Buyer Demand Surging in Utah as Spring Market Begins

Last fall, some predicted that the 2019 residential real estate market would be a disaster. There was even belief we might experience a housing crash like the one that occurred during the last decade.

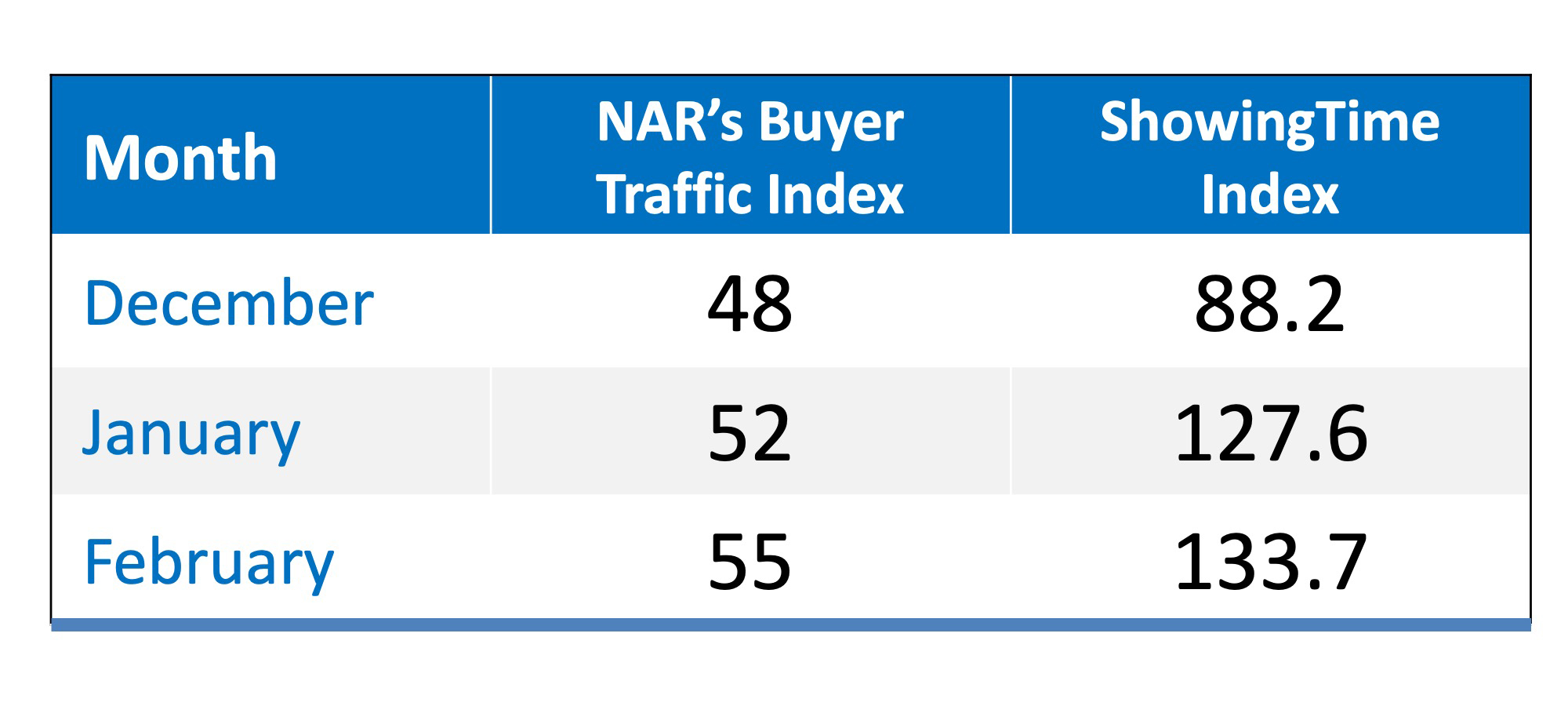

However, according to two separate reports*, buyer demand dramatically increased over the last three months, leading into this spring buyers’ market (the March data is not yet available).

Both the ShowingTime Showing Index and the National Association of REALTORS Buyer Traffic Index show that buyer demand has increased in each of the last three months.

Why the increase in demand? Increased buying power.

According to the National Association of Realtors’ Economists’ Outlook Blog, purchasing a home has become more affordable, which has led to increased demand.

“Due to the combination of falling home prices and mortgage rates, the income needed to make an affordable mortgage payment (mortgage no more than 25% of income) on a median-priced home with 10% down payment and 30-year fixed rate mortgage decreased from $60,425 in June 2018 to $53,783 as of February 2019, and the difference of $6,642 represents a gain in buying power because one can afford a home purchase at a lower level of income.”

Bottom Line

It appears the spring buyers’ market is going to be much stronger than many had projected. Whether you are selling or buying, this is important news.

*The methodology behind the indices:

The ShowingTime Showing Index

“The ShowingTime Showing Index® tracks the average number of buyer showings on active residential properties on a monthly basis, a highly reliable leading indicator of current and future demand trends.”

