The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

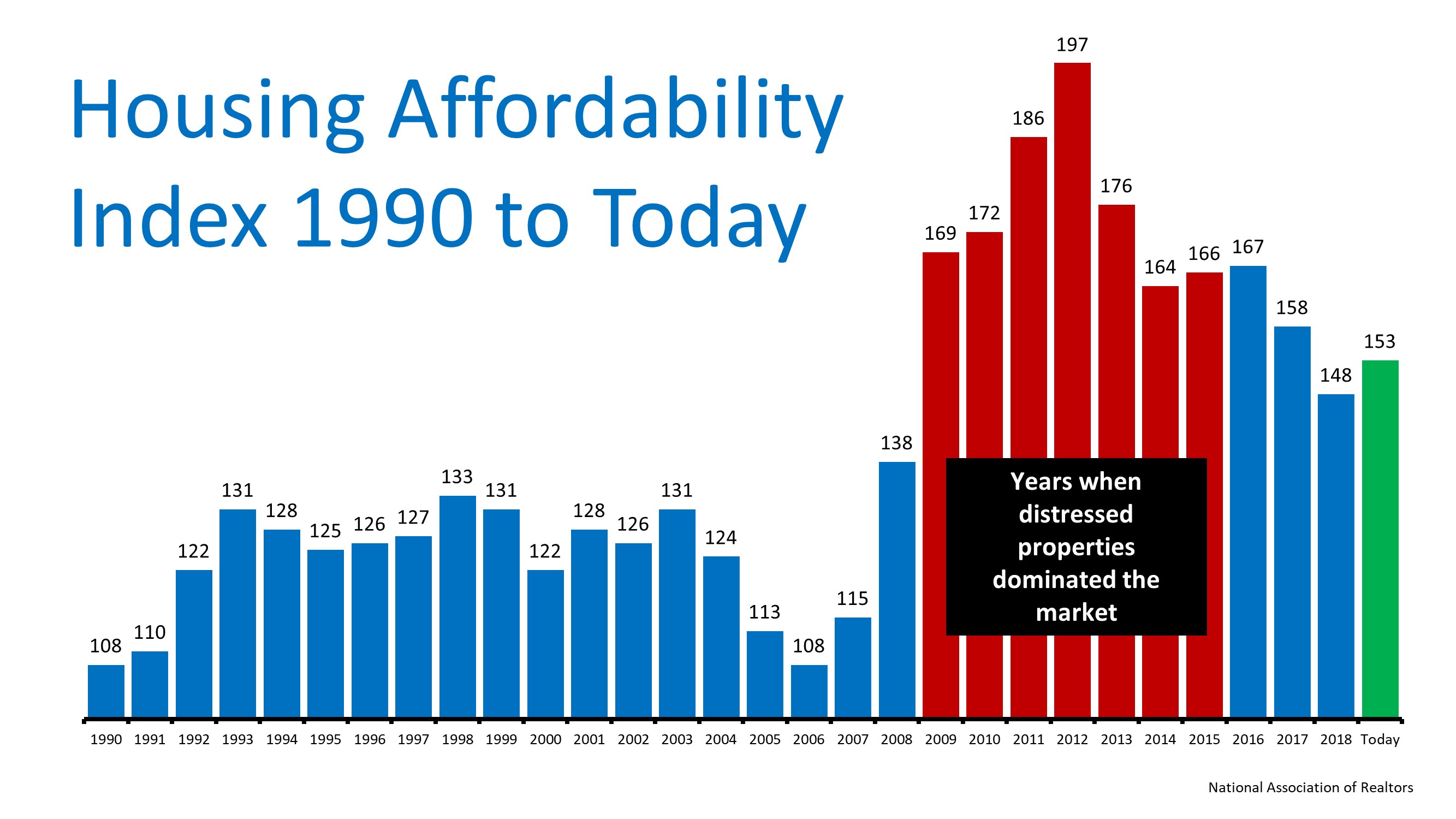

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Interest Rates Twelve Month Low

https://bit.ly/2T4yeXH

Owning a home is a great way to build family wealth

https://bit.ly/2SXqPta

3 Tips for Making Your Dream Of Buying A Home Come True

https://bit.ly/2E5yKKF

Housing Crash in Utah

3 Reasons Why We Are Not Heading Toward Another Housing Crash With home prices softening, some are concerned that we may be headed toward the next housing crash. However, it is important to remember that today’s market is quite different than the bubble market of...

first time buyer?

Ready for some Baby Steps Start looking for homes at https://Utah RealtyPlace.com/buying Let Marty be your guide to a new home! After all his is the most interesting Realtor in Utah! https://youtu.be/lqHiZgEy074

How To List Your Home for the Best Price

How To List Your Home for the Best Price If your plan for 2019 includes selling your home, you will want to pay attention to where experts believe home values are headed. According to the latest Home Price Index from CoreLogic, home prices increased by 4.7% over the...

4 Questions to Ask Before Selling Your House

Why It Makes No Sense to Wait for Spring to Sell

Why It Makes No Sense to Wait for Spring to Sell The price of any item (including residential real estate) is determined by the theory of ‘supply and demand.’ If many people are looking to buy an item and the supply of that item is limited, the price of that item...

The Difference Having a Professional on Your Side Makes

The Difference Having a Professional on Your Side Makes In today’s fast-paced world, where answers are a Google search away, there are some who may wonder what the benefits of hiring a real estate professional to help them in their home search are. The truth is, with...

Utah Housing Loan Changes

Did you know? Utah Housing has made some changes to our Loan Programs; these changes will become effective with Mortgage Purchase Agreements (interest rate locks) issued on or after February 11, 2019. https://utahhousingcorp.org/ HomeAgain: May include an...