The Ultimate Truth about Housing Affordability

Courtesy of Marty Gale Utah Realty

There have been many headlines decrying an “affordability crisis” in the residential real estate market. While it is true that buying a home is less affordable than it had been over the last ten years, we need to understand why and what that means.

On a monthly basis, the National Association of Realtors (NAR), produces a Housing Affordability Index. According to NAR, the index…

“…measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.”

Their methodology states:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment.”

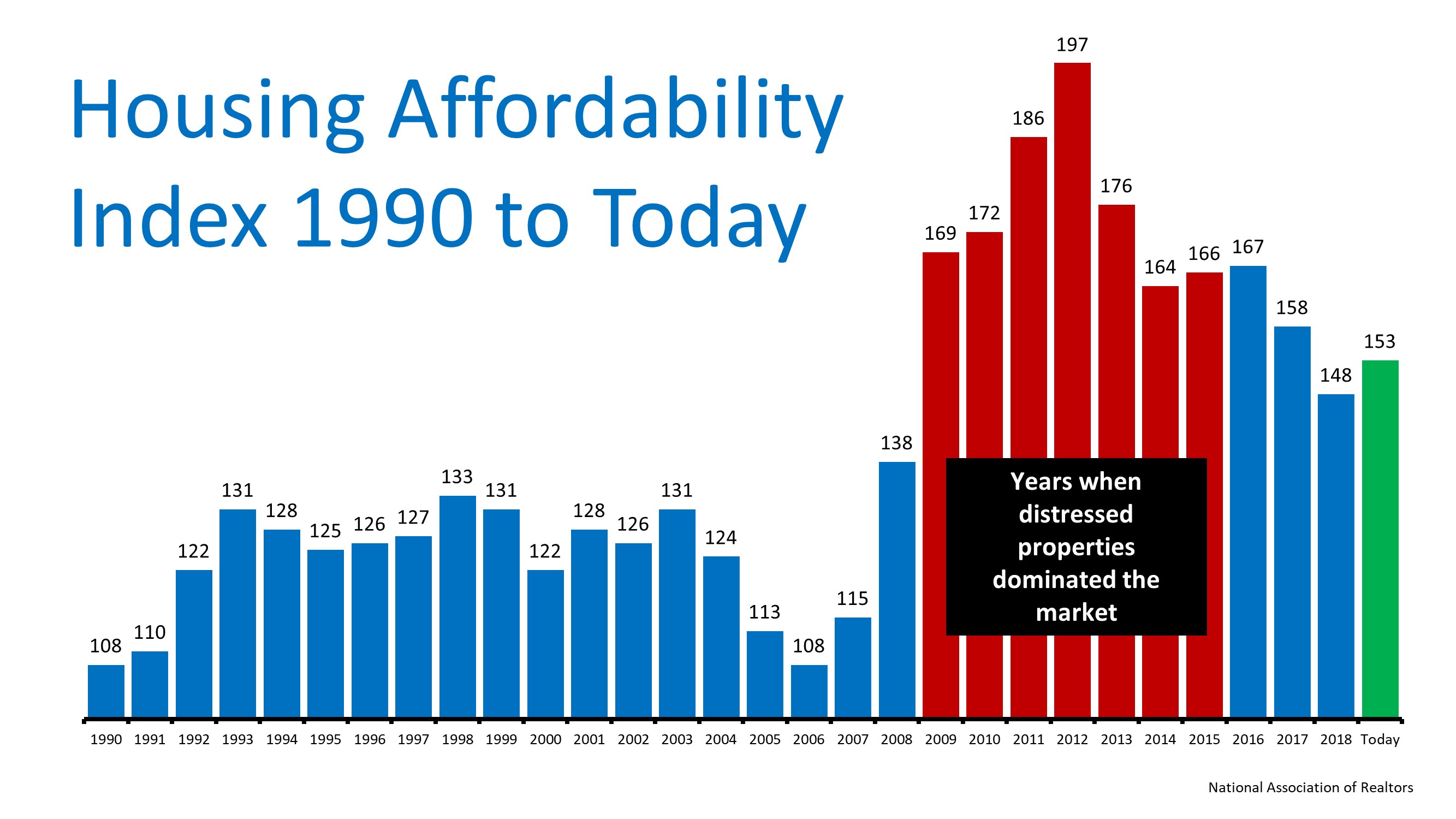

So, the higher the index, the more affordable it is to purchase a home. Here is a graph of the index going back to 1990:

It is true that the index is lower today than any year from 2009 to 2017. However, we must realize the main reason homes were more affordable. That period of time immediately followed a housing crash and there were large numbers of distressed properties (foreclosures and short sales). Those properties were sold at large discounts.

Today, the index is higher than any year from 1990 to 2008. Based on historic home affordability data, that means homes are more affordable right now than any other time besides the time following the housing crisis.

With mortgage rates remaining low and wages finally increasing, we can see that it is MORE AFFORDABLE to purchase a home today than it was last year!

Bottom Line

With wages increasing, price appreciation moderating, and mortgage rates remaining near all-time lows, purchasing a home is a great move based on historic affordability numbers.