The National Association of REALTORS® Buyer Traffic Index

“In a monthly survey of REALTORS®, NAR asks respondents ‘Compared to the same month last year, how would you rate the past month’s traffic in neighborhood(s) or area(s) where you make most of your sales?’ NAR compiles the responses into an index, where an index above 50 indicates that more respondents reported “stronger” traffic than “weaker” traffic.”

Mortgage rates fell to their lowest level March 2020

Mortgage rates fell to their lowest level on record Thursday, pulled down by fears that the spread of coronavirus could weigh on the U.S. economy. The average rate on a 30-year fixed-rate mortgage fell to 3.29 percent from 3.45 percent last week and down from 4.41...

Thinking of Getting Your House Ready to Sell?

Impact of the Coronavirus on the U.S. Housing Market

Impact of the Coronavirus on the U.S. Housing MarketThe Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s...

How Interest Rates Can Impact Your Monthly Housing Payments

How Interest Rates Can Impact Your Monthly Housing Payments Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage...

How Your Tax Refund Can Move You Toward Homeownership This Year

How Your Tax Refund Can Move You Toward Homeownership This Year If you’re looking to buy a home in 2020, have you thought about putting your tax refund toward a down payment? Homeownership may be one step closer than you think if you spend your dollars wisely this...

10 Steps to Buying a Home

10 Steps to Buying a Home Some Highlights: If you’re thinking of buying a home and you’re not sure where to start, you’re not alone. Here’s a guide with 10 simple steps to follow in the homebuying process. Be sure to work with a trusted real estate professional to...

How Much “Housing Wealth” Can You Build in a Decade?

How Much “Housing Wealth” Can You Build in a Decade? Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30...

Thinking of Selling? Now May Be the Time

Thinking of Selling? Now May Be the Time. The housing market has started off much stronger this year than it did last year. Lower mortgage interest rates have been a driving factor in that change. The average 30-year rate in 2019, according to Freddie Mac, was 3.94%....

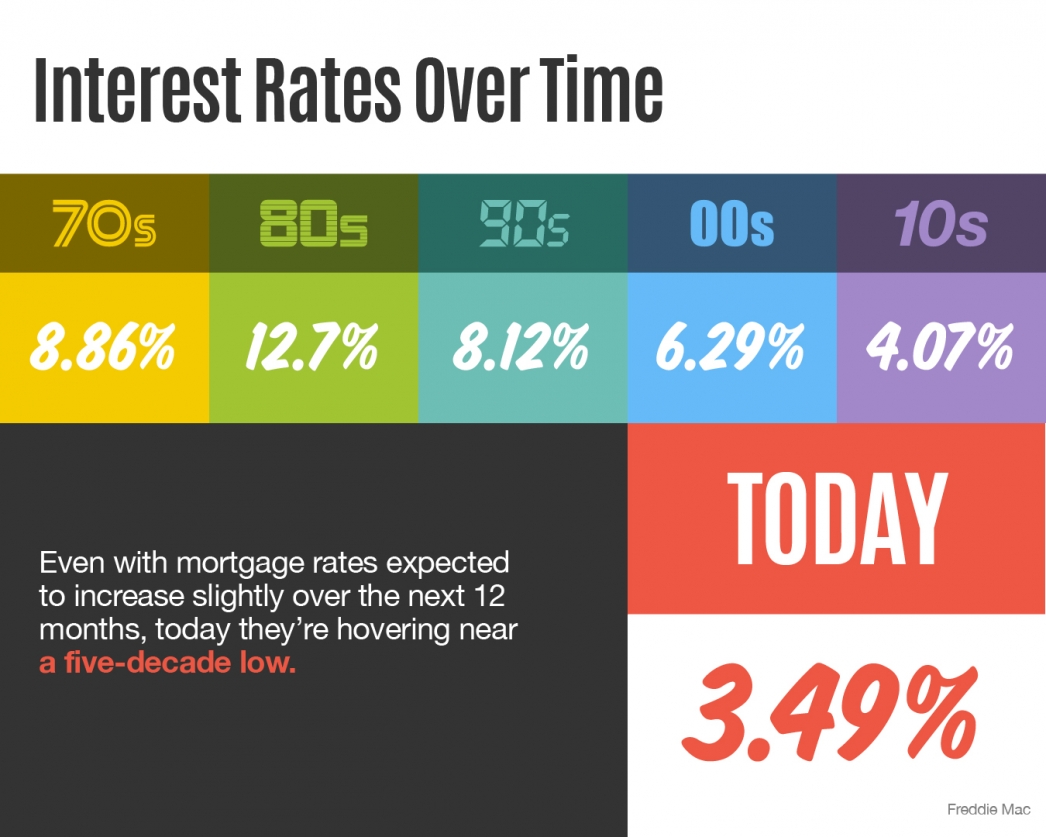

Income Rates Over Time

Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low. The...

Entry-Level Homeowners Are in the Driver’s Seat

Entry-Level Homeowners Are in the Driver’s Seat One thing helping homeowners right now is price appreciation, especially in the entry-level market. In the latest Home Price Insights report, CoreLogic reveals how home prices increased by 4% year-over-year and projects...