The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

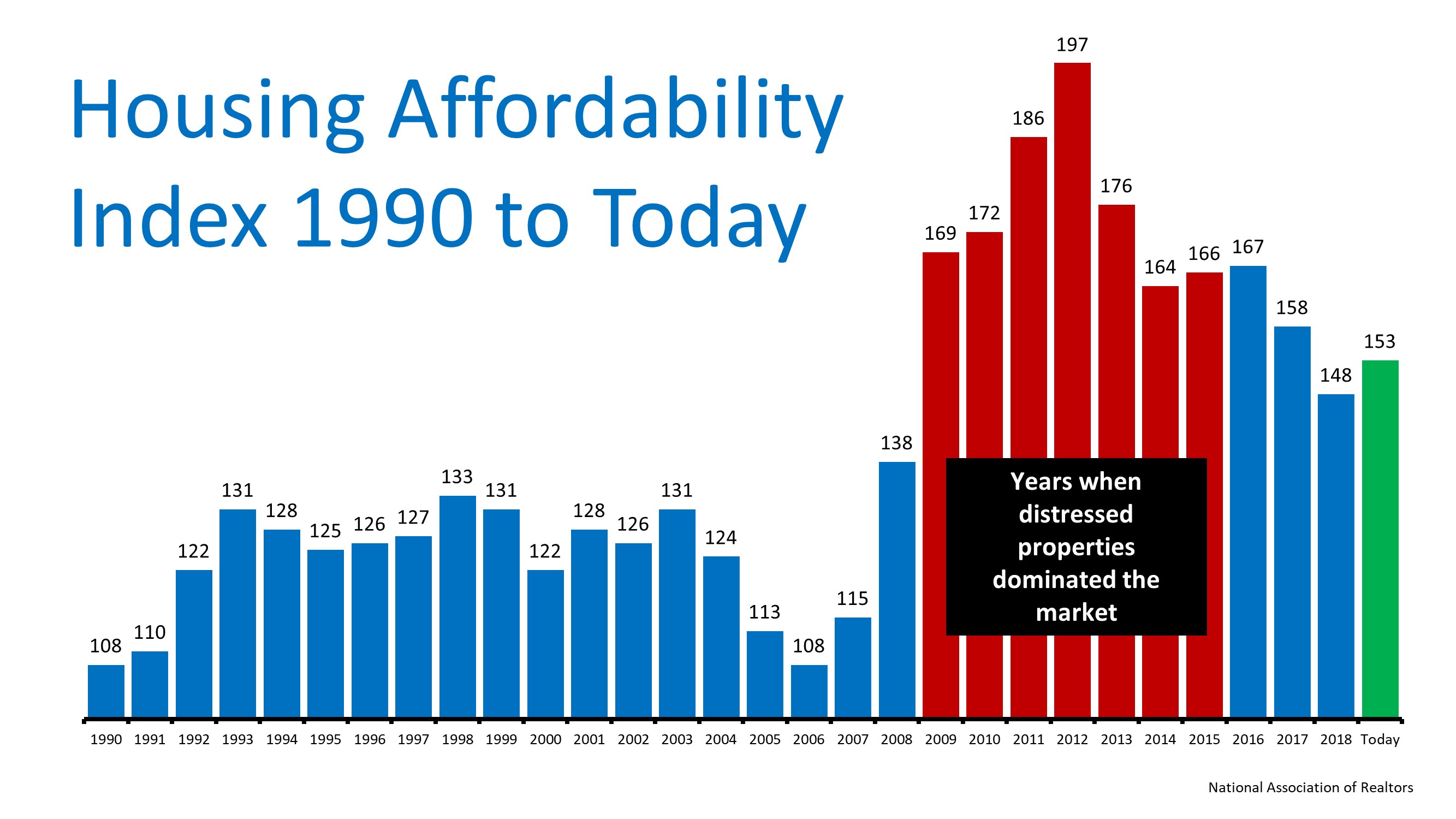

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

The Feeling You Get from Owning Your Home – Utah Realty

The Feeling You Get from Owning Your Home We often talk about the financial reasons why buying a home makes sense. But, more often than not, the emotional reasons are the more powerful and compelling ones. No matter what shape or size your living space is, the concept...

