3 Benefits to Buying Your Dream Home This Year

Outside of a strong economy, low unemployment, and higher wages, there are three more great reasons why you may want to consider buying your dream home this year instead of waiting.

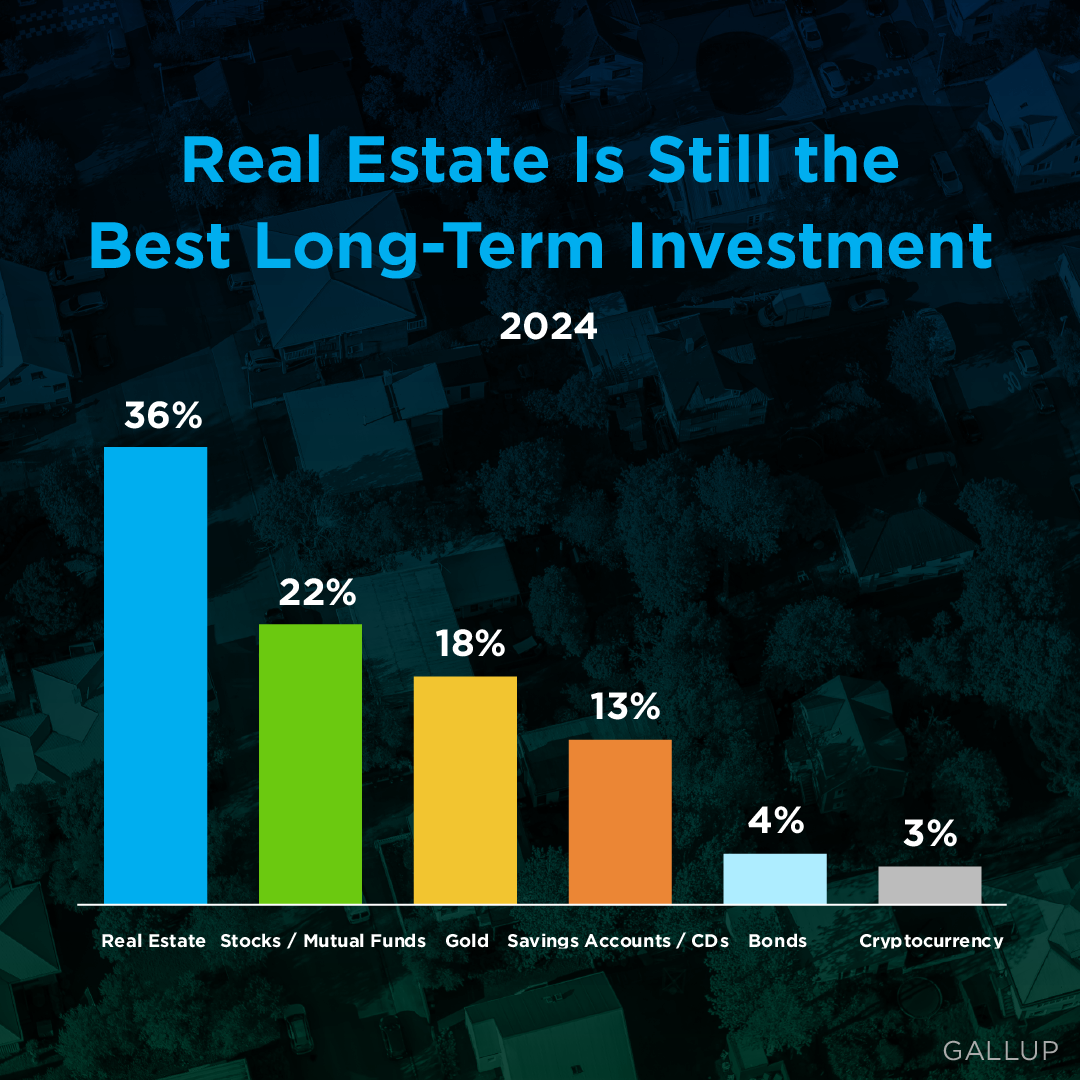

1. Buying a Home is a Great Investment

Several reports indicate that real estate is a good investment, topping other options such as gold, stocks, bonds, and savings. Why? Real estate helps build equity, a form of investing for you and your family. According to CoreLogic’s Equity Report,

“U.S. homeowners with mortgages (roughly 64% of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1%, year over year.”

