Costs in 2025

In 2025, housing affordability remains a major issue across the US, straining household budgets. New data shows that in several states, housing costs now exceed 50% of avg household income, well above the 30% affordability threshold. In Utah, rising property values...

What’s the Wait Time for First-Time Buyers in Utah?

A new study has ranked U.S. states based on the difficulty first-time homebuyers face when trying to enter the housing market. Arizona ranks #7 overall (tied), making it one of the seventh hardest states for first-time buyers to afford a home. The median home value in...