Death of a Spouse and Selling Your Home

Selling your home after the passing of a Spouse can be Tricky

According to IRS Publication 523, when your spouse passes away, you are entitled to utilize their $250,000 capital gains exemption in addition to your own $250,000 one-time exemption for up to 2 years from the date of your spouse’s passing. However, if you sell more than 2 years after the death of your spouse, you are only entitled to use your own $250,000 one-time exemption on capital gains tax. If your home equity is likely to exceed $250,000 this could affect you dramatically.

Here’s a good place to start. The first number you need is how much you paid for your home when you bought it. The second number you will need is a total of all of the monies you paid for capital improvements on your property (i.e.: pools, new roofs, new furnaces, and other improvements). Hopefully, you have a file with all of these receipts you have saved over the period you have owned your home. The last number you will need is an idea of what your home is worth in today’s market and a “net sheet” indicating how much you will likely have in your pocket from a sale. These last items are ones that we are happy to help with. If you need to find out the potential market value of your home please fill the request out and we will reply.

Please check with your accountant to verify the current tax regulations.

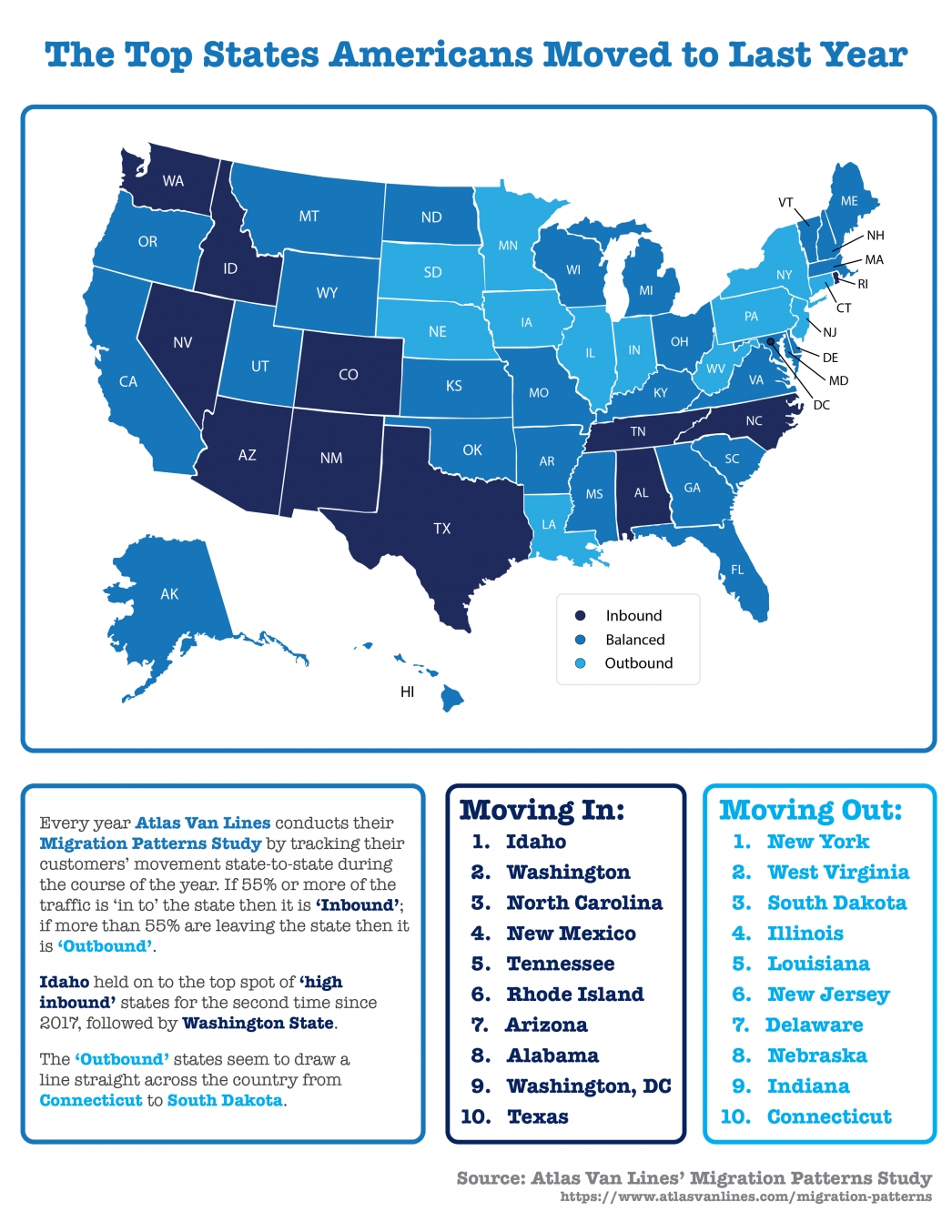

The Top States Americans Moved to Last Year

The Top States Americans Moved to Last Year Some Highlights: Americans are on the move, and the most recent Atlas Van Lines Migration Patterns Survey tracked the 2019 traffic flow from state-to-state. Idaho held on to the top spot of ‘high inbound’ states for the...

Great News for Renters Who Want to Buy a Home

Great News for Renters Who Want to Buy a Home Rents in the United States have been skyrocketing since 2012. This has caused many renters to face a tremendous burden when juggling their housing expenses and the desire to save for a down payment at the same time. The...

How Owning a Home Can Make You Happier

Think owning a home can make you happier? It sure can! Let's connect to see if homeownership can brighten your day.

