What Credit Score Do You Need To Buy A House?

There are many misconceptions about the credit score needed to buy a house. Recently, it was reported that 24% of renters believe they need a 780-800 credit score to be considered for a mortgage. The reality is they are misinformed!

Only 25% of the Americans have a FICO® Score between 740 and 800. Here is the breakdown according to Experian:

- 16% Very Poor (300-579)

- 18% Fair (580-669)

- 21% Good (670-739)

- 25% Very Good (740-799)

- 20% Exceptional (800-850)

Randy Hopper, Senior Vice President of Mortgage Lending for Navy Federal Credit Union said,

“Just because you have a low credit score doesn’t mean you can’t purchase a home. There are a lot of options out there for consumers with low FICO® scores,”

There are many programs available with low or no credit score requirement. The Federal Housing Administration (FHA) now requires a minimum FICO® score of 580 if you want to qualify for the low down payment advantage. The US Department of Agriculture (USDA) does not set a minimum credit score requirement, but most lenders require a score of at least 640. Veterans Affairs (VA) loans have no credit score requirement.

As you can see, none of them are above 700!

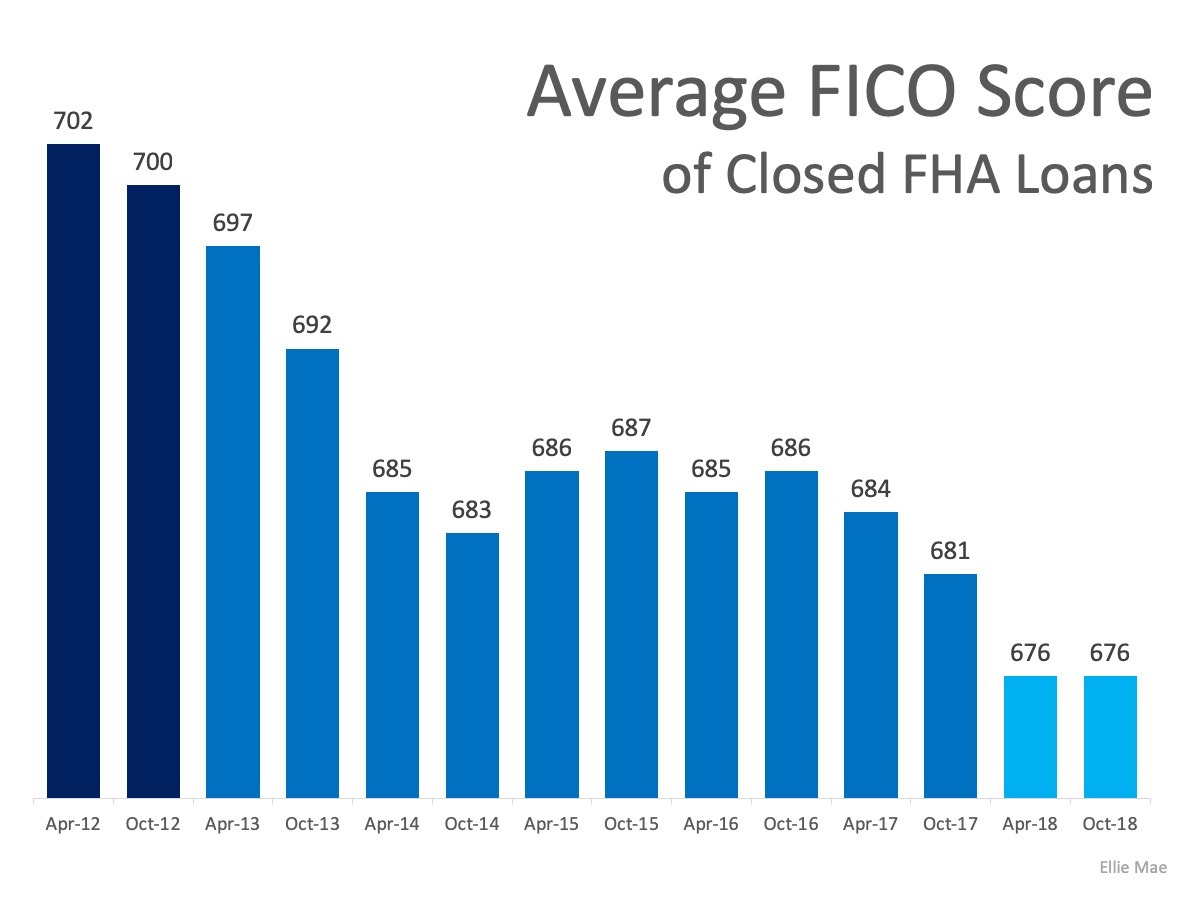

It is true that the average FICO® score for all closed loans in January was 726, but there are plenty of people taking advantage of the low credit score requirements. Here is the average FICO® Score of closed FHA Loans since April 2012 according to Ellie Mae: As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

As you can see, that number has been dropping for the last seven years. As a matter of fact, the average FHA Purchase FICO® Score reported in January 2019 was 675!

One of the challenges is that Americans are unsure about their credit score. They just assume that it is too low to qualify and do not double check. Credit.com confirmed that only 57% of individuals sought out their credit score at least once last year.

