2 Things You Need to Know to Properly Price Your Home

In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high demand from buyers has pushed prices to rise rapidly.

In the mind of the homeowner, annual home price appreciation over 6% has become the new normal. This becomes a challenge when a homeowner looks to refinance or sell their home, as the expectation of what the homeowner believes the home should be worth does not always line up with the bank’s appraisal.

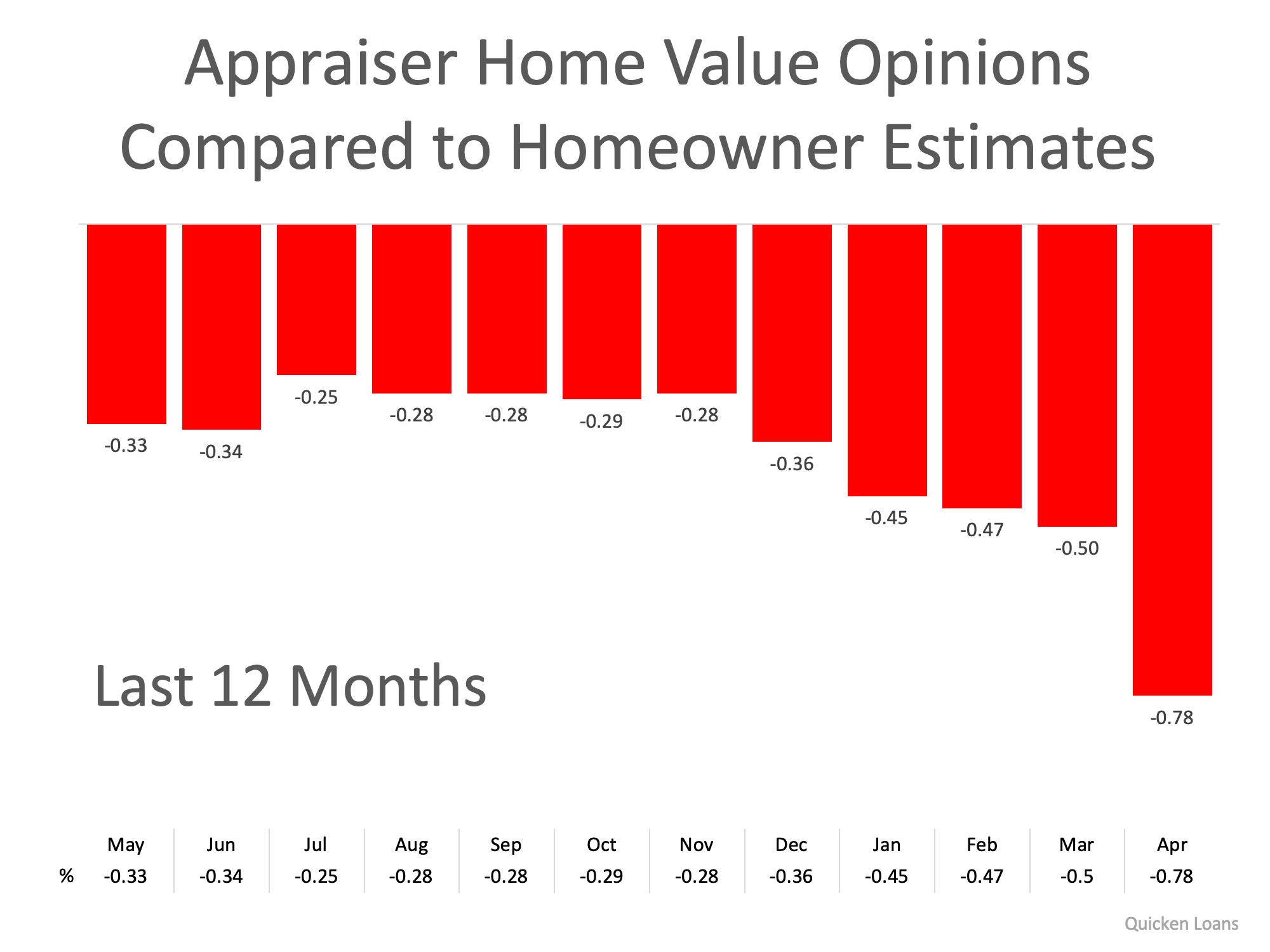

Every month, the Home Price Perception Index (HPPI) measures the disparity between what a homeowner seeking to refinance their home believes their house is worth and what an appraiser’s evaluation of that same home is.

