A mother and her son are hugging in their living room. The mother is wearing a military uniform.

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice.

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational training to home loans.

Facts About VA Home Loans:

- Nearly 24 million home loans have been guaranteed by the Veterans Administration.

- Nearly 82% of VA home loans are made with no down payment.

- The VA also provides grants to help seriously disabled Veterans purchase, modify, or construct a home to meet their needs. Last year the VA provided 2,000 grants totaling $104 million.

Benefits of a VA Home Loan:

- No down payment

- No Private Mortgage Insurance*

- Lower credit score requirements

- Limitation on closing costs

- Lower average interest rates

*More information on VA Home Loan Fees

Bottom Line

The best thing you can do today to celebrate Veterans Day is to share this information with those who can benefit from these opportunities. For more information, or to find out how to qualify to use a VA Home Loan Benefit, let’s get together to navigate through the process. Thank you for your service!

January Single Family Inventory Salt Lake County (Active)

January Single Family Inventory Salt Lake County (Active)

3 Must-Do’s When Selling Your House This Year

3 Must-Do’s When Selling Your House This YearIt’s exciting to put a house on the market and to think about making new memories in new spaces. However, despite the anticipation of what’s to come, we can still have deep sentimental attachments to the home we’re leaving...

Expert Forecast on the 2021 Housing Market

Here’s to a Wonderful 2021!

Here’s to a Wonderful 2021!

Thank You for All Your Support

Thank You for All Your Support We Cherish Your Relationships With Us!You helped us make a great 2020!

The Difference a Year Makes for Homeownership

The Difference a Year Makes for HomeownershipOver the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant...

Holidays Aren’t Stopping Homebuyers

The Holidays Aren’t Stopping Homebuyers This Year Black Friday and Cyber Monday are behind us, yet finding the perfect holiday gifts for friends and family is certainly still top of mind for many right now. This year, there’s another type of buyer that’s very active...

Utah Forbearance Problems

Are Home Prices Headed Toward Bubble Territory

Are Home Prices Headed Toward Bubble Territory?Talk of a housing bubble is beginning to crop up as home prices have appreciated at a rapid pace this year. This is understandable since the appreciation of residential real estate is...

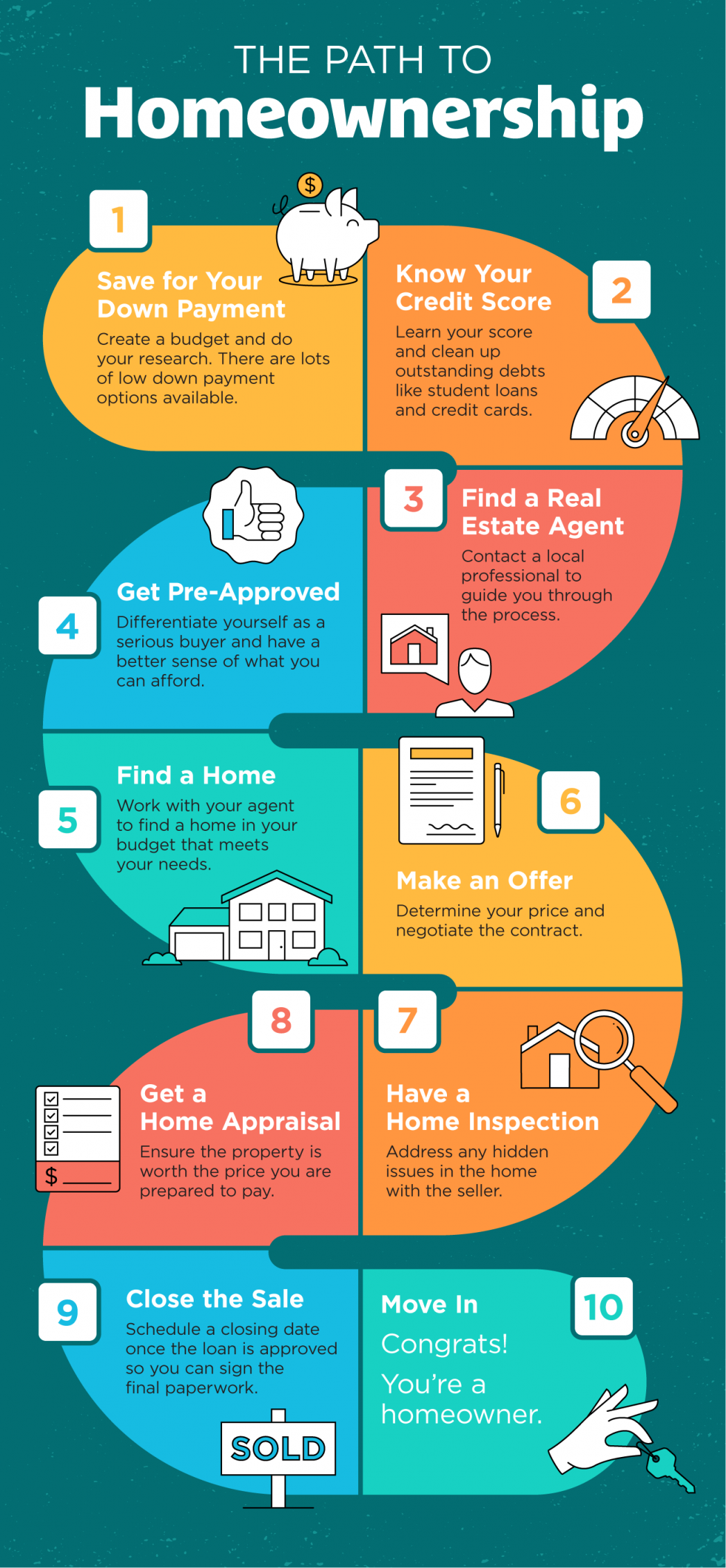

Homeownership can be yours

The Path to Homeownership Some Highlights If you’re thinking of buying a home and not sure where to start, you’re not alone. Here’s a map with 10 simple steps to follow in the homebuying process. Let’s connect today to discuss the specific steps along the way in our...