The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

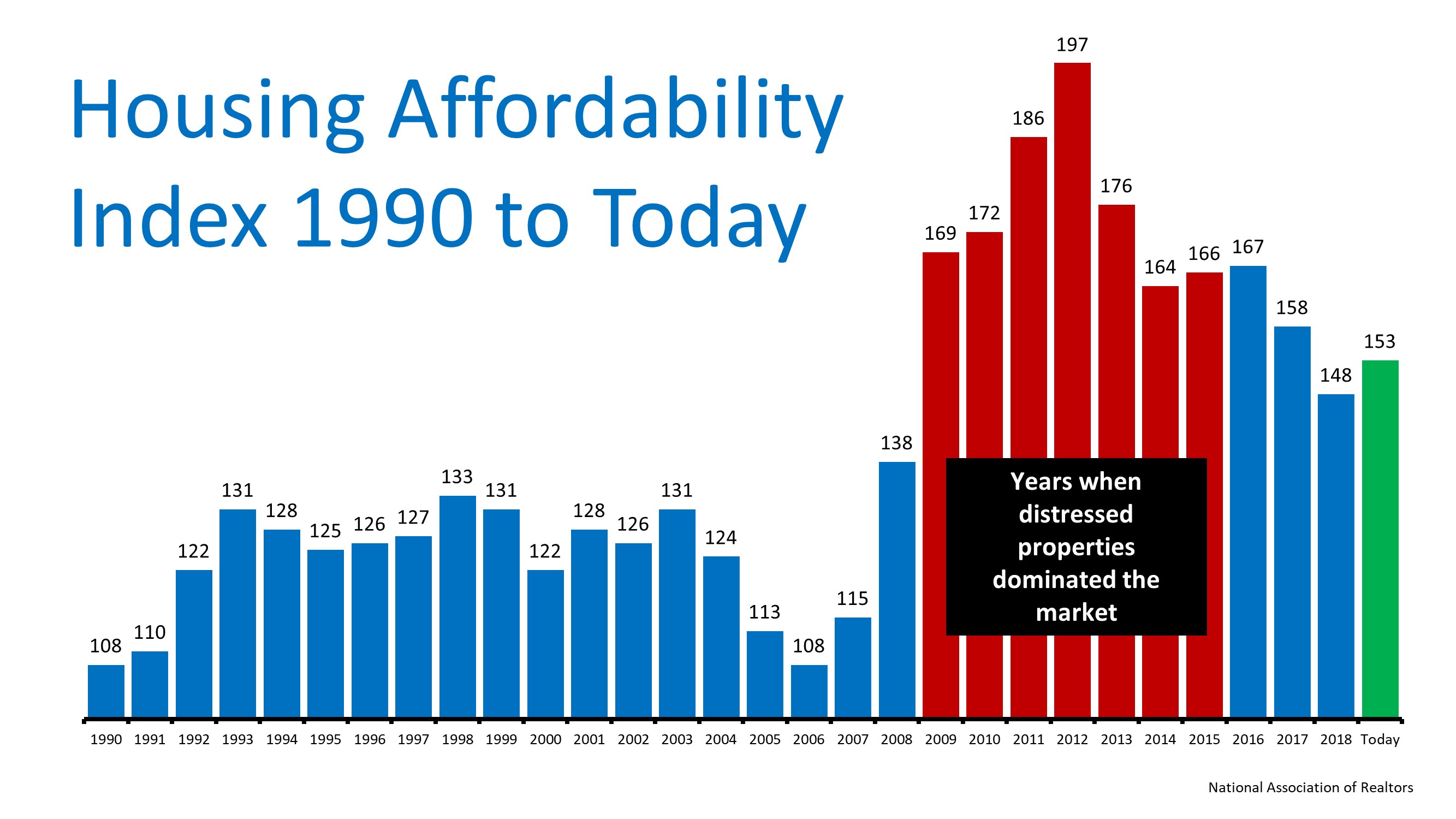

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Protected Class

Things you should not have your clients put in a letter to a buyer or seller. Protected Class A group of people with a common characteristic who are legally protected from employment discrimination on the basis of that characteristic. Protected classes are created by...