Does “Aging in Place” Make the Most Sense?

Does “Aging in Place” Make the Most Sense? A desire among many seniors is to “age in place.” According to the Senior Resource Guide, the term means, “…that you will be remaining in your own home for the later years of your life; not moving into a smaller home,...

The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election

Strength of the Economy Is Surprising the Experts We’re currently in the longest economic recovery in U.S. history. That has caused some to ask experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by...

The top 10 highest Utah median prices in the fourth quarter by ZIP code

The median single-family home price in Salt Lake County in the fourth quarter increased to $378,000, up 8 percent compared to a median price of $350,000 in 2018's fourth quarter. Strong demand for homes is being driven by net in-migration and population increase. In...

First-Time Buyers Are Searching for Existing Homes This Year

First-Time Buyers Are Searching for Existing Homes This Year In the latest Housing Trends Report, the National Association of Home Builders (NAHB) measured the share of adults planning to buy a home over the next 12 months. The report indicates the percentage of all...

American Dream Grant

Homeownership matters. That is why the Salt Lake Board of Realtors® this year is giving away down payment housing grants. This is just one way for us to help our community. The next grant is for single parents. The deadline to apply for this grant is March 20.

Utah Real Estate Market Stats for December

An Exceptional Year for Salt Lake’sHousing Market | 2019 Was One of theBest Years in Overall Residential Sales

Attention Utah Home Buyers

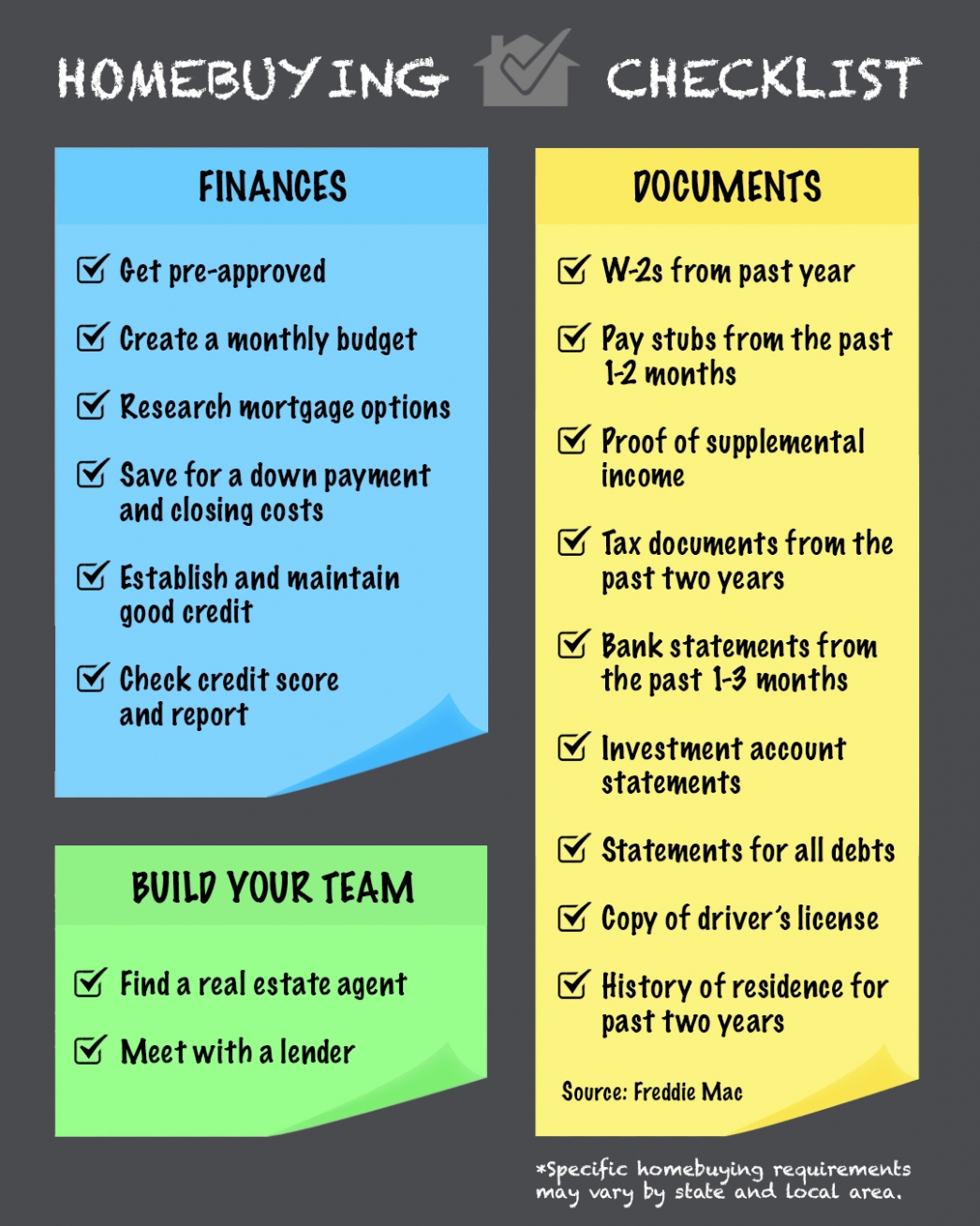

2020 Homebuying Checklist Some Highlights: If you’re thinking of buying a home, plan ahead and stay on the right track, starting with pre-approval. Being proactive about the homebuying process will help set you up for success in each step. Make sure to work with a...