Home Buyer Demand Will Be Strong for Years to Come

There has been a lot written about millennials and their preference to live in city centers above their favorite pizza place. Some have even gone so far as to say that millennials are a “Renter-Generation”.

And while this might be true for some millennials, more and more research has surfaced that shows for the vast majority, owning a home is a major part of their American Dream!

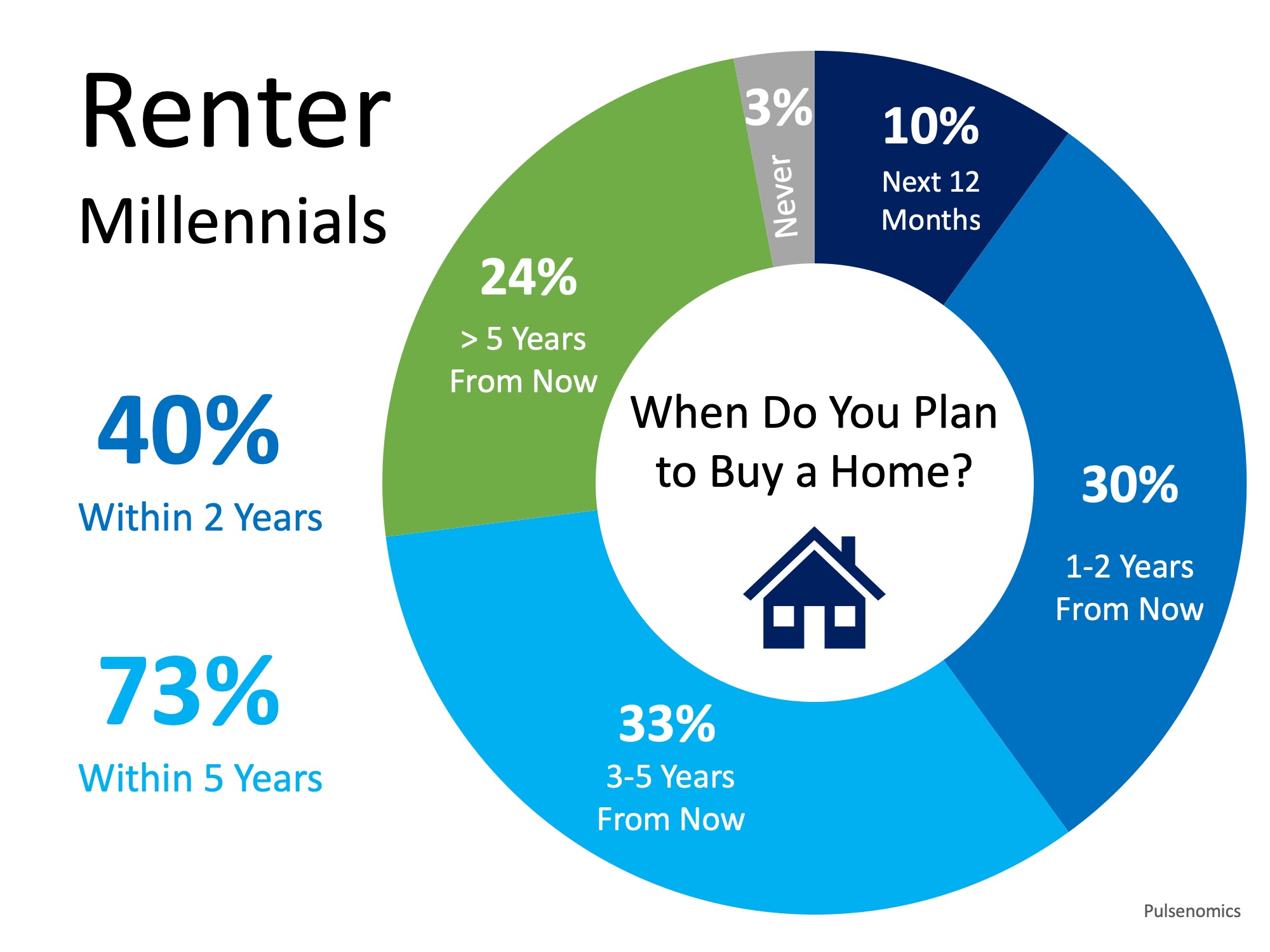

New research shows that 66% of millennials who currently rent are determined to buy a home! Seventy-three percent of those surveyed by Pulsenomics plan to buy a home in the next five years, with 40% planning to do so within the next two years!

“Millennials want to own a home as much as prior generations,” Ali Wolf, Director of Economic Research at Meyers Research says. “We saw millennial shoppers scooping up homes in 2018—and 2019 will be no different.”

