What is Important to Boomers when Selling their House?

If you are a “baby boomer” (born between 1946 and 1964), you may be thinking about selling your current home. Your children may have finally moved out. Your large, four-bedroom house with three bathrooms no longer fits the bill. Taxes are too high. Utilities are too expensive. Cleaning and repair are too difficult. You may be ready to move into a home that better fits your current lifestyle. Many fellow boomers have already made the move you may be considering.

The National Association of Realtors recently released their 2019 Home Buyer and Seller Generational Report. The report revealed many interesting tidbits about both categories of baby boomers: younger boomers (ages 54 to 63) and older boomers (64 to72). Here are a few of the more interesting topics.

Percentage of Buyers who Looked Online First

- All Buyers: 44%

- Younger Boomers: 46%

- Older Boomers: 44%

Where Boomers Found the Home They Purchased

The two major ways buyers found the home they purchased:

- All buyers: 50% on the internet, 28% through a real estate agent

- Younger Boomers: 46% on the internet, 33% through a real estate agent

- Older Boomers: 36% on the internet, 35% through a real estate agent

Distance Seller Moved

The distance between the home they purchased and the home they recently sold was much greater for boomers than the average seller.

- All sellers: 20 miles

- Younger Boomers: 27 miles

- Older Boomers: 50 miles

Tenure in Previous Home of Seller

The percentage of older boomers who lived in their previous home for more than 20 years was almost twice the amount of the average seller.

- All sellers: 16%

- Younger Boomers: 20%

- Older Boomers: 31%

Primary Reason to Sell their Previous Home

- Want to move closer to friends or family

- Home too large

- Retirement

View of Homeownership as a Financial Investment

- 83% of Younger Boomers see homeownership as a good investment

- 82% of Older Boomers see homeownership as a good investment

Bottom Line

If you are a boomer and thinking about selling, now might be the time to contact an agent to help determine your options.

What You Can Do to Keep Your Dream of Homeownership Moving Forward

What You Can Do to Keep Your Dream of Homeownership Moving ForwardSome Highlights:Don’t put your homeownership plans on hold just because you’re stuck inside.There are several things you can do right now to keep your home search moving forward.Connect with an agent,...

With so much changing in today’s market

Does the News have you Scared

Don’t Let Frightening Headlines Scare YouThere’s a lot of anxiety right now regarding the coronavirus pandemic. The health situation must be addressed quickly, and many are concerned about the impact on the economy as well.Amidst all this anxiety, anyone with a...

According to the Salt Lake Board of Realtors®Salt Lake home sales year-to-date are roughly the same as they were last year at this time. While everyday life has changed, the current economic quarantine could be short-lived, according to Lawrence Yun, chief economist...