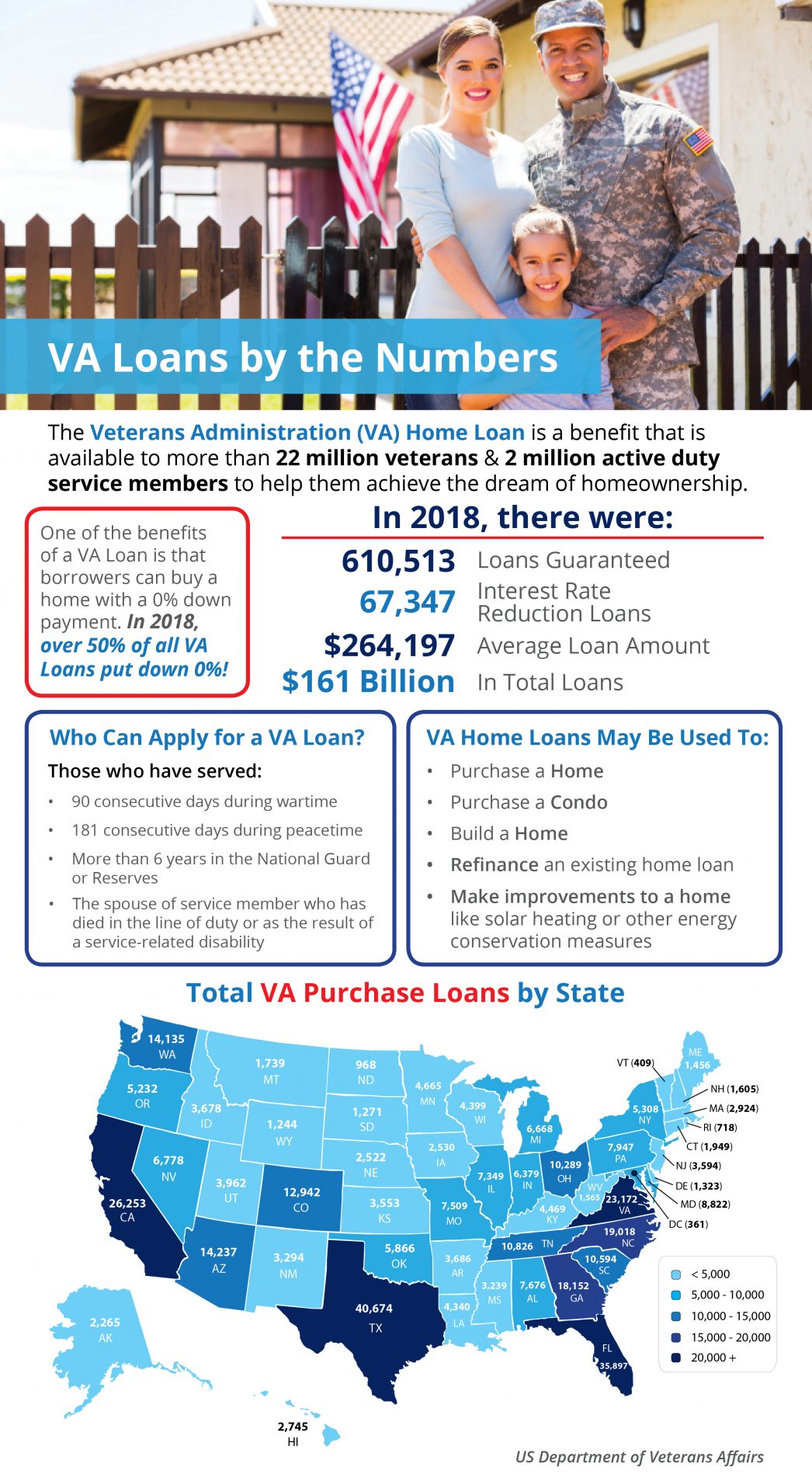

Utah Realty Presents VA Home Loans by the Numbers

Utah Realty Presents VA Home Loans by the Numbers Some Highlights: The Veterans Administration (VA) Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members to help them achieve the dream of homeownership. In...

The #1 Reason to List Your House in the Winter

The #1 Reason to List Your House in the Winter Many sellers believe spring is the best time to put their homes on the market because buyer demand traditionally increases at that time of year. What they don’t realize is if every homeowner believes the same thing, then...

Don’t Get Spooked by the Real Estate Market!

Have a Hauntingly Good Halloween! Having an agent to help guide you is key in today's complex housing...

