Home Value Appreciation Stops Falling, Begins to Stabilize

The percentage of home price appreciation on a year-over-year basis has decreased each month for over a year. The question was how far annual appreciation would fall. It seems we may now have the answer.

In a recent post on the National Association of Realtors’ Economists’ Outlook Blog, it was revealed that Realtors are starting to sense that home values are beginning to stabilize and that we may see appreciation beginning to accelerate again:

“About 3,000 REALTORS® who responded to NAR’s February 2019 REALTORS Confidence Index Survey had more optimistic— although modest— home price growth expectations over the next 12 months. Respondents expect home prices to typically increase by 1.9 percent nationally, up from 1.4 percent in the January survey.”

The thinking that home appreciation has bottomed-out was also confirmed in two additional housing reports recently released:

CoreLogic Home Price Index – The analysts at CoreLogic increased their projection for home appreciation for the next twelve months to 4.7% as compared to the 4.6% they projected in their previous report.

The Home Price Expectation Survey – In the 2019 first quarter survey, the nationwide panel of over one hundred economists, real estate experts, and investment & market strategists increased their projection for home value growth in 2019 to 4.3% compared to the 3.8% increase they had projected in the fourth quarter of 2018.

Bottom Line

Agents working the business every day, one of the premier data companies in the real estate space, and one hundred housing experts all agree: home price appreciation has ended its decline and looks to be stabilizing… and may even accelerate.

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates With the average 30-year fixed mortgage rate from Freddie Mac climbing above 3%, rising rates are one of the topics dominating the discussion in the housing market today. And since...

Salt Lake homebuyers, on average, paid $120,000 more than they did the same quarter last year

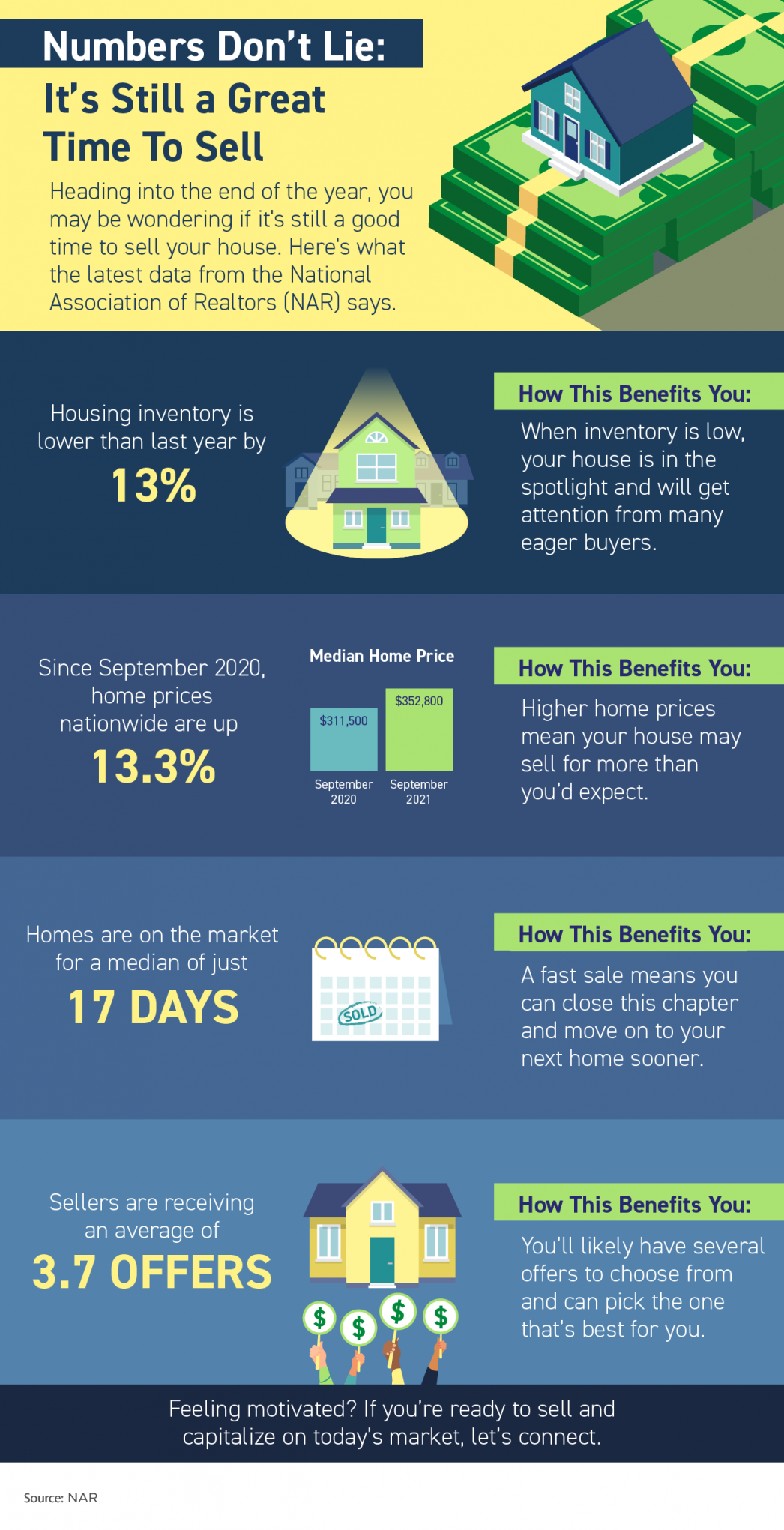

Numbers Don’t Lie – It’s Still a Great Time To Sell

Numbers Don’t Lie – It’s Still a Great Time To Sell Some Highlights Heading into the end of the year, you might wonder if it’s still a good time to sell your house. Here’s what the latest data from the National Association of Realtors (NAR) says. Housing supply is...