Bottom Line

Are you one of the millions of renters who are ready and willing to buy a home? Let’s get together to determine your ability to buy now!

Retirement May Be Changing What You Need in a Home

Retirement May Be Changing What You Need in a Home The past year and a half brought about significant life changes for many of us. For some, it meant entering retirement earlier than expected. Recent data shows more people retired this year than anticipated. According...

Sellers: You’ll Likely Get Multiple Strong Offers This Season

Sellers: You’ll Likely Get Multiple Strong Offers This Season Are you thinking about selling your house right now, but you’re not sure you’ll have the time to do so as the holidays draw near? If so, consider this: even as the holiday season approaches, there are...

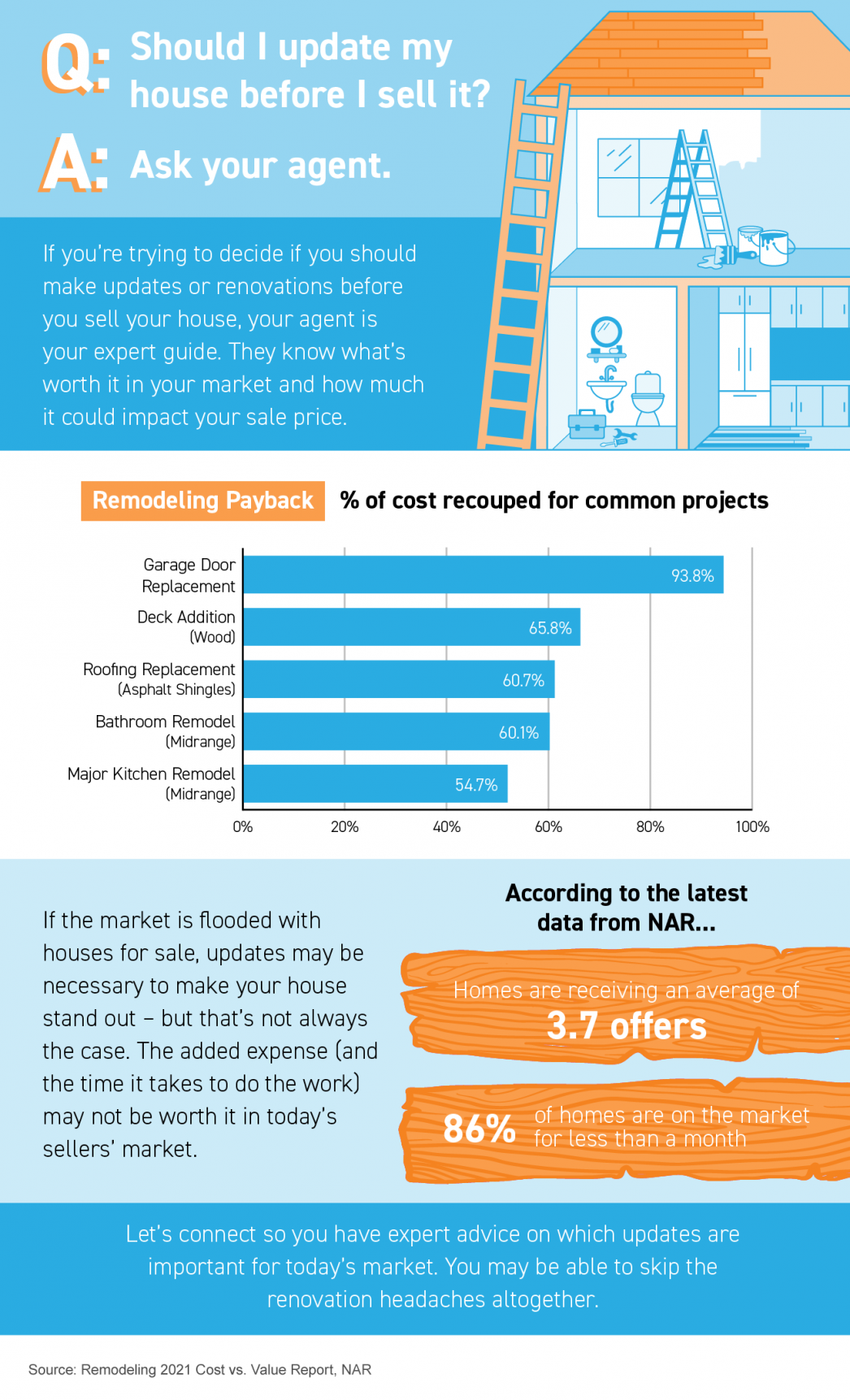

Should I Update My House Before I Sell It?