FICO® reported,

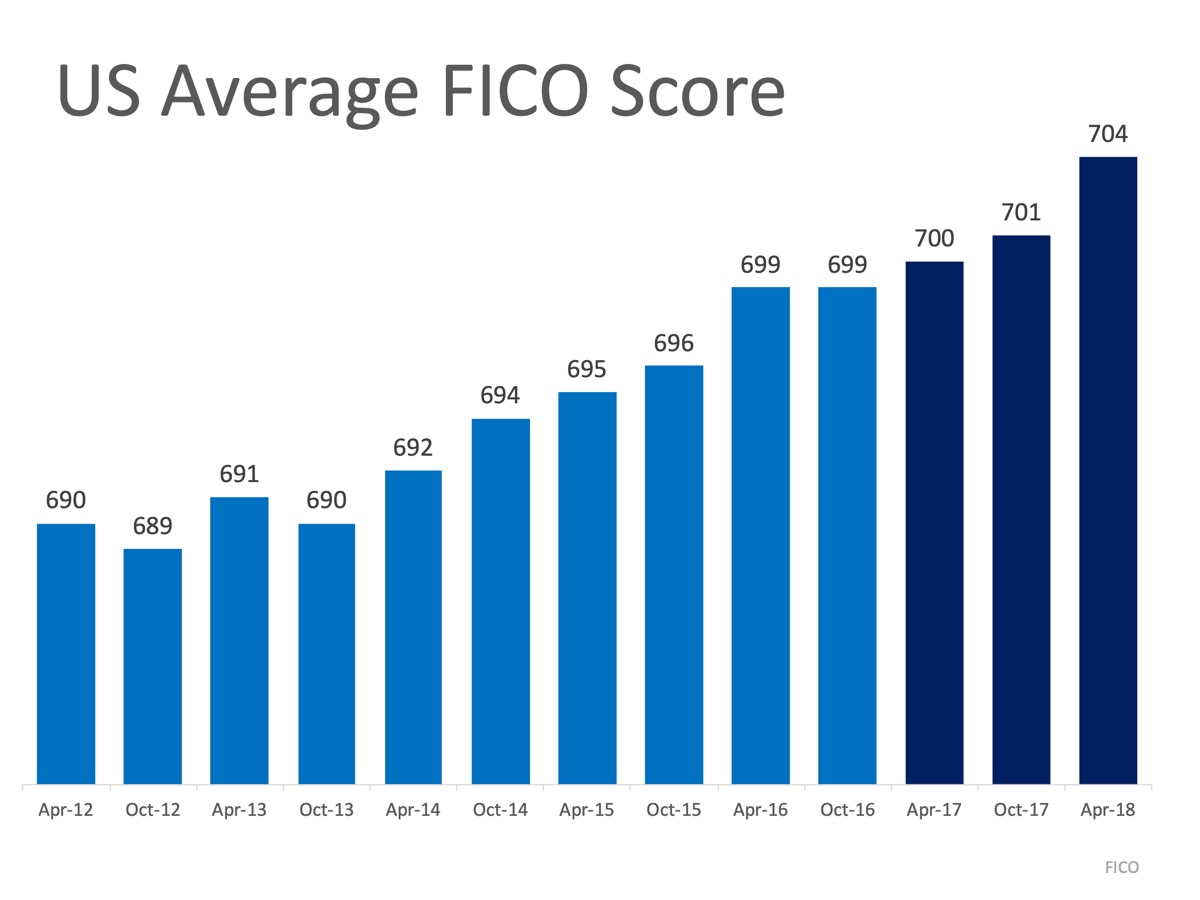

“Since October 2009, the average year-over-year FICO® Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.”

Here is the increase in the average US FICO® Score over the same period of time as the graph earlier.

Bottom Line

At least 84% of Americans have a score that will allow them to buy a house. If you are unsure what your score is or would like to improve your score in order to become a homeowner, let’s get together to help you set a path to reach your dream!

Staged Property: The Hidden Risks

Staged Property: The Hidden Risks - Buyer Beware In the dynamic realm of real estate, the allure of staged properties often captivates potential buyers, presenting spaces in their most attractive light and promising a dreamlike living scenario. However, beneath the...

Buying a House With Tenants? Know Your Rights

If a lease exists, it remains valid, preventing rent hikes or evictions until its term expires. Want tenants to move out? You must negotiate, buy them out, or ensure vacancy before purchase.

Smart Timeline Strategies for Selling Your Home

Selling a home takes 8-12 weeks, including 1-2 weeks for prep, 3-4 weeks for listing, and 4-6 weeks for closing. Preparation is crucial; allocate 3-5 days for decluttering, staging, and 1-2 days for professional photography.

SCAM ALERT: Fraudulent Tax Collection Letters Targeting Utah Taxpayers

The Utah State Tax Commission warns taxpayers about a fraudulent letter circulating in Utah, falsely claiming unpaid state taxes. The letter resembles an official notice and threatens legal action if payment is not made. Taxpayers are advised to verify the...

Utah’s Housing Growth at Risk?

Rapid price hikes in Salt Lake City and Provo raise serious affordability concerns. Many buyers priced out, causing declining demand and potential home value drops.

Happy Easter

Easter is a Christian holiday that celebrates the belief in the resurrection of Jesus Christ.However, according to many theologians, Easter originally began before the arrival of Christianity.It is believed that Easter is named after the Anglo-Saxon goddess of the...

Tariffs Could Add 5% to Home Prices

The US faces a shortage of 4.4M homes, including 1.3M single-family homes for lower-income buyers. New tariffs on Canadian and Mexican imports could raise home construction costs by ↑ 5%, worsening accessibility.

Home Upgrades Booming by 2032 With 6% CAGR Predicted!

The home improvement market is set to grow from $974.57B in 2025 to $1.46T by 2032, driven by innovation. The Leading Indicator of Remodeling Activity projects a 1.2% increase in year-over-year home renovation spending for 2025.

Cities With the Most Expensive Homes in Utah

Typical home values in various Utah metro areas show significant increases over the past year and five years. Provo-Orem has a typical home value of $658,066 with a 1-year change of +2.9% and a 5-year change of +49.7%. Salt Lake City’s typical home value is $662,640,...

Act Now: Prep for Spring Home Buying

Winter is slow, but 2025 will see more sellers returning, possibly leading to a more balanced market. Buyers should start credit repair now, as spring sees the biggest jump in available homes from February to March.