Your Fabulous New Dream Home is Now Available

Over the last several years, many “baby boomers” have undergone a metamorphosis. Their children have finally moved out and they can now dream about their own future. For many, a change in lifestyle might necessitate a change in the type of home they live in.

That two-story, four-bedroom colonial with three bathrooms no longer fits the bill. Taxes are too high. Utilities are too expensive. Cleaning and repair are too difficult. When they decide to travel to be with friends and family, locking up the house is too time-consuming and worrisome.

Instead, a nice ranch home with 2-3 bedrooms and two baths might better fulfill their new needs and lifestyle. The challenge many “boomers” have faced when trying to downsize to the perfect new home has been a lack of inventory.

The average number of years a family stays in their home has increased by fifty percent since 2008, causing fewer houses to come to the market. During the same time, new home builders were concentrating most of their efforts on large, luxury, expensive houses.

However, that is starting to change.

According to the U.S. Department of Housing and Urban Development and the U.S. Census Bureau, sales of newly built, single-family homes rose to a seasonally adjusted annual rate of 692,000 units in March. The great news is that more of those homes were sold at the lower end of the price range.

In a press release last week, the National Association of Home Builders (NAHB) explained that:

“The median sales price was $302,700, with strong gains in homes sold at lower price points. The median price of a new home sale a year earlier was $335,400.”

NAHB Chief Economist Robert Dietz offered further detail:

“We saw a large gain at lower price points where demand is strong. In March of 2019, 50% of new home sales were priced below $300,000, compared to 39% in March of 2018.”

Bottom Line

If you are a “boomer” thinking of selling your old house in order to buy a new home that better fits your current lifestyle, now may be the perfect time!

Top Markets for Office Development in the West

In 2024, the office sector saw significant changes with high vacancy rates and minimal increases in office utilization. Nationally, office space under construction decreased to 57.8 million square feet, down by 39 million from 2023. In the Western U.S., the office...

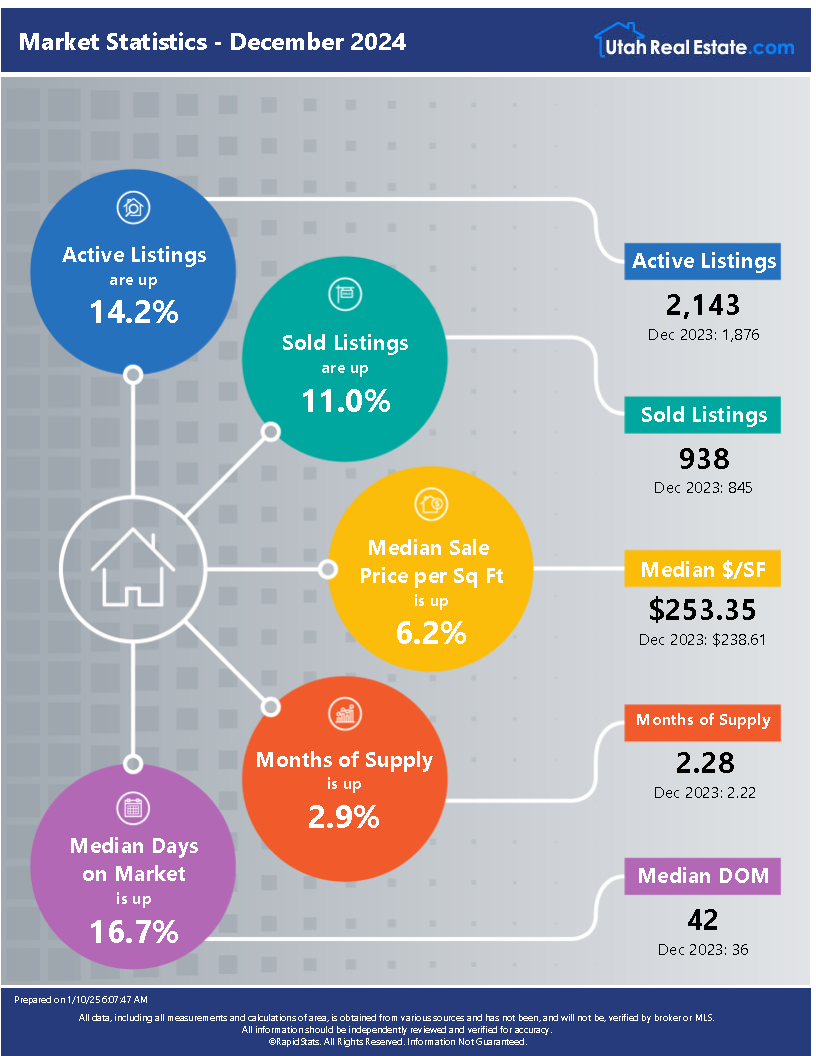

Utah Market Stats January 2025

Key Factors Influencing Utah Insurance Rates

The average annual homeowners insurance premium for a $200K home in Utah is $1,063. Utah’s insurance rates are influenced by low weather risks, local crime, and construction material costs.

Salt Lake City – A Top Pick for Millennial Homeowners

Salt Lake City: A Top Pick for Millennial Homeowners Buy or Sell with Marty Gale "Its The Experience" Principal Broker and Owner of Utah Realty™ Licensed Since 1986 CERTIFIED LUXURY HOME MARKETING SPECIALIST (CLHM) PSA (Pricing Strategy Advisor) General Contractor...

2026 Interest Rate Forecast: Continued Adjustments

Federal funds rate projected to fall from 3.7% (Q1) to 3.1% (Q4), marking consistent quarterly reductions. Rate adjustments aim to stabilize the economy, setting the stage for long-term equilibrium.

2025 Housing Market Forecast for Buyers & Sellers

2025 housing market: moderate rise in home sales, stabilized mortgage rates, and slower price increases. All-cash buyers make up 26% of sales, driven by increased homeowner equity.

Home Prices Stay High, Buyers Wait for Relief

In October, the combination of rising mortgage rates and high home prices has slowed home sales to a 14-year low.New single-family home sales ↑ 4.1% MoM, signaling potential market recovery.

How To Use the 28/36 Rule To Determine How Much House You Can Afford

The 28/36 rule is a guideline for determining how much house you can afford. It states that your total housing costs should not exceed 28% of your gross income, and your total debt should not exceed 36%. This rule helps ensure that you don't take on too much...

Governors of Western states consider public lands for developing affordable housing

Colorado Gov. Jared Polis and other Western governors are exploring the use of federal lands to address the affordable housing crisis in the region. In Nevada, officials are leveraging a federal law to acquire land for development at reduced prices, while...

Household debt in Utah rising at one of the fastest rates in the nation

A report reveals that Utah has one of the highest rates of household debt growth in the U.S., with residents adding over $1 billion in debt between the second and third quarters of 2024. The average household increased its debt by more than $1,000, ranking just behind...