Capital gains and your home sale

When you sell your primary residence, you can make up to $250,000 in profit if you’re a single owner, twice that if you’re married, and not owe any capital gains taxes.

When the Taxpayer Relief Act of 1997 became law, the rollover or once-in-a-lifetime options were replaced with the current per-sale exclusion amounts.

You don’t have to buy another home with your sale proceeds. You can use the money as you wish.

Better yet, there’s no limit on the number of times you can use the home-sale exemption. In most cases, you can make tax-free profits of $250,000, or $500,000 depending on your filing status, every time you sell a home.

Qualifying Requirements:

- First, the property you’re selling must be your principal residence. That means you live in it. This tax break doesn’t apply to a house or other property that you have solely for investment purposes. In those cases, the usual capital gains rules apply.

- You also must live in that principal residence for 2 of the 5 years before you sell. This is known as the use test. It also means, practically speaking, each sale must be at least 2 years apart.

- That still leaves you room to make some money on several properties. You can sell your residence this year, pocket any gain within the tax limits and buy a new residence. Then 2 years later, you can do the same thing, again and again, every 2 years.

It’s just about that easy.

Shameless disclaimer: I am not a tax attorney, accountant or CPA. Always seek the property authorities for the proper

advice. Until then this will have to do.

Marty Gale

The Perks of Downsizing When You Retire

The Perks of Downsizing When You Retire Some Highlights If you’re about to retire, or just did, downsizing can be a good way to try to cut down on some of your expenses. Smaller homes typically have lower energy and maintenance costs. Plus, you may have...

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home You may have heard headlines in the news lately about agents in the real estate industry and discussions about their commissions. And if you’re following along, it can be pretty confusing....

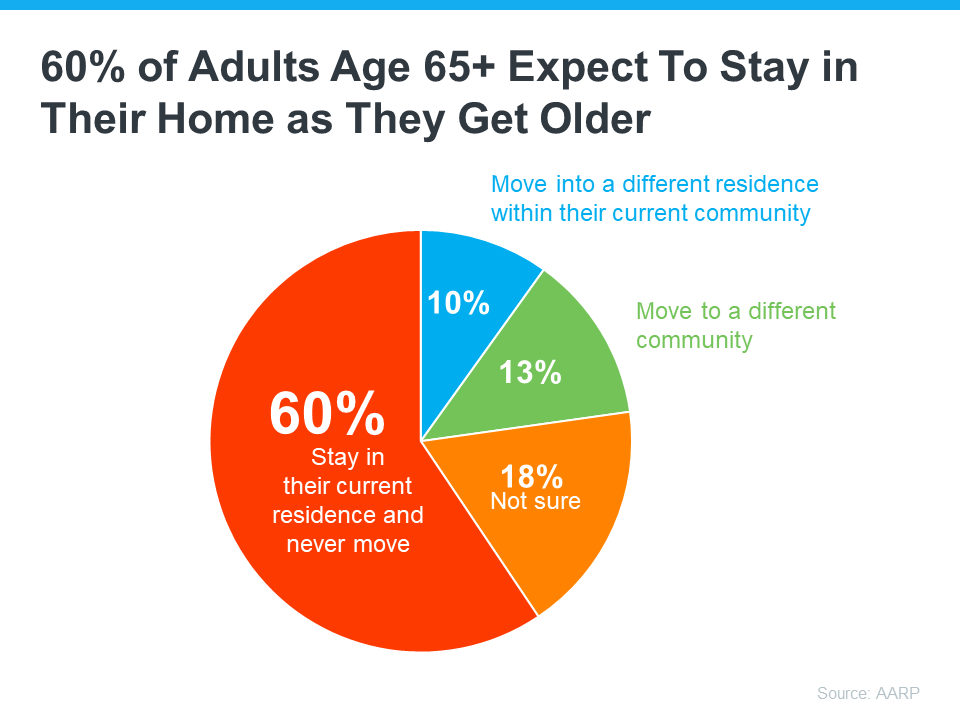

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami Have you heard the term “Silver Tsunami” getting tossed around recently? If so, here’s what you really need to know. That phrase refers to the idea that a lot of baby boomers are going to move or downsize...