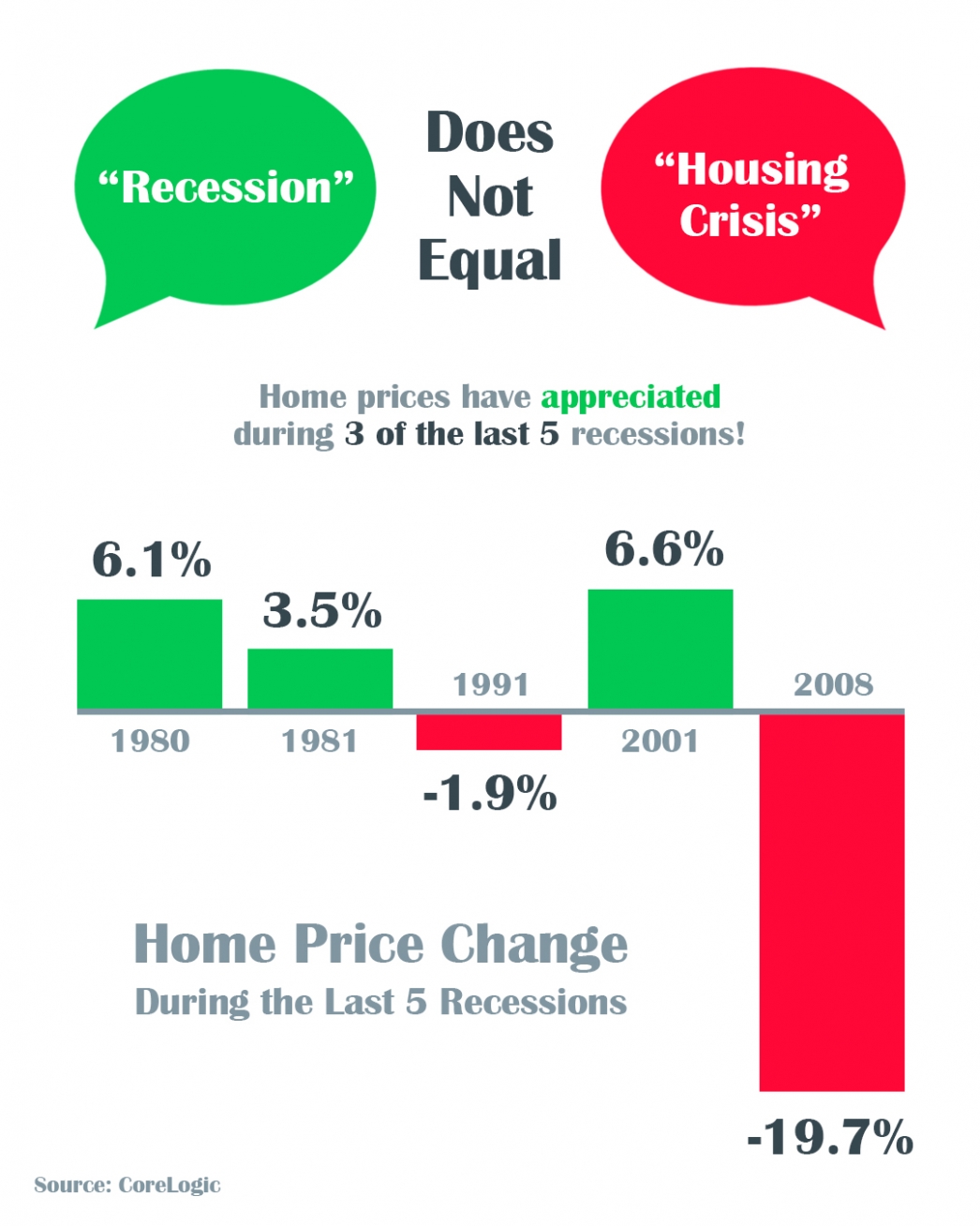

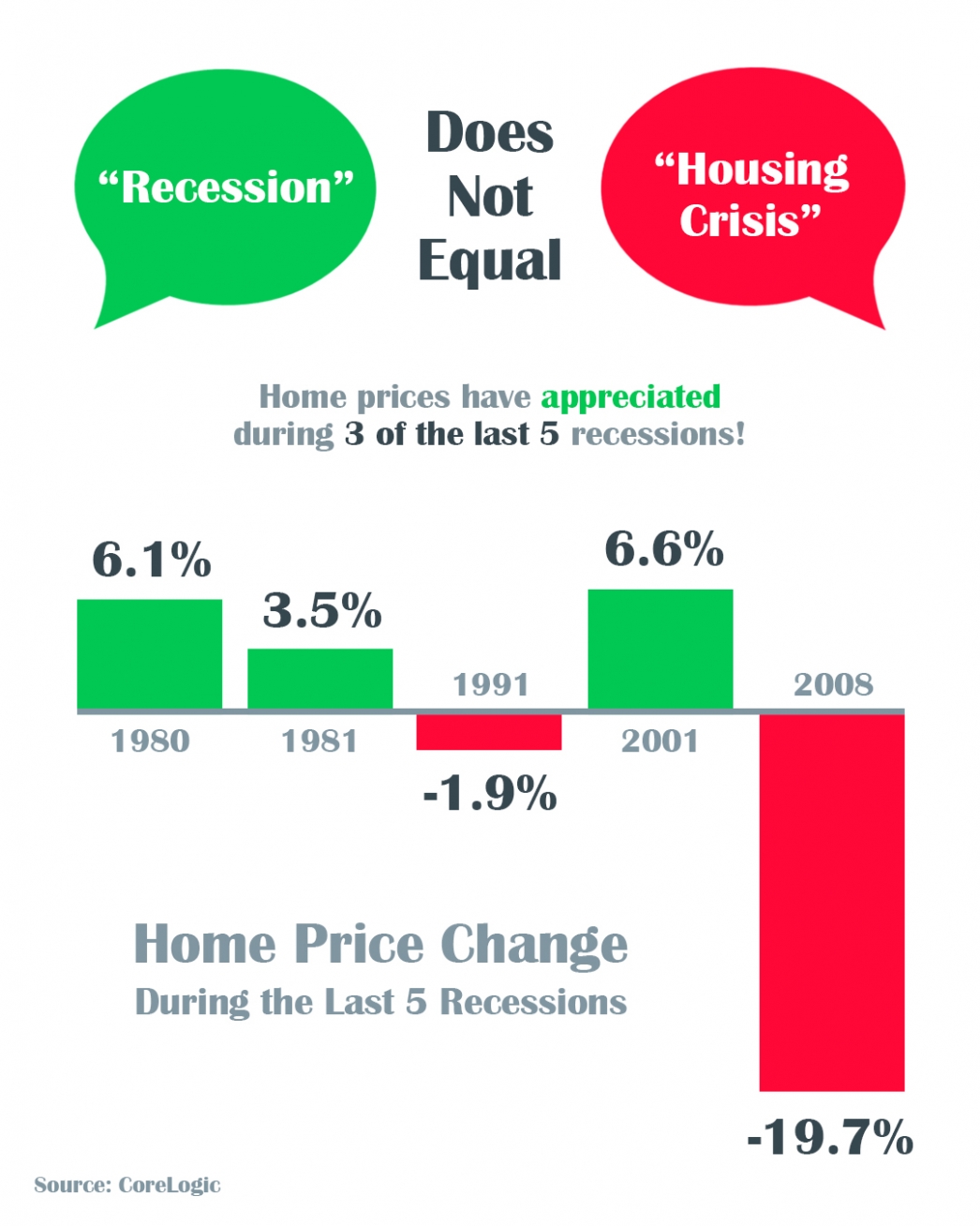

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

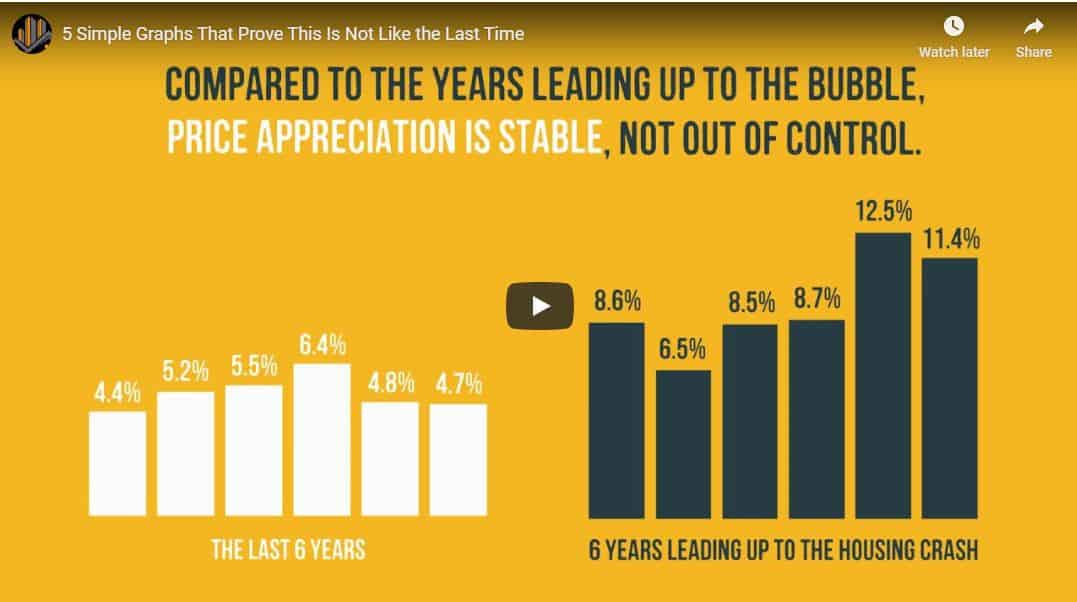

Why the Stock Market Correction Probably Won’t Impact Home Values

Why the Stock Market Correction Probably Won’t Impact Home ValuesWith the housing crash of 2006-2008 still visible in the rear-view mirror, many are concerned the current correction in the stock market is a sign that home values are also about to tumble. What’s taking...

5 Simple Graphs That Prove This Is Not Like the Last Time

A Recession Does Not Equal a Housing Crisis

A Recession Does Not Equal a Housing Crisis Some HighlightsThe COVID-19 pandemic is causing an economic slowdown.The good news is, home values actually increased in 3 of the last 5 U.S. recessions and decreased by less than 2% in the 4th.All things considered, an...

Coronavirus Map

View the the interactive map https://google.org/crisisresponse/covid19-map

Coronavirus (COVID-19)

Notice the On Set Dates Below