Taking the Fear Out of the Mortgage Process

Taking the Fear Out of the Mortgage Process A considerable number of potential buyers shy away from the real estate market because they’re uncertain about the buying process – particularly when it comes to qualifying for a mortgage. For many, the mortgage process can...

Buying a home can be SCARY…Until you know the FACTS

Buying a home can be SCARY…Until you know the FACTS Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts...

What credit Score Do You Need to Qualify for a Mortgage

What FICO® Score Do You Need to Qualify for a Mortgage? While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a...

Should You Use Your Equity to Move Up

Utah Realty News

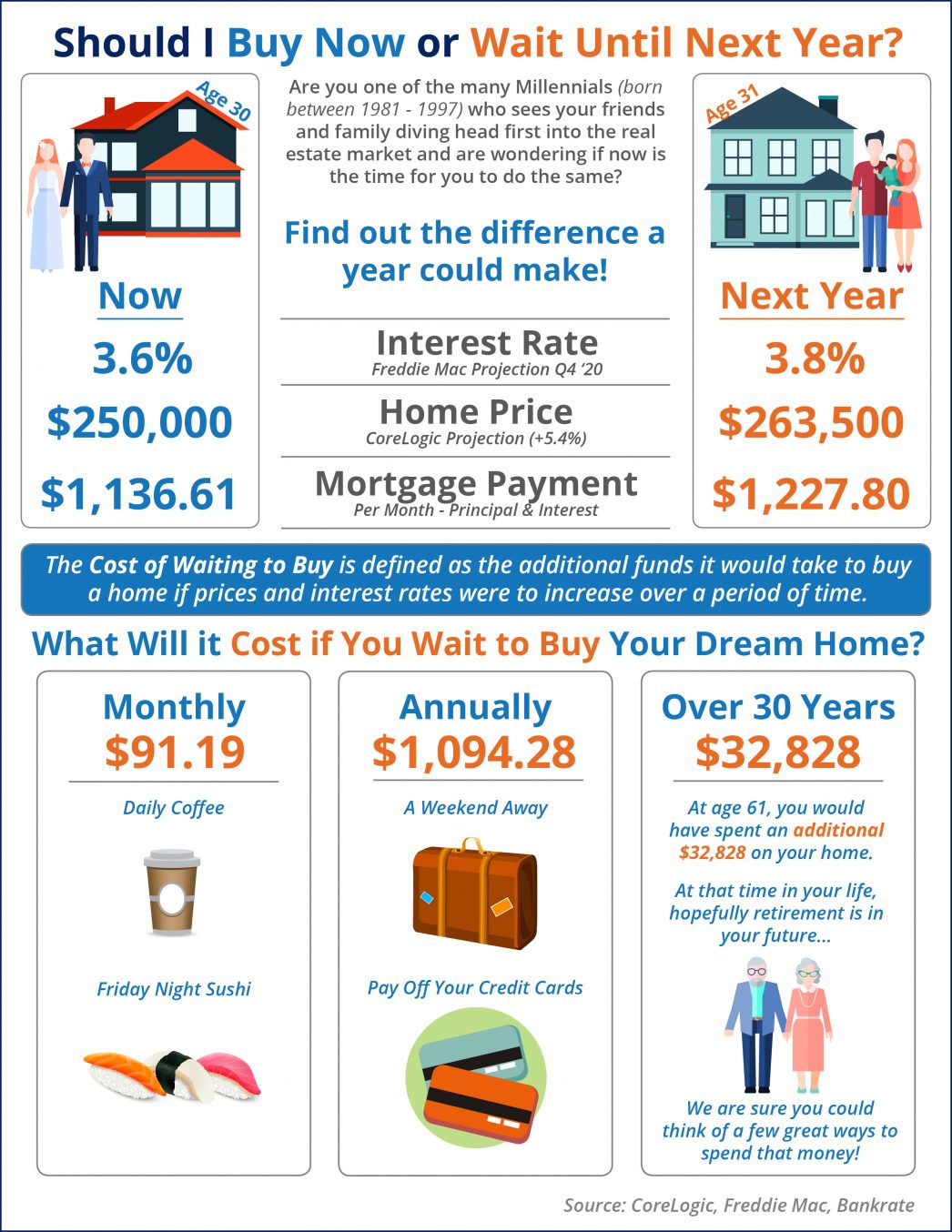

What Is the Cost of Waiting Until Next Year to Buy?

What Is the Cost of Waiting Until Next Year to Buy? Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will...