Top 5 reasons to own a home

June is National Homeownership Month

Some Highlights: June is National Homeownership Month! Now is a great time to reflect on the many benefits of homeownership that go way beyond the financial. What reasons do you have to own your own home?

Utah Realty – Utah is Number Three with New Homes Built

Utah Realty – 2 Things You Need to Know to Properly Price Your Home

2 Things You Need to Know to Properly Price Your Home In today’s housing market, home prices are increasing at a slower pace (3.7%) than they have over the last eight years (6-7%). However, they are still are above historical norms. Low supply of listed homes and high...

Remember Our Fallen Heroes

All Gave Some. Some Gave All. The Memorial Day of May 27th 2019 We remember, today and always.

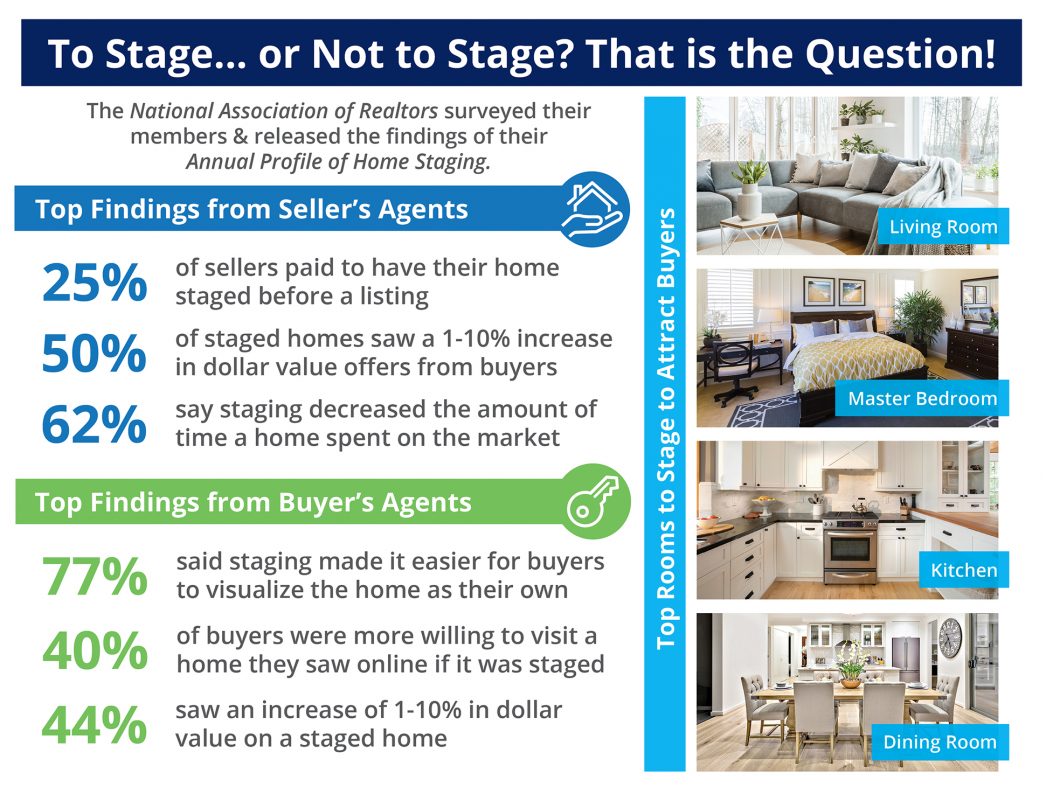

Utah Realty Blog of the day – Impact of home staging

The Impact Staging Your Home Has On Your Sale Price. Utah Realty educational blog of the day Some Highlights: The National Association of Realtors surveyed their members & released the findings of their Profile of Home Staging. 62% of seller’s agents say that...

Should You Buy a Home Now or Wait Until Next Year?