Should I Update My House Before I Sell It? Some Highlights If you’re deciding whether you should make updates before you sell your house, lean on your agent to be your guide. If the market is flooded with houses for sale, updates...

Sell Your House Before the Holidays

Sell Your House Before the Holidays As you look ahead to the winter season, you’re likely making plans and thinking about what you want to achieve before the year ends. One of those key decision points could be whether or not you want to move this year. If the...

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since...

Salt Lake homebuyers, on average, paid $120,000 more than they did the same quarter last year

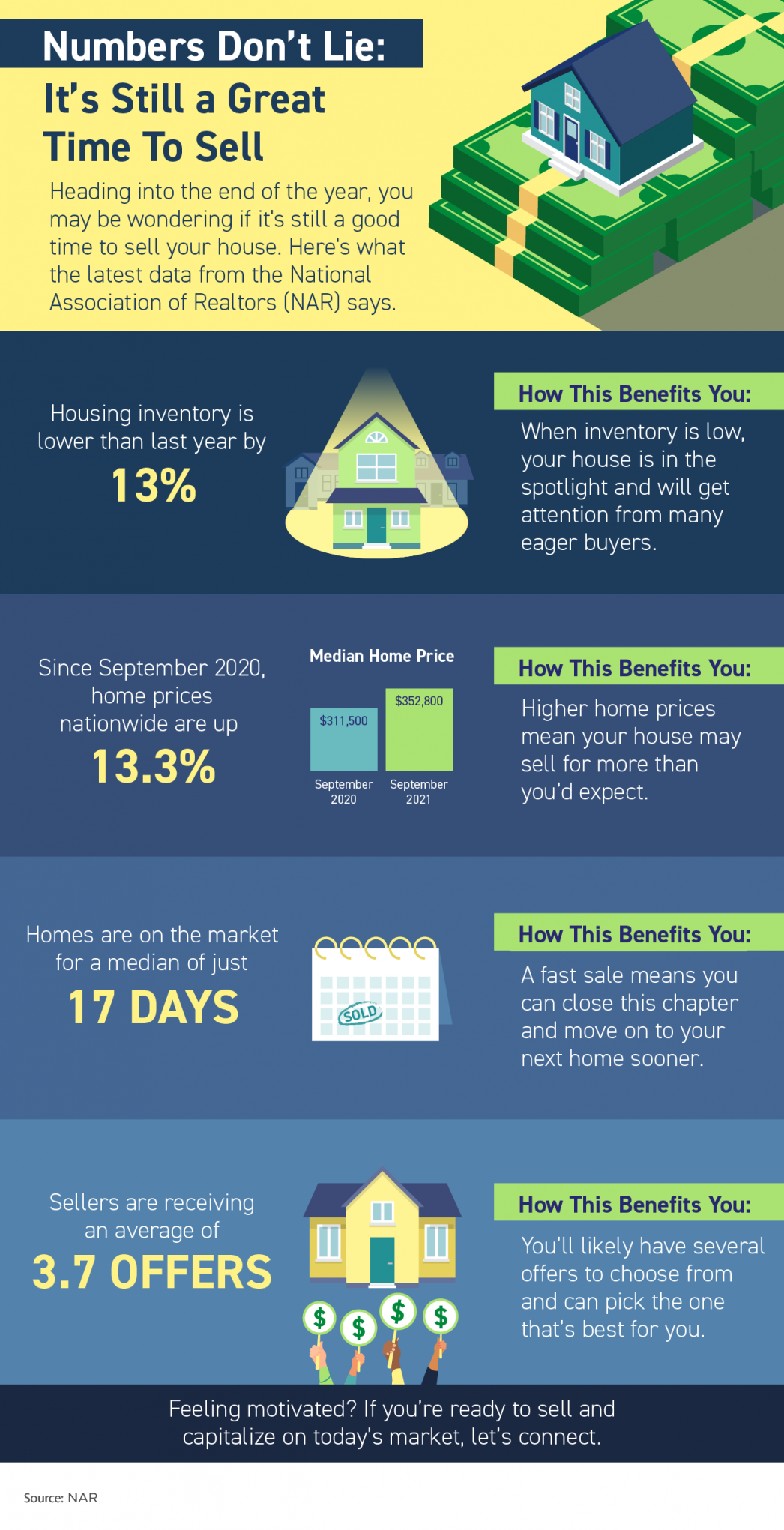

Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell Some Highlights Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says. Housing supply is...

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022 Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates...

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of...

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary Some Highlights Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare. Know your credit score and work to build strong credit. When...