Home Value Appreciation Stops Falling, Begins to Stabilize

The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer.

In a recent post on the National Association of Realtors’ Economists’ Outlook Blog, it was revealed that Realtors are starting to sense that home values are beginning to stabilize and that we may see appreciation beginning to accelerate again:

“About 3,000 REALTORS® who responded to NAR’s February 2019 REALTORS Confidence Index Survey had more optimistic— although modest— home price growth expectations over the next 12 months. Respondents expect home prices to typically increase by 1.9 percent nationally, up from 1.4 percent in the January survey.”

The thinking that home appreciation has bottomed-out was also confirmed in two additional housing reports recently released:

CoreLogic Home Price Index – The analysts at CoreLogic increased their projection for home appreciation for the next twelve months to 4.7% as compared to the 4.6% they projected in their previous report.

The Home Price Expectation Survey – In the 2019 first quarter survey, the nationwide panel of over one hundred economists, real estate experts, and investment & market strategists increased their projection for home value growth in 2019 to 4.3% compared to the 3.8% increase they had projected in the fourth quarter of 2018.

Bottom Line

Agents working the business every day, one of the premier data companies in the real estate space, and one hundred housing experts all agree: home price appreciation has ended its decline and looks to be stabilizing… and may even accelerate.

Top Markets for Office Development in the West

In 2024, the office sector saw significant changes with high vacancy rates and minimal increases in office utilization. Nationally, office space under construction decreased to 57.8 million square feet, down by 39 million from 2023. In the Western U.S., the office...

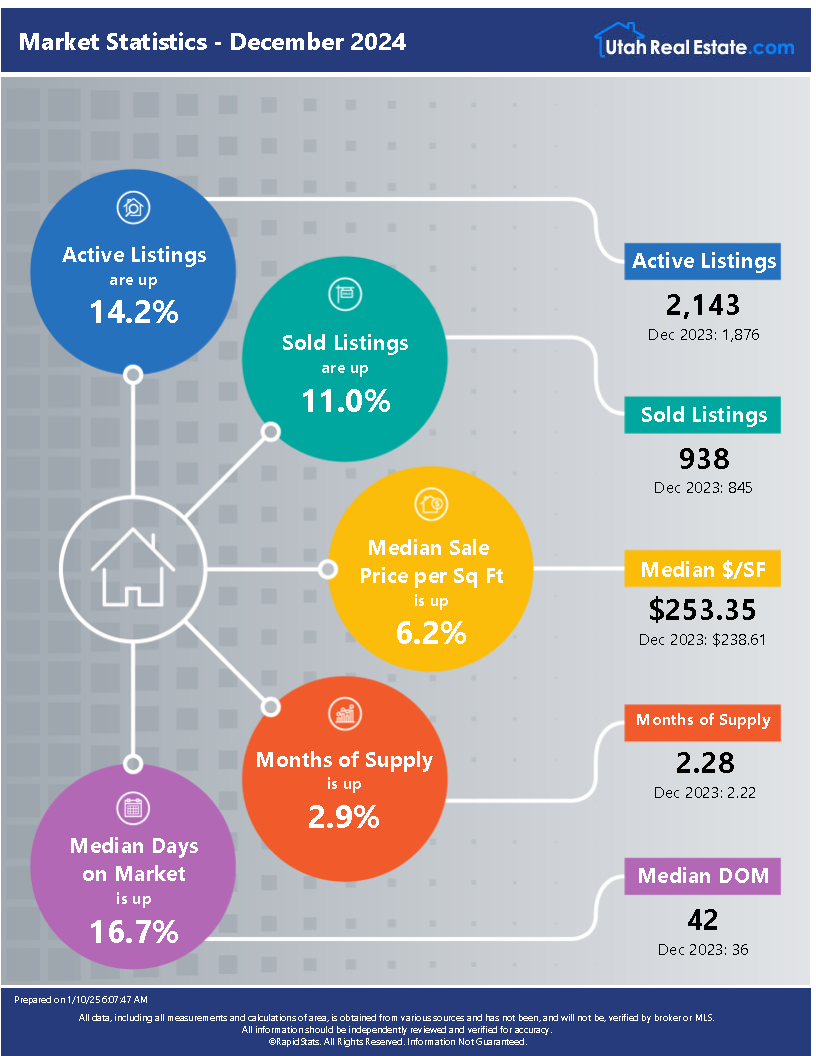

Utah Market Stats January 2025

Key Factors Influencing Utah Insurance Rates

The average annual homeowners insurance premium for a $200K home in Utah is $1,063. Utah’s insurance rates are influenced by low weather risks, local crime, and construction material costs.

Salt Lake City – A Top Pick for Millennial Homeowners

Salt Lake City: A Top Pick for Millennial Homeowners Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor...

2026 Interest Rate Forecast: Continued Adjustments

Federal funds rate projected to fall from 3.7% (Q1) to 3.1% (Q4), marking consistent quarterly reductions. Rate adjustments aim to stabilize the economy, setting the stage for long-term equilibrium.

2025 Housing Market Forecast for Buyers & Sellers

2025 housing market: moderate rise in home sales, stabilized mortgage rates, and slower price increases. All-cash buyers make up 26% of sales, driven by increased homeowner equity.

Home Prices Stay High, Buyers Wait for Relief

In October, the combination of rising mortgage rates and high home prices has slowed home sales to a 14-year low.New single-family home sales ↑ 4.1% MoM, signaling potential market recovery.

How To Use the 28/36 Rule To Determine How Much House You Can Afford

The 28/36 rule is a guideline for determining how much house you can afford. It states that your total housing costs should not exceed 28% of your gross income, and your total debt should not exceed 36%. This rule helps ensure that you don't take on too much...

Governors of Western states consider public lands for developing affordable housing

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Household debt in Utah rising at one of the fastest rates in the nation

A report reveals that Utah has one of the highest rates of household debt growth in the U.S., with residents adding over $1 billion in debt between the second and third quarters of 2024. The average household increased its debt by more than $1,000, ranking just behind...