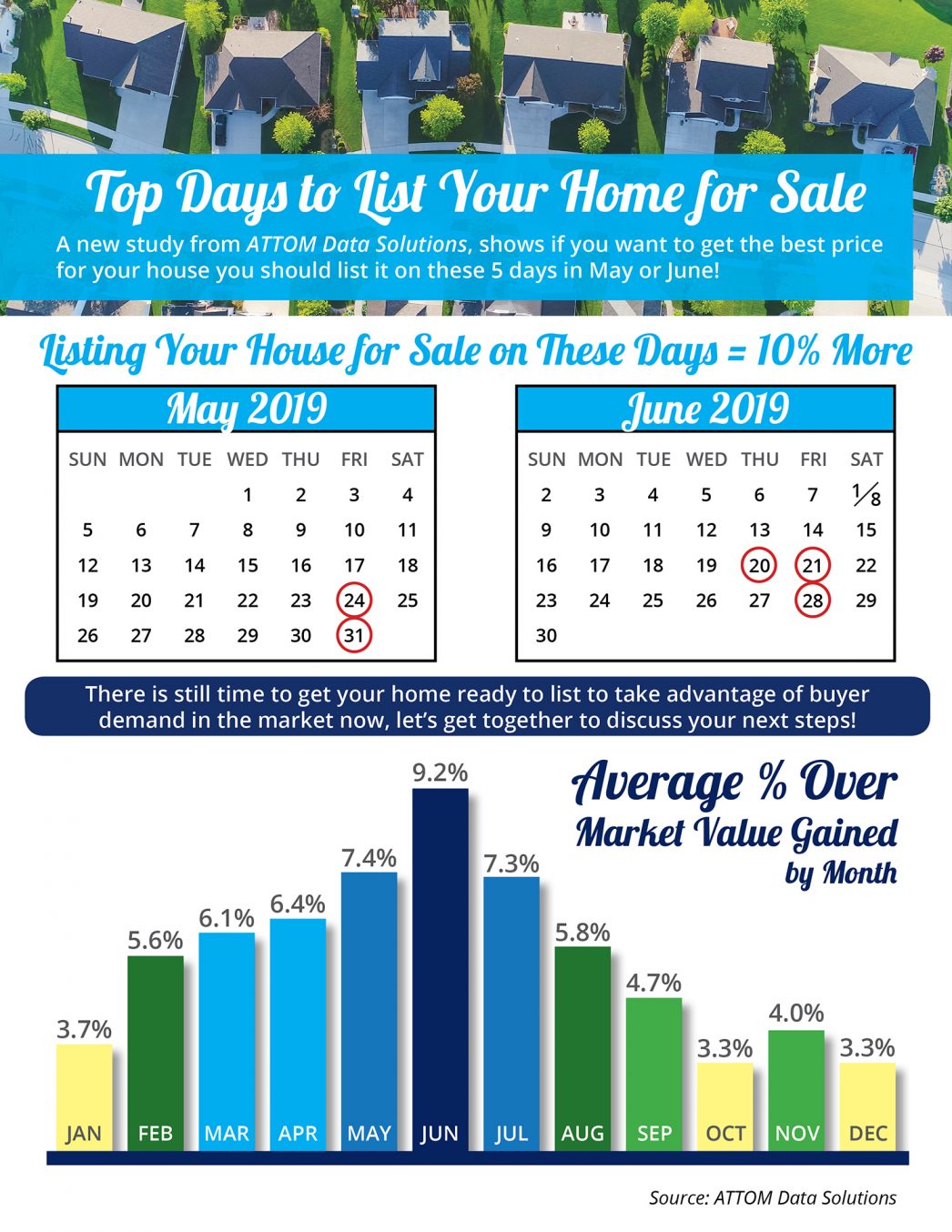

Top Days to List Your Home for Sale in Utah by Utah Realty

Top Days to List Your Home for Sale Some Highlights: ATTOM Data Solutions conducted an analysis of more than 29 million single family home and condo sales over the past eight years to determine the top days to list your home for sale. The top five days to list your...

Are Older Generations in Utah Really Not Selling Their Homes

Are Older Generations Really Not Selling Their Homes? Many studies suggest one of the main reasons for the inventory shortage in today’s market of homes for sale is that older generations have chosen to “age in place” over moving. The 2019 Home Buyers & Sellers...