Expert Forecast on the 2021 Housing Market

Here’s to a Wonderful 2021!

Here’s to a Wonderful 2021!

Thank You for All Your Support

Thank You for All Your Support We Cherish Your Relationships With Us!You helped us make a great 2020!

The Difference a Year Makes for Homeownership

The Difference a Year Makes for HomeownershipOver the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant...

Holidays Aren’t Stopping Homebuyers

The Holidays Aren’t Stopping Homebuyers This Year Black Friday and Cyber Monday are behind us, yet finding the perfect holiday gifts for friends and family is certainly still top of mind for many right now. This year, there’s another type of buyer that’s very active...

Utah Forbearance Problems

Are Home Prices Headed Toward Bubble Territory

Are Home Prices Headed Toward Bubble Territory?Talk of a housing bubble is beginning to crop up as home prices have appreciated at a rapid pace this year. This is understandable since the appreciation of residential real estate is...

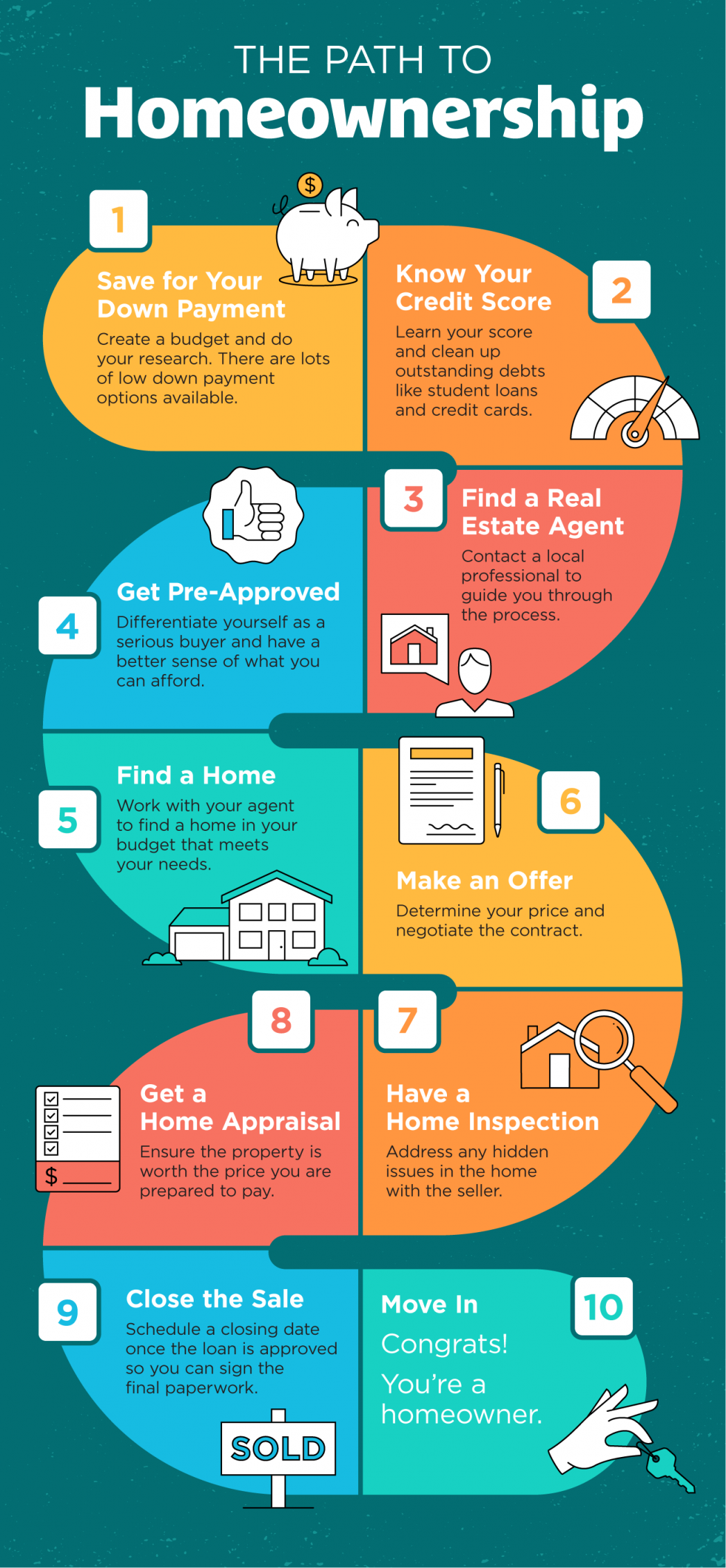

Homeownership can be yours

The Path to Homeownership Some Highlights If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the homebuying process. Let’s connect today to discuss the specific steps along the way in our...

Shop for Homes in a Virtual World

A New Way to Shop for Homes in a Virtual WorldIn a year when we’re learning to do so much remotely, homebuying is no exception. From going to work to attending school, grocery shopping, and even seeing our doctors online, digital practices have changed the way we...

Thank You

Thank You for Your Support!