2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

Utah Mortgage Rates at a 3 Year Low

Utah Mortgage Rates at a 3 Year Low

American Confidence in Housing at an All-Time High

Fannie Mae just released the July edition of their Home Purchase Sentiment Index (HPSI). The HPSI takes information regarding consumers’ confidence in the real estate market from Fannie Mae’s National Housing Survey and condenses it into a single number. Therefore,...

How to Increase Your Equity Over The Next 5 Years

How to Increase Your Equity Over the Next 5 Years Many of the questions currently surrounding the real estate industry focus on home prices and where they are heading. The most recent Home Price Expectation Survey (HPES) helps target these projected answers. Here are...

If you are Thinking about Selling and Live in Utah? You should read this first!

If you are Thinking about Selling and Live in Utah? You should read this first! Why Now Is the Perfect Time to Sell Your House As a homeowner, it’s always tempting to dream about the next big project you’re going to tackle. The possibilities are endless. Should I...

Utah Realty Expert Insights On Inventory In The Current Market

3 Expert Insights On Inventory In The Current Market The current housing landscape presents greater home values, low interest rates, and high buyer demand. All of these factors point to the strong market forecasted to continue throughout the rest of the year. There...

What Experts are Saying About the Current Housing Market

What Experts are Saying About the Current Housing Market We’re halfway through the year, and with a decline in interest rates as well as home price and wage appreciation, many are wondering what the experts predict for the second half of 2019. Here’s what some have to...

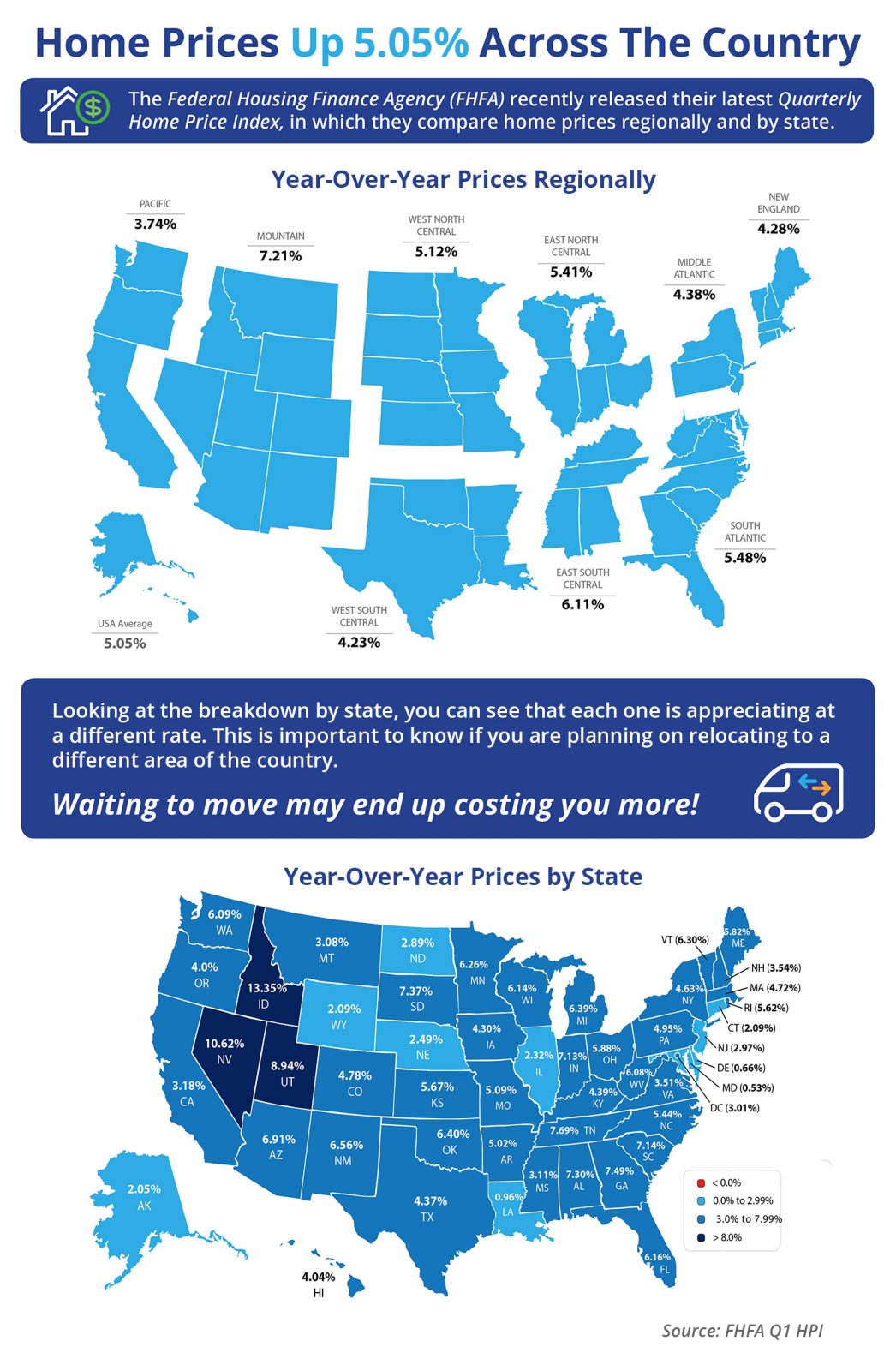

Home Prices Up 5.05% Across the Country Utah is just under nine percent

Home Prices Up 5.05% Across the Country [INFOGRAPHIC] Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest...

Salt Lake City Median House Prices

Wasatch Front median home prices bottomed in 2011, years after The Great Recession ended. Since then, home prices (all housing types) have been on the rise. The median price of Wasatch Front homes sold in the first quarter of this year was $308,000, 75 percent higher...

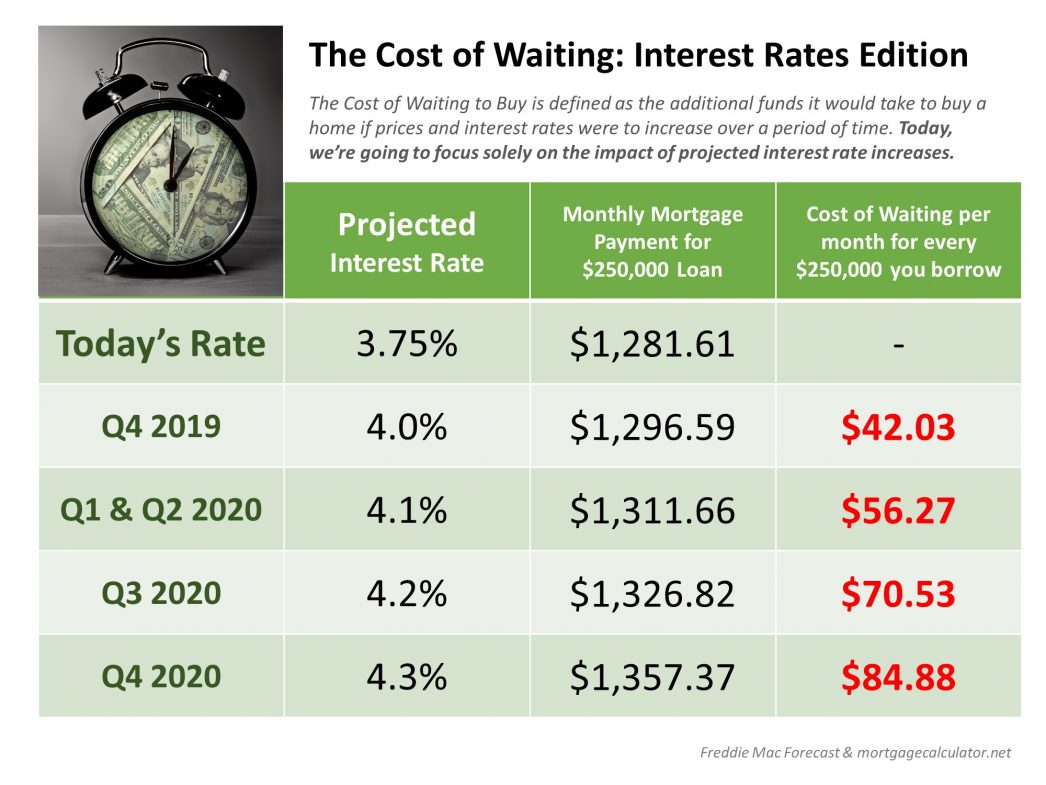

The Cost of Waiting: Interest Rates Edition

Some Highlights: Interest rates are projected to increase steadily heading into 2020. The higher your interest rate, the more money you will end up paying for your home and the higher your monthly payment will be. Rates are still low right now – don’t wait until they...

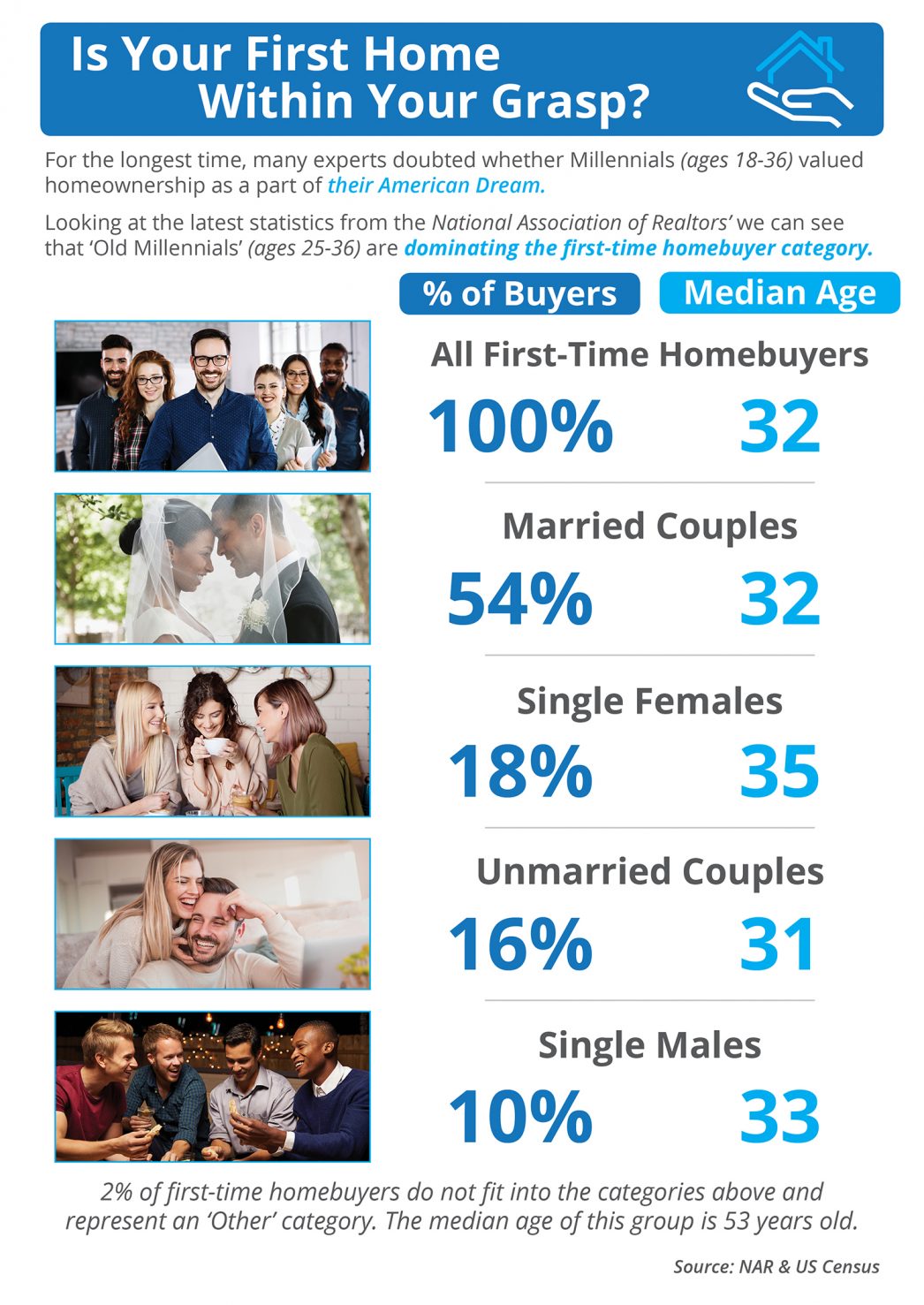

Is Your First Home Now Within Your Grasp?

Is Your First Home Now Within Your Grasp? Some Highlights: According to the US Census Bureau, “millennials” are defined as 18-36-year-olds. According to NAR’s latest Profile of Home Buyers & Sellers, the median age of all first-time home buyers is 32. More and...