This means the average homeowner gained approximately $5,300 in equity over the past year. If you want to start building your equity, put your housing costs to work for you through homeownership this year.

2. Mortgage Interest Rates Are Low

The Primary Mortgage Market Survey from Freddie Mac indicates that interest rates for a 30-year mortgage have fallen since November 2018 when they hit 4.94%. In their latest forecast, Freddie Mac expects rates to remain low, leveling out to a yearly average of 3.8% in 2020.

When you purchase a home at a low mortgage rate, it will impact your monthly mortgage payment, giving you the opportunity to buy more house for your money.

3. Investing in Your Family is a Win

There are some renters who haven’t purchased a home yet because they’re uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you’re living rent-free with your parents, you’re paying a mortgage – either yours or that of your landlord.

Today, rental prices continue to increase, and when you’re paying your landlord’s mortgage instead of your own, you’re not the one earning the equity. As an owner, your mortgage payment is a form of ‘forced savings’ you can use later in life to reinvest in your family. You can use it for a variety of opportunities, such as saving for your children’s education, moving up to a bigger home, or starting your own business. As a renter, it can be more challenging to achieve those types of dreams without home equity working for you.

Bottom Line

Buying a home sooner rather than later could lead to substantial savings and long-term financial growth for you and your family. Let’s get together to determine if homeownership is the right choice for you this year.

What we Know About Policy Changes Regarding the NAR Settlement

Important MLS System and Policy Changes Regarding the NAR SettlementOn Wednesday - August 14, 2024, UtahRealEstate.com will be making adjustments to the MLS system and MLS Rules as required by the settlement terms agreed to by the National Association of REALTORS®...

Unlocking Homebuyer Opportunities in 2024

Unlocking Homebuyer Opportunities in 2024 There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt...

N.A.R. Lawsuit Settlement Fact Sheet for Utah

Lawsuit Settlement Fact Sheet – Utah Changes ChangesWhile changes will be minimal in Utah because of the state’s pro-consumer laws and customs, Utah REALTORS® are committed to helping buyers and sellers understand and navigate the changes. Key settlement terms...

Why Moving to a Smaller Home After Retirement Makes Life Easier

Why Moving to a Smaller Home After Retirement Makes Life Easier Retirement is a time for relaxation, adventure, and enjoying the things you love. As you imagine this exciting new chapter in your life, it's important to think about whether your current home still fits...

Why Your Asking Price Matters Even More Right Now

Why Your Asking Price Matters Even More Right Now If you’re thinking about selling your house, here’s something you really need to know. Even though it’s still a seller’s market today, you can’t pick just any price for your listing. While home prices are still...

Things To Avoid After Applying for a Mortgage

Things To Avoid After Applying for a Mortgage Some Highlights There are a few key things you’ll want to avoid after applying for a mortgage to make sure you’re in the best position when you get to the closing table. Don’t change bank accounts, apply for new credit,...

Real Estate Is the Best Investment

Did you know? Real estate has been voted the best long-term investment for 12 years straight. That’s because history shows home values usually go up. And when that happens, it helps homeowners grow their net worth. So, if you’re debating renting or buying, remember to...

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024 As we move into the second half of 2024, here’s what experts say you should expect for home prices, mortgage rates, and home sales. Home Prices Are Expected To Climb Moderately Home prices are...

Do Elections Impact the Housing Market?

Do Elections Impact the Housing Market? The 2024 Presidential election is just months away. As someone who’s thinking about potentially buying or selling a home, you’re probably curious about what effect, if any, elections have on the housing market. It’s a great...

More Than a House: The Emotional Benefits of Homeownership

More Than a House: The Emotional Benefits of Homeownership With all the headlines and talk about housing affordability, it can be tempting to get lost in the financial side of buying a home. That’s only natural as you think about the dollars and cents of it...