Experts Project Mortgage Rates Will Continue To Rise in 2022

Experts Project Mortgage Rates Will Continue To Rise in 2022 Mortgage rates are one of several factors that impact how much you can afford if you’re buying a home. When rates are low, they help you get more house for your money. Within the last year, mortgage rates...

Sellers Have Incredible Leverage in Today’s Market

Sellers Have Incredible Leverage in Today’s Market With mortgage rates climbing above 3% for the first time in months, serious buyers are more motivated than ever to find a home before the end of the year. Lawrence Yun, Chief Economist for the National Association of...

The Mortgage Process Doesn’t Have To Be Scary

The Mortgage Process Doesn’t Have To Be Scary Some Highlights Applying for a mortgage is a big step towards homeownership, but it doesn’t need to be one you fear. Here are some tips to help you prepare. Know your credit score and work to build strong credit. When...

Housing Challenge or Housing Opportunity? It Depends.

Housing Challenge or Housing Opportunity? It Depends. The biggest challenge in real estate today is the lack of available homes for sale. The low housing supply has caused homes throughout the country to appreciate at a much faster rate than what we’ve experienced...

There Are More Homes Available Now than There Were This Spring

There Are More Homes Available Now than There Were This Spring There’s a lot of talk lately about how challenging it can be to find a home to buy. While housing inventory is still low, there are a few important things to understand about the supply of homes for sale...

Knowledge Is Power When It Comes to Appraisals and Inspections

Knowledge Is Power When It Comes to Appraisals and Inspections Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and...

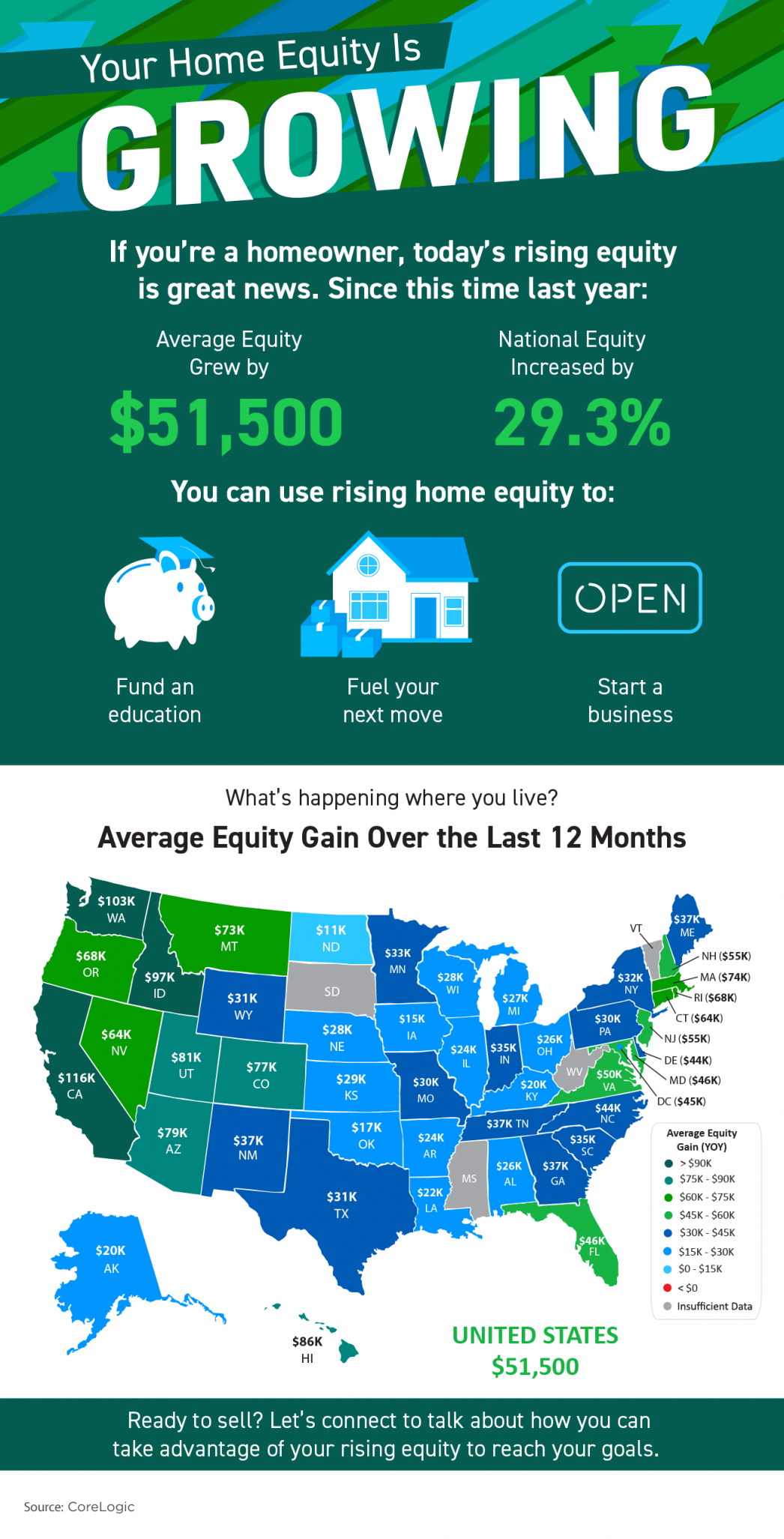

Your Home Equity Is Growing

Your Home Equity Is Growing Some Highlights If you’re a homeowner, today’s rising equity is great news. On average, homeowners have gained $51,500 in equity since this time last year. Whether it’s funding an education, fueling your next move, or starting a business,...