Over the last five months, the gap between the homeowner’s opinion and the bank’s appraisal has widened to -0.78%. This is important for homeowners to note, as even a 0.78% difference in appraisal can mean thousands of dollars that a buyer or seller would have to come up with at closing (depending on the price of the home).

The chart below illustrates the changes in home price estimates over the last 12 months.

While the appraisal gap widens, another trend is also becoming more common.

According to realtor.com, “the share of homes which had their prices cut increased by 2% compared to last year”. Thirty-seven out of the 50 largest US housing markets saw an increase in overall price reductions.

In today’s market, you need an expert agent who can help price your house right from the start. Homeowners who make the mistake of overpricing their homes will eventually have to drop the price. This leaves buyers wondering if the price drop was caused by something wrong with the house. In reality, nothing is wrong- the price was just too high!

Bottom Line

If you are planning on selling your house in today’s market, let’s get together to set your listing price properly from the start!

Real Estate Tops Best Investment Poll for 7th Year Running

Real Estate Tops Best Investment Poll for 7th Year RunningEvery year, Gallup conducts a survey of Americans to determine their choice for the best long-term investment. Respondents are asked to select real estate, stocks/mutual funds, gold, savings accounts/CDs, or...

How Did Covid-19 pandemic affect Salt Lake County home sales

How did the Covid-19 pandemic affect Salt Lake County home sales? In April, sales of all housing types fell to an eight-year low, and were down 28 percent compared to April 2019. The silver lining? Deferred spring home sales are now being realized as the market...

Are You Ready for the Summer Housing Market?

Are You Ready for the Summer Housing Market? As the health crisis started making its way throughout our country earlier this spring, sellers have been cautious about putting their homes on the market. This hesitation stemmed primarily from fear of the spread of the...

Is a Recession Here? Yes. Does that Mean a Housing Crash? No.

Is a Recession Here? Yes. Does that Mean a Housing Crash? No. On Monday, the National Bureau of Economic Research (NBER) announced that the U.S. economy is officially in a recession. This did not come as a surprise to many, as the Bureau defines a recession this way:...

Real Estate Will Lead the Economic Recovery

Real Estate Will Lead the Economic RecoveryWith more U.S. states reopening for business this summer, and as people start to return to work, we can expect the economy to begin improving. Most expert forecasts indicate this economic recovery will start to happen in the...

Unemployment Report Blows Away Skeptics

Unemployment Report Blows Away Skeptics Last Friday, the U.S. Bureau of Labor Statistics released their May Employment Situation Summary. Leading up to the release, most experts predicted the unemployment rate would jump up to approximately 20% from the 14.7% rate...

June is National Homeownership Month

National Homeownership Month Some Highlights National Homeownership Month is a great time to reflect on how we can each promote stronger community growth. Homeownership helps families build financial freedom, find greater happiness and satisfaction, and make a...

The Expert Economic Recovery Forecast

10 Questions to Ask an Elder Law Attorney

10 Questions to Ask an Elder Law Attorney Elder law attorneys cover a wide variety of legal areas, potentially including guardianship, long-term care planning, knowledge of government benefit programs, powers of attorney, estate planning, advance medical directives,...

Three Things to Understand About Unemployment Statistics

Three Things to Understand About Unemployment StatisticsTomorrow morning the Bureau of Labor Statistics will release the latest Employment Situation Summary, which will include the most current unemployment rate. It will be a horrific number. Many analysts believe...