2 Myths Holding Back Home Buyers

Freddie Mac recently released a report entitled, “Perceptions of Down Payment Consumer Research.” Their research revealed that,

“For many prospective homebuyers, saving for a down payment is the largest barrier to achieving the goal of homeownership. Part of the challenge for those planning to purchase a home is their perception of how much they will need to save for the down payment…

…Based on our recent survey of individuals planning to purchase a home in the next three years, nearly a third think they need to put more than 20% down.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate the funds needed to qualify for a home loan. According to the same report:

22% of renters and 31% of homeowners believe lenders require 20% or more of a home’s sale price as a down payment for a typical mortgage today. And,

“If a 20% down payment was required, 70% of those who were planning to buy a home in the next three years said it would delay them from purchasing and nearly 30% indicated they would never be able to afford a home.”

While many believe at least 20% down is necessary to buy the home of their dreams, they do not realize programs are available which permit as little as 3%. Many renters may actually be able to enter the housing market sooner than they ever imagined!

Myth #2: “I Need a 780 FICO® Score or Higher to Buy”

Many either don’t know or are misinformed concerning the FICO® score necessary to qualify, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

As indicated in the chart above, 52.4% of approved mortgages had a credit score of 600-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

2020 Luxury Market Forecast

2020 Luxury Market Forecast By the end of last year, many homeowners found themselves with more equity than they realized, and at the same time their wages were increasing. When those two factors unite, it can spark homeowners to think about making a move to a larger...

Buying a Home Early in Life Can Increase Future Wealth

Buying a Home Early Can Significantly Increase Future Wealth According to an Urban Institute study, homeowners who purchase a house before age 35 are better prepared for retirement at age 60. The good news is, our younger generations are strong believers in...

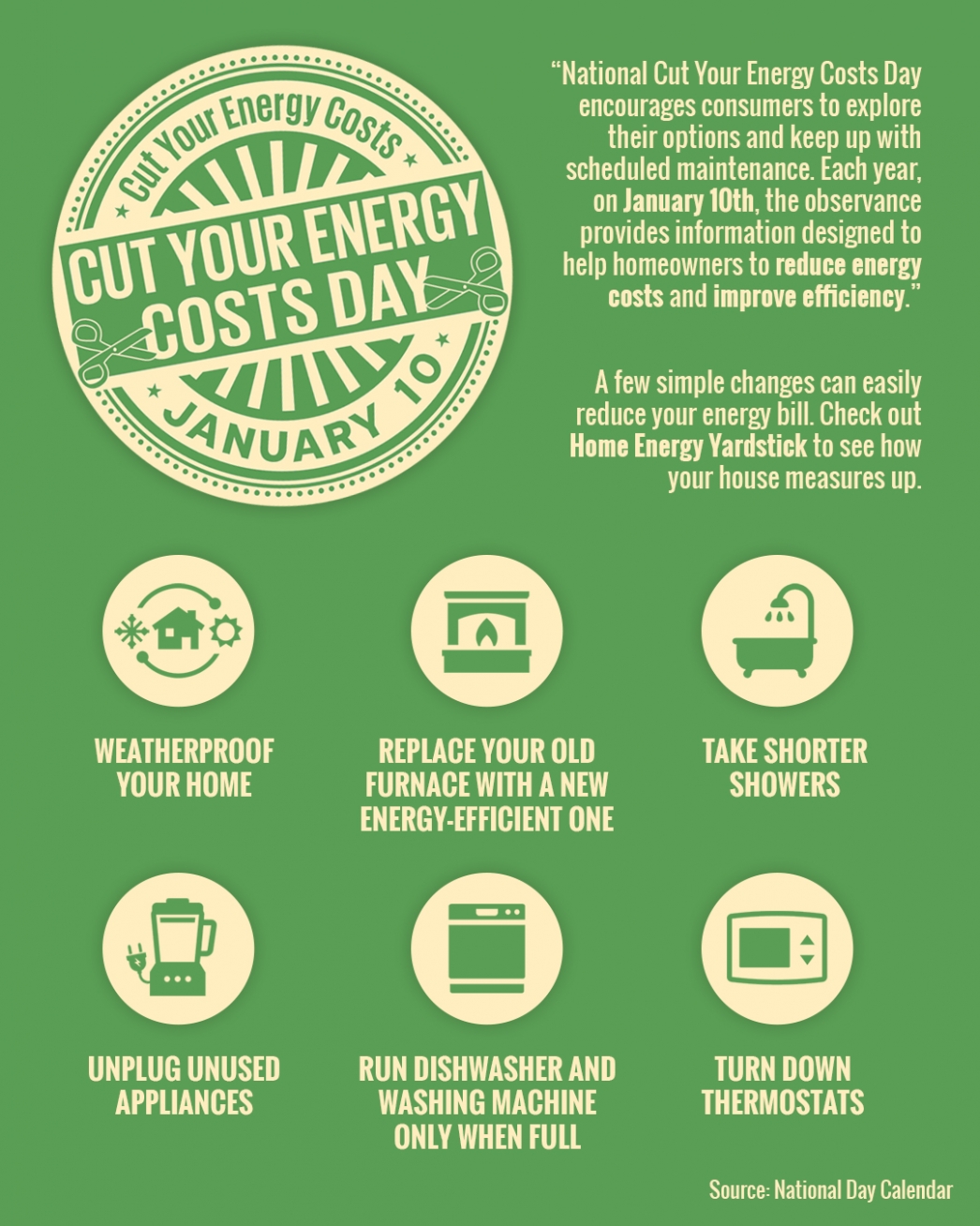

National Cut Your Energy Costs Day

National Cut Your Energy Costs Day | January 10 2020 Some Highlights: On January 10th of each year, “National Cut Your Energy Costs Day” encourages consumers to reduce their overall energy costs by improving home efficiency. According to Freddie Mac, a typical U.S....

There’s a Long Line of Buyers Waiting for Your House

There’s a Long Line of Buyers Waiting for Your House If you’re following what’s happening in the housing market right now, you know that many people believe the winter months aren’t a good time to sell a home. As realtor.com Senior Economist George Ratiu recently...

How can SRES Help You Plan for Your Future Housing Needs

How can SRES Help You Plan for Your Future Housing Needs? Most of us put time and effort into planning for retirement. That is, we plan for money related issues such as retirement funds. Secondly, people plan for long-term care and life insurance. Deciding on where...

Plus Fifty Today

Do you know where is your market is going? In 2020: More than one-third of the U.S. population reached age 50. 17 million baby boomers (20 percent) were age 60 or older. Generation X moved into middle age and began knocking on the door of age 58 Today demographic...

Spring Real Estate Market is Here Ready or Not?

The New Spring Real Estate Market is Here. Are You Ready? Which month do you think most people who are considering buying a home actually start their search? If you’re like most of us, you probably think the surge happens in the spring, likely in April. Not...

Demand for Smaller Homes is on the rise

Big Demand for Small Homes Movies, tv shows, and celebrities often have us dreaming of owning large homes, but the reality for most people is quite different. Since 2015, the square footage of newly built houses has been shrinking, according to Yahoo Finances. This is...

3 Benefits to Buying Your Dream Home This Year

3 Benefits to Buying Your Dream Home This Year Outside of a strong economy, low unemployment, and higher wages, there are three more great reasons why you may want to consider buying your dream home this year instead of waiting. 1. Buying a Home is a Great Investment...