The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

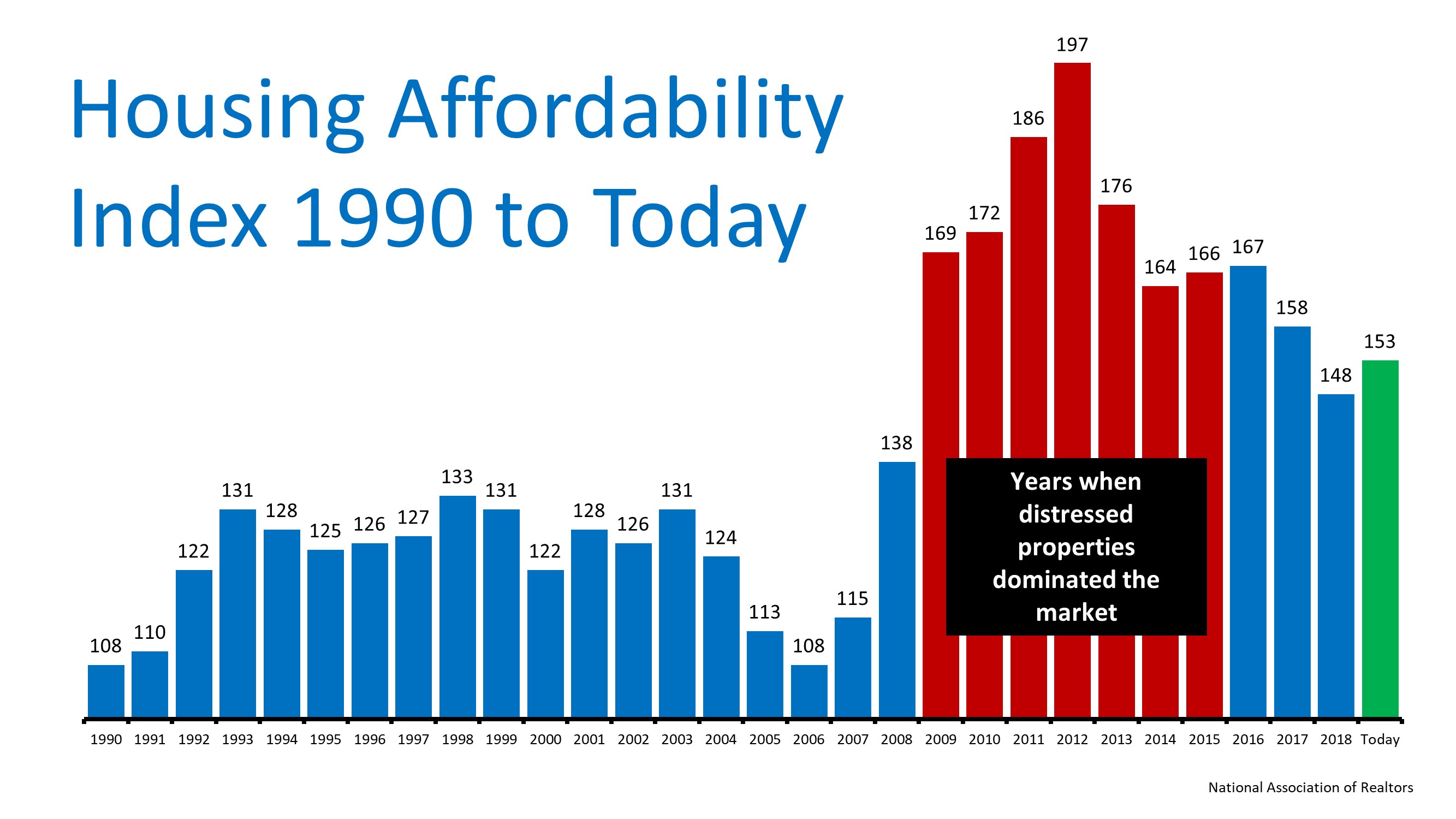

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Is Your House “Priced to Sell Immediately”?

Is Your House “Priced to Sell Immediately”? In today’s real estate market, more houses are coming to market every day. Eager buyers are searching for their dream homes, so setting the right price for your house is one of the most important things you can do. According...

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year

Utah had the second highest house-price appreciation of all states in the second quarter year-over-year Utah had the second highest house-price appreciation of all states in the second quarter year-over-year, according to a new report by the Federal Housing Finance...

What Will Home Prices Look Like Over the Next Few Years

What Will Home Prices Look Like Over the Next Few Years? September 19th, 2019 Home prices will continue to rise throughout 2023. This means that now is a great time to sell! If you're thinking of listing your home, let's get together to determine your best move.

4 Reasons to Sell This Fall In Utah With Utah Realty

Utah Realty 4 Reasons to Sell This Fall Some Highlights: Buyers are active in the market and often competing with one another for available listings. Housing inventory is still under the 6-month supply found in a normal housing market. Homes are still selling...

Three Benefits of Growing Equity in Your Home

The Benefits of Growing Equity in Your Home Over the last couple of years, we’ve heard quite a bit about rising home prices. Today, expert projections still forecast continued growth, just at a slower pace. One of the often-overlooked benefits of rising home prices is...

Utah Mortgage Rates at a 3 Year Low

Utah Mortgage Rates at a 3 Year Low

American Confidence in Housing at an All-Time High

Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore,...

How to Increase Your Equity Over The Next 5 Years

How to Increase Your Equity Over the Next 5 Years Many of the questions currently surrounding the real estate industry focus on home prices and where they are heading. The most recent Home Price Expectation Survey (HPES) helps target these projected answers. Here are...

If you are Thinking about Selling and Live in Utah? You should read this first!

If you are Thinking about Selling and Live in Utah? You should read this first! Why Now Is the Perfect Time to Sell Your House As a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I...

Utah Realty Expert Insights On Inventory In The Current Market

3 Expert Insights On Inventory In The Current